QUOTE(Hansel @ Feb 21 2022, 01:00 PM)

lambo... SGX Counters, Discussion on Counters in the SGX

SGX Counters, Discussion on Counters in the SGX

|

|

Feb 21 2022, 02:56 PM Feb 21 2022, 02:56 PM

Return to original view | Post

#1

|

Senior Member

6,227 posts Joined: Jun 2006 |

|

|

|

|

|

|

Apr 22 2022, 03:11 PM Apr 22 2022, 03:11 PM

Return to original view | Post

#2

|

Senior Member

6,227 posts Joined: Jun 2006 |

|

|

|

Apr 22 2022, 04:14 PM Apr 22 2022, 04:14 PM

Return to original view | Post

#3

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(TOS @ Apr 22 2022, 03:26 PM) dunno man... but I've started selling more usd for myr... with us market risk off... BNM may keep rates low to support klse... bro Hansel probably best guy to talk to... I dun follow monetary policies... but this weak myr dumping so hard surprises me... whilst I expected the direction, I didn't expect the velocity... TOS liked this post

|

|

|

Apr 25 2022, 09:30 PM Apr 25 2022, 09:30 PM

Return to original view | Post

#4

|

Senior Member

6,227 posts Joined: Jun 2006 |

|

|

|

Apr 25 2022, 10:08 PM Apr 25 2022, 10:08 PM

Return to original view | Post

#5

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(Cubalagi @ Apr 25 2022, 09:52 PM) wise still giving me 4.3565... sgd market makers having fun... all 3 dips (arrows) starting exactly 9pm... This post has been edited by dwRK: Apr 25 2022, 10:35 PM TOS liked this post

|

|

|

May 8 2022, 08:49 PM May 8 2022, 08:49 PM

Return to original view | Post

#6

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(TOS @ May 8 2022, 01:30 PM) BT 07-080522 (weekend): very clear zero commission ≠ free trade... ppl assume too much never read..."Zero-commission trades don't mean free trades in many cases" "Office lunches may not prove much costlier as low demands caps CBD food prices" you have supply vs demand... also base cost + profit margin... as commodities and fuel hitting record high, surely base cost will go up eventually... |

|

|

|

|

|

Jun 26 2022, 03:01 PM Jun 26 2022, 03:01 PM

Return to original view | Post

#7

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(TOS @ Jun 26 2022, 02:30 PM) Was looking at T-bills, SGS bonds and SSB bonds. probably link to inflation and gdp... The most recent 6-month SG T-bill cut-off yield is 2.36% p.a. https://www.mas.gov.sg/-/media/MAS/SGS/SGS-...1581578EE0031EA Looking at a 6-month Malaysia bank FD rate is only 2.45% p.a. by CIMB eFD. https://www.myfdrates.com/, similar MGS yields are also around 2.7% p.a. https://www.bnm.gov.my/government-securities-yield How come the yield spread is so little? dwRK No wonder capital outflow from Msia. outflow not linked to this lah imho... after songlap by jholow, et al... and katak gov... instability no good for business... y'all also withdrawing from epf go offshore mah... hahaha but why diy bonds... lol... next time dump in cpf enough lah... |

|

|

Oct 25 2022, 07:20 PM Oct 25 2022, 07:20 PM

Return to original view | Post

#8

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(TOS @ Oct 25 2022, 05:58 PM) 4.1% p.a., will bid tomorrow. can only bid once or can ladder a range?Range should be 3.9% to 4.1%, midpoint 4%. I bid at the high end. US yield around 4.55% https://www.investing.com/rates-bonds/u.s.-...onth-bond-yield SGD appreciated around 1% against USD since last issue of T-bill whose auction was also 1-2 days before MAS policy statement. Plus our kiasu kiasi HWZ friend also bid 3.8 to 3.9% So, I think 3.9 to 4.1 is reasonable enough. You can bid at the low end of 3.8% or 3.9% or just go for non-comp if you are determined to get the issue regardless of the yields. All numbers quoted per annum (p.a.), except SGD/USD appreciation rate. |

|

|

Oct 25 2022, 07:47 PM Oct 25 2022, 07:47 PM

Return to original view | Post

#9

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(TOS @ Oct 25 2022, 07:31 PM) Wow you got CDP account also? no cdp. just learn for fun It's flexible. You can submit multiple competitive bid with different yields or a mixture of non-competitive bid and competitive bid. Non-competitive bid maximum is 1 million SGD per auction but no limit for total individual holdings. The maximum allocation rule for competitive bid is a bit complicated, can check here for details: https://www.mas.gov.sg/bonds-and-bills/inve...s-are-conducted In general, 1 mil max for non-competitive bids and not more than 15% of issuance size for both comp + non-comp bids per auction. TOS liked this post

|

|

|

Nov 10 2022, 09:24 AM Nov 10 2022, 09:24 AM

Return to original view | Post

#10

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(TOS @ Nov 10 2022, 12:04 AM) And I have not yet graduated from uni, no certificates and no accreditions. I find it funny I can make you "stick" to certain concepts. i rmb got few smart ppl who didn't finish college... becoming successful famous n rich...morale of the story... can drop out of college |

|

|

Apr 18 2023, 10:16 PM Apr 18 2023, 10:16 PM

Return to original view | Post

#11

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(TOS @ Apr 18 2023, 08:54 PM) Today I attended my Fixed Income class and learnt about Mortgage-Backed Securities. Finally I know what's going on with Astrea bonds. if you have time ... go search n watch this documentary "small enough to jail" on yt... I attach the slides of today's lecture (minus the first page which has my prof's name...) » Click to show Spoiler - click again to hide... « I think the content of the slide is self-explanatory. ---------------------- In fact that is how Freddie Mac, Fannie Mae and Gennie Mae make money. US commercial banks originate the residential real estate loans and the 3 US agencies are the "SPVs" that package them into ABS/MBS that is then sold to the market. You (and US home owners) almost always pay a a mortgage rate higher than T-bill/risk-free rates. The three US agencies package the loans and "guarantee" the final MBS in the name of Uncle Sam so the market prices it as near "risk-free" assets, i.e. the MBS pays near risk-free rates. The resulting spread in rates (mortgage rate - near "risk-free" rates = profit for the SPVs and the US commercial banks). Astrea's situation is almost the same, except this time, the SPV (Azalea) is also owned by Temasek (the originator of the PE funds). The assets are now PE funds instead of residential real estate loans. The same way of making money. Pool together a bunch of underperforming/risky stuffs, bundle them and sell at a higher price to the market (i.e., a lower yield/rate to pay from SPV's point of view, the difference is the SPV's (and hence Temasek's) profit). Whereas Ginnie Mae have strict standards for loans (e.g. LTV ratio < 80%, limit on individual loan amounts etc.), there is nothing to stop Azalea from working in the interest of the final ABS buyer (you, the Astrea bondholders). In fact, quite likely Azalea works in Temasek's interest, i.e., what the slide in the screenshot above illustrates. [attachmentid=11465668] similar thing with some reits too... unsold leftover properties by developers are repackaged as reits... with it risks/debts are transferred to unsuspecting buyers... same with some timeshare vacation... lol... This post has been edited by dwRK: Apr 19 2023, 09:20 AM TOS liked this post

|

|

|

Dec 6 2023, 07:57 PM Dec 6 2023, 07:57 PM

Return to original view | Post

#12

|

Senior Member

6,227 posts Joined: Jun 2006 |

|

|

|

Jan 22 2024, 08:08 AM Jan 22 2024, 08:08 AM

Return to original view | Post

#13

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(TOS @ Jan 20 2024, 11:53 AM) BT Weekend 20-210124: https://drive.google.com/file/d/1dK8NVU9Otf...iew?usp=sharing eagerly awaits your love story update Finally the Shanghai girl is going to meet me today, one to one! First time going out with a girl alone in my life! Have a great weekend everyone. ps... i learn some proper ballroom dancing too long ago... but have never danced with my wife... lol |

|

|

|

|

|

Jan 24 2024, 09:23 PM Jan 24 2024, 09:23 PM

Return to original view | Post

#14

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(TOS @ Jan 22 2024, 12:26 PM) BT 220124: https://drive.google.com/file/d/1GwID1NA8ai...iew?usp=sharing i like her... seems like direct no nonsense girl... she must like you too share so much personal info... good luck man... Well, at least you found a wife... and live happily... --------------------------------------------------- She's from a well-to-do background, parents hate communists (father from warlord family, mother from landlord family, wealth and powers seized during the Mao's Communist era). Since I am not a Communist sympathizer, she said I passed the "first test" from her parents. Notwithstanding the fact that she's no longer a virgin and her short hookup past "due to horniness and impulsiveness..." She said she slept for 2 hours only that morning, so was super tired. She also said she wanted to start her own musical band and she's a fan of 焦恩俊. We had dinner together and thereafter I bought her a S$11 milkshake... She helped edit my CMB profile, changed the picture orientation and gave me some "dating advice"... I "escorted" her back home thereafter and handed her some Taiwanese biscuits as a gift. I asked her out for a second date and I just shared my weekly schedule with her yesterday. She hasn't replied thus far. -------------------------------------------------- Yesterday's Bachata dance allowed me to understand bank's IT stuff better. UOB has 2 data centers in SG. The main and central one is in Alexandria (near to HarbourFront) and a backup one is located in Tampines. In another news, the Visa friend I met last week told me Visa helps banks to promote their cards to cardholders (so that they can earn more interchange fees from you all...). Some banks do this by themselves (usually SG and other Asian banks) while US banks (Citi, JP Morgan etc.) tend to outsource this job to Visa. Visa will hold your transaction records and with the bank's sharing of your personal data to Visa, the combined database allow Visa to "target" you to nudge you towards spending more with your cards. (E.g. send promo emails to someone who use cards at ATM more often so that they spend at POS machines instead...). Just so you know... TOS liked this post

|

|

|

Feb 8 2024, 09:07 PM Feb 8 2024, 09:07 PM

Return to original view | Post

#15

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(TOS @ Feb 7 2024, 01:35 PM) Singapore Key Household Income Trends, 2023 pretty high inflation ...https://www.singstat.gov.sg/-/media/files/n...ss07022024.ashx |

|

|

Nov 9 2024, 10:32 AM Nov 9 2024, 10:32 AM

Return to original view | IPv6 | Post

#16

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(prophetjul @ Nov 9 2024, 09:07 AM) Nicely done, bro. Yeah. The US market is giving great returns. What's inside QQQ? Looks like QQQ is more price appreciation. Yield is very low. As a retireee, i like my yields. If you are looking for capital gains connected to QQQ, you may want to have a look at TQQQ ProShares UltraPro QQQ QUOTE(gashout @ Nov 9 2024, 09:30 AM) Yes. Performance is great.. My retirement fund is only 12% so far this year, maybe I should reduce my contribution. But I lack the discipline to invest myself. Hence always force system to do it. qqq is top 100 us tech stocks... driven mostly by a few darling companies that survived the tech bubble...Yield.. Do you reinvest them or cash out? QQQ should be a collection of top US stocks. Yes. I know about TQQQ, looks cheaper than QQQ too (just kidding on the price) us companies mostly don't like to pay div... they do share buy back... this reduces supply driving up prices... div is taxable... capital gain is not... hence don't look at div yield per se... every year you can sell 1 share as 'yield' equivalent... d05 beats spy... so still not a bad investment gashout liked this post

|

|

|

Nov 9 2024, 10:38 AM Nov 9 2024, 10:38 AM

Return to original view | IPv6 | Post

#17

|

Senior Member

6,227 posts Joined: Jun 2006 |

gashout ... should look into brokerage houses...

they beat banks and qqq... |

|

|

Nov 9 2024, 07:44 PM Nov 9 2024, 07:44 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(gashout @ Nov 9 2024, 02:06 PM) comparing past 5 years with dividend reinvested... boring qqq still wins, assuming the info is correct (sometimes they extract wrong info from wrong website). was looking at 10 yrs... i assume data is correct... tradingview adjusted for dividend... 5 yr should win also looking at relative positionsSummary IBKR: $1,000 -> $2,316.90 SCHW: $1,000 -> $1,602.10 QQQ: $1,000 -> $2,532.30 Among the available options, QQQ has provided the highest return over the past five years when dividends are reinvested. qqq... 450%...  ibkr... 610%...  hood... 250% in 1 yr...  about 3 yrs back i mentioned these in the ibkr tered i think... alas myself at the time no mood to invest... edit... and something closer to your home...  This post has been edited by dwRK: Nov 9 2024, 09:31 PM |

|

|

Apr 23 2025, 11:32 AM Apr 23 2025, 11:32 AM

Return to original view | Post

#19

|

Senior Member

6,227 posts Joined: Jun 2006 |

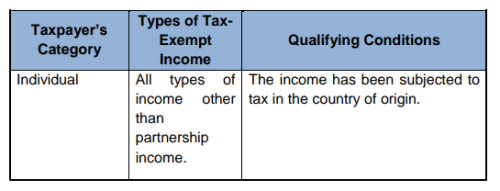

QUOTE(Hansel @ Apr 15 2025, 08:24 PM) Hi bro,....... I have just finished reading the 30+ pgs,... the exemption has qualifying conditions and some further fine prints... so is not blanket across the board... some ppl will need to pay...Don't know if I've wasted my time or not,... https://theedgemalaysia.com/node/730798 https://www.taxathand.com/article/38335/Mal...iduals-extended One more thing : Since the exemption is for 10 years until Dec 31, 2036, why is the IRB asking for details on income which has been exempted from tax ? Any ideas, bros and sis ?  |

|

|

May 1 2025, 04:44 PM May 1 2025, 04:44 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

6,227 posts Joined: Jun 2006 |

QUOTE(Hansel @ May 1 2025, 12:05 PM) Just back today and browsing thru my favourite forum,... bro... my understanding of the 10 yr extension (by correction of the old June 2024 guideline section 5, while waiting for the new one)...Bro, above exemption that you showed is a general exemption that will be in-place when the said Foreign-Sourced Income (FSI) taxation kicks-in in 2036. Today, ALL FSI brought into Msia is tax-exempted, inclusive of dividends and interest that have NOT been taxed at the ctry-of-origin. 5.2 Foreign income received in Malaysia which is exempted from tax from 1 January 2022 until 31 December 5.2.2.1 All foreign income other than partnership income received in Malaysia by a resident individual from 1 January 2022 until 31 December 5.2.2.2 Qualifying conditions... has a subsection on foreign dividend income... but i lazy to understand it fully since am not vested... long ago all fsi was fully taxable... then come full exemption... then no exemption with 6 months special flat tax but rakyat protested so partial exemption till 2026... then extended till 2036... come 2036 no more partial exemption... anyways... to me its clear... if you repatriat fsi that hasnt been taxed, check the qualifying conditions for exemption... dun just read the headlines... and your action is simple... get clarification from IRB or if audited feign wrong interpretation and beg for mercy... This post has been edited by dwRK: May 1 2025, 11:06 PM |

| Change to: |  0.4877sec 0.4877sec

0.46 0.46

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 29th November 2025 - 12:53 AM |