Anyway.... just sharing some thoughts....

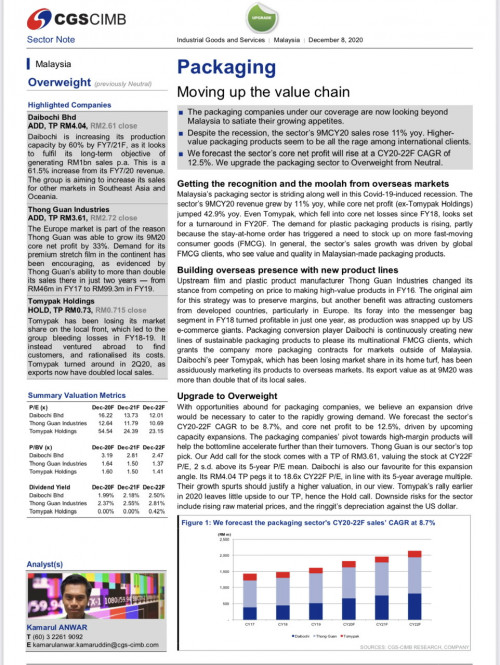

I was looking back at some of those notes... esp this one...

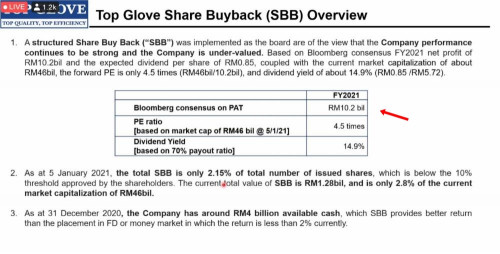

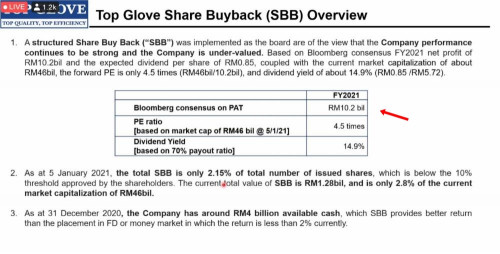

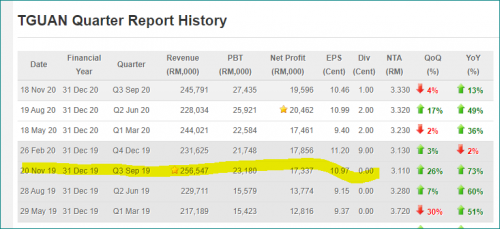

That's TG own notes...

Now ... that TG put out the Bloomberg consensus on PAT of 10.2 billion... is rather telling when I thought about it over when I went lim teh ....

Their Q1 PAT was 2.3 billion. Which means, the company/management is accepting that TG would turn in a profit of 10.2 - 2.3 = 7.9 billion for the rest of the

3 remaining quarters of 2021 Ahem! those last few words is worth noting. Only 3 quarters left in fy 2021 ... which is why ... you cannot blame/you have to accept why the analysts are already basing their Toilet Paper prices for TG based on 2022 estimates already. It is what it is. Industry standard. Will come back to that....

Now 7.9 PAT for 3 quarters... on average, that's only 2.6 billion per quarter for the next 3 quarters.

Is it mistake from the company? Did they bother to check the implication of what those numbers are saying? Or perhaps it's yet another glitch from the company...

Now for the investor/punter/trader or what not ..... if TG only turns in a PAT of 2.6 billion .... that's about a 10% growth only on a q-q basis. Would that not be considered a disappointing given the boom boom numbers it has been reporting? and that the next 2 quarters of fy 2021 will see flat earnings at 2.6 billion....

That's not too encouraging, isn't it?

Think about that la........................

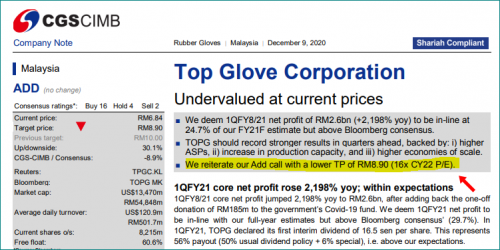

Now back to the forward earnings... ie... Toilet Paper prices based on 2022 numbers.

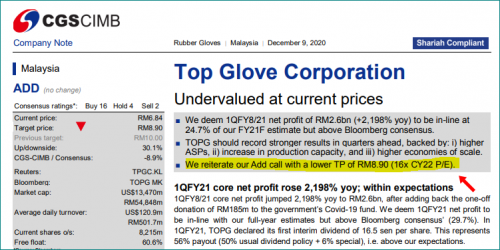

CIMB had already started it last month. Yes, they did ...

