QUOTE(j.passing.by @ Jul 11 2015, 11:23 PM)

If I may add, it is sort of a trick question; by asking how would the ROI drop in comparison to the IRR.

IRR or CAGR has the element of time, while ROI has not. The ROI can remain the same, and the IRR will decrease as time moves forward.

For example:

If

IRR is 9.16% p.a., and the corresponding end period value (in 2 years) is RM 11,915.00. The ROI is 19.15%

And if the ROI is still RM1,915 or 19.15% at the end of 3 years, the IRR is 6.01%

And if the ROI is still RM1,915 or 19.15% at the end of 4 years, the IRR is 4.48%

In other words, if you pull out of an investment and keep the profits under your bed, you locked in the ROI but not the IRR.

yes,...good illustration.

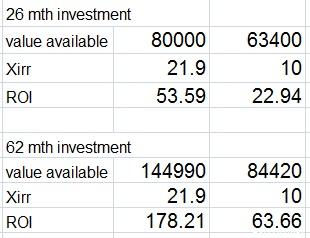

my question is, if someone said, that his China fund's IRR dropped from 20%+ to IRR 10%

(so the time is I think is about 3 weeks different)....just wondering how much did his fund's ROI dropped in %.

(yes, I know Fund Returns tabs in the FSM can do that.....jus that it did not show that much....it just showed -6.5%.)

now come to think of it,...will his regular top ups of < 12 months time frame played a role in the big different of variance of IRR and ROI?

This post has been edited by yklooi: Jul 12 2015, 08:18 AM

Jul 11 2015, 09:49 AM

Jul 11 2015, 09:49 AM

Quote

Quote

0.0477sec

0.0477sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled