QUOTE(Pink Spider @ Dec 29 2015, 05:21 PM)

TQ very much... feel like a dumbo Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

Fundsupermart.com v13, Merry X'mas and Happy 牛(bull!) Year

|

|

Dec 29 2015, 05:31 PM Dec 29 2015, 05:31 PM

Return to original view | Post

#21

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

|

|

|

Dec 29 2015, 06:31 PM Dec 29 2015, 06:31 PM

Return to original view | Post

#22

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

Dec 30 2015, 11:19 AM Dec 30 2015, 11:19 AM

Return to original view | Post

#23

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Pink Spider @ Dec 30 2015, 11:10 AM) High correlation coefficient with Ponzi 2.0 ma...Anyway, all these correlation stuffs sounded familiar to me but not exactly sure what it really includes... Now I know why, I studied them in ACCA last time As to EI bond fund, is it such a great fund? If I judge from 6 months returns of 1.9%*2, the annualised return is 3.8% which is the same as CMF. I disregarded the one off recovery of previously impaired bond that caused 1 year return of 11.7% I hold RHB Islamic bond... but it's riskier la, 20% on a single A rated bond |

|

|

Dec 30 2015, 11:41 AM Dec 30 2015, 11:41 AM

Return to original view | Post

#24

|

Senior Member

1,498 posts Joined: Nov 2012 |

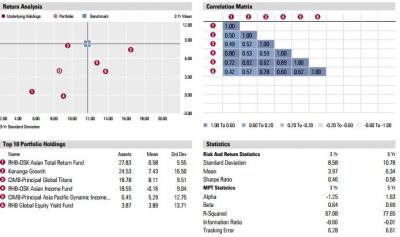

QUOTE(Pink Spider @ Dec 30 2015, 11:31 AM) u also ACCA? Opps... sounds like I'm older I failed my finance paper, I think I got 20%++ only. All those formulas baffle me Luckily the next sitting got ethics paper, I took that in lieu of finance paper to clear my exams. Ethics paper I scored >80% Dig back that FSM competitor CON-sultan post...mana ada highly correlated? Nah ini dia. Only low-moderate correlation, quite close to 0  Geng wor, professional level can score >80%... so at least Msia prize winner lor? Hmm... when I tried on morningstar, I remember getting 60ish correlation between RHBATR and ponzi 2.0 |

|

|

Dec 30 2015, 12:01 PM Dec 30 2015, 12:01 PM

Return to original view | Post

#25

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Pink Spider @ Dec 30 2015, 11:44 AM) Aku ni akauntan scoring high for written questions but crappy for calculation questions. I was never meant to be a calculation guy OT... accountants who r better at goreng-ing exams than counting... sounds like will be good at cooking books.... alarm bells going off Back to topic... Refer to the chart...if u combo ATR + (Ponzi 1.0+Ponzi 2.0)/2, u get near zero Correlation can average like that tak? Anyway... of course cannot average like that la... I logged in to morningstar again, still show me 0.72 Need to ask your con-sultan how he get his numbers

|

|

|

Dec 30 2015, 12:12 PM Dec 30 2015, 12:12 PM

Return to original view | Post

#26

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

|

|

|

Dec 30 2015, 02:09 PM Dec 30 2015, 02:09 PM

Return to original view | Post

#27

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(lukenn @ Dec 30 2015, 12:59 PM) I'll show you how I didn't get my numbers. TQTQ [attachmentid=5655369] But for you benefit, in MYR, your correlation table would look like this over the last 3yrs. [attachmentid=5655374] So it's something free account can't do? Can't seem to find a button to change currency |

|

|

Dec 30 2015, 02:20 PM Dec 30 2015, 02:20 PM

Return to original view | Post

#28

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

Dec 30 2015, 02:22 PM Dec 30 2015, 02:22 PM

Return to original view | Post

#29

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(river.sand @ Dec 30 2015, 02:11 PM) Just created a Morningstar account. Still learning to use it. After you x-ray it, the document has a pdf link at the top right corner, click that and a more detailed report would appearHow to get the correlation table? I click the 'X-ray this Portfolio', but don't see it. Do we need to enter purchase price, purchase date etc.? |

|

|

Dec 30 2015, 03:22 PM Dec 30 2015, 03:22 PM

Return to original view | Post

#30

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

Dec 31 2015, 02:16 PM Dec 31 2015, 02:16 PM

Return to original view | Post

#31

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

Dec 31 2015, 02:20 PM Dec 31 2015, 02:20 PM

Return to original view | Post

#32

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

Jan 3 2016, 10:32 PM Jan 3 2016, 10:32 PM

Return to original view | Post

#33

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

|

|

|

Jan 4 2016, 01:45 PM Jan 4 2016, 01:45 PM

Return to original view | Post

#34

|

Senior Member

1,498 posts Joined: Nov 2012 |

Wah.... free falling today

China fell 5.7% |

|

|

Jan 6 2016, 10:52 AM Jan 6 2016, 10:52 AM

Return to original view | Post

#35

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

Jan 6 2016, 10:59 AM Jan 6 2016, 10:59 AM

Return to original view | Post

#36

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Ramjade @ Jan 6 2016, 09:37 AM) What I am saying is just buy PRS for max tax relief. Any balance dump into epf rather than buy a PRS. You are looking at PRS too simplisticallyI would look at it at each of its element 1. Employee contribution - compare against UTs; PRS with lock in, UT without - only differentiating factor is tax relief So yes, contribute only up to RM3k per annum 2. Employer contribution - compare against EPF; both have lock in period If you are self employed in a Sdn Bhd; or have some say on how HR deals with the additional employment benefit; ie company currently contribute more than 12% to EPF I would recommend for the extra % to be contributed into PRS instead of EPF Why? - The additional % up to 7% would be tax deductible anyway, if contributed to EPF or PRS - The employee does not have to pay sales charge to take out account 1 balances to invest in UTs - The choice of PRS funds are not limited to Malaysia equity funds; you get asia pac funds as well Cons - HR got more work to do as the employees might choose different funds in different fund house Unfortunately PPA does not do a good job in (2) and therefore the AUM for PRS is still very low. Most banks and many MNCs contribute additional % to EPF as a staff perk. Most PRS equity funds would exceed 2.5% return or even EPF returns on a longer term basis |

|

|

Jan 8 2016, 09:45 AM Jan 8 2016, 09:45 AM

Return to original view | Post

#37

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Vanguard 2015 @ Jan 7 2016, 04:29 PM) When in doubt, broaden the battlefield. Currently I am running 4 separate FSM accounts. I supposed each of your account would be designated for a different purpose right? I did thought of transferring my current individual account to 2 beneficiary accounts for my 2 kids; but what if 1 perform and 1 doesnt? (a) Primary Account - already topped up to the max $. No more fresh investment. Going to use VA every quarterly and reduce the equity exposure if necessary. (b) Secondary Account No. 1 - Same as above. © Secondary Account No. 2 - Using RSP. (d) Secondary Account No. 3 - Using RSP. Let's see which account will perform better in the future. |

|

|

Jan 12 2016, 02:02 PM Jan 12 2016, 02:02 PM

Return to original view | Post

#38

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(cheahcw2003 @ Jan 12 2016, 01:47 PM) i like reading this thread. More insights to learn compared to the ASB/ASW thread. I tried adding more flavors to that thread.... needless to say, I failed miserably In that thread, if any guy successfully top up 1k into their account, 10 postings asking which bank/branch, which counter, what time, 1 trial or multiple trials, and another 10 postings congrat the guy well done, and why so lucky. The quality of that thread very low. |

|

|

Jan 12 2016, 02:04 PM Jan 12 2016, 02:04 PM

Return to original view | Post

#39

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(wongmunkeong @ Jan 12 2016, 01:54 PM) Checkers players VS Chess players - of courselar here more oomph.. Ahem, the asset allocation within the fund is 75% or more in equity ok... Over there only "fixed income" and main tikam (can get/cannot get) Here, asset allocation lar, diversification via time, assets sub-assets lar, fear vs greed check & controls (or leveraging on those) lar, etc. But yes, not much difference with fund you go with in terms of returns Even after multiple reminders most still think it's FD equivalent and capital guaranteed |

|

|

Jan 12 2016, 05:46 PM Jan 12 2016, 05:46 PM

Return to original view | Post

#40

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(MUM @ Jan 12 2016, 05:06 PM) Thanks for explaining.... Thanks to our government who wants to leverage on the people's money to prop up the share market but at the same time these people will not invest in anything that may lose moneyin the end...is it capital protected in layman term? how should I explain it to my children? It looks like capital protected (bcos buy/sell at RM1) but it is actually not?...sound confusing.... Capital guaranteed is such a powerful term in behavioral finance; as soon as people hear that word, all logic goes out of the window |

|

Topic ClosedOptions

|

| Change to: |  0.0373sec 0.0373sec

0.52 0.52

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 07:19 AM |