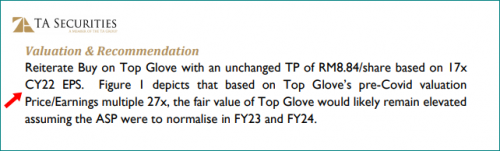

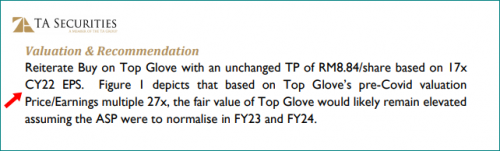

and of course, yesterday, I showed that TA is also doing such reference

What does this mean? Think about it .....

Isn't it saying fy 2021 doesn't even matter anymore?Yup, this is the market... pricing the stock based on forward earnings.

TG Q1 is already gone.. only 3 quarters left for the year.... hence focus is now on 2022 numbers.

Which means. ..... no matter what boom boom numbers TG reports next .... it won't have much impact....

and the sad thing ... if TG reports a lackluster/flat set of profits the next Q ... the stock could be hit...

It's sad/unfortunate/or whatever you wanna call it/ kind of situation.

Everything is priced forward .... it is what it is....

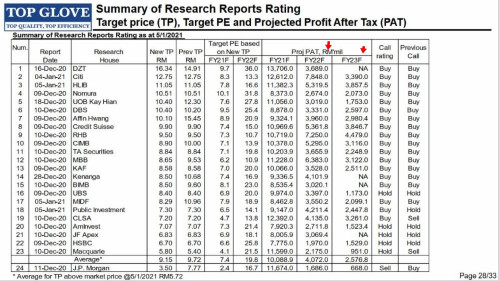

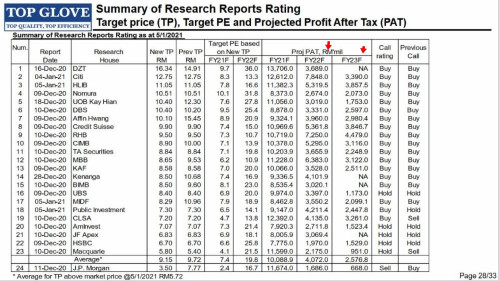

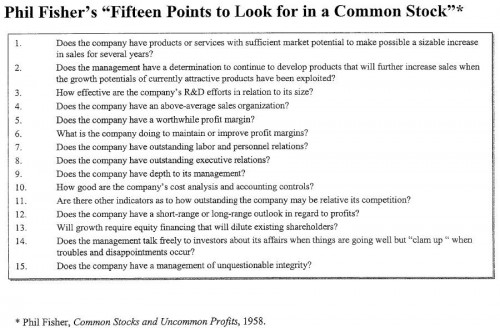

and last but not least.... this one.... it's from TG itself

2 interesting things from that...

1. CLSA .... sell recommendation. CLSA was one of the big bulls on TG. First to call a TP of rm28 on TG in July .... The sell recommendation was made on 23 Nov 2020.

2. The earnings estimate/trend . What can be seen is the clear earnings trend..

Big, big profits in 2021 .... but huge deciline in profits for 2022.

23 scientist from different research houses all making the same set of estimates....

Now think about this...

Can they all be wrong?

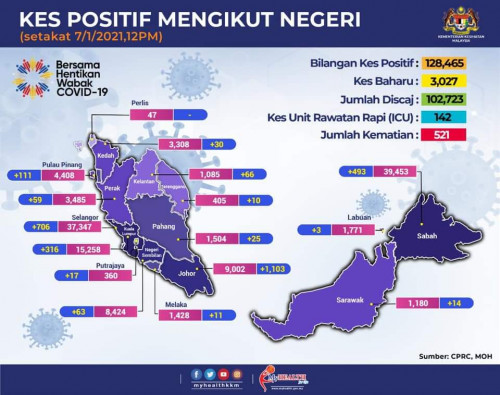

If they are not wrong.... think about it ..... the shorties. Does this or does this not explain why so many were willing to short TG?

Yeah .... I own no TG shares... and I don't intend to buy any ... it doesn't matter if I am right or wrong... it's just mere sharing of info and some light workout for my fat fingers... and yeah... last I check... this is a stock market discussion thread

Wah bro you’ve quite some free time to dig out these infos consistently eh, mind to share with us what do you do for a living? Or you already don’t? Haha..

Jan 7 2021, 01:13 PM

Jan 7 2021, 01:13 PM

Quote

Quote

0.0991sec

0.0991sec

0.24

0.24

7 queries

7 queries

GZIP Disabled

GZIP Disabled