QUOTE(TOS2 @ Apr 14 2025, 11:01 AM)

There is no part K in the eBE. In fact, there are no sections stated in my wife's eBE form. How?

SGX Counters, Discussion on Counters in the SGX

|

|

Apr 14 2025, 11:02 AM Apr 14 2025, 11:02 AM

|

All Stars

12,267 posts Joined: Oct 2010 |

|

|

|

|

|

|

Apr 14 2025, 11:06 AM Apr 14 2025, 11:06 AM

|

Junior Member

351 posts Joined: Dec 2024 |

QUOTE(prophetjul @ Apr 14 2025, 11:02 AM) Err you are filling for 2024 tax returns right? Wife is "residential individual, does not carry on business" yea? Your form should look like the one here, yes? https://www.hasil.gov.my/en/forms/download-...form-individual |

|

|

Apr 14 2025, 11:12 AM Apr 14 2025, 11:12 AM

|

All Stars

12,267 posts Joined: Oct 2010 |

QUOTE(TOS2 @ Apr 14 2025, 11:06 AM) Err you are filling for 2024 tax returns right? Yes. That is the one. No sections.Wife is "residential individual, does not carry on business" yea? Your form should look like the one here, yes? https://www.hasil.gov.my/en/forms/download-...form-individual Just Statutory Inocme and Total Income. Which is divided into Inocme in Malaysia, Non Employment income undeclared in preceeding years and "TAX EXEMPT INCOME FROM SOURCES OUTSIDE MALAYSIA RECEIVED IN MALAYSIA" Just the 3 sections for income declaration. |

|

|

Apr 14 2025, 11:16 AM Apr 14 2025, 11:16 AM

|

All Stars

12,267 posts Joined: Oct 2010 |

QUOTE(TOS2 @ Apr 14 2025, 11:06 AM) Err you are filling for 2024 tax returns right? the forms are differentWife is "residential individual, does not carry on business" yea? Your form should look like the one here, yes? https://www.hasil.gov.my/en/forms/download-...form-individual Why are they different? Maybe because my wife ahs no employment income for many years now? This post has been edited by prophetjul: Apr 14 2025, 11:18 AM |

|

|

Apr 14 2025, 12:23 PM Apr 14 2025, 12:23 PM

|

Junior Member

351 posts Joined: Dec 2024 |

QUOTE(prophetjul @ Apr 14 2025, 11:16 AM) the forms are different Err I don't know about that. e-BE form should be universal for everyone, right? You fill up through the mytax portal? https://mytax.hasil.gov.my/Why are they different? Maybe because my wife ahs no employment income for many years now? |

|

|

Apr 14 2025, 01:02 PM Apr 14 2025, 01:02 PM

Show posts by this member only | IPv6 | Post

#6466

|

All Stars

12,267 posts Joined: Oct 2010 |

QUOTE(TOS2 @ Apr 14 2025, 12:23 PM) Err I don't know about that. e-BE form should be universal for everyone, right? You fill up through the mytax portal? https://mytax.hasil.gov.my/ Yes. Through the portal. Strange. |

|

|

|

|

|

Apr 14 2025, 01:11 PM Apr 14 2025, 01:11 PM

|

Junior Member

351 posts Joined: Dec 2024 |

QUOTE(prophetjul @ Apr 14 2025, 01:02 PM) Ah then I could not help out. I don't file taxes on MY side. Maybe you can drop by LHDN with wife and fill up everything on their PC with guidance from officials in real time.At least that's what my parents did back then, save time and avoid issues in the future. Kind LHDN officials can even teach you on tricks to save taxes! (e.g. split certain income/profits to 50% husband 50% wife to lower tax rate etc.) prophetjul liked this post

|

|

|

Apr 14 2025, 07:40 PM Apr 14 2025, 07:40 PM

|

Senior Member

9,347 posts Joined: Aug 2010 |

The taxation onto Foreign-Sourced Income has been pushed out to 2035. Do we have to start declaring from now ?

|

|

|

Apr 15 2025, 05:50 AM Apr 15 2025, 05:50 AM

|

All Stars

12,267 posts Joined: Oct 2010 |

|

|

|

Apr 15 2025, 09:21 AM Apr 15 2025, 09:21 AM

|

Senior Member

9,347 posts Joined: Aug 2010 |

QUOTE(prophetjul @ Apr 15 2025, 05:50 AM) There is a section for declaration of Good morning, bro,..."TAX EXEMPT INCOME FROM SOURCES OUTSIDE MALAYSIA RECEIVED IN MALAYSIA" Thank you,... in your sentence above, I see the word 'TAX EXEMPT INCOME'. What sort of income shld we input here ? All of our dividend income received in an overseas acct ? Or our dividend income received in an overseas acct and then transferred back to Msia ? |

|

|

Apr 15 2025, 09:45 AM Apr 15 2025, 09:45 AM

|

All Stars

12,267 posts Joined: Oct 2010 |

QUOTE(Hansel @ Apr 15 2025, 09:21 AM) Good morning, bro,... This one bro....Thank you,... in your sentence above, I see the word 'TAX EXEMPT INCOME'. What sort of income shld we input here ? All of our dividend income received in an overseas acct ? Or our dividend income received in an overseas acct and then transferred back to Msia ? " received in an overseas acct and then transferred back to Msia". You only need to declare it if you transfer the funds back to malaysia. Hansel liked this post

|

|

|

Apr 15 2025, 06:06 PM Apr 15 2025, 06:06 PM

|

Senior Member

9,347 posts Joined: Aug 2010 |

|

|

|

Apr 15 2025, 06:12 PM Apr 15 2025, 06:12 PM

|

All Stars

12,267 posts Joined: Oct 2010 |

QUOTE(Hansel @ Apr 15 2025, 06:06 PM) There are certain conditions to be met.https://www.hasil.gov.my/media/fzofh1gz/202...t-june-2024.pdf Hansel liked this post

|

|

|

|

|

|

Apr 15 2025, 06:27 PM Apr 15 2025, 06:27 PM

|

Senior Member

9,347 posts Joined: Aug 2010 |

QUOTE(prophetjul @ Apr 15 2025, 06:12 PM) There are certain conditions to be met. Thank you, bro,... much appreciated,...https://www.hasil.gov.my/media/fzofh1gz/202...t-june-2024.pdf |

|

|

Apr 15 2025, 08:24 PM Apr 15 2025, 08:24 PM

|

Senior Member

9,347 posts Joined: Aug 2010 |

Hi bro,....... I have just finished reading the 30+ pgs,...

Don't know if I've wasted my time or not,... https://theedgemalaysia.com/node/730798 https://www.taxathand.com/article/38335/Mal...iduals-extended One more thing : Since the exemption is for 10 years until Dec 31, 2036, why is the IRB asking for details on income which has been exempted from tax ? Any ideas, bros and sis ? |

|

|

Apr 22 2025, 12:16 PM Apr 22 2025, 12:16 PM

|

Senior Member

1,550 posts Joined: Feb 2013 |

QUOTE(Hansel @ Apr 15 2025, 08:24 PM) Hi bro,....... I have just finished reading the 30+ pgs,... Probably to gain data for tax collection forecast after 2036, just to know how much potential can the lhdn gets from this policy. My guess la.Don't know if I've wasted my time or not,... https://theedgemalaysia.com/node/730798 https://www.taxathand.com/article/38335/Mal...iduals-extended One more thing : Since the exemption is for 10 years until Dec 31, 2036, why is the IRB asking for details on income which has been exempted from tax ? Any ideas, bros and sis ? |

|

|

Apr 23 2025, 11:32 AM Apr 23 2025, 11:32 AM

|

Senior Member

6,227 posts Joined: Jun 2006 |

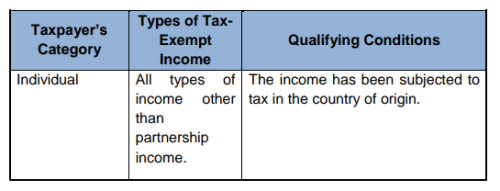

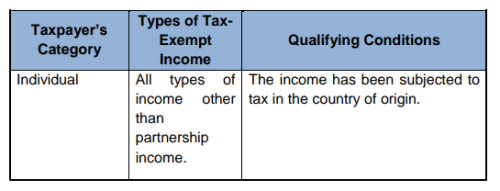

QUOTE(Hansel @ Apr 15 2025, 08:24 PM) Hi bro,....... I have just finished reading the 30+ pgs,... the exemption has qualifying conditions and some further fine prints... so is not blanket across the board... some ppl will need to pay...Don't know if I've wasted my time or not,... https://theedgemalaysia.com/node/730798 https://www.taxathand.com/article/38335/Mal...iduals-extended One more thing : Since the exemption is for 10 years until Dec 31, 2036, why is the IRB asking for details on income which has been exempted from tax ? Any ideas, bros and sis ?  |

|

|

May 1 2025, 12:05 PM May 1 2025, 12:05 PM

|

Senior Member

9,347 posts Joined: Aug 2010 |

QUOTE(dwRK @ Apr 23 2025, 11:32 AM) the exemption has qualifying conditions and some further fine prints... so is not blanket across the board... some ppl will need to pay... Just back today and browsing thru my favourite forum,... Bro, above exemption that you showed is a general exemption that will be in-place when the said Foreign-Sourced Income (FSI) taxation kicks-in in 2036. Today, ALL FSI brought into Msia is tax-exempted, inclusive of dividends and interest that have NOT been taxed at the ctry-of-origin. Wedchar2912 liked this post

|

|

|

May 1 2025, 04:44 PM May 1 2025, 04:44 PM

Show posts by this member only | IPv6 | Post

#6479

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(Hansel @ May 1 2025, 12:05 PM) Just back today and browsing thru my favourite forum,... bro... my understanding of the 10 yr extension (by correction of the old June 2024 guideline section 5, while waiting for the new one)...Bro, above exemption that you showed is a general exemption that will be in-place when the said Foreign-Sourced Income (FSI) taxation kicks-in in 2036. Today, ALL FSI brought into Msia is tax-exempted, inclusive of dividends and interest that have NOT been taxed at the ctry-of-origin. 5.2 Foreign income received in Malaysia which is exempted from tax from 1 January 2022 until 31 December 5.2.2.1 All foreign income other than partnership income received in Malaysia by a resident individual from 1 January 2022 until 31 December 5.2.2.2 Qualifying conditions... has a subsection on foreign dividend income... but i lazy to understand it fully since am not vested... long ago all fsi was fully taxable... then come full exemption... then no exemption with 6 months special flat tax but rakyat protested so partial exemption till 2026... then extended till 2036... come 2036 no more partial exemption... anyways... to me its clear... if you repatriat fsi that hasnt been taxed, check the qualifying conditions for exemption... dun just read the headlines... and your action is simple... get clarification from IRB or if audited feign wrong interpretation and beg for mercy... This post has been edited by dwRK: May 1 2025, 11:06 PM |

|

|

May 2 2025, 06:26 PM May 2 2025, 06:26 PM

|

Senior Member

9,347 posts Joined: Aug 2010 |

QUOTE(dwRK @ May 1 2025, 04:44 PM) bro... my understanding of the 10 yr extension (by correction of the old June 2024 guideline section 5, while waiting for the new one)... Hi bro,... 5.2 Foreign income received in Malaysia which is exempted from tax from 1 January 2022 until 31 December 5.2.2.1 All foreign income other than partnership income received in Malaysia by a resident individual from 1 January 2022 until 31 December 5.2.2.2 Qualifying conditions... has a subsection on foreign dividend income... but i lazy to understand it fully since am not vested... long ago all fsi was fully taxable... then come full exemption... then no exemption with 6 months special flat tax but rakyat protested so partial exemption till 2026... then extended till 2036... come 2036 no more partial exemption... anyways... to me its clear... if you repatriat fsi that hasnt been taxed, check the qualifying conditions for exemption... dun just read the headlines... and your action is simple... get clarification from IRB or if audited feign wrong interpretation and beg for mercy... Appreciated your write-up in the above. I have checked with the tax authorities, they told me to just read the ann'ts,.... so that's what I'm doing,... No need to beg-lar, bro,... tax is a normal thing is life,... Big editing here : 'The document' has changed from when I last saw it. This post has been edited by Hansel: May 2 2025, 06:32 PM |

| Change to: |  0.0236sec 0.0236sec

0.62 0.62

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 29th November 2025 - 07:22 AM |