QUOTE(xuzen @ Dec 29 2015, 07:02 PM)

Green Kao Kao kanProfit taking anyone ?

This post has been edited by aoisky: Dec 29 2015, 11:40 PM

Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

|

|

Dec 29 2015, 11:40 PM Dec 29 2015, 11:40 PM

|

Senior Member

1,203 posts Joined: Dec 2008 |

|

|

|

|

|

|

Dec 30 2015, 03:44 AM Dec 30 2015, 03:44 AM

Show posts by this member only | IPv6 | Post

#602

|

Junior Member

567 posts Joined: Mar 2011 |

|

|

|

Dec 30 2015, 06:38 AM Dec 30 2015, 06:38 AM

|

Senior Member

1,203 posts Joined: Dec 2008 |

|

|

|

Dec 30 2015, 08:07 AM Dec 30 2015, 08:07 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

KWAP to repatriate proceeds from sale (270 million pound sale of an office building in central London) by end of first quarter

KWAP, as the state-owned fund is known, expects to be able to repatriate the funds back to Malaysia by the end of the first quarter to invest in local markets, Wan Kamaruzaman said. He didn’t name the buyer of the London office building. Malaysia’s stock market may recover next year as a result of recent government measures, Wan Kamaruzaman said. As well as repatriating funds from the U.K., KWAP is contributing to a 20 billion ringgit capital injection into ValueCap Sdn., http://www.bloomberg.com/news/articles/201...patriation-move KGF & EISC |

|

|

Dec 30 2015, 11:07 AM Dec 30 2015, 11:07 AM

|

Senior Member

4,436 posts Joined: Oct 2008 |

Madam Zorra aka Xuzen

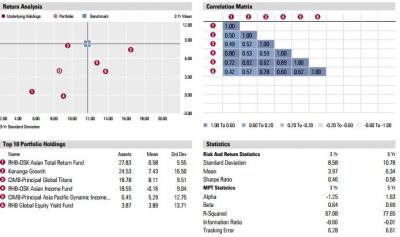

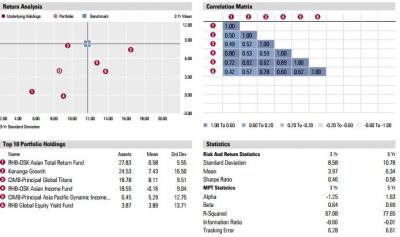

latest crystal ball™ reading: No major changes to the portfolio as the data present no major seismic activity. a) Titan slightly overweight (+5%) b) Ponzi 2.0 = neutral or slightly underweight (-5%) c) Small Cap = neutral / hold d) Local Corporate Bond = overweight in lieu of Bolehland large cap. e) Titan is my proxy for developed market esp US exposure f) Ponzi 2.0 is my proxy for Asia-pac ex Japan. I prefer ver 2.0 versus 1.0 because ver 2.0 it is less volatile than 1.0 g) I use Eastspring small cap as proxy for Bolehland small to mid cap exposure. I like this asset class because it is a great diversifier to Titan & Ponzi 2.0 and most other asset class. It is not easy to find a low correlation asset class these days and small cap is a wonderful gem! However due to its high volatility I cap my exposure to 10%. h) Eastspring Inv bond is my proxy to Bolehland corporate bond. I am using it as my proxy to Bolehland exposure. My reading shows weak equities performance from large cap stocks. A stable, fixed income asset class is my preferred Bolehland exposure going into 2016. I will not hold any large cap fund going into 2016. Xuzen p/s May all Huat Huat Huat in 2016! |

|

|

Dec 30 2015, 11:10 AM Dec 30 2015, 11:10 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

As usual, Crystal Balls™ hates RHB Asian Total Return!

|

|

|

|

|

|

Dec 30 2015, 11:19 AM Dec 30 2015, 11:19 AM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Pink Spider @ Dec 30 2015, 11:10 AM) High correlation coefficient with Ponzi 2.0 ma...Anyway, all these correlation stuffs sounded familiar to me but not exactly sure what it really includes... Now I know why, I studied them in ACCA last time As to EI bond fund, is it such a great fund? If I judge from 6 months returns of 1.9%*2, the annualised return is 3.8% which is the same as CMF. I disregarded the one off recovery of previously impaired bond that caused 1 year return of 11.7% I hold RHB Islamic bond... but it's riskier la, 20% on a single A rated bond |

|

|

Dec 30 2015, 11:30 AM Dec 30 2015, 11:30 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Dec 30 2015, 11:31 AM Dec 30 2015, 11:31 AM

|

Senior Member

10,001 posts Joined: May 2013 |

Bursa trading above 1,700 now

|

|

|

Dec 30 2015, 11:31 AM Dec 30 2015, 11:31 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(dasecret @ Dec 30 2015, 11:19 AM) High correlation coefficient with Ponzi 2.0 ma... u also ACCA? Anyway, all these correlation stuffs sounded familiar to me but not exactly sure what it really includes... Now I know why, I studied them in ACCA last time As to EI bond fund, is it such a great fund? If I judge from 6 months returns of 1.9%*2, the annualised return is 3.8% which is the same as CMF. I disregarded the one off recovery of previously impaired bond that caused 1 year return of 11.7% I hold RHB Islamic bond... but it's riskier la, 20% on a single A rated bond I failed my finance paper, I think I got 20%++ only. All those formulas baffle me Luckily the next sitting got ethics paper, I took that in lieu of finance paper to clear my exams. Ethics paper I scored >80% Dig back that FSM competitor CON-sultan post...mana ada highly correlated? Nah ini dia. Only low-moderate correlation, quite close to 0  This post has been edited by Pink Spider: Dec 30 2015, 11:36 AM |

|

|

Dec 30 2015, 11:34 AM Dec 30 2015, 11:34 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Dec 30 2015, 11:39 AM Dec 30 2015, 11:39 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

|

|

|

Dec 30 2015, 11:41 AM Dec 30 2015, 11:41 AM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Pink Spider @ Dec 30 2015, 11:31 AM) u also ACCA? Opps... sounds like I'm older I failed my finance paper, I think I got 20%++ only. All those formulas baffle me Luckily the next sitting got ethics paper, I took that in lieu of finance paper to clear my exams. Ethics paper I scored >80% Dig back that FSM competitor CON-sultan post...mana ada highly correlated? Nah ini dia. Only low-moderate correlation, quite close to 0  Geng wor, professional level can score >80%... so at least Msia prize winner lor? Hmm... when I tried on morningstar, I remember getting 60ish correlation between RHBATR and ponzi 2.0 |

|

|

|

|

|

Dec 30 2015, 11:44 AM Dec 30 2015, 11:44 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(dasecret @ Dec 30 2015, 11:41 AM) Opps... sounds like I'm older Aku ni akauntan scoring high for written questions but crappy for calculation questions. I was never meant to be a calculation guy Geng wor, professional level can score >80%... so at least Msia prize winner lor? Hmm... when I tried on morningstar, I remember getting 60ish correlation between RHBATR and ponzi 2.0 Back to topic... Refer to the chart...if u combo ATR + (Ponzi 1.0+Ponzi 2.0)/2, u get near zero Correlation can average like that tak? |

|

|

Dec 30 2015, 11:55 AM Dec 30 2015, 11:55 AM

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

Dec 30 2015, 12:01 PM Dec 30 2015, 12:01 PM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Pink Spider @ Dec 30 2015, 11:44 AM) Aku ni akauntan scoring high for written questions but crappy for calculation questions. I was never meant to be a calculation guy OT... accountants who r better at goreng-ing exams than counting... sounds like will be good at cooking books.... alarm bells going off Back to topic... Refer to the chart...if u combo ATR + (Ponzi 1.0+Ponzi 2.0)/2, u get near zero Correlation can average like that tak? Anyway... of course cannot average like that la... I logged in to morningstar again, still show me 0.72 Need to ask your con-sultan how he get his numbers

|

|

|

Dec 30 2015, 12:03 PM Dec 30 2015, 12:03 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

Those fancy charts and tables got from where? Morningstar?

|

|

|

Dec 30 2015, 12:03 PM Dec 30 2015, 12:03 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

Those fancy charts and tables got from where? Morningstar?

|

|

|

Dec 30 2015, 12:03 PM Dec 30 2015, 12:03 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(dasecret @ Dec 30 2015, 12:01 PM) OT... accountants who r better at goreng-ing exams than counting... sounds like will be good at cooking books.... alarm bells going off Mana ada goreng...I cuma pandai argue...esp with theoretical stuff... Anyway... of course cannot average like that la... I logged in to morningstar again, still show me 0.72 Need to ask your con-sultan how he get his numbers

LOL! CON-sultan pwned! Oi CON-sultan, MANA LU??? |

|

|

Dec 30 2015, 12:11 PM Dec 30 2015, 12:11 PM

|

Junior Member

311 posts Joined: Mar 2010 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0179sec 0.0179sec

0.49 0.49

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 07:30 AM |