Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

contestchris

|

Mar 2 2024, 01:08 AM Mar 2 2024, 01:08 AM

|

|

QUOTE(watabakiu @ Mar 1 2024, 11:36 PM) I receive a sum of money (quite a lot) as a prize for a competition held by my company. The money was remitted together with my salary, and is appearing in my payslip. Do I declare this? Dude, it's really simple. If that amount is reflected as taxable income in your EA form, you need to declare it. Otherwise your income declaration won't tally with LHDN's data, and LHDN will send you a letter with a penalty + interest in a year or two time. If the amount is listed as taxable income in your EA form, then you're good. |

|

|

|

|

|

contestchris

|

Mar 3 2024, 03:22 AM Mar 3 2024, 03:22 AM

|

|

QUOTE(Leo the Lion @ Mar 3 2024, 01:05 AM) I was surprised that I needed to pay balance tax (before adding the relief) about RM160+. So, I went to check my payslip last year, and pcb deduction, it is tallying with total PCB deduction in BE form. What I noticed when I checked PCB deduction vs Payroll.my and other PCB calculator sites. PCB Deduction vs Payroll.my Jan -43.35 (Less, Salary+Bonus) Feb 84.95 (Extra) March 84.95 (Extra) April 84.95 (Extra) May 54.95 (Extra, Back-dated Salary increment) June -38.05 (Less) July -38.05 (Less) Aug -38.05 (Less) Sept -38.05 (Less) Oct -38.05 (Less) New company Nov -81.80 (Less) Dec -81.85 (Less) I don't know what I should do. Any advice? I think the PCB tax was not calculated accurately for November and December 2023 by your new company. Perhaps when you joined. You only gave them your tax paid until September 2023. The difference before/after June is due to the change in tax rate that came into effect in June 2023. This post has been edited by contestchris: Mar 3 2024, 03:23 AM |

|

|

|

|

|

contestchris

|

Mar 3 2024, 01:18 PM Mar 3 2024, 01:18 PM

|

|

QUOTE(Leo the Lion @ Mar 3 2024, 11:30 AM) Im scared if I kena penalties No, as long as your final submission is correct, you got nothing to worry about. |

|

|

|

|

|

contestchris

|

Mar 5 2024, 02:17 PM Mar 5 2024, 02:17 PM

|

|

QUOTE(yongtjunkit @ Mar 5 2024, 02:07 PM) Just wondering, this one can claim phone bill such as Maxis Postpaid 109 and Maxis Postpaid Share 48? Yes |

|

|

|

|

|

contestchris

|

Mar 5 2024, 08:20 PM Mar 5 2024, 08:20 PM

|

|

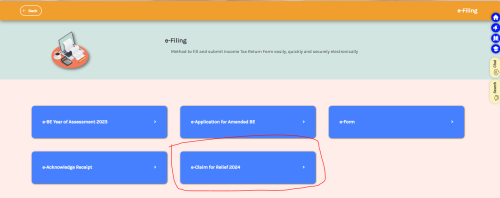

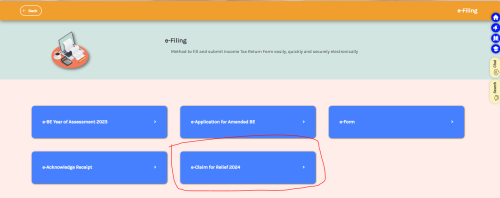

On LHDN website, I noticed there is a link to an "e-Claim for Relief 2024". 1. What is the purpose of this? 2. What does it do? I tried to input RM3k for medical insurance, then click "save". But what does it do? 3. Is this linked to PCB deduction? 4. Is it linked to Borang TP3? Link: https://mytax.hasil.gov.my/eFiling |

|

|

|

|

|

contestchris

|

Mar 8 2024, 11:35 AM Mar 8 2024, 11:35 AM

|

|

QUOTE(ronnie @ Mar 8 2024, 09:54 AM) yes... they add a word to it.. you cannot have RM4k Salary EPF contribution + RM4k Voluntary EPF (based on the PCB 2024 calculator) Dude, please don't spread misinformation. For YA 2023 onwards, everyone can claim EPF up to RM7,000 (vs limit to RM4,000 previously). 1. RM4k voluntary self-contribution and/or mandatory contribution (no change) 2. RM3k voluntary self-contribution only (new, limit shared with Life Insurance) |

|

|

|

|

|

contestchris

|

Feb 6 2025, 01:05 PM Feb 6 2025, 01:05 PM

|

|

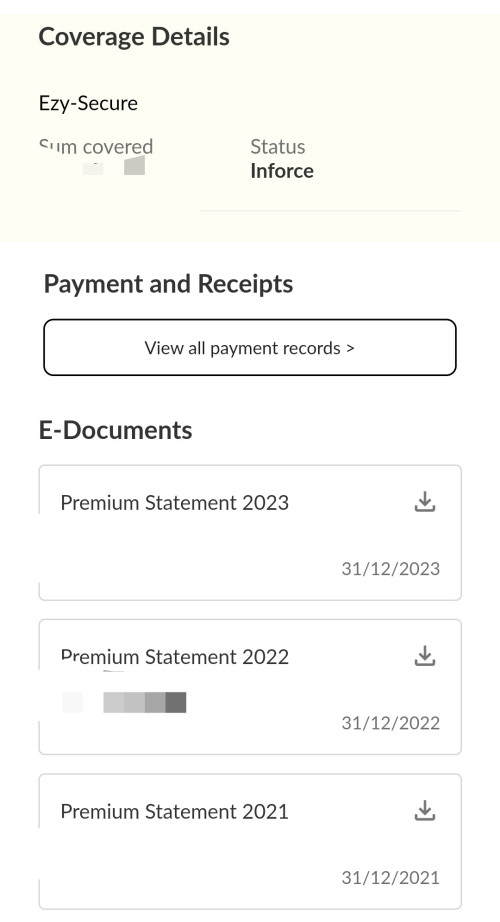

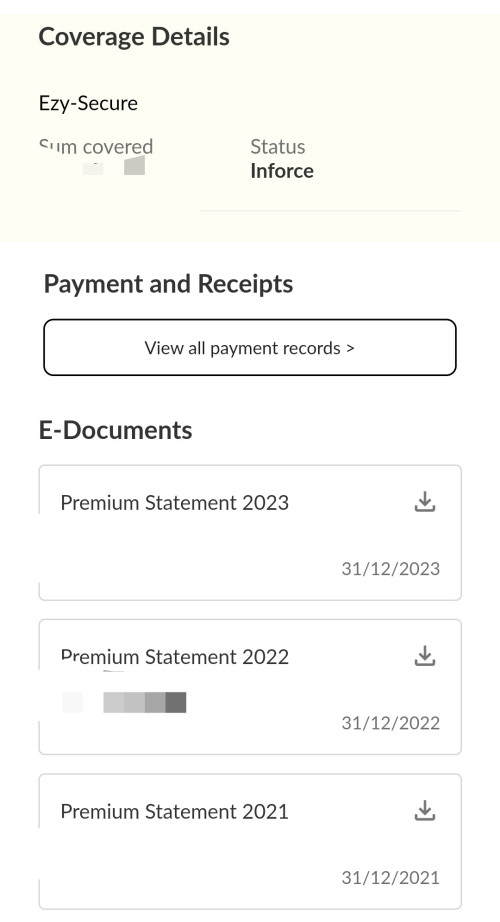

Anyone ever received their annual statement from Etiqa for tax purposes? Where to get it from?

I usually download from Great Eastern every year, no issue

|

|

|

|

|

|

contestchris

|

Feb 6 2025, 01:17 PM Feb 6 2025, 01:17 PM

|

|

QUOTE(poweredbydiscuz @ Feb 6 2025, 01:16 PM) You get it? I check, have none |

|

|

|

|

|

contestchris

|

Feb 28 2025, 10:17 PM Feb 28 2025, 10:17 PM

|

|

QUOTE(poweredbydiscuz @ Feb 6 2025, 01:20 PM) Ya.  Have you received for YA2024? Mine is still blank. Is it safe to assume the full premium amount is considered under "life insurance" category? |

|

|

|

|

|

contestchris

|

Mar 4 2025, 05:27 PM Mar 4 2025, 05:27 PM

|

|

QUOTE(ronnie @ Mar 4 2025, 08:24 AM) definitely Ramadan related Aiyoo how cruel you say like that |

|

|

|

|

|

contestchris

|

Mar 5 2025, 12:05 PM Mar 5 2025, 12:05 PM

|

|

QUOTE(ronnie @ Mar 5 2025, 08:09 AM) if you have 5-digits refund, that means you are not utilising the TP1 form with your employer to reduce your PCB deductions Can employer choose to ignore TP1? |

|

|

|

|

|

contestchris

|

Mar 6 2025, 02:29 PM Mar 6 2025, 02:29 PM

|

|

QUOTE(Barricade @ Mar 6 2025, 11:36 AM) Same here, does it mean money come in today evening, or tomorrow? |

|

|

|

|

|

contestchris

|

Mar 10 2025, 08:00 AM Mar 10 2025, 08:00 AM

|

|

QUOTE(arsenal @ Mar 8 2025, 07:50 PM) Apple smartwatch does it eligible for income tax rebate under tablet? Don't be dense, it's neither a smartphone nor a tablet. |

|

|

|

|

|

contestchris

|

Jun 3 2025, 03:45 PM Jun 3 2025, 03:45 PM

|

|

Yes obviously meal and transport allowance is taxable.

However, meal and transport claim/reimbursement is NOT taxable.

This post has been edited by contestchris: Jun 3 2025, 03:45 PM

|

|

|

|

|

|

contestchris

|

Jul 9 2025, 04:46 PM Jul 9 2025, 04:46 PM

|

|

How to qualify for tax relief for the payment of life and medical insurance for spouse and children.

Do you need to be the "owner" of the policy? How to prove you paid for it?

Also, if your spouse insurance is paid monthly, and you pay for 6 months to maximize your quote, is that okay? Spouse will also only claim for the 6 months they paid.

When I pay, it is charged to my card. When my spouse pay, it is charged to their account.

|

|

|

|

|

Mar 2 2024, 01:08 AM

Mar 2 2024, 01:08 AM

Quote

Quote

0.2678sec

0.2678sec

0.27

0.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled