same story, crude rushes to make gains. realy tempted to get few before it shoots to 50+ !!!

USA Stock Discussion v7, Greece Debt Crisis!

USA Stock Discussion v7, Greece Debt Crisis!

|

|

May 20 2016, 09:46 PM May 20 2016, 09:46 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

same story, crude rushes to make gains. realy tempted to get few before it shoots to 50+ !!!

|

|

|

|

|

|

May 20 2016, 09:54 PM May 20 2016, 09:54 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

something went wrong n crude is dropping like a stone in past minuted ??? !!!

|

|

|

May 20 2016, 09:56 PM May 20 2016, 09:56 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

biught few uwto, 35.1. wish me luck.

|

|

|

May 20 2016, 10:06 PM May 20 2016, 10:06 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

buy a bit more, 35.1

day trading only |

|

|

May 20 2016, 11:08 PM May 20 2016, 11:08 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Dollar spiking again..hence, crude retreating a bit.

I usually look at the Dollar as the leading indicator for Crude and Crude as leading indicator for Energy stocks. After Yellen speech, immediately, dollar spikes, crude tanks, followed by energy and the general market. Then, the next day, after Asian market finished, crude already traded down, market gapped down. Such gaps usually followed by gap filled (to cover) by the institutional who has short positions, the bargain buyers also came in to position themselves. This post has been edited by danmooncake: May 20 2016, 11:09 PM |

|

|

May 20 2016, 11:30 PM May 20 2016, 11:30 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

agree. i was losing 1 dollar earlier, now profiting! omg...what a trade.

|

|

|

|

|

|

May 21 2016, 02:01 AM May 21 2016, 02:01 AM

|

All Stars

24,454 posts Joined: Nov 2010 |

neutral/good news for oil bulls?

i guess will try 50 again next week. QUOTE US oil rig count unchanged from last week at 318: Baker Hughes .. After seven years of relative peace, one of the world's most oil-rich regions is once again under siege by militants. And though Nigeria is well-acquainted with violence on its southern shores, the group behind a new wave of attacks — the Niger Delta Avengers — is shrouded in mystery and sabotaging one of the world's biggest oil producers. |

|

|

May 21 2016, 04:11 AM May 21 2016, 04:11 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Today is a very weird day. Dollar up, Oil down (which is normal) but Energy stocks up and general market is up too.

Maybe is 'bcoz Friday option expiration, strange price movement... This post has been edited by danmooncake: May 21 2016, 05:23 AM |

|

|

May 21 2016, 12:04 PM May 21 2016, 12:04 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

|

|

|

May 21 2016, 08:10 PM May 21 2016, 08:10 PM

|

Senior Member

3,165 posts Joined: Feb 2015 |

I read that if we invest in US stocks, dividends are subject to 30% tax. Isn't it less attractive compared to local stocks?

|

|

|

May 22 2016, 05:20 PM May 22 2016, 05:20 PM

|

Senior Member

1,820 posts Joined: May 2010 From: Kuala Lumpur |

QUOTE(aspartame @ May 21 2016, 08:10 PM) I read that if we invest in US stocks, dividends are subject to 30% tax. Isn't it less attractive compared to local stocks? For individual stocks this is the case - for index funds / ETFs we can use products domiciled elsewhere with agreement to reduce this to 15% (which Ireland domiciled)Trading on the US market can't really be compared to local Bursa - better liquidity, bigger choice, lower fees etc. If you're investing locally in products (eg UT) which have US stocks as underlying assets the dividend withholding tax will be paid somewhere also. |

|

|

May 23 2016, 10:25 PM May 23 2016, 10:25 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

dunno what to make out of this...

QUOTE Oil Traders Are Borrowing From Banks to Store Crude at a Loss The supply glut floats on. http://www.bloomberg.com/news/articles/201...crude-at-a-loss  |

|

|

May 23 2016, 10:27 PM May 23 2016, 10:27 PM

|

Senior Member

2,711 posts Joined: Sep 2005 |

sold all aapl $97

... now rest from markets good luck everyone.... |

|

|

|

|

|

May 24 2016, 03:19 AM May 24 2016, 03:19 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

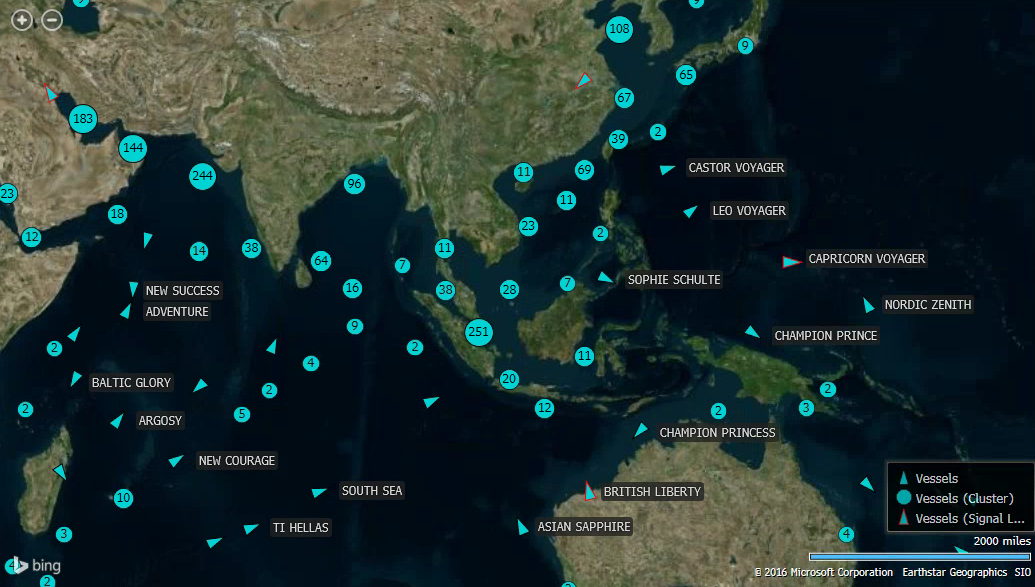

QUOTE(AVFAN @ May 23 2016, 10:25 PM) Over supply continues....I also saw this article.. http://www.zerohedge.com/news/2016-05-20/s...coast-singapore The map on the numbers of oil tankers floating standby in Singapore is really amazing. |

|

|

May 24 2016, 04:49 AM May 24 2016, 04:49 AM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(danmooncake @ May 24 2016, 03:19 AM) Over supply continues.... like that also can go near 50.....bull bull don't play play lah.... I also saw this article.. http://www.zerohedge.com/news/2016-05-20/s...coast-singapore The map on the numbers of oil tankers floating standby in Singapore is really amazing. |

|

|

May 24 2016, 11:44 AM May 24 2016, 11:44 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

|

|

|

May 24 2016, 11:44 AM May 24 2016, 11:44 AM

|

All Stars

24,454 posts Joined: Nov 2010 |

the situation is probably the same in amsterdam and other major oil terminals.

well, can say there is a physical crude bubble getting bigger and bigger. traders want to stock, vessels want to rent out, insurance cos. want premium, the banks willing to lend... everyone's happy. until oil price goes up to a good level. or one of them in the chain breaks. then, they will be giving every household a barrel for free. only the upstream side has suffered, mostly. downstream logistics, trading and refining has not. if and when it comes, it can be devastating. This post has been edited by AVFAN: May 24 2016, 11:55 AM |

|

|

May 24 2016, 04:01 PM May 24 2016, 04:01 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

it won't be pretty if the oil bubble breaks.

it will definitely threaten world economy in a big way....hopefully short term effect instead of another round of recession.... |

|

|

May 24 2016, 05:10 PM May 24 2016, 05:10 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(yok70 @ May 24 2016, 04:01 PM) it won't be pretty if the oil bubble breaks. but... there will be fires, strikes, terror...it will definitely threaten world economy in a big way....hopefully short term effect instead of another round of recession.... Live: Union says all of France's oil refineries on strike |

|

|

May 24 2016, 09:26 PM May 24 2016, 09:26 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

so, it seems crude bulls are back charging after pauses fir 2 days?

buy at open.... |

|

Topic ClosedOptions

|

| Change to: |  0.0231sec 0.0231sec

0.75 0.75

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 09:29 AM |