Outline ·

[ Standard ] ·

Linear+

Public Mutual Funds, version 0.0

|

daniellehu

|

Feb 9 2021, 07:47 AM Feb 9 2021, 07:47 AM

|

|

QUOTE(JimK @ Feb 8 2021, 04:17 PM) still got prospect if join PBMutual unit trust consultant nowadays? as part time First of all, Public Mutual Berhad is no longer a performing fund management company. It performed poorly since 2012. There are so many other fund management companies who did a much better job like Kenanga, East Spring and etc These companies also offer an easier way to invest via online with little to no service charge whereas PMB still requires agents to sell their products with high front loading. Realising that their company is facing stiff competition, PMB started with online sales as well with high front loading to existing client (with servicing agents) but the sales goes to the company directly, leaving the agents in the dirt. I would recommend you to look for a job on a part time basis, but do give it a good long thought if you intend to join PMB as a UTC. |

|

|

|

|

|

daniellehu

|

Oct 10 2021, 07:48 PM Oct 10 2021, 07:48 PM

|

|

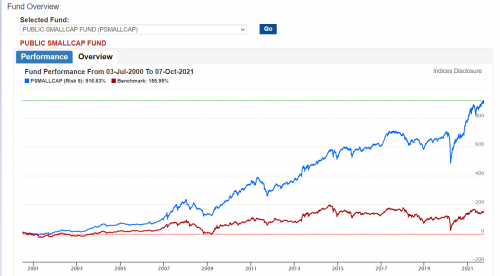

