QUOTE(idyllrain @ Jul 12 2015, 12:57 AM)

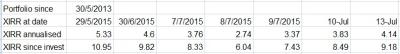

If anyone's interested, I've added the following code in polarzbearz IRR Excel sheet to obtain the latest NAV prices from FSM with just one click (I attached the macro to a button).

.......

As this code relies on FSM's price list pages, if there's any changes to that in the future, this code will break. The only modifications done on the table was changing Column C into the Fund Codes used at FundSuperMart (You can get these from the URL: http://www.fundsupermart.com.my/main/fundi...do?sedolnumber=MYKNGGF) and adding the value "*exit*" into the final row of Column C.

why is that when I tried to click on that link............

As this code relies on FSM's price list pages, if there's any changes to that in the future, this code will break. The only modifications done on the table was changing Column C into the Fund Codes used at FundSuperMart (You can get these from the URL: http://www.fundsupermart.com.my/main/fundi...do?sedolnumber=MYKNGGF) and adding the value "*exit*" into the final row of Column C.

it shows this....

(I just wanted to see what is the code for my funds...sort of a lists of them)

Attached thumbnail(s)

Jul 12 2015, 03:42 PM

Jul 12 2015, 03:42 PM

Quote

Quote

0.0234sec

0.0234sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled