QUOTE(stormaker @ Mar 13 2020, 01:57 PM)

i believe so. how fast how slow they process transfer, no idea.but at least already recorded and "acknowledged" for refund

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Mar 13 2020, 01:59 PM Mar 13 2020, 01:59 PM

Return to original view | Post

#61

|

All Stars

65,329 posts Joined: Jan 2003 |

|

|

|

|

|

|

Mar 16 2020, 07:44 PM Mar 16 2020, 07:44 PM

Return to original view | Post

#62

|

All Stars

65,329 posts Joined: Jan 2003 |

|

|

|

Mar 19 2020, 08:22 AM Mar 19 2020, 08:22 AM

Return to original view | Post

#63

|

All Stars

65,329 posts Joined: Jan 2003 |

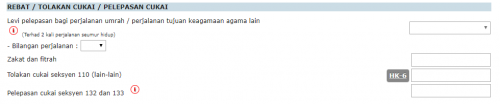

QUOTE(OhNooy @ Mar 18 2020, 08:25 PM) Thanks a lot! read Page 14Another question: Under this section 110/132/133  My EA form got $$$ for the below  Should I fill in the section 110/132/133? http://lampiran1.hasil.gov.my/pdf/pdfam/Ex...es_BT2019_2.pdf the exemption stated on the EA is the general exemption. if you have special tax exemption under Section 110/132/132, then use Working Sheet HK-6/8/9 o compute the amount. |

|

|

Mar 25 2020, 08:24 AM Mar 25 2020, 08:24 AM

Return to original view | Post

#64

|

All Stars

65,329 posts Joined: Jan 2003 |

MCO: IRB to shut Hasil Care Line call centre from March 26

https://www.theedgemarkets.com/article/mco-...centre-march-26 KUALA LUMPUR (March 24): The Inland Revenue Board (IRB) announced that its Hasil Care Line (HCL) call centre will be closed from March 26, until the end of the Movement Control Order (MCO) on March 31. The IRB in a statement on Tuesday said the services offered by the board are also limited to online services such as the filing of the Income Tax Return Form (BNCP) and tax payments through the ezHASiL platform. Any enquiries can be directed to the board via HASiL Live Chat or by filling up feedback form, available on the website at https://maklumbalaspelanggan.hasil.gov.my/MaklumBalas/ms-my/, Facebook and Twitter. For further information, taxpayers can access IRB’s official website at http://www.hasil.gov.my |

|

|

May 25 2020, 08:53 PM May 25 2020, 08:53 PM

Return to original view | Post

#65

|

All Stars

65,329 posts Joined: Jan 2003 |

QUOTE(Salary @ May 25 2020, 07:54 PM) Really? Have you experienced this before and will they penalise you if you do not keep receipts older than 7 years? thye dont penalize you for "storage", but inability to present the original receipt and non-substantiated claims.http://www.hasil.gov.my/bt_goindex.php?bt_...t_sequ=7&cariw= 11.1 Retention Of Records 11.1.1 Taxpayers are required to keep sufficient records for a period of seven years from the end of the year to which income from the business relates, as provided under paragraph 82(1)(a) of the Act, to enable the DGIR to ascertain income or loss from the business. Subsection 82(8) further provides that all records relating to any business in Malaysia must be kept and retained in Malaysia. 'Records' under subsection 82(9) include books of accounts, invoices, vouchers, receipts and other documents necessary to verify entries in any books of accounts. http://www.hasil.gov.my/bt_goindex.php?bt_...sequ=1&bt_lgv=2 Record Keeping Taxpayer is required to keep the following documents for 7 years: EA/EC Form Original dividend vouchers Insurance premium receipts Books purchase receipts Medical receipts Donation receipts Zakat receipts Children`s birth certificates Marriage certificate Other supporting documents Working sheets (if any) The calculation of the 7 year period begins from the end of the year in which the ITRF is filed. |

|

|

Dec 13 2020, 05:22 PM Dec 13 2020, 05:22 PM

Return to original view | Post

#66

|

All Stars

65,329 posts Joined: Jan 2003 |

|

|

|

|

|

|

Jan 24 2021, 07:53 AM Jan 24 2021, 07:53 AM

Return to original view | Post

#67

|

||||||||||||||||||||

All Stars

65,329 posts Joined: Jan 2003 |

QUOTE(iamloco @ Jan 23 2021, 11:35 PM) give you simpler answer: nobody will give a guaranteed answer. we are not LHDN.relief statement is simple: payment of monthly bill for internet subscription (Under own name) Let's compare both your proofs.

You see, there is not enough info from both your proofs that can fulfill the statement, many ambiguities. Yes, you can argue about it, but when LHDN officer reviews it, they look at facts/proofs aka receipts/tax invoices. Even for postpaid users who uses combination of voice+data service, it has been on the grey area. Some ppl dare to claim it. Some dont. When LHDN come knocking the door asking for interview, you're the one liable, not us here. So, as much as we wish these circumstances leans on our side, when it comes to LHDN, it's better to be on the safe side. |

||||||||||||||||||||

|

|

Jan 25 2021, 06:45 PM Jan 25 2021, 06:45 PM

Return to original view | Post

#68

|

All Stars

65,329 posts Joined: Jan 2003 |

QUOTE(lyt25_1234 @ Jan 25 2021, 04:41 PM) http://www.hasil.gov.my/bt_goindex.php?bt_...sequ=1&bt_lgv=2Lifestyle – purchase of personal computer, smartphone or tablet for self, spouse or child and not for business use (Additional deduction for purchase made within the period of 1st June 2020 to 31st December 2020) lyt25_1234 liked this post

|

|

|

Feb 19 2021, 04:12 PM Feb 19 2021, 04:12 PM

Return to original view | IPv6 | Post

#69

|

All Stars

65,329 posts Joined: Jan 2003 |

19 Feb 2021: MEDIA RELEASE : PERKHIDMATAN E-FILING BAGI TAHUN TAKSIRAN 2020

http://phl.hasil.gov.my/pdf/pdfam/KM_LHDNM...ksiran_2020.pdf    |

|

|

Mar 18 2021, 08:38 AM Mar 18 2021, 08:38 AM

Return to original view | IPv6 | Post

#70

|

All Stars

65,329 posts Joined: Jan 2003 |

QUOTE(blibala @ Mar 18 2021, 02:05 AM) read the nota peneranganparents ic just in case IRB invite you for interview or request details via email to prove your relationship (technically, IC cant prove that, only birth cert can just be prepared and documentation is well supported QUOTE(supadupa @ Mar 18 2021, 02:57 AM) Any1 can help to answer? i oso have some amount in Section F so where should i put in the BE form? Under which part? Thanks! no need do anythingthat TAX EXEMPTED (DIKECUALIKAN CUKAI) amount is just stated by your company through EA form (FYI to you). meaning you dont need to include as part of your income. supadupa liked this post

|

|

|

Mar 21 2021, 03:56 PM Mar 21 2021, 03:56 PM

Return to original view | Post

#71

|

All Stars

65,329 posts Joined: Jan 2003 |

QUOTE(kart @ Mar 21 2021, 02:10 PM) Let's say that I have not yet submitted my e-BE form in https://mytax.hasil.gov.my. no such thing laIs there a maximum number of attempts set by LHDN MyTax system for saving draft of e-BE form, before the final submission of e-BE form? For example, if the maximum number of attempts is 3 times, it means that I can modify the e-BE form and save the draft of e-BE form 3 times only, whereby I am not allowed to modify my e-BE form anymore, and I must officially submit my e-BE form. 8 Thank you for your clarification. final submission will need your nric+password to "sign". kart liked this post

|

|

|

Apr 4 2021, 08:28 AM Apr 4 2021, 08:28 AM

Return to original view | Post

#72

|

All Stars

65,329 posts Joined: Jan 2003 |

|

|

|

Apr 4 2021, 08:16 PM Apr 4 2021, 08:16 PM

Return to original view | Post

#73

|

All Stars

65,329 posts Joined: Jan 2003 |

|

|

|

|

|

|

Apr 10 2021, 08:33 AM Apr 10 2021, 08:33 AM

Return to original view | Post

#74

|

All Stars

65,329 posts Joined: Jan 2003 |

QUOTE(mafioso @ Apr 9 2021, 04:39 PM) hi, just checking same, mine got the email last year June 2020does LHDN staff send email (through their work personal email) to ask for audit documents from specific years? i was asked to submit the documents ASAP within the email without a due date. the exact text was "Tindakan segera di perlukan" and one of the required info was for my phone number (i thought LHDN system should have my number already?) though the email is sent with domain @hasil.gov.my just double checking if phishing/spoofing can be made. as i googled, normally it will send a physical letter. but i received an email instead. so just checking if its legit. tried to call 1800885436 but toll free number not in service. lol.  they put the reference at the top of the email content: [my name] [my ldhn account, SG xxxxxx] TT 2019 after submit docs, 1 week later, gotten reply: Terimakasih di atas kerjasama segera tuan. Mohon maklum cukai TT2019 tuan telah Berjaya dikemaskini. Terimakasih sekali lagi |

|

|

Apr 10 2021, 08:44 AM Apr 10 2021, 08:44 AM

Return to original view | Post

#75

|

All Stars

65,329 posts Joined: Jan 2003 |

QUOTE(a-ei-a @ Apr 10 2021, 08:30 AM) Hello guys, if for me, i'd take the "safe" option: (ii) Phone Price (on Sales): RM499Need advise/guidelines - Can I know what is the amount to put for this tax relief - under lifestyle? (i) Phone Price (RRP): RM699 (ii) Phone Price (on Sales): RM499 (iii) Accessories (RRP): RM39.90 (iv) Accessories (on Sales Price): RM9.90 (v) Shipping Fee: RM4.50 (vi) Shipping (Discount): -RM4.50 (vii) Shopee Coins Redeemed: -RM30 (viii) Shopee Voucher: -RM5 (ix) Shopee Voucher 2: -RM8 ORDER TOTAL appeared in sales invoice: RM465.90 Is phone power adapter considered part of the relief? (since more and more manufacturer exclude the adapter for phone purchase) Thanks in advance that's the actual phone price that you actually paid. accessories not eligible lor, not part of the phone |

|

|

Apr 10 2021, 10:56 AM Apr 10 2021, 10:56 AM

Return to original view | Post

#76

|

All Stars

65,329 posts Joined: Jan 2003 |

QUOTE(mafioso @ Apr 10 2021, 10:54 AM) Ahh mine didnt even greet me with name I guess different staff has different way of writing email. no standardized template hahaJust 'selamat petang' And they didnt write within 14 days. Or provide any due date My email title is just my tax number 'SG XXXXXXXXXXXXXX' and they ask me for my phone number That's why i dunno scam or not cuz i thought they will never ask for phone number. Lol mafioso liked this post

|

|

|

Apr 15 2021, 02:04 PM Apr 15 2021, 02:04 PM

Return to original view | IPv6 | Post

#77

|

All Stars

65,329 posts Joined: Jan 2003 |

QUOTE(cucubud @ Apr 15 2021, 01:55 PM) Hi, i guess it's a typo on the year 2020, not 2021 ya I bought a phone on 10/7/21 for RM2,200.00 and a tablet on 20/11/21 for RM2,000.00. Can I submit RM4,200.00 under the lifestyle section even though I purchased both items in the second half of the year? should be yes to both purchaes in 2nd half of the year |

|

|

Apr 21 2021, 09:37 PM Apr 21 2021, 09:37 PM

Return to original view | Post

#78

|

All Stars

65,329 posts Joined: Jan 2003 |

QUOTE(babylon52281 @ Apr 21 2021, 03:19 PM) Hi, can I ask roughly when these Nota Penerangan would be released? Like for BE2021, will it be release within this year? Thanks just before YA2021 in 2022 lorthat answer was a rhetoric reply since the question was asking about spending in 2021. nobody know what will change between now and YA2021, so wait for actual 2021 Nota Penerangan. |

|

|

Jun 20 2021, 08:04 PM Jun 20 2021, 08:04 PM

Return to original view | IPv6 | Post

#79

|

All Stars

65,329 posts Joined: Jan 2003 |

IRB raises limit for income tax payment via FPX - The Malaysian Reserve

business-to-business (B2B) transactions, the maximum limit was increased from RM1 million to RM100 million business-to-consumer (B2C) it was increased from RM30,000 to RM500,000 |

|

|

Dec 28 2021, 04:51 PM Dec 28 2021, 04:51 PM

Return to original view | IPv6 | Post

#80

|

All Stars

65,329 posts Joined: Jan 2003 |

|

| Change to: |  0.1434sec 0.1434sec

0.74 0.74

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 02:18 PM |