STOCK MARKET DISCUSSION V150

|

|

Aug 25 2020, 05:06 PM Aug 25 2020, 05:06 PM

Return to original view | Post

#161

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

today a happy day? HereToLearn liked this post

|

|

|

|

|

|

Aug 25 2020, 06:16 PM Aug 25 2020, 06:16 PM

Return to original view | Post

#162

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

|

|

|

Aug 25 2020, 06:21 PM Aug 25 2020, 06:21 PM

Return to original view | Post

#163

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

QUOTE(HereToLearn @ Aug 25 2020, 05:46 PM) Happy to help/share QUOTE(theberry @ Aug 25 2020, 06:07 PM) actually I am curious what is TG's market expectation? |

|

|

Aug 25 2020, 06:34 PM Aug 25 2020, 06:34 PM

Return to original view | Post

#164

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

|

|

|

Aug 25 2020, 08:32 PM Aug 25 2020, 08:32 PM

Return to original view | Post

#165

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

QUOTE(HereToLearn @ Aug 25 2020, 06:47 PM) 866mil close two eyes also can achieve lo... |

|

|

Aug 25 2020, 10:53 PM Aug 25 2020, 10:53 PM

Return to original view | Post

#166

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

|

|

|

|

|

|

Aug 26 2020, 01:02 AM Aug 26 2020, 01:02 AM

Return to original view | Post

#167

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

|

|

|

Aug 26 2020, 11:29 AM Aug 26 2020, 11:29 AM

Return to original view | Post

#168

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

QUOTE(ChAOoz @ Aug 26 2020, 10:35 AM) those that buy supermax, i wonder they think how the next quarter profit will be like ? 600m ? 800m ? based on this forecast, I guess you have stop buying / start selling / didn't buy at all.Atleast TG you still can gamble abit on 1.x bil profit. But i'm feeling most likely its 800mil range. that aside, today is another shopping day!!! woohoo! |

|

|

Aug 26 2020, 02:56 PM Aug 26 2020, 02:56 PM

Return to original view | Post

#169

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

QUOTE(ChAOoz @ Aug 26 2020, 12:15 PM) They are all overvalued. many people thought glove stock price will only get affected when vaccine come.Careful don't miss the departure train, covid don't come twice in short succession. Some stock you can still make mistake and it will recover back to old high. Some, especially situational effect one i usually don't keep long. Buy for fun got la, scalp here and there but never invest. that's the reason why I foresee many will get stuck in Presidential suite because they only pay attention to vaccine progress. the one who really do homework and know how the industry works, will invest calmly. |

|

|

Aug 26 2020, 03:25 PM Aug 26 2020, 03:25 PM

Return to original view | Post

#170

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

|

|

|

Aug 26 2020, 03:52 PM Aug 26 2020, 03:52 PM

Return to original view | Post

#171

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

spmx today in out like that get 10%

so good |

|

|

Aug 26 2020, 05:40 PM Aug 26 2020, 05:40 PM

Return to original view | Post

#172

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

wow. seems like everyone suddenly become optimistic about bank based on AmBank QR?

|

|

|

Aug 26 2020, 05:59 PM Aug 26 2020, 05:59 PM

Return to original view | Post

#173

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

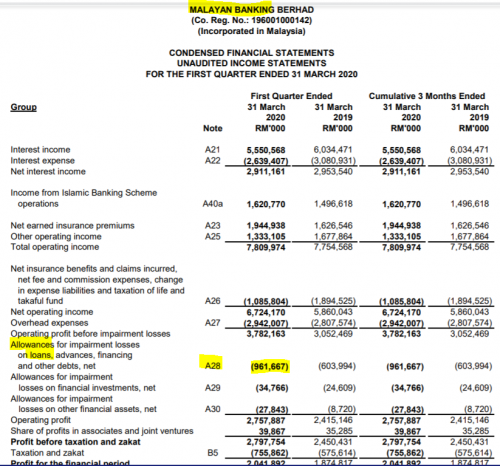

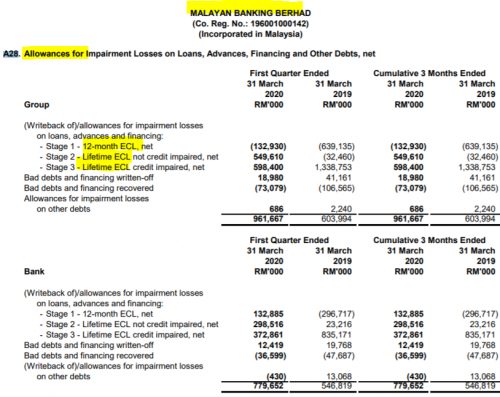

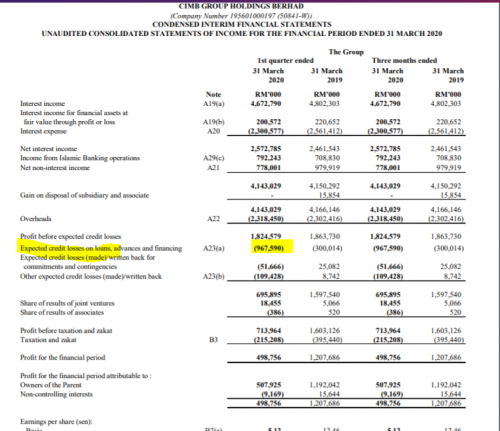

QUOTE(HereToLearn @ Aug 26 2020, 05:43 PM) I am always optimistic on banks in the long run, but i do hope the next QR for banks will get fcked up. I want MORE maybanks at RM5-6 I am talking from business point of view. Banks future QR will definitely f up, especially in 2021. Yeah maybank supporters will bash me later Just look at those statistic of Malaysia economy. The real situation will appear after honeymoon is over. |

|

|

|

|

|

Aug 26 2020, 06:44 PM Aug 26 2020, 06:44 PM

Return to original view | Post

#174

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

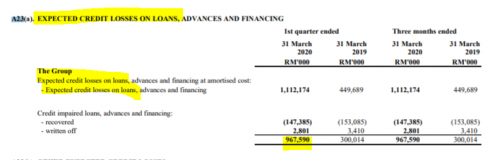

QUOTE(HereToLearn @ Aug 26 2020, 06:18 PM) Kindly enlighten me on the 'real situation'. I dont quite get what you mean focus on the main business income source.For expected NPL, banks are already 'artificially reduce' their earnings, setting aside a portion of the earnings for loan loss provision. see what's the incoming impact to it. on the NPL part, bank cannot include something that doesn't happen yet into "expected" NPL. when it happen, bank will then only realize how severe it can be. |

|

|

Aug 26 2020, 10:41 PM Aug 26 2020, 10:41 PM

Return to original view | Post

#175

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

QUOTE(HereToLearn @ Aug 26 2020, 09:39 PM) After something happen = credit loss You have to know what's the procedure of a bank need to go through before they treat it into NPL category.Before and anticipated things to happen = loss provision OR expected credit loss (ECL) How accurate is their ECL prediction model, this I dont know If you want to be safe, go for banks with higher loan loss coverage ratio? For maybank (since a lot of maybank supporters here, I personally think CIMB is much more attractive at the current prices):  For the details, look below  For CIMB:  For the details, look below  Not sure if anyone actually goes through financial statement/balance sheet before investing. But it is wiser to do so: a lot less risk, when you know the share value. IMO, banks are good for investments, but not good for trading. NOSH too high, very hard for sharks to collect MOST and swing it in a certain direction. Might still possible to do it, but sharks need A DAMN LOT of time to collect at low prices. But I am happy with the 7-10% dividend yield after economy recovery. This year prolly expecting less DY, but I go for long term, I am still in my 20s. With the anti-banks sentiment, I seriously dont see how bank share prices will rise significantly. Share price will only go up, once IBs or sharks have collected enough and start sharing news (most prolly they will use economy recovery as the trend later in 6 months - 1 year time) to push the share price up. They cannot estimate something not happen yet and provide "estimated" NPL. The worst still not happen and nobody can estimate it because you don't know how many customer cannot pay back. It might be not so bad. It might be worst. Nobody knows for sure but statistic is very pessimistic about Malaysia economy. There is no any sector that is bad for investment, provided you know what you are doing. Bank might one day be a sunset industry, as there is sign of revolution in US. It might take 100 years for the evolution, it might take 10 years, it might not happen at all. No one really knows when. So there is no industry that after invest, sure make money. The skill and experience of invest is about managing risk. Reduce the risk in every investment. Overall, win more than lose. Everything we do have opportunity cost. Unless you have already a lot of money, I don't recommend to invest in dividend stock. You want faster growth of your money by investing in growth stock. But that doesn't mean dividend stock cannot grow. Buy cheap when it drop, when it goes back to the usual price, it's consider as capital gain as well. Opportunity cost is the very important reason why the investor who only invest based on purely fundamental and don't consider other factors, will be very slow in growing their funds. But you have to know you invest for dividend or growth. Sometime people when initial invest, they claim they invest for long term dividend. When the price increase back to usual price, they cannot resist the capital gain and then sell. When you cannot control fear and greed, you cannot control your own life. Don't always get attracted by dividend, ie. 10% is a very good company then only invest in those. You need to manage your portfolio well. I give another example that is outside from stock market. For example, you throw all your money into a property and rent it out. You might get RM2000 per month. But you no more bullet to flip your funds. That's why some people that have less bullet will want to sell the property for capital gain instead of getting steady positive cashflow. Grow your fund first and then diversify your portfolio. For sharks issue, when I invest, I don't care about sharks because sharks control/manipulate price, not value of the company. I invest in business, not share price. When you own a business, everyday Mr. Market come and offer you different price to take over your business, would you consider to sell or hold your business everyday? SunBear1999 liked this post

|

|

|

Aug 26 2020, 10:53 PM Aug 26 2020, 10:53 PM

Return to original view | Post

#176

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

I sorry if you can't understand chinese/mandarin. But I quite sad to see the investment direction of some here.

I want to share this video: https://www.facebook.com/watch/?v=278161580...YEqw3Z2j5QsKv9l Pls be open minded and do some tinkering about your own investment strategy. |

|

|

Aug 27 2020, 05:50 PM Aug 27 2020, 05:50 PM

Return to original view | Post

#177

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

QUOTE(bronkos @ Aug 27 2020, 01:17 PM) the worst has yet to come. 2021 will show everything. QUOTE(ZeroSOFInfinity @ Aug 27 2020, 01:22 PM) I wouldn't be so sure about that. Supermax is a haven for contra and margin players. They might push up as high as possible next week before ex-date, then sell on date of split. spmx and kossan will have some foreign funds coming starting end of this month. TG seems more of cash players.... and have the better advantage of maintaining its value even after splits. So most likely will slowly increase from now onwards until next Wed. QUOTE(ben3003 @ Aug 27 2020, 01:45 PM) analyst report if can believe, all ali, ah kau, mutu become millionaires. |

|

|

Aug 27 2020, 06:10 PM Aug 27 2020, 06:10 PM

Return to original view | Post

#178

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

|

|

|

Aug 27 2020, 06:30 PM Aug 27 2020, 06:30 PM

Return to original view | Post

#179

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

QUOTE(bronkos @ Aug 27 2020, 06:13 PM) even without pandemic, its very near already to the peak of cyclewhen gold price is roar high, it gives a very good indication already. bronkos liked this post

|

|

|

Aug 28 2020, 04:34 PM Aug 28 2020, 04:34 PM

Return to original view | Post

#180

|

Senior Member

4,508 posts Joined: Aug 2005 From: Klang/Shah Alam |

QUOTE(B@rt @ Aug 28 2020, 09:29 AM) haizz my sad story... the other day I bought Karex in anticipation of their Quarterly profits bouncing back into the green and a nice announcement (which they did to announce they are venturing into gloves in addition to domdom). Mana tau the day they announce was the day Nasdaq and S&P500 rose significantly on the back of strong vaccine news which countered their good news significantly... I sold adi yesterday at a loss :....( conclusion of this story is you until now still don't know why you lose money. Moral of the story is sometimes you win sometimes you lose. |

| Change to: |  0.0733sec 0.0733sec

0.24 0.24

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 05:29 AM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote