QUOTE(Boon3 @ Jun 4 2021, 01:38 PM)

refer comments made by ChAOoz

you better no itchy back side .....

Tangan Kiri tukar Kanan. Some hardcore fans calling the few-day movement as sideways and betting for the clarification on the case.

STOCK MARKET DISCUSSION V150

|

|

Jun 4 2021, 01:56 PM Jun 4 2021, 01:56 PM

Return to original view | Post

#21

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Jun 4 2021, 01:38 PM) refer comments made by ChAOoz you better no itchy back side ..... Tangan Kiri tukar Kanan. Some hardcore fans calling the few-day movement as sideways and betting for the clarification on the case. |

|

|

|

|

|

Jun 15 2021, 03:32 PM Jun 15 2021, 03:32 PM

Return to original view | Post

#22

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(ChAOoz @ Jun 15 2021, 01:58 PM) Maybe move on to telegram or other platform. All the old one are missing. me too. but compared to all those groups, lyn is still the best place to actually engage in conversations. groups are for spams. Last time this sub channel was pretty hard on new comers, i also mostly lurked only. This post has been edited by billy_overheat: Jun 15 2021, 03:44 PM |

|

|

Jun 15 2021, 04:49 PM Jun 15 2021, 04:49 PM

Return to original view | Post

#23

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

Jun 16 2021, 10:33 AM Jun 16 2021, 10:33 AM

Return to original view | Post

#24

|

Senior Member

3,373 posts Joined: Nov 2008 |

if tech is what interests one, aren't stocks like toufu or maybe d&o, a reversal which are on uptrend and tighter range more attractive?

|

|

|

Jun 16 2021, 10:39 AM Jun 16 2021, 10:39 AM

Return to original view | Post

#25

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

Jun 16 2021, 12:22 PM Jun 16 2021, 12:22 PM

Return to original view | Post

#26

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

|

|

|

Jun 16 2021, 01:20 PM Jun 16 2021, 01:20 PM

Return to original view | Post

#27

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Jun 16 2021, 12:39 PM) yours is widescreen..... There are better options out there. mine is macam letter box....  which is more efficient? Answer? The one that you are most good at. Clearly the stock is bias to the downside... the volume is shrinking - indicating the lack of interest... so getting in anytime now versus being the patient one... well, which do you choose? And mana ada widescreen. I just crop it to be a rectangle. QUOTE(squarepilot @ Jun 16 2021, 01:00 PM) I'm not sure whether dca is a good way to be used on stocks. But for etf, yeah, dca all the way. |

|

|

Jun 16 2021, 02:50 PM Jun 16 2021, 02:50 PM

Return to original view | Post

#28

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Jun 16 2021, 01:30 PM) It takes me a long time to find out that there's no distinct difference between investing/trading. And reading back your writing, now it makes sense to me. But still I will need more time to find out the right setups and most importantly, the psychology of the market and myself. It's always the individual vs the market with all the noise. But still, how to be better? Eerrmmmm.... |

