QUOTE(T231H @ Aug 22 2015, 01:57 PM)

was looking at your portfolio IRR....

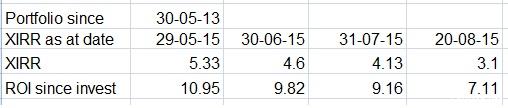

started in may 2013 till now 20 Aug 2015 (2+yrs) = IRR 3.1% (ROI 7.11%)

Now assuming from now till Aug 2017 (next 2 yrs)...your portfolio can get 10% ROI pa...

that means 7.1 + 10 + 10 = 27% ROI in 4+ yrs .

therefore estimated IRR is about 6%.....

which is less than kimyee's and Pink's current IRRs...

that too,....

provided you can get 10% ROI pa for the next 2 years....

can you get it??

you are now at about 80% EQ already.....

time to change?? Forex maybe??

QUOTE(Pink Spider @ Aug 22 2015, 04:49 PM)

Unker Looi went through the initial phase of my UT investing journey during the past 2 years...the dunno-what-funds-to-choose phase, naturally he'd screw up

Give him some time

thanks

T231H for highlighted this predicament...

I did not see that coming.... now I am dumbfounded ...just don't know what to say anymore.

I think will need to do a quantum leap to the portfolio ROI....cannot go by the usual diversified portfolio liao, even given enough time (cos the IRR just "distributes it" evenly)...

(Recalled this saying......If continue to do as usual...the usual results will be achieves)

with the almost Risk Free Rate of about 3.5% in FD,....5.8% in EPF and (low risk) of RHB Islamic bond versus the risk taken in a diversified EQ portfolio.....just how much more ROI % or IRR% of returns on a diversified EQ portfolio is justified?

go for concentrated FULL firepower on Bolehland EQ (after there is a change of *M, and oil price starts to moves up) ?

or guess this thing about EQ 20%: FI 80% (as in page#66, post# 1320) is good to follow liao??....

This post has been edited by yklooi: Aug 23 2015, 12:21 AM Attached thumbnail(s)

Aug 19 2015, 11:58 PM

Aug 19 2015, 11:58 PM

Quote

Quote

0.0465sec

0.0465sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled