thanks to unker google for the info

Fundsupermart.com v11, Grexit or not, Europe will sail on...

Fundsupermart.com v11, Grexit or not, Europe will sail on...

|

|

Jul 7 2015, 08:35 PM Jul 7 2015, 08:35 PM

|

All Stars

48,483 posts Joined: Sep 2014 From: REality |

actually I also 1st time heard the word..

thanks to unker google for the info |

|

|

|

|

|

Jul 7 2015, 08:51 PM Jul 7 2015, 08:51 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

Equities Weekly: Fear Grips Markets Over Greek Impasse [3 Jul 15]

Equity markets worldwide on aggregate declined over the week ended 3 July 2015, with the MSCI AC World Index falling -1.59%. US equities, as represented by the benchmark S&P 500 index, declined by -1.82% over the week. Deeper declines were seen across the equity markets in Europe, as fears of the situation in Greece increased – the benchmark Stoxx 600 index fell -3.94% over the week. On the other hand, the Japanese equity market, represented by the Nikkei 225 index, was the least affected developed market under our coverage during the risk aversion seen last week, with the index up just 0.23%. Asian and emerging markets also saw declines as a whole, with the MSCI Asia ex Japan index and the MSCI Emerging Markets index declining by -1.30% and -1.48% respectively over the week. East Asian markets like China (represented by the HSML 100 index) and Taiwan incurred losses, falling by -2.91% and -0.54% over the week. The volatile local Chinese equity market however, was the bottom performer under our coverage over the week, with the Shanghai Composite index plunging -11.85% and the Shenzhen CSI 300 index falling -10.15%. Other emerging markets like Russia and Brazil also saw declines, with the RTSI$ index and the Bovespa index falling by -2.30% and -2.89% respectively over the week. Southeast Asian equity markets in general actually posted gains, with Malaysia and Singapore up 1.39% and 0.86% respectively, while Indonesia's JCI index posted a 1.28% gain over the week. Crude oil prices, as represented by WTI crude, fell -5.15% in MYR terms, closing with a price of USD 56.93 when the week ended. [All returns in MYR terms unless otherwise stated] Investors may refer to Market Valuations as of 3 July 2015 for more details. URL: http://www.fundsupermart.com.my/main/resea...?articleNo=6024 |

|

|

Jul 7 2015, 08:54 PM Jul 7 2015, 08:54 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

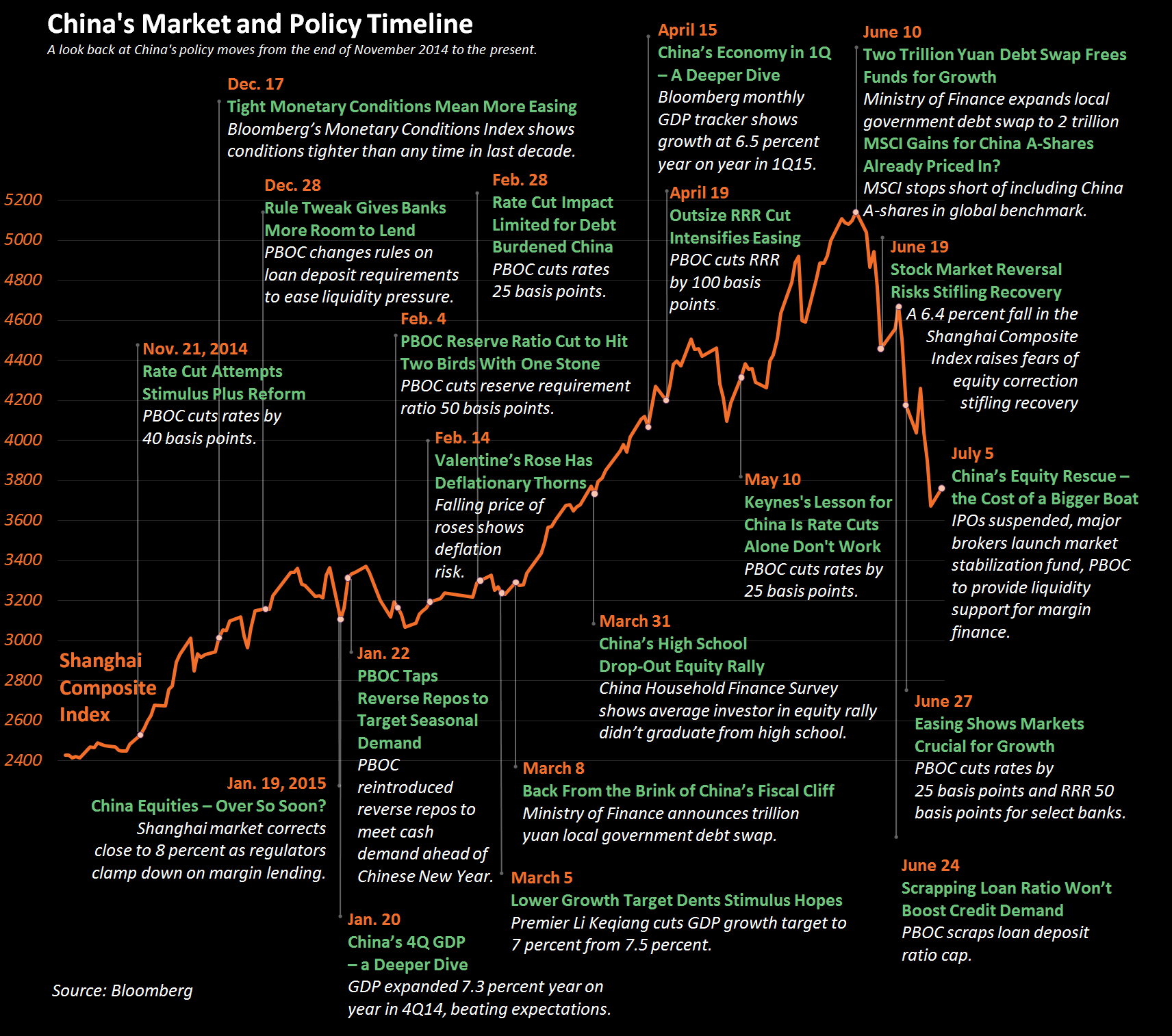

China fund lovers, you may be interested with this article:

Charting the Rise and Fall of China's Equity Market It’s been a wild ride on China’s equity market, with the Shanghai Composite Index rising from just above 2,400 in November 2014 to a high close of 5,200 in June, before plunging back toward 3,700 in early July. Along the way there have been four rate cuts, three reserve requirement cuts and, most recently, a raft of measures from the government aimed at stabilizing the market. This chart maps out the recent history of policy and market moves.  URL: http://www.bloomberg.com/news/articles/201...s-equity-market |

|

|

Jul 7 2015, 09:21 PM Jul 7 2015, 09:21 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(yeah016 @ Jul 7 2015, 03:39 PM) Thanks for the responding, ermm so meaning that most properly the technique use will be monthly deduction (so called ringgit cross average) even is for the high risk market which 100% on equity fund(provided you pick the correct fund with overall uptrend right?). Did you use any profile balancing? Monthly deduction is because the paycheck comes monthly... RSP is "GOOD" when on the Downtrend...buy more units with the same amount of monies... what is profile balancing? for low risk mutual fund yeah you are quite right, but if lump sum also need to see the market timing right? actually cannot time the market.....best is buy when the valuation of the region/country is low....then wait... Last, do you have any book recommend to understand more on investing in unit trust? Thanks. better do as post #125....learn more and faster.... |

|

|

Jul 7 2015, 09:52 PM Jul 7 2015, 09:52 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

Weak Ringgit is cushioning the fall for my portfolio...

Too late to react...just hold still until I see a significant fall » Click to show Spoiler - click again to hide... « |

|

|

Jul 7 2015, 09:53 PM Jul 7 2015, 09:53 PM

|

Junior Member

239 posts Joined: Feb 2013 |

Stupid political influence....now suddenly my portfolio has red ink joined in zzz

Time to buy in? i dun think so....just wait and see what is going to happen next, likely negative impact.. I guess it is time to gather reserve, to pump in more once things get settled... |

|

|

|

|

|

Jul 7 2015, 09:54 PM Jul 7 2015, 09:54 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

Jul 7 2015, 09:58 PM Jul 7 2015, 09:58 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Jul 7 2015, 10:11 PM Jul 7 2015, 10:11 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

Recommended Unit Trusts 2015/16 Special Feature July 3, 2015

For the first time this year, Fundsupermart.com is collaborating with Smart Investor for a special feature. This feature includes commentaries by our research team on the Recommended Unit Trusts and also coverage on the Recommended Unit Trusts Awards 2015/16. ...Author : Fundsupermart http://www.fundsupermart.com.my/main/resea...?articleNo=6017 just be warned..it is 32 pages... |

|

|

Jul 7 2015, 10:27 PM Jul 7 2015, 10:27 PM

|

All Stars

48,483 posts Joined: Sep 2014 From: REality |

U.S. stocks edge lower as Greece talk resume

http://www.marketwatch.com/story/us-stocks...ocus-2015-07-07 |

|

|

Jul 8 2015, 04:16 AM Jul 8 2015, 04:16 AM

|

All Stars

52,874 posts Joined: Jan 2003 |

Europe market closed nearly 2% lower.

|

|

|

Jul 8 2015, 04:51 AM Jul 8 2015, 04:51 AM

|

All Stars

18,429 posts Joined: Oct 2010 |

Amid bloodbath, this could be the year for fishing, and cash is king?

|

|

|

Jul 8 2015, 06:44 AM Jul 8 2015, 06:44 AM

Show posts by this member only | IPv6 | Post

#173

|

Senior Member

10,001 posts Joined: May 2013 |

Greece Faces Euro Exit Unless Tsipras Bows to Demands Sunday

|

|

|

|

|

|

Jul 8 2015, 07:45 AM Jul 8 2015, 07:45 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

Good morning.. It is a beautiful day!

|

|

|

Jul 8 2015, 07:46 AM Jul 8 2015, 07:46 AM

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

Jul 8 2015, 07:56 AM Jul 8 2015, 07:56 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(MGM @ Jul 8 2015, 04:51 AM) “Keeping cash when the equity market is at the extreme low is not a good alternative, as chances of equities outperforming cash improve significantly.” – Dr. Tan Chong Koay“As a value investor, you should not buy a share just because it has dropped more than 80%. You will only buy because the share meets your investment criteria and it is undervalued.” – Dr. Tan Chong Koay |

|

|

Jul 8 2015, 08:27 AM Jul 8 2015, 08:27 AM

|

All Stars

18,429 posts Joined: Oct 2010 |

QUOTE(T231H @ Jul 8 2015, 07:56 AM) “Keeping cash when the equity market is at the extreme low is not a good alternative, as chances of equities outperforming cash improve significantly.” – Dr. Tan Chong Koay Sharing the same wavelength. Thanks. “As a value investor, you should not buy a share just because it has dropped more than 80%. You will only buy because the share meets your investment criteria and it is undervalued.” – Dr. Tan Chong Koay |

|

|

Jul 8 2015, 08:36 AM Jul 8 2015, 08:36 AM

|

Junior Member

303 posts Joined: May 2010 From: Kurau Stone |

QUOTE(T231H @ Jul 8 2015, 06:26 AM) “Keeping cash when the equity market is at the extreme low is not a good alternative, as chances of equities outperforming cash improve significantly.” – Dr. Tan Chong Koay Well we dun buy share we buy unit trust and unit trust managers know how to get the undervalued ... Need to be fairly clear on this“As a value investor, you should not buy a share just because it has dropped more than 80%. You will only buy because the share meets your investment criteria and it is undervalued.” – Dr. Tan Chong Koay |

|

|

Jul 8 2015, 08:43 AM Jul 8 2015, 08:43 AM

|

Junior Member

144 posts Joined: May 2010 |

|

|

|

Jul 8 2015, 08:46 AM Jul 8 2015, 08:46 AM

|

Junior Member

144 posts Joined: May 2010 |

QUOTE(Vanguard 2015 @ Jul 7 2015, 05:17 PM) Hi, you may try reading any of these books... Thanks for the recommendation, all of these book are regarding to unit trust/ mutual fund? (1) The 3% Signal by Jason Kelly (2) The Four Pillars Of Investing by William J Bernstein (3) All About Asset Allocation by Richard Ferri, 2nd Edition. Sorry, I forgot to ask. Are you looking for books catering for beginner, intermediate or advance/expert readers? it is ok for beginner, intermediate or advanced also, actually I got invest in stock market, though for unit trust it might different. |

|

Topic ClosedOptions

|

| Change to: |  0.0294sec 0.0294sec

0.78 0.78

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 10:26 AM |