Outline ·

[ Standard ] ·

Linear+

STOCK MARKET DISCUSSION V150

|

qsrt1616

|

Aug 2 2021, 12:18 AM Aug 2 2021, 12:18 AM

|

|

Going all in on BABA puts/ JD puts/ puts on every single China heavy ETFs/ Baidu. All in baby. China is no longer a viable emerging market. The next emerging market is Taiwan/Vietnam and hopefully Malaysia. Hedge fund crybabies asking people to buy the dip on Bloomberg TV/CNBC 24/7. If you have a subscription and watch Bloomberg religiously like me, these crooks whining on TV and give one thousand reasons why China is the 'next' emerging market and so much growth potential. Duh, the last thing they will do is help retail investors and let retailers have the opportunity to buy the dip. Why scream in your face on live TV to ask you nicely to buy the dip in Chinese stocks?

Screw Chinese stocks. Puts on every single one of them (with exceptions, still) Serious position: LEAP Puts on Baba expiring 2022 & MCHI 60p expiring 2022. Charlie Munger is wrong. China wants to take every company private and focus on EV companies. So calls on BYD/Nio/XPEV. Screw every other companies

Chinese stocks are not dead dead. But the large cap tech companies will all be privatised by state government. Brother Xi is afraid of big tech monopoly like the US of A and will throw the banhammer on all of them. Jack Ma is screwed. Liu Qiangdong is next on the hitlist. China is gonna funnel all money out of these 'greedy' tech companies and put them to save property companies like Evergrande and inject funds into green energy. China is going to be a green energy superpower. Tech will be state-controlled 100% by 2022. Property companies will recover and fly. China-focused ETFs will die. Chinese EV will skyrocket.

Nasdaq and S&P500 will continue to go vertical until our beloved JPOW leaves the chair. And god do I wish Jpow gets re-elected. American exceptionalism means America will continue to fluorish until aliens come and invade our planet. If America falls, we all fall. If China falls, maybe North Korea falls. Who knows

Bursa tech to 100. God do I hope these dumb hedge funds look to us as the next emerging market after they got burnt from 'buying the dip' in China. Taiwan, done goreng. Vietnam, done goreng. Look AT US. Serious position: Calls on IWM, all in Bursa technology large caps, all Bursa index blue chips and yes, including TopGlove (Boon3's favourite stock). Any export-heavy companies that benefit from weaker dollars. Buy ALL OF THEM. Long Ringgit Malaysia. Short USD. Once this political turmoil is over, it is our time to FLY and it is gonna happen soon. We are in the capitulation phase.

Thanks for listening to my midnight trade ideas

This post has been edited by qsrt1616: Aug 2 2021, 12:33 AM

|

|

|

|

|

|

qsrt1616

|

Aug 2 2021, 12:35 AM Aug 2 2021, 12:35 AM

|

|

QUOTE(ChAOoz @ Aug 2 2021, 12:33 AM) Err good luck. I will be on the other ends with China calls. I dont know what bloomberg you are looking at but basically most fund are selling out of China, go see ark holdings. Fund managers are lame cause they gotta cater to their customer taste and preference, and the climate is pretty negative on china like your view. The trend reversal will come when those affirmation seeking fund managers see berkshire buy into baba on their next filing and china tech show growth and profit resiliency and then all start fomo again. Its ok im long, i can wait Bullish on Chinese EV and anything green energy. Chinese want to be green energy superpower and they will do whatever it takes to reach that. I watch Bloomberg TV after US market open. ARK fund manager Cathie Wood is irrational af. She is an evangelist and asked God to direct her trades lmao watch her interviews/past videos. You gotta pay attention to the funds that actually move the market like Bridgewater, Eastspring, Temasek. I don't know what crack they are smoking cause all they said on interviews was to buy the dip in Chinese stocks. A lot of these funds are either selling or will get margin-called soon. China wants to crash the market. Still Good luck on your bullish calls. Different opinions. But the goal is to make money This post has been edited by qsrt1616: Aug 2 2021, 12:43 AM |

|

|

|

|

|

qsrt1616

|

Aug 2 2021, 10:21 AM Aug 2 2021, 10:21 AM

|

|

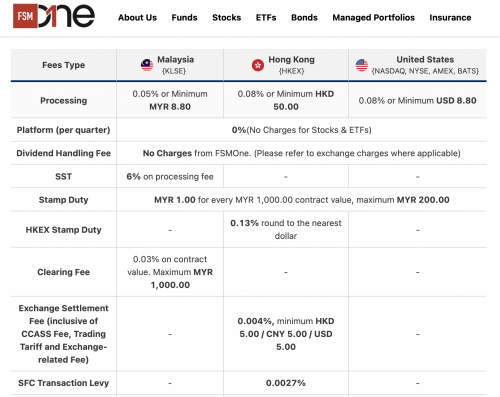

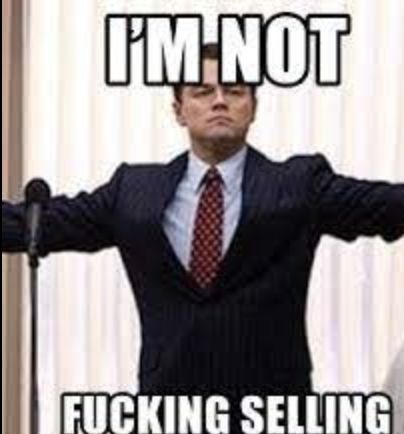

QUOTE(coklatua @ Aug 2 2021, 10:09 AM) Hi, anybody here is using FSMOne to trade US stocks? Im a noob to US trade. Is there any pro and cons compared to other brokers? Their service I think is very easy as we dont need to open foreign bank account. But the CDS account is nominee account.   This is FSMOne Malaysia btw. Not SG.. it is not that difficult to open an account with a more reputable firm. Charles Shwab, IBKR, TD Ameritrade. Heck, even using CIMB/Hong Leong foreign trading at a higher brokerage fee is better than brokers that people have never heard of. |

|

|

|

|

|

qsrt1616

|

Aug 2 2021, 11:15 AM Aug 2 2021, 11:15 AM

|

|

QUOTE(squarepilot @ Aug 2 2021, 10:28 AM) Those interactive broker and TDA is not approved by SC or BNM Malaysia Binance Malaysia is in deep shit because of this SC/BNM will never approve foreign brokers because they don't want you to convert into USD. Smooth brain. I am talking about broker reputation. They can't do shit about Binance. What are they going to do? Pull Bitcoin out of your account? |

|

|

|

|

|

qsrt1616

|

Aug 2 2021, 03:42 PM Aug 2 2021, 03:42 PM

|

|

QUOTE(missfarren @ Aug 2 2021, 02:28 PM) thanks will monitor maybank Nestle is developing a plant-based/meatless food products and spent hundreds of millions on investments in Malaysia. Try looking into it. It is virtually impossible to make money from Maybank unless you have an investment horizon of more than 5 years. Important financial ratios for financial services companies would be ROE/Price-to-book/net interest margins. The rest I cannot think of at the moment. Nestle is a little tricky to value. It is mostly controlled by Nestle S.A.. Important financial ratios would be PE/profit margins/FCF/ebitda. Also, if you are a Bursa veteran, you usually won't buy any stock heavily controlled by EPF or KWSP? No hate against these institutional buyers but they tend to not let retailers make money from their portfolio. They have an entire country of retirees to feed so.. This post has been edited by qsrt1616: Aug 2 2021, 03:48 PM |

|

|

|

|

|

qsrt1616

|

Aug 3 2021, 10:52 AM Aug 3 2021, 10:52 AM

|

|

My Baba puts gonna print tonight. Tencent put warrant already printing now.

This post has been edited by qsrt1616: Aug 3 2021, 10:55 AM

|

|

|

|

|

|

qsrt1616

|

Aug 3 2021, 11:28 AM Aug 3 2021, 11:28 AM

|

|

Watch Bloomberg TV live now. They are talking about big funds's price target for Chinese big tech companies. Really useful if you are short-medium term trader. But if you are a long term investor, please ignore everything from CNBC/Bloomberg and buy more Chinese companies. This sell-off feels like an orchestrated plan by Chinese governments and Western hedge funds lol. But within the short term, Baba and Tencent are going down. This feels like Amazon and Apple in 2008 again.

This post has been edited by qsrt1616: Aug 3 2021, 11:32 AM

|

|

|

|

|

|

qsrt1616

|

Aug 3 2021, 11:33 AM Aug 3 2021, 11:33 AM

|

|

Bursa technology index massive green candle and reversal. Seems like there is nowhere else for the market to inject funds except technology companies.

|

|

|

|

|

|

qsrt1616

|

Aug 3 2021, 11:42 AM Aug 3 2021, 11:42 AM

|

|

BYD Nio XPEV Jinko Solar are up. Not every Chinese stocks are down. Massive rotation. Jinko Solar is a pretty reputable company in Malaysia and several factory operating here.

This post has been edited by qsrt1616: Aug 3 2021, 11:42 AM

|

|

|

|

|

|

qsrt1616

|

Aug 3 2021, 12:11 PM Aug 3 2021, 12:11 PM

|

|

Bridgewater: Buy the dip

State Street: Buy the dip

Temasek: Buy the dip

JP Morgan: Sell/Trim

We all know Chinese tech companies will go up in value in the long term. But are these fund managers actually that kind-hearted/generous to tell us ikan bilis to buy the dip? icemanfx please give you expert analysis on Chinese tech stocks.

This post has been edited by qsrt1616: Aug 3 2021, 12:17 PM

|

|

|

|

|

|

qsrt1616

|

Aug 3 2021, 12:15 PM Aug 3 2021, 12:15 PM

|

|

Things are looking good for Bursa small caps today!

|

|

|

|

|

|

qsrt1616

|

Aug 3 2021, 12:31 PM Aug 3 2021, 12:31 PM

|

|

Up 70% in Greatech 60% Unisem 120% MPI. I am not complaining. Bursa Tech is going to 100

But still down -50% in SCIB though. One major pain

Added more D&O today. Let's ride the final FOMO wave. I was talking about the final wave and I am pretty sure it is here. The time to buy is almost or already over,

This post has been edited by qsrt1616: Aug 3 2021, 12:33 PM

|

|

|

|

|

|

qsrt1616

|

Aug 3 2021, 03:09 PM Aug 3 2021, 03:09 PM

|

|

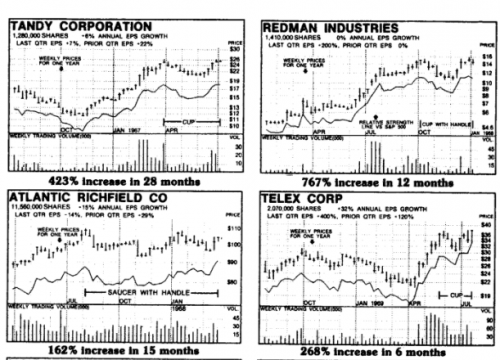

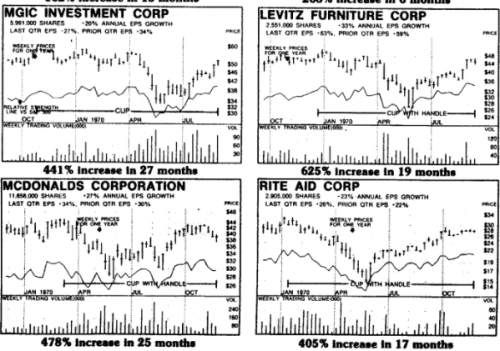

QUOTE(billy_overheat @ Aug 3 2021, 01:40 PM) What the hell are these boomer charts? Haha This post has been edited by qsrt1616: Aug 3 2021, 03:10 PM |

|

|

|

|

|

qsrt1616

|

Aug 5 2021, 07:49 AM Aug 5 2021, 07:49 AM

|

|

Bought AMD at 70$. Later SiTime/Analog Devices because I know a few people working in the semiconductor industry. The semiconductor play in 2020-2021 is amazing. Been accumulating since October 2020. Surprisingly Bursa seminconductor stocks actually perform better YTD.

We haven't seen the TopGlove/Supermax pump and dump technical chart yet. So that means the buying volume is not artificial and organic. Once Bursa tech gains more than 5%, that is the time to exit. Institutions still have a lot of shares to dump for the massive selloff to happen

This post has been edited by qsrt1616: Aug 5 2021, 07:54 AM

|

|

|

|

|

|

qsrt1616

|

Aug 5 2021, 08:13 AM Aug 5 2021, 08:13 AM

|

|

Why isn't Bursa technology included in KLCI component? Is it intentional? Adding them would literally stop the bleeding every day. Is it because institutional buyers want to accumulate and would sell every time a stock joins the index. There is not a single semiconductor company in it, even Inari.

This post has been edited by qsrt1616: Aug 5 2021, 08:13 AM

|

|

|

|

|

|

qsrt1616

|

Aug 5 2021, 10:04 AM Aug 5 2021, 10:04 AM

|

|

QUOTE(zstan @ Aug 5 2021, 09:19 AM) Mr DIY entering KLCI???? what a world we are living in  Mr DIY will be a cult brand soon. Just like Apple. But it is selling hardware and consumer goods. Also never bet against Brahmal This post has been edited by qsrt1616: Aug 5 2021, 10:05 AM |

|

|

|

|

|

qsrt1616

|

Aug 11 2021, 09:52 AM Aug 11 2021, 09:52 AM

|

|

93.24

|

|

|

|

|

|

qsrt1616

|

Aug 11 2021, 11:49 AM Aug 11 2021, 11:49 AM

|

|

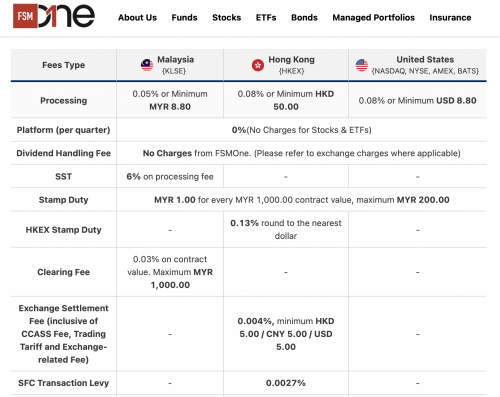

I am up so much on Bursa technology. As always, not selling until I see 100 on Bursa index. Better not tank at 99.

Holy shit what a great day

This post has been edited by qsrt1616: Aug 11 2021, 11:50 AM

|

|

|

|

|

|

qsrt1616

|

Aug 11 2021, 11:54 AM Aug 11 2021, 11:54 AM

|

|

Show me 100 Bursa technology. King of 2021  |

|

|

|

|

|

qsrt1616

|

Aug 11 2021, 12:07 PM Aug 11 2021, 12:07 PM

|

|

QUOTE(icemanfx @ Aug 11 2021, 12:03 PM) Most of local "semi-con" companies are 2nd or 3rd tier supplier; change of demand/order is normally lagging. recent drastic rise of semi-con demand was largely circumstances and is unlikely to last. like all meme stocks, price drop will be sooner than most expected. So you are telling me Genetech will hit RM30 by Friday? |

|

|

|

|

Aug 2 2021, 12:18 AM

Aug 2 2021, 12:18 AM

Quote

Quote

0.0924sec

0.0924sec

0.77

0.77

7 queries

7 queries

GZIP Disabled

GZIP Disabled