What sort of trader would not like the assistance of a broker that he can rely on? Most new traders struggle to find a genuine forex broker who is transparent and provides a great forex trading experience. There are several reasons for this, but one of the major reasons is the mindset of the traders themselves. As most new traders are lured into the forex game through a fake forex broker as an easy way to make money, they have a wrong image about the forex market and hence do not know how to get long term success. Most of us know that forex is one of the most volatile markets in the world, and due to its floating nature, the prices of the currencies cannot be predicted. But the question of how to identify weather a forex broker is genuine or not depends on several factors. You can also check the various internet websites like forexstars and other to get reviews about the various forex brokers. Here are some ways how you can check the authenticity of a forex broker.

MAKE SURE THE FOREX BROKER IS WELL REGULATED

Only trade or invest with top tier licensed brokers/banks who are under tier 1 and 2 licenses for highest protection. For example, in the event of a Swiss broker/bank bankruptcy, traders and investors are given up to CHF100k capital protection.

Tier 1 licenses under: US NFA, UK FCA, SWISS FINMA, JAPAN FSA, SINGAPORE MAS.

Tier 2 licenses under: European financial regulators (except Cysec), Australia ASIC, Canada IIROC, Hong Kong SFC.

AVOID UNREGULATED BROKERS OR OFFSHORE REGULATED BROKERS THAT WITHOUT TIER 1 or 2 licenses. (Vanuatu, Seychelles, St. Vincent, Comoros, Belize, Indonesia etc)

Traders and investors can check with their corresponding regulatory agencies that check the credibility of the forex brokers. They include the National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC) in the United States, Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) in the United Kingdom, Australian Securities and Investment Commission (ASIC), Swiss Federal Banking Commission (SFBC) and FINMA, Bundesanstalt für Finanzdienstleistungsaufsicht (BaFIN) in Germany and Autorité des Marchés Financiers (AMF) in France.

Analyze the Website

We all know that in this age of peerless internet technology, coming across fake content is totally possible and one must first check the website first for a clear picture of the reviews. Some websites are meant not for the viewers but an organization’s attempt at getting more affiliates. In such cases you have to judge for yourself whether the reviews are real or are posted through automated software to get more viewers.

Check the Comment Box

Some sites are highly moderated along with the viewer’s comments that appear on the website due to the fear of spam. If a website allows regular users to comment on their posts that is a great sign of openness. But if your comment doesn’t appear immediately on the website and is stuck in the moderation phase forever, you certainly do not want to waste a lot of time reading your reviews on such a website. Several times unanswered comment boxes also indicate the website’s poor activity.

Only Promote Genuine Reviews

There are several websites that post a review and also refer the viewer to a broker’s website as several broker’s pay the sites to promote themselves. While there is nothing wrong in referrals, the viewers must also use their full discretion when it comes to judging whether the reviews are genuine or not. Try to avoid websites that also provide a referral link in a review that also redirects the user to the broker’s webpage.

Transparency Is A Must

The best way to know whether your forex broker is a fake one or not, is to look for his list of clients. While several fake brokers might tell you that it is against the law to disclose such information, the reality is the total opposite and no genuine broker would be afraid to share the list of his clients. Genuine brokers use their network of traders more as their work portfolio and you can always judge the authenticity of a broker through the profiles of the various clients and traders that he deals with. More transparency in a broker’s activities will instill more faith in the clients.

Look At How The Broker Works

While this would be like judging a book from its cover, forex brokers can be judged based on how they deal with their clients. If the forex broker holds each client’s funds in a segregated account approved by the traders, then it is quiet likely that you’re working with a genuine broker. Make sure that the broker has a valid proof of operating under a government regulation.

Check the Broker’s Portfolio

After you have checked how the broker works and the long list of his client’s, you still need to see if the clients are earning regular profits or not. Doing a short background check on how the various traders are performing with a particular broker is one of the best ways to know a broker’s authenticity. Forex is a highly fluctuating market and to ensure profits one requires having a really keen eye and a really honest forex broker.

Forex trading is a risky business and requires a lot of experience and skills, to earn profits over a long term period. Hence it is highly important that the new traders must check the genuineness of a broker to experience a non-stressful forex trading environment.

Indication of SCAMs:

1. FIX RETURN (SCAM)

2. Unregulated, offshore regulated or white label(AR) brokers (Potential SCAM)

3. Lucrative upfront commission (SCAM)

4. Without live report/statement access or Myfxbook (Potential SCAM)

5. Fix exchange rate for deposit and withdrawal (SCAM)

6. Cash payment

7. Lock up period (Potential SCAM)

8. No segregated bank account

9. High monthly return with illogical low drawdown

10. Capital guaranteed

11. Fixed payout schedule or cycle

12. Funny story like ROI from rebates.

13. Owned by China boss.

Any FX companies matched at least 2 of above indications, it is a potential SCAM. If matched 3 of the above indications, then it is definitely a SCAM!

__________________________________________________________________________

List of Genuine Forex Brokers

1. IC Markets

2. Pepperstone

3. Tradeview Markets

4. Forex.com (Gain Capital)

5. CMC Markets

6. Axi

7. equiti

8. Interactive Brokers

9. Finalto

10. FXCM

11. Saxobank

12. IG

13. FXPro

14. Oanda

15. BlueberryMarkets

16. One Royal

17. ATCBrokers

18. Velocity Trade

19. Bloomberg

20. Noor Capital

21. ZeroMarkets

22. Swissquote

23. TMGM

24. ATFX

25. EightCap

26. Moomoo

27. CFI

28. OPOFinance

29. Exness

30. Hantec Markets

31. LMAX

32. FXPro

33. Global Prime

34. Alchemy Markets

35. Varianse

36. Tickmill

37. Trade.com

38. ADS Securities

39. Markets.com

40. YCM-Invest

41. City Index (Gain Capital)

42. Scandinavian Markets

43. Capital.com

44. Plus500

45. HY Markets

46. ActivTrades

47. MAS Markets

48. Admiral Markets

49. Advanced Markets

50. ForexVox (ValuTrades)

51. Tigerwit

52. Pacific Financial Derivatives (PFD)

53. Rakuten Securities

54. GKFX

55. MiTrade

56. ValuTrades

57. FXOpen

58. EBC Financial Group

59. CMS Forex

60. GOMarkets

61. XM

62. FPMarkets

63. ThinkMarkets

64. FXTM

65. GMI (Global Market Index Limited)

66. Aetos

67. MaxFX

68. FBS

69. Kohle Capital Markets

70. Synergy FX

71. Halifax Investment Services

72. eToro

73. AAAFX

74. Amana Capital

75. FXTrading.com

76. EasyForex

77. AVAFX

78. GBE Broker

List of Genuine Forex Investments

1. VESBOLT

List of BAD B BOOK FX Brokers that you should avoid !ALERT!

1. HFM

2. Blackbull

3. FXPrimus

4. EC Markets

5. Infinox

_____________________________________________________________________________

List of SCAM Forex Firms/Brokers !ALERT!

1. LiteForex

2. GSM Financial Group

3. RCFX

4. Maxim Trader

5. ODFX

6. GM Trader (TriumphFX)

7. WFX

8. Eu Trading Group EUTG (NewTradeFX)

9. IBS

10. FXUnited

11. YouTradeFX (EUTG)

12. UFXMarkets

13. GVF

14. TP Eagles

15. Efzinitus

16. IGOFX

17. Vortex Assets and VFX Premium (Eu Trading Group)

18. KBFX

19. JJPTR

20. SFX Markets

21. FXMAC

22. Nordhill Capital

23. Otex World

24. ikoFX

25. FXcoliseum

26. FXCitizen

27. Capital Foster Advisor

28. IIB International Broker

29. PTFX

30. Falconaire

31. FIN888 (SamTradeFX)

32. Xtrade

33. iiinvestments

34. Exia International Group

35. MYS CAPITAL (SFX Markets)

36. Zurich Prime

37. VenusFX

38. WMS Capital

39. MXC Forex

40. ECM

41. Sentratama Investor Future

42. Midasama (Pruton Capital)

43. FG GLOBAL ENRICH (White Label of Fullerton Markets)

44. FCMIS

45. ODIN Management (odincapital.com)

46. BlueMax Capital

47. Questra

48. Atlantic Global Asset Management

49. FXPrimus

50. OctaFX

51. AccentForex

52. Financial.org

53. OTM Capital

54. MG Falconer (TP Eagle)

55. Starexfx

56. FintechFX (MIA)

57. SuperForex

58. Algotechs

59. Bealgo

60. FiFx Global

61. UTS (Sentratama)

62. Blue Trading

63. Midtou Financials

64. OTM Capital (Midtou)

65. MX Capital (Scrptx Portfolio)

66. EssenceFX

67. Tradesto

68. GCG Asia

69. Gold Tinkle - Genesis Business Group

70. WikiFX (fxeye.com)

71. TradeFred - BrightFX Capital Limited (MIA)

72. Smart Contract Group

73. OlympusFX

74. AIP

75. Ocean Bliss Investments (oceanicblissfx)

76. IronFX

77. Veonco Group

78. ECM Trader (ECM Group)

79. CK Ltd.

80. Daweda (Midasama)

81. HiiFX

82. HKdahui

83. Trilasia.com

84. Stone Lion Financial

85. Throne Legacy Capital 腾乐

86. Fullerton Markets

87. NARTT

88. Oribix

89. Awe SwissFX

90. CTIN (MDCFOREX)

91. MAXWISE Union (Sentratama)

92. TrealFX

93. 360coinpath

94. Jadesan Capital Investments (JCI)

95. Orion Star Capital

96. Maxi Services

97. Mahamudra (MMDFX)

98. Forex Chief

99. ATA Markets

100. Juze Investment

101. CP Markets (CooperMarkets.com)

102. FDX Capital (fdxcap.com)

103. Vextrader

104. Arotrade

105. MFM Group (MFM Securities) Union Technology Platform

106. Starling Gold Asset Management HK

107. SamTradeFX

108. Victory Trade International (VTFX)

109. Zentrade (NET89)

110. MaxGlobalFX (NET89)

111. Global Premier (NET89)

112. iAL Group

113. EOB Corporation/EOB Infinity/EOB Miles (TriumphFX)

114. GFS Asia (Janis Urste)

115. Grex Capital

116. Trivial Capital (Grex)

117. Raffles Market FX

118. GST HUB

119. Sky Markets

120. Unison Corporation

121. Jireh Trillions Berjangka

122. Quantic Venture

123. DRCFX

124. AiProFX (YunikonFX)

125. PrimaFX / Prima International

126. FVP Trade

127. Panthera Trade & Pansaka (AutoTrade Gold)

128. AMG Capital (TriumphFX)

129. Herzen (AIFC Technology)

130. Goldenaire (TriumphFX)

131. ASJ Forex Global

132. MogaFX

133. FX Winning

134. VLADO

135. OPIXTECH (RAYNAR Prime)

136. Lirunex

137. UEZ Markets

138. ULTIMATE PINNACLE (Rainmaker Quantum)

139. XAU Merlion (DymonFX)

140. Dollars Markets

141. UW Global (Sentratama - Janis Urste)

142. Tradehall (ValueEnvision)

143. Ridder Trader

144. DMT (Tradehall)

145. CCT (TriumphFX)

146. Wikifx

147. European Credit Investment Bank Ltd (Labuan)

148. Global Trade Finance (BOStrading)

149. Crownstone Private Investments (Lirunex)

150. OXSecurities

151. InstaForex

152. Ultima Markets.

153. PUPrime

154. Gold Fun (AGA)

155. Maxima

156. InterTrader

157. Raze Markets

List of Genuine CRYPTOS

1. Bitcoin

2. Bitcoin Cash

3. Ripple

4. Ethereum

5. Litecoin

6. Dash

7. Neo

8. EOS

9. Qtum

10. Ontology

11.

12.

13.

14.

15.

List of Suspicious CRYPTO Companies (SCAM!)

1. OneCoin

2. WoToken

3. S Block

4. Plus Token

5. Sixmos

6. Emas Fintech

7. Crypto Grand Trade FX

8. CoinCat

9. Loom-X

10.

In case you have invested or trading with any of the scam brokers above, try your very best to withdraw your money back ASAP. If you can't take out your money, file a report or complaint to your local regulator. In most cases, it does not help as scam brokers do not hold any licenses and end up regulators unable to trace them.

Feel free to share your experiences with any other brokers and allow us to add on to above lists.

Based on all the information we provided, i hope it helps new FX investors or traders to differentiate and identify real/scam FX.

We welcome everyone who required due diligence or advise to check the genuineness of a FX brokers. After all, it's FOC.

Moderator, please do not move this topic to join with general Forex spread as it will served as a WARNING to those new to Forex. Thank you.

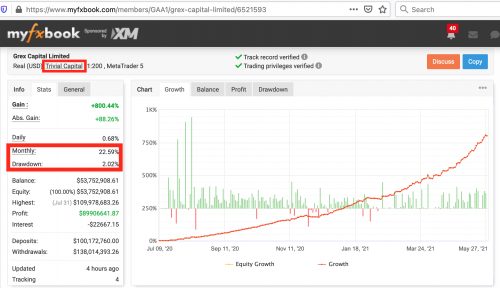

LEARN THE SIMILARITY OF FX SCAMS FROM MYFXBOOK.

Priority check: Check the broker on Myfxbook top left corner. If you find the unknown broker did not hold top tier 1 or 2 licenses (UK, Swiss, US, Australia, Canada, SG, Japan), AVOID IT. Scammers will not spend millions dollar to buy a good license for the purpose of scam. All FX SCAMS operate and collect funds by using offshore firms.

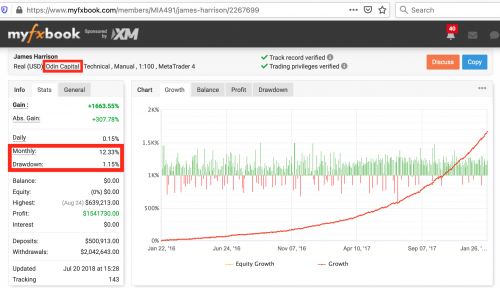

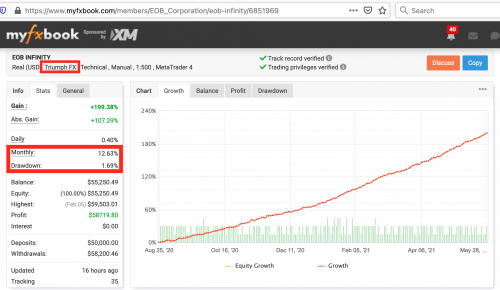

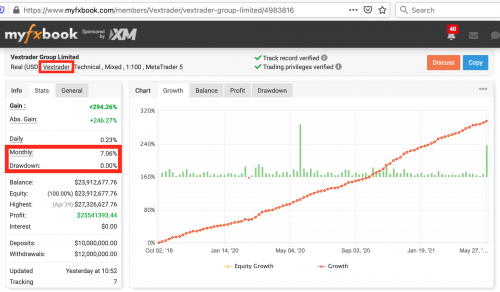

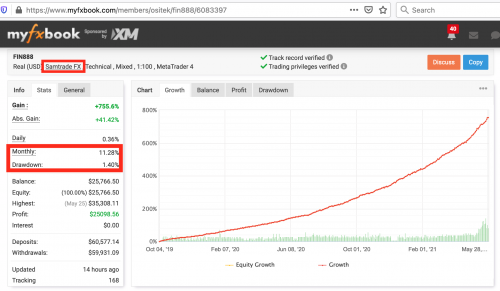

Secondary check: Check the Myfxbook performance on the left which stated Monthly and Drawdown. If you find illogical high returns and low drawdown, you sense something wrong. God does not exist in the real trading world. Every trader experienced drawdown.

Third check: All the charts of FX SCAMS have pretty solid growth curve, without zip zap nor drawdown period. They cant afford to have any drawdown as this will kill the investors and marketers confident.

[After this post, SCAMMERS may start to raise their drawdown. Yet they still can't get any top-tier license.]

We have picked 5 FX SCAMS as examples for everyone to learn the skill. Please check out the Myfxbook screenshot as below.

1. MIA (James Harisson) - Game over, all investors suffered total loss.

2. TriumphFX (EOB) - Scammed several times via Hong Kong, New Zealand firms. Remain very active. Mislead by Cysec license, but in fact they are scamming with offshore.

3. SamTradeFX (FIN888) - Very active. Offshore unregulated. Use white label license to mislead investors.

4. VexTrader - Very active. Offshore unregulated. Mislead by using Canada FINTRAC and Dubai DED, both not FX license, Canada Financial license is under IIROC and Dubai is DFSA.

5. Grex Capital - Very active. Using Labuan license to mislead, it's a tier 3 license without strict requirement.

DONT LET THE FX SCAMMERS CHEAT YOUR HARD EARN MONEY DURING THIS MCO!

RULES OF THE THREAD

1. NO MERCY FOR ANYONE WHO DEFENDING FX SCAMS.

2. Never forgot rules number 1.

3: Remember rules number 1.

This post has been edited by DrFX: Nov 22 2025, 05:54 PM

Nov 14 2015, 05:16 AM, updated 4w ago

Nov 14 2015, 05:16 AM, updated 4w ago

Quote

Quote

0.1836sec

0.1836sec

0.92

0.92

6 queries

6 queries

GZIP Disabled

GZIP Disabled