QUOTE(dasecret @ Dec 31 2015, 02:20 PM)

Not sure if our con-sultan regret coming to this thread... all the people in this thread same same one.... want free and good!

i guess, sometimes some angels will come by giving guidance and assistance willingly.....

like previously and now still continuing doing it

the "ONE" that keep updating the revision

the "ONE" that done a good work of coming out with a "canggih" excel file for all to share

the "ONE" that suddenly appeared to provide some programs on auto NAV update from FSM website.

the "ONE" that provided and corrected many misconceptions about UTs investing

the "ONE" that provided .............(you name it)

etc, etc

"may GOD reward them with some goodies".......Happy New Year everyone.....

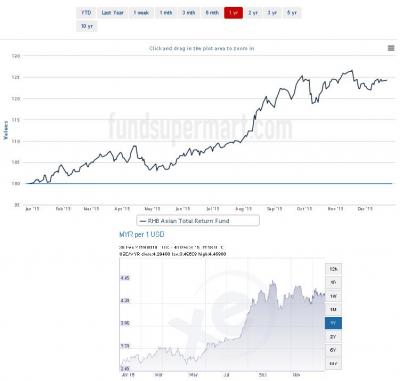

Attached thumbnail(s)

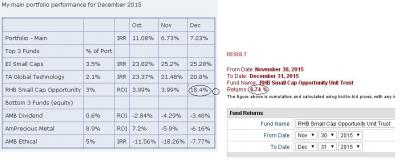

Attached thumbnail(s)

Dec 28 2015, 04:08 PM

Dec 28 2015, 04:08 PM

Quote

Quote

0.0343sec

0.0343sec

0.28

0.28

7 queries

7 queries

GZIP Disabled

GZIP Disabled