|

|

Jun 17 2021, 10:05 AM Jun 17 2021, 10:05 AM

Return to original view | Post

#29

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Jun 16 2021, 02:52 PM) noted and THAT'S THE FREAKING FIRST RULE. QUOTE(qsrt1616 @ Jun 16 2021, 03:02 PM) Treat investing less seriously and make it fun and try not to lose money. Do as much research as possible. If you obtain any information that has yet to be discovered by other market participants, you will make money. The ultimate rule is to get AHEAD of the rest of the market. Totally agree with you with the part of being patient and confident with the position. The companies themselves are crucial to making the decision whether to invest/trade. Long term gains are in favour but I'm still trying to identify the best and most efficient way within my trades/investments. Techs wise, they are of my best performance group till dates. Some were managed to be sold before the peak, some, I missed the peak and took a much smaller profits. So, how do you identify peaks? Charts? So you know oil is going to hit 100$ soon. And people are skeptical about it. So you accumulate them and always be patient and confident about your position. Treat your shares like a form of ownership in a publicly-traded companies rather than being obsessed with technical charts and human behaviours. Pay attention to any shift in macroeconomic trends. Once it hits peak euphoria, you sell. This is the cyclical - contrarian strategy. However, mathematicians and technical chartists oppose this idea and favour models like Monte-Carlo and Fibonacci retracements to predict human behaviour. Whereas economists look at economic data and formulate models around it while eliminating the human element. Tech companies is the anomaly though. In the end, stocks only go up. Other asset classes are boring QUOTE(icemanfx @ Jun 16 2021, 08:17 PM) Investing could be trading, trading is not investing. Speculate on good companies with earnings, income, and growth? Like what boon said, trade like an investor? An investor relies on earnings, income, growth in the value of assets. A speculator is someone who thinks other people will pay more for it than you did. Many started as an investor become too smart/over confidence and end up as speculator. A broken clock is useful twice a day. |

|

|

Jun 17 2021, 12:39 PM Jun 17 2021, 12:39 PM

Return to original view | Post

#30

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Jun 17 2021, 11:58 AM) Trading doesn't need to be reckless laaa.... sitting tight is mostly fine for me. Usually when the vol decreases and price goes up, together with some other factors like news and alerts in qr will make me sell, when things clear up a bit and charts go back up, I will then find reentry. if you think from a business perspective, trading can be just as intelligent as investing. i do like to look at various companies and see how their businesses doing but they are of secondary data, aren't they? all we can do is googling and reading and sometimes confirmation bias happens. it's a lonewolf job but too much info stirs things up too from various comments. have to strive for a balance. |

|

|

Jun 17 2021, 02:06 PM Jun 17 2021, 02:06 PM

Return to original view | Post

#31

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Bendan520 @ Jun 17 2021, 12:50 PM) I don't really trade intraday and most of my holdings are of weeks/months. I did hold some stocks for years. Lol QUOTE(Boon3 @ Jun 17 2021, 12:52 PM) QUOTE(icemanfx @ Jun 17 2021, 01:14 PM) Yup. So, for investing, unless one subscribes for IPOs, or even preferred shares way before the IPOs, then those are of primary, aren't they? I read about your posts and you're mostly screening stocks using FA first, right? |

|

|

Jun 17 2021, 02:38 PM Jun 17 2021, 02:38 PM

Return to original view | Post

#32

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Smurfs @ Jun 17 2021, 02:17 PM) all the data we obtain via the companies' fillings, news and by the time we got it, it's sometimes already too late. but, to identify the structure of the companies, ie, management, earnings, credibility, they are still useful. so to quote the previous explanation, how do retailers get ahead of the game when most of the time, institutions have much more comprehensive data (regardless their writings of recommendations QUOTE(Boon3 @ Jun 17 2021, 02:30 PM) Aiyohhh... you are meant to keep it simple.... stop thinking about whether you are trading/investing .... all you know is know how not to lose.... that's the first step, which you don't want to complicate it too much. When Sounds simple but many a times... ppl simply loves to complicates the f out of themselves.... and starts finding reason why it's not their fault that the stock A is not turning around as one had assumed.... errr..... complicated enough? teh, teh. teh..... mana 555? mana teh teh teh? This post has been edited by billy_overheat: Jun 17 2021, 02:43 PM |

|

|

Jun 18 2021, 08:51 AM Jun 18 2021, 08:51 AM

Return to original view | Post

#33

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(icemanfx @ Jun 18 2021, 03:31 AM)  If u.s lumber price drop continue, could be a early indicator of u.s stock and other commodities price. |

|

|

|

|

|

Jun 19 2021, 11:18 AM Jun 19 2021, 11:18 AM

Return to original view | Post

#34

|

Senior Member

3,373 posts Joined: Nov 2008 |

They are in tough spot. do this x boleh do that x boleh. lol fomc meeting becomes the head of market manipulation

|

|

|

Jul 2 2021, 11:30 AM Jul 2 2021, 11:30 AM

Return to original view | Post

#35

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(squarepilot @ Jul 2 2021, 11:25 AM) They already have enough in their pocket. they can say whatever they want. I think he will tell you that MA doesnt tell what you already know from the kosong chart. I'm looking at this, but i'm not convinced it will fly high once it's break due to the political sentiment  Does SMA200 plays a big part this chart? boon3 what say you? |

|

|

Jul 2 2021, 11:57 AM Jul 2 2021, 11:57 AM

Return to original view | Post

#36

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Jul 2 2021, 11:37 AM) benda macam ni susah  there are only two proper entries for me in daily, for the other, intraday chart is needed and risk is always there, today's vol so far is still less than yesterday and if the vol can't sustain for the other day next week, like you said, exhaustion is imminent. you bad bad, ask you ada apa in 555 but now baru show after vertical. i guess stories work. EV theme + thin floating shares = vertical. mr cold eye, how did you work this out? where's your PE valuation This post has been edited by billy_overheat: Jul 2 2021, 11:57 AM |

|

|

Jul 2 2021, 12:19 PM Jul 2 2021, 12:19 PM

Return to original view | Post

#37

|

Senior Member

3,373 posts Joined: Nov 2008 |

QUOTE(Boon3 @ Jul 2 2021, 12:15 PM) This one is simple la.... it's not a bloody stock tip asking you to buy... instead, it's a good time... to study and learn how to exit a stock.... even if it's a garbage stock (yaya... this one fits right inside the category) .... all profits are good profits, in such vertical soar, layang-layang a bit and cabut once things are not well agree with the rubbish term but of course, ada spidey ada cycley analysis pun ok what This post has been edited by billy_overheat: Jul 2 2021, 12:20 PM |

|

|

Jul 2 2021, 12:50 PM Jul 2 2021, 12:50 PM

Return to original view | Post

#38

|

Senior Member

3,373 posts Joined: Nov 2008 |

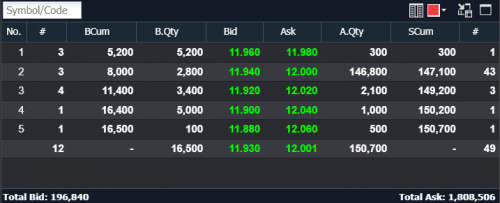

QUOTE(Boon3 @ Jul 2 2021, 12:35 PM) That part I don't agree.... not really. missing out is certainly fine for me. setups are extremely important or else FOMO will eventually take back whatever profits we have. Profits derived from variations from our setup is never ever good. I am a strong believer in discipline. Sticking to my setups is most important. Missing a whole bunch of vertical climbers is never a problem for me. Is it for you? so 11.90... that would have been my exit... companies like this won't even come out from my screener fundamentally, chart wise it doesn't really have a sound base, it belongs to something which i don't understand  11.96 would have been my exit since there's a huge roadblock in 12. wont 'hope' for it to break but if it breaks, so shall it be. This post has been edited by billy_overheat: Jul 2 2021, 12:52 PM |

|

|

Jul 2 2021, 01:04 PM Jul 2 2021, 01:04 PM

Return to original view | Post

#39

|

Senior Member

3,373 posts Joined: Nov 2008 |

|

|

|

Jul 5 2021, 10:45 AM Jul 5 2021, 10:45 AM

Return to original view | Post

#40

|

Senior Member

3,373 posts Joined: Nov 2008 |

woah, didn't realize that there was a fight over here. lol. if one needs to fight and protect the companies which they bought. it's a bit, eerrr, weird right?

always wonder ehh @Boon3 what's your trade setup? good companies with sound FA with triangle/pennant/flag? **if one needs to ask advice whether to buy or sell, that means homework is not done enough. for me laaaaaa my dua kupang |

| Change to: |  0.0979sec 0.0979sec

0.22 0.22

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 10:08 AM |