QUOTE(MUM @ Apr 22 2024, 11:22 AM)

i don't think so if I'm from LHDNIncome Tax Issues v4, Scope: e-BE and eB only

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Apr 22 2024, 01:33 PM Apr 22 2024, 01:33 PM

Return to original view | Post

#201

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

|

|

|

Apr 22 2024, 03:49 PM Apr 22 2024, 03:49 PM

Return to original view | Post

#202

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Apr 22 2024, 05:12 PM Apr 22 2024, 05:12 PM

Return to original view | Post

#203

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

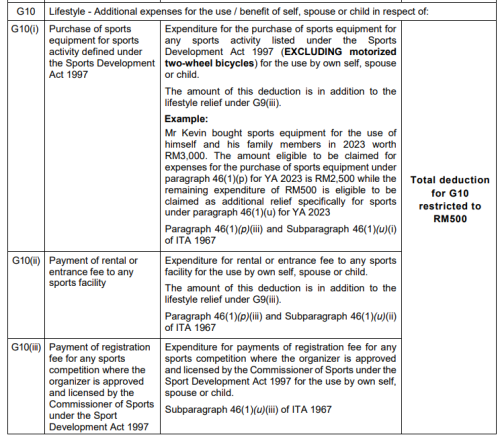

QUOTE(MUM @ Apr 22 2024, 05:07 PM) In post 10040, there is a link, page 19 of that link. the example is not about eSports, BUT sports equipment.I think it is under item 9 & 10. There is an example too. I think it is related and applicable. What your opinion on that example? As usual the Govt comes out with things which they plan later.\  This post has been edited by ronnie: Apr 22 2024, 05:13 PM |

|

|

Apr 22 2024, 05:19 PM Apr 22 2024, 05:19 PM

Return to original view | Post

#204

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(MUM @ Apr 22 2024, 05:16 PM) In post 10046, mentioned eSports is gray area....badminton --> racquet + shuttlecock cycling --> bicycle yoga --> mat what would be the equipment require for electronic sports? mobile phone should also be qualified since there is mobile legend, pubg mobile, etc Under sports activity listed under the Sports Development Act 1997 it has Traditional Games ? Congkak ? Gasing ? This post has been edited by ronnie: Apr 22 2024, 05:22 PM |

|

|

Apr 23 2024, 03:50 PM Apr 23 2024, 03:50 PM

Return to original view | Post

#205

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(MUM @ Apr 20 2024, 12:17 PM) RM1,000 tax relief for 103 types of sports Card games is under sports ?https://www.thestar.com.my/news/nation/2024...types-of-sports Can i buy poker cards for CNY under Tax Relief ? Or Pokemon cards ? This post has been edited by ronnie: Apr 23 2024, 03:51 PM |

|

|

Apr 23 2024, 04:06 PM Apr 23 2024, 04:06 PM

Return to original view | Post

#206

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

|

|

|

Apr 23 2024, 04:11 PM Apr 23 2024, 04:11 PM

Return to original view | Post

#207

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

strange that Act 576 First Schedule shows 34 sports, while there a new 103 sports now.

|

|

|

Apr 24 2024, 01:07 AM Apr 24 2024, 01:07 AM

Return to original view | Post

#208

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

From the list of 103 Sports listed

BM: 29. Daun Terup English: 29. Bridge We can also buy a chess set and claim Sports Tax Relief under 27. Chess |

|

|

Apr 25 2024, 09:55 AM Apr 25 2024, 09:55 AM

Return to original view | Post

#209

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Apr 26 2024, 04:29 PM Apr 26 2024, 04:29 PM

Return to original view | Post

#210

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Apr 26 2024, 04:45 PM Apr 26 2024, 04:45 PM

Return to original view | Post

#211

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

IRBM has temporarily stopped accepting tax payments using credit cards on the ByrHASİL portal until further notice. Payment by credit card can still be made only at PPTH KL. An Administration Charge of 0.8% will be imposed upon making a payment using Credit Card.

|

|

|

Apr 30 2024, 09:36 AM Apr 30 2024, 09:36 AM

Return to original view | Post

#212

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

We can pay our outstandng taxes via ByrHasil for Individual BE unil 15-May-2024, right ?

|

|

|

Apr 30 2024, 01:20 PM Apr 30 2024, 01:20 PM

Return to original view | Post

#213

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

|

|

|

May 1 2024, 01:27 PM May 1 2024, 01:27 PM

Return to original view | Post

#214

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

You must all join my special class how to "pay income tax" rather than wait for refunds every year.

|

|

|

May 6 2024, 04:00 PM May 6 2024, 04:00 PM

Return to original view | Post

#215

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

May 13 2024, 11:34 AM May 13 2024, 11:34 AM

Return to original view | Post

#216

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(ronnie @ May 6 2024, 04:00 PM) after chatting with LHDN officer last week, and send the screenshot, they have updated the DUE DATE to 15-May-2024 in my latest tax bill shown today MUM liked this post

|

|

|

May 20 2024, 05:21 PM May 20 2024, 05:21 PM

Return to original view | Post

#217

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Jun 26 2024, 03:44 PM Jun 26 2024, 03:44 PM

Return to original view | Post

#218

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

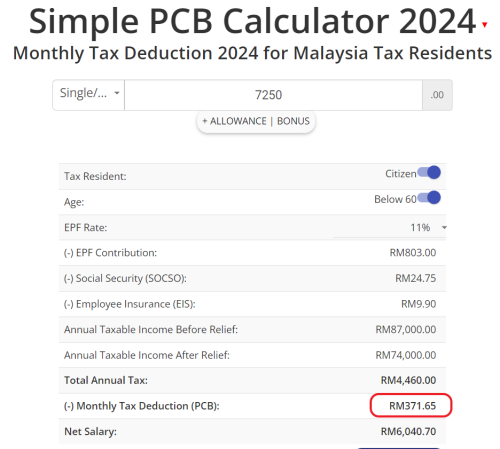

QUOTE(Teutonic Knight @ Jun 25 2024, 06:22 PM) Hi guys, want to ask about PCB monthly deduction. I recently make a switch to a new company and I noticed my PCB from 2 digits jump to 4 digits deduction. Maybe the HR didn't process the TP1 details for the new pay ?Old Pay Gross Pay: RM5873.20, PCB - RM97.60 New Pay Gross Pay: RM7250, PCB - RM1177.85 Does it makes sense? I am very shock now, please help to advise whether is it a mistake? use this https://jeremisong.com/income-tax/pcb-calculator/2024/ to check the base value.  Salary RM7250 as single individual This post has been edited by ronnie: Jun 26 2024, 03:46 PM |

|

|

Jul 15 2024, 08:12 AM Jul 15 2024, 08:12 AM

Return to original view | Post

#219

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

Sports Tax relief ... Any sports equipment required for the sports like racquet, golf stick, shuttle cock, golf balls can be claim under Tax Relief. LHDN analogy is if you can still play badminton and golf naked or swim naked too, right ? thus Sports attire is not included poooky liked this post

|

|

|

Dec 8 2024, 09:46 PM Dec 8 2024, 09:46 PM

Return to original view | IPv6 | Post

#220

|

All Stars

21,313 posts Joined: Jan 2003 From: Kuala Lumpur |

if salary payment for Dec 2024 is received in Jan-2025.... does LHDN still count as Year 2024 income ?

This post has been edited by ronnie: Dec 8 2024, 09:47 PM |

| Change to: |  0.0331sec 0.0331sec

0.68 0.68

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 02:00 AM |