Fundsupermart.com v12, Najibnomics to lift KLCI?

Fundsupermart.com v12, Najibnomics to lift KLCI?

|

|

Nov 6 2015, 07:49 PM Nov 6 2015, 07:49 PM

Return to original view | Post

#81

|

Senior Member

4,436 posts Joined: Oct 2008 |

LOL J.passing.by for being such a Dork!

|

|

|

|

|

|

Nov 7 2015, 02:43 PM Nov 7 2015, 02:43 PM

Return to original view | Post

#82

|

Senior Member

4,436 posts Joined: Oct 2008 |

Why sudden so many so itchy about China ar? Miss those smell of Jasmine scented China dolls izzit?

I do not recommend China specific fund at the moment. If you mati-mati mesti mau itu Tong San exposure... this is my ranking: RHB China-India Dynamic Fund > CIMB Greater China Fund > Manulife China Fund. As for me, this is my preferred portfolio (equity portion): Titan (45%), Ponzi 2.0 (40%), Malaysian small cap (10%), India (5%) Xuzen p/s: My preferred port have very low China exposure. This post has been edited by xuzen: Nov 7 2015, 02:43 PM |

|

|

Nov 7 2015, 03:01 PM Nov 7 2015, 03:01 PM

Return to original view | Post

#83

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(Pink Spider @ Nov 5 2015, 06:42 PM) Paraphrasing Esther "Using Fixed Income to lower portfolio volatility as part of portfolio allocation strategy" These experts are copying what I have been saying all these times. Take home message: Using bond fund to generate alpha is like using dad's old pick up to impress girl. Hence when Pinky & Co says those High Yield bond are great bla bla bla.... from a portfolio approach, a pure equities fund will over time generate better risk adjusted return compared to those High Yield Bond fund. Bond fund like I said needs to be low volatile to maintain beta; look again at those High Yield Bond... their volatility is around like 7.XX; read: NOT LOW RISK if you are taking on volatility around 7.XX%, might as well go for pure broad geographical region fund where their volatility is like 100 basis point higher but their ROI is 10% more. That is called being efficient. Second point is that these High Yield Bond fund are quite highly positively correlated to equities. So, you are not getting the diversification that you thought you are getting. Xuzen |

|

|

Nov 7 2015, 03:03 PM Nov 7 2015, 03:03 PM

Return to original view | Post

#84

|

Senior Member

4,436 posts Joined: Oct 2008 |

|

|

|

Nov 7 2015, 03:06 PM Nov 7 2015, 03:06 PM

Return to original view | Post

#85

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(prince_mk @ Nov 7 2015, 03:00 PM) Bro Xuzen, If KGF is a lot , then take that into account. If is small amt, then ignore. Granted KGF is a good proxy to M'sian exposure. For your case, you may take out small cap from your port. Take note India should only form a very small part of your port, < 10% max! I am most comfortable around 5%. I have KGF purchased via epf monies. do i include or exclude from the portfolio? fyi, I encompassed of 50% of my total portfolio. BTW, KGF YTD aroung 19%? Happy boh? Xuzen p/s I use eastspring as my KWSP-MIS service provider. Its' small-cap lately has been on steroid! This post has been edited by xuzen: Nov 7 2015, 03:15 PM |

|

|

Nov 7 2015, 03:17 PM Nov 7 2015, 03:17 PM

Return to original view | Post

#86

|

Senior Member

4,436 posts Joined: Oct 2008 |

Back a few pages there some of you who asked about buying into CIMB-PRS Asia xJp Dynamic. You do realised that this PRS also feed directly into Ponzi 2.0.

Now if you start to buy into both Ponzi 2.0 and CIMB-PRS Asia xJp Dynamic; you are concentrating your exposure to one single fund. Something to take note. Xuzen |

|

|

|

|

|

Nov 7 2015, 03:21 PM Nov 7 2015, 03:21 PM

Return to original view | Post

#87

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(prince_mk @ Nov 7 2015, 03:16 PM) Bro Xuzen, Over the internet I can only give you general answers and not specific. If you want to obtain specific technical advise, especially when your investable sum is starting to look big with many zero behind, stop being a cheapskate and seek the advise of professional Licensed Financial Planneras for epf monies, I can think of KGF... now it makes up 50% of my portfolio. i m thinking how to go abt it. advisable to invest using epf monies? or shall i sell off and all funds in fsm should be using cash? Xuzen p/s example: especially some lurking unker who claim that the small one day change in NAV can make him lose 20,000, they should be the one who must seek the technical expertise of a financial planner. If one day NAV change of Titan = 0.023% = 20,000, then by logic his total Titan holding = 87 Million. Why is he lurking here in ikan bilis forum is beyond me. Should be rubbing shoulder with Jho Low and partying with Paris Hilton on The Equinimity Xuzen This post has been edited by xuzen: Nov 7 2015, 03:32 PM |

|

|

Nov 7 2015, 03:25 PM Nov 7 2015, 03:25 PM

Return to original view | Post

#88

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(prince_mk @ Nov 7 2015, 03:21 PM) Bro Xuzen, I love Affin-Hwang's PRS for its broad coverage of multi-assets across vast geographical region. Yes, I aware of that PRS feeding into ponzi2. but i wanted to entitle for tax relief of max 3k nxt year. last year I bought Kenanga OnePrs which feed into KGF too. Not much choice too. what other prs funds can i consider. Xuzen p/s Esther Teo This post has been edited by xuzen: Nov 7 2015, 03:32 PM |

|

|

Nov 7 2015, 07:37 PM Nov 7 2015, 07:37 PM

Return to original view | Post

#89

|

Senior Member

4,436 posts Joined: Oct 2008 |

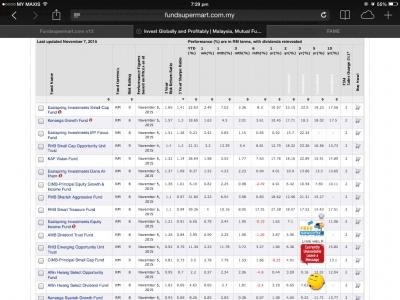

QUOTE(Kaka23 @ Nov 7 2015, 07:00 PM) I present to you the Risk adjusted return league table for KWSP-MIS funds. Look at the risk adjusted peer to peer ranking of AHSOF...... almost at the mid bottom of the league table. Using 2015 EPL table league as analogy, Small-Cap is Man U Xuzen Attached thumbnail(s)

|

|

|

Nov 8 2015, 01:37 PM Nov 8 2015, 01:37 PM

Return to original view | Post

#90

|

Senior Member

4,436 posts Joined: Oct 2008 |

Signed, sealed & delivered my top up form for Titan & Ponzi 2.0 on Monday.

Xuzen p/s Holding my foray into India fund for another month. I shall wait a little while longer for its number to excite me. It is now only at titillating level saje. This post has been edited by xuzen: Nov 8 2015, 01:43 PM |

|

|

Nov 8 2015, 01:49 PM Nov 8 2015, 01:49 PM

Return to original view | Post

#91

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(prince_mk @ Nov 8 2015, 01:40 PM) i know... we are too much living in the world of instant gratification. There is something still ol'skool in me that makes me want do things the old fashioned way. Perhaps it is how when I was younger, my life never have emails nor internet etc.... Also, with these clicks and done thingy, it is very easy to confuse UT investing with UT trading. Take cognizance of this fact. Xuzen p/s Not sure how the Gen-Y or Millenials feel, but there is something still romantic for me about filing up forms, writing it neatly and folding it properly and putting it into a envelope then putting on a stamp on it and the drive to a post-office to drop it into the post box. This post has been edited by xuzen: Nov 8 2015, 02:01 PM |

|

|

Nov 8 2015, 02:13 PM Nov 8 2015, 02:13 PM

Return to original view | Post

#92

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(Pink Spider @ Nov 7 2015, 04:43 PM) Mana Lee Sook Yee fund? Lee Sook Yee RHB Asian Total Return is not high yield bond fund Think this way, don't u think an Asian bond fund would be safer than a pure Bolehland bond fund? U have exposure to HK, Singapore, Australia etc... And, scientific calculations aside, from my personal observation, more often than not when my equity funds fall, my bond combo (RHB Asian Total Return and RHB EM Bond) go up, and vice versa. Pink, I am not comparing Asian bond to Bolehland bond, I am saying that with the type of volatility shown by Asian HY bond fund, it is better to go on a pure Asia xJP equity fund. I respect your personal observation wrt to the non-correlation between those bond combos and equity. Mine is based purely on data I obtain from fund house research paper. I agree that sometimes these research may have gaps. I personally do not have exposure to Asia HY bond fund because the numbers do not tell me to go for it. Xuzen |

|

|

Nov 8 2015, 03:52 PM Nov 8 2015, 03:52 PM

Return to original view | Post

#93

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(Pink Spider @ Nov 8 2015, 03:29 PM) This comes from someone who once said that in the long run u won't go wrong with a Bolehland equity fund, due to the Alpha or taktau apa Beta factor I already have a very high exposure to Bolehland from my KWSP-MIS investment (Eastspring Inv), hence no point for me to buy into KGF lagi.Remember concentration risk? On a more serious note, Pinky, you = ACCA graduate kan? All the way? In ACCA, completely no touch at all on financial quantitative engineering? Not even one chapter on it? Alpha, Greeks or Beta? stats and Probability leh? Xuzen |

|

|

|

|

|

Nov 8 2015, 04:26 PM Nov 8 2015, 04:26 PM

Return to original view | Post

#94

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(Pink Spider @ Nov 8 2015, 04:14 PM) Got a paper on finance...but I phailed it How to songlap when the money in KWSP-MIS account is no longer directly under KWSP jurisdiction, but under the care of the relevant UTMC?Lucky me next sitting got a professional ethics paper (fully written, no number! Yay!!! I never mixed my cash investments with my EPF...cos EPF cannot touch until 50/55 or unless to purchase a home. Furthermore, anytime could be songlap-ed by Jibby & Co Xuzen |

|

|

Nov 9 2015, 07:32 PM Nov 9 2015, 07:32 PM

Return to original view | Post

#95

|

Senior Member

4,436 posts Joined: Oct 2008 |

Are you on track to a happy financial retirement?

Here's a reality check? Do you have enough moolah to retire well?. The figures are in USD, but just take it at par value and make the comparison. Xuzen p/s Their 401(K) is similar to our KWSP. This post has been edited by xuzen: Nov 9 2015, 07:34 PM |

|

|

Nov 9 2015, 07:37 PM Nov 9 2015, 07:37 PM

Return to original view | Post

#96

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(besiegetank @ Nov 9 2015, 03:50 PM) Guys is there any quick way to check if there is any correlation between the funds we bought? LOL, first it was Sifu... now Dato?So influenced by Dato Xuzen now I scare the funds i bought don't really have the diversification I wanted. In short if I bought CIMB-Principal APDIF and Kenanga APTRF, both invest in Asia Pacific region then means both have high correlation? Bila want to promote me to Tan Sri? |

|

|

Nov 10 2015, 03:01 PM Nov 10 2015, 03:01 PM

Return to original view | Post

#97

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(wongmunkeong @ Nov 10 2015, 02:49 PM) er.. bro.. if i move $100K around "just like that", Hansel, WMK is talking about you....that means that $100K is just a small part of my total assets. thus.. $2K or 2% is still chump change leh. Just thinking.. heheh i don't move $100K "just like that" but a few Ks got lar and the 2% also i don't sweat it.. coz i get lower than that |

|

|

Nov 11 2015, 03:01 PM Nov 11 2015, 03:01 PM

Return to original view | Post

#98

|

Senior Member

4,436 posts Joined: Oct 2008 |

BRIC, GOLD & EM etc....

Note that all these are thematic investments and they all move in cycles. Some history lessons: For those of you whom are long enough in this forum, do recall that throughout the whole of 2014 was a stellar year for M'sia equities. It went up, up and up. I hope you all profited from it. I was singing praise for KGF fund.... Then, in the early of 2015, Bolehland equities went downhill and subsequently China stocks went up, up and up. We were all very gung-ho about it. At one time I even allocated up to 80% of my equity portion in China! All the media were bullish on China; even my CIO was also bullish on China! Hey! With son many experts being bullish on China, they surely must be right, right? Even my Algozen™ also was pointing at China (NB: I was using short term data at that time to input into my Algozen™ but now I use longer term data) And in the early part of Qtr3-2015, you people would recalled what happened. I, too got burned with my China exposure. I am not sure about you people but my system has an exit point built-in and I exited with some minor cuts and scrapes: No major damage! Subsequently, MYR depreciated as I was putting my money into Developed Market fund (Titan). Through this occurrence, my portfolio has turned around from loss to positive territory as YTD. Take home lesson: Money moves around; no one asset class will forever be the star. Follow the smart money. For thematic type fund, allocate slowly and only in small percentage b'coz they can turn around very quickly just like what happened with the China fiasco. If you are not a risk-taker, then buy into broad a geographical area fund that covers almost everything. You won't gain much, but you also won't lose much either. Happy investing, Xuzen This post has been edited by xuzen: Nov 11 2015, 06:45 PM |

|

|

Nov 12 2015, 10:14 AM Nov 12 2015, 10:14 AM

Return to original view | Post

#99

|

Senior Member

4,436 posts Joined: Oct 2008 |

I recalled attending a lecture by Ms Yvoone Tan, FM of Eastspring Small Cap fund in June15.

She said by end year you should see gain and true enough it is happening. She is good. Xuzen |

|

|

Nov 13 2015, 10:40 AM Nov 13 2015, 10:40 AM

Return to original view | Post

#100

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(Hansel @ Nov 13 2015, 10:34 AM) Yes, I would attest to this point too. I call it via another name - information overload. Hansel, I corrected it. There are times when not reading too much inputs a certain element of luck into investments, for which we all know, in everything that we do, there is always an element of luck as the component of the final decider. In investments, as in everything in life, we can prepare all we want, calculate and model all the possible outcomes, however, there is always a certain unpredictable outcome that cannot be forfeited out entirely. And hence the saying at times - ignorance is Xuzen p/s If info overload, just listen to Algozen™! This post has been edited by xuzen: Nov 13 2015, 10:40 AM |

|

Topic ClosedOptions

|

| Change to: |  0.0450sec 0.0450sec

0.80 0.80

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 21st December 2025 - 10:53 PM |