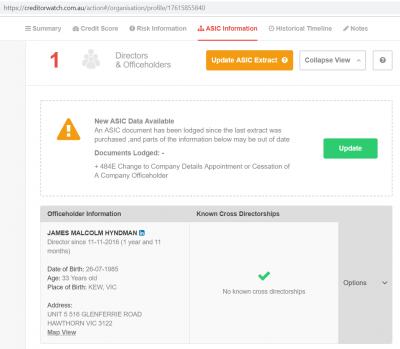

My Group Fintech Co Pty Ltd (

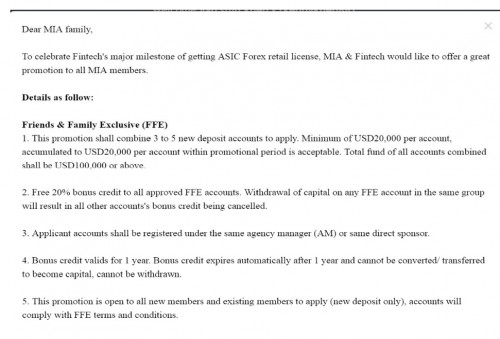

24375 IBC 2017) is a related entity of My Group Fintech Co Pty Ltd (ACN 615 855 840; Australian Financial Services Licence 493603). The two entities are

managed separately. No The FX and /Derivatives offered on this website are

NOT provided by the Australian entity and no recourse against the Australian entity is available.

source:

https://fintechfx.com/Look like ASIC have already requested them to be very clear on their marketing and trading offerings.

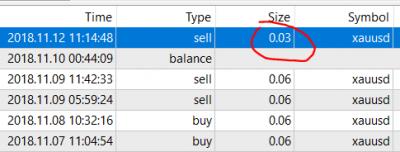

Trading is done on SVG, and to set up an SVG entity only cost less than 1K USD and no other requirements.

Importantly, no banks are willing to facilitate forex broker business due to high risks of AML.

Usually, banks facilitate if they are regulated in the home country or special relationship or fake business activities.

Looks like the latest changes on footer already declared that all trading is done by SVG side, SVG has no regulation.

The Aus side is not responsible for trading or future trading losses.

14% is not sustainable, especially with recent Gold movements, real trading losses cannot be diluted if the inflow of funds cannot meet the speed of draw-down.

The funds of mia has exceed 1 billion USD and will be bigger than IGOFX scam and probably reaching 2-3bilion USD if more investors are supporting into this money game MLM pyramid game.

Good luck folks, happy new year and soon will doom.

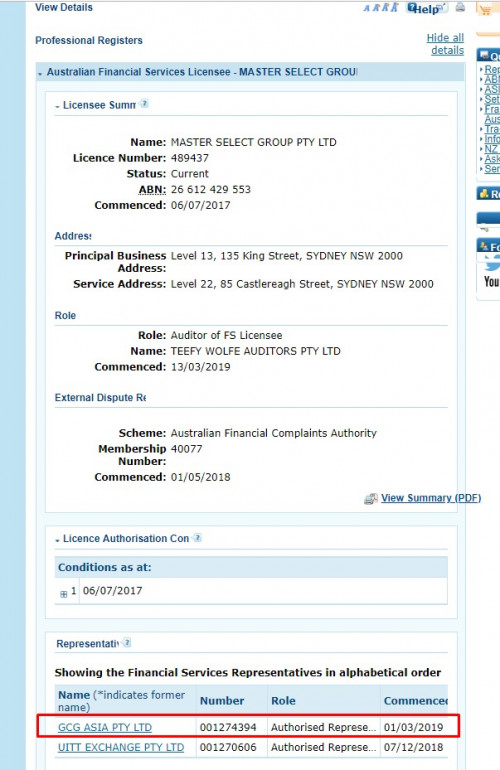

It seem ASIC already take action (at least warning) to FintechFX to NOT MISLEAD customer saying that they are ASIC REGULATED BROKER

Oct 24 2018, 05:32 PM

Oct 24 2018, 05:32 PM

Quote

Quote

0.1646sec

0.1646sec

0.53

0.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled