interesting correlation....with almost similar returns for the past 1,2 & 3 years...

Attached thumbnail(s)

Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

|

|

Dec 21 2015, 01:50 PM Dec 21 2015, 01:50 PM

Return to original view | Post

#21

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Dec 21 2015, 07:29 PM Dec 21 2015, 07:29 PM

Return to original view | Post

#22

|

Senior Member

8,188 posts Joined: Apr 2013 |

Unit Trusts Investment Fair: What and Where to Invest in 2016

http://www.fundsupermart.com.my/main/resea...?articleNo=6645 Attached thumbnail(s)

|

|

|

Dec 22 2015, 07:49 AM Dec 22 2015, 07:49 AM

Return to original view | Post

#23

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(iamoracle @ Dec 22 2015, 07:45 AM) Quite close to CNY. I will be busy looking for money to fill up ang-pow packets. I remember that almost every years without fail, FSM sent me ang-pow packet but with empty content. |

|

|

Dec 22 2015, 03:28 PM Dec 22 2015, 03:28 PM

Return to original view | Post

#24

|

Senior Member

8,188 posts Joined: Apr 2013 |

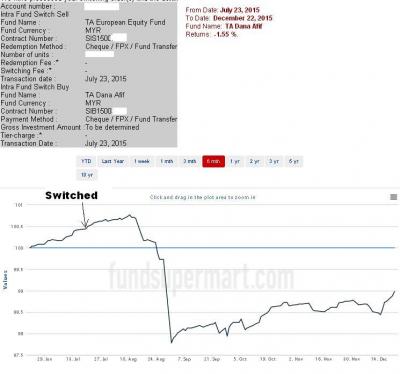

QUOTE(Vanguard 2015 @ Dec 22 2015, 02:50 PM) No need to pay SC. You are automatically using the credit points which you obtained in the first place when you switched from the Affin Hwang Equity Fund into the Affin Hwang Bond Fund. just checked....i had credit points earned...BUT not thru CIMB transactions.... i bought into Ponzi 2.0 last week using cash IBG...FSM charge me 1%sc. i think credits points to be used must be earned from that FH to be eligible.... Attached thumbnail(s)

|

|

|

Dec 22 2015, 03:34 PM Dec 22 2015, 03:34 PM

Return to original view | Post

#25

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(lukenn @ Dec 22 2015, 03:31 PM) I do not have access to the FSM platform, as I am not a client . I am looking at the last fund, PMB Shariah Aggressive, and trying to read up on its FFS here. welcome on board...The data seems ... different. Am I looking at the right thing there ? I'm trying to figure out how to post pictures here. Help ? Full disclosure : I am an IC with a competing FI. you can try use FSM tools for free on its website on the FUNDS INFO tabs....got many tools there can try.... http://www.fundsupermart.com.my/main/fundi...fundSelect.svdo to post picture...have to SAVE under jpg. This post has been edited by yklooi: Dec 22 2015, 03:35 PM |

|

|

Dec 22 2015, 03:53 PM Dec 22 2015, 03:53 PM

Return to original view | Post

#26

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Dec 22 2015, 10:19 PM Dec 22 2015, 10:19 PM

Return to original view | Post

#27

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(kimyee73 @ Dec 22 2015, 09:56 PM) It is automatic but you need to intra-switch from fixed to equity and not purchase using CMF. The later will charge you SC. intra switch.....what about inter switch ( A switch from one fund manager to another) like what vanguard posted....Convert your INTER-fund switch into INTRA-fund switch. Affin Hwang Equity Fund = Affin Hwang Bond Fund = Kenanga Bond = Kenanga Equity Fund. Affin Hwang Equity Fund => Affin Hwang Bond Fund ...you get credit points, then; Affin Hwang Bond Fund => Kenanga Bond ....0% sc, then Kenanga Bond => Kenanga Equity Fund...need to pay SC or FSM will just deduct from the credit points. (if no need to pay sc and just deduct from credit point then, the whole cycle from Affin Hwang Eq to Kenanga Equity would be "FOC") This post has been edited by yklooi: Dec 22 2015, 10:28 PM |

|

|

Dec 22 2015, 10:26 PM Dec 22 2015, 10:26 PM

Return to original view | Post

#28

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(lukenn @ Dec 22 2015, 10:17 PM) The more i read this thread the more questions I have ... I think the 1. Why Kenanga Bond Fund ? It's not a performer. Actually I think they're below benchmark. 2. What fund is Ponzi 1.0 ? 3. Which one of Ms. Lee's funds are you referring to ? Please be patient with me. #1 oh...the Kenanga Bond fund we are currently discussing is just an example of the switching to save the SC #2 is Affin Hwang Select Asia X japan Quantum Fund #3 is Kenanga Growth Fund...Ms Lee sook yee is the designated Fund manager This post has been edited by yklooi: Dec 22 2015, 10:35 PM |

|

|

Dec 22 2015, 10:33 PM Dec 22 2015, 10:33 PM

Return to original view | Post

#29

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Vanguard 2015 @ Dec 22 2015, 10:28 PM) .......For simplicity, just think of how many credit points you have. Recycle the points until eternity. Never redeem directly into CMF from equity funds. Always intra switch into a bond fund first. Then you will earn the credit points. will the credit stays once the money is out to CMF?ex Hwang EQ to Hw Bond, then to Kenanga Bond, then to Kenanga EQ, then to CMF/cashout.... |

|

|

Dec 22 2015, 11:03 PM Dec 22 2015, 11:03 PM

Return to original view | Post

#30

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(lukenn @ Dec 22 2015, 10:40 PM) 1. Actually the are talking about KBF, but more of an intermediary fund to reduce sales charge, I think. This post has been edited by yklooi: Dec 22 2015, 11:19 PM(yes...see my amended post). So you guys are paying : 1. 2% sales charge, for all equity funds ? 1% on fixed income ? normal price is 2% for EQ fund purchase, but many are status holders where they get another 0.25~0.75% off the normal SC. http://www.fundsupermart.com.my/main/faq/1...-Programme-8873 FI fund normally is 0%SC, but has platform fees http://www.fundsupermart.com.my/main/faq/1...atform-Fee-8467 2. 2% switching if you're moving to equity funds in different fund houses ? the sc depends of to EQ or FI 3. 2% switching if moving from fixed income to equity funds ? Q: Where can I see the charges applicable for Intra/Inter fund house switching? A: To view the switching fees for Intra and Inter fund house switches, please look under FUNDS INFO-> FUNDS SALES CHARGES-> SWITCHING and select either INTRA FUND HOUSE or INTER FUND HOUSE. http://www.fundsupermart.com.my/main/faq/1...g-of-Funds-8922 |

|

|

Dec 22 2015, 11:07 PM Dec 22 2015, 11:07 PM

Return to original view | Post

#31

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Vanguard 2015 @ Dec 22 2015, 10:51 PM) Yes, the credit points will be there for eternity. If I could sell my spare credit points to the forumers here, I would. oh, yes.... BTW, your eg above is missing one crucial step. It should be from Kenanga EQ to Kenanga Bond again and then only to CMF. Otherwise you don't earn credit points. thks for the corrections. |

|

|

Dec 23 2015, 01:37 PM Dec 23 2015, 01:37 PM

Return to original view | Post

#32

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(wing2010 @ Dec 23 2015, 01:22 PM) hi all sifus, newbie here seeking for advice Maximise Returns while Minimising Risk with a Core and Supplementary Portfolio i plan to start with 3 funds will buy kenanga growth and affin hwang ap divident fund on 9th jan in view of 0.5% sc and today i wanna buy cimb (1% sc for new user) but undecided among these three:- global titans asia pacific dynamic greater china equity can anyone recommend which to buy for now? not too sure how to diversify it ur input is greatly appreciated http://www.fundsupermart.com.my/main/resea...y-Portfolio--59 Keep Your Risks In Check Different investments come with different levels of risks and investors need to understand and know the risks that they can stomach given the circumstances that they are in before making a decision on what to invest. We explain how Fundsupermart.com Risk Rating can help investors to identify which unit trusts suit their risk appetite. http://www.fundsupermart.com.my/main/resea...-Apr-2012--2266 if still in doubt...call FSM CIS...they can helps |

|

|

Dec 28 2015, 08:42 AM Dec 28 2015, 08:42 AM

Return to original view | Post

#33

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Vanguard 2015 @ Dec 28 2015, 12:21 AM) I am now at Genting Highlands. I just came out from the casino but I didn't spend a single cent. The minimum bet for Pontoon or Blackjack is RM100. 20 years ago the minimum bet was RM25 or sometimes even RM10. I did some mental calculation. The odds are better if I put RM10k into TA Global Technology Fund or AmPrecious Metals. In the worst case scenario, I may lose 20% of my investment in a few months. But in the best case scenario, I may earn 10% return in a few months. So better for me to buy unit trusts than to gamble at the casino. with so many risks involved as in... http://www.cimb-principal.com.my/Investor_...rust_Funds.aspx but if for longer terms....like the JEDI master [wongmunkeong] said in post# 512... Beware the Dark Side.. Greed it is.. Fast it is.. Use the <mutual> FUNDS Luke.. This post has been edited by yklooi: Dec 28 2015, 08:48 AM |

|

|

|

|

|

Dec 28 2015, 09:06 AM Dec 28 2015, 09:06 AM

Return to original view | Post

#34

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(wongmunkeong @ Dec 28 2015, 08:52 AM) heheh - my opinion & statistical reality i think (casino owners legal/illegal & workers intheknow, please correct my assumptions below ya) How can I determine the odds of flat betting (no counting, no progressions , etc ) of being ahead in a negative game such as blackjack, w/o counting, with a 0.5% disadvantage after 45,000 or so hands? Is it even possible?....... <cue Kenny Roger's "The Gambler" - U gotta know when to hold 'em, Know when to walk-away, Know when to run> yes yes, old farts like me knows Mr Kenny as a singer first before grilled chicken/roasters Any basic statistics book should have a standard normal table which will give the Z statistic of 0.8186. So the probability of being ahead in your example is about 18%. http://wizardofodds.com/ask-the-wizard/bla...ck/probability/ |

|

|

Dec 28 2015, 09:18 AM Dec 28 2015, 09:18 AM

Return to original view | Post

#35

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(river.sand @ Dec 28 2015, 08:58 AM) You go to casino for entertainment. You don't go there with expectation to win. as entertainment fee I used to play slot machine with expectation to lose, and I set a maximum amount of money I would spend, e.g. RM50. Call this entertainment fee. Once this amount was used up I would stop. Sorry just how to avoid being seduced by the Darker Force... and when it is gone...what did you do then? Drive back down hill again? for many, once my entertainment fees are used up in the "chicken" farm....they would just wash up and leave...no more excitement or fun in staying around anymore |

|

|

Dec 28 2015, 09:29 AM Dec 28 2015, 09:29 AM

Return to original view | Post

#36

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(brotan @ Dec 28 2015, 09:23 AM) hi guys for cooling off period, does that mean if i withdraw within that period, no sales charge occurs? can we utilize this feature to exit the fund if price drop a lot during that period? and I think yes..to your question. try check it out with FSM CS for confirmation |

|

|

Dec 28 2015, 09:32 AM Dec 28 2015, 09:32 AM

Return to original view | Post

#37

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(wongmunkeong @ Dec 28 2015, 09:16 AM) found many sites in google when I typed (the odds of winning in Blackjack)...which is OT ...so will not elaborate more . the end story is ...."most of them (Uts) don't lose all capital injected" vs gambling. |

|

|

Dec 28 2015, 03:59 PM Dec 28 2015, 03:59 PM

Return to original view | Post

#38

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(dasecret @ Dec 28 2015, 03:35 PM) Hand itchy liao.... decided to try Vanguard's ninja trick; intra switched some of my MY equity funds to bond funds for credits hope you have a BETTER luck than me....Attached thumbnail(s)

|

|

|

Dec 28 2015, 04:02 PM Dec 28 2015, 04:02 PM

Return to original view | Post

#39

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Dec 28 2015, 04:05 PM Dec 28 2015, 04:05 PM

Return to original view | Post

#40

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0524sec 0.0524sec

0.15 0.15

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 12:49 AM |