QUOTE(Duckies @ Feb 25 2021, 07:37 PM)

Why 2024 will be the peak ya? Could you please enlighten this lost goat?

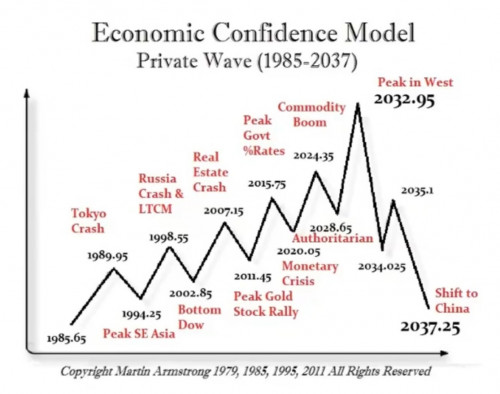

this is what CA is about. This is what the CA model tell me. I cannot answer why the model tell me the turning point is shown there because it's using AI to process tons of data thrown into it.

everything has it's own cycle. Commodity cycle will peak on 2024.

the cycle sometime will run -+ 1 year or few months. That's normal because it's influenced by people.

but history always repeat itself so the cycle will always be there.

2020 was the war cycle. -+ 1 year or few months you can see US-China trade war, current Myanmar army take over, all these things.

So CA can increase the success probability in investing if we know what to avoid.

I keep saying about 2H2021. This also from CA. This is big one lo... 3 big cycles divergence.

but sometime cycle inversion will happen. But it's very rare. Cycle inversion mean at a period of time that we expect a turning point, but it doesn't happen, instead of turn direction, it continue to accelerate the current direction. Now, if this happen, we can be very sure that the next turning point after this cycle inversion, will not be cycle inversion anymore.

by saying this, if US market doesn't go through a correction from Feb to May, it mean a cycle inversion has happened and it will bring what is going to happen in 2H2021 even earlier.

my 2 cents.

Feb 25 2021, 02:08 AM

Feb 25 2021, 02:08 AM

Quote

Quote

0.1039sec

0.1039sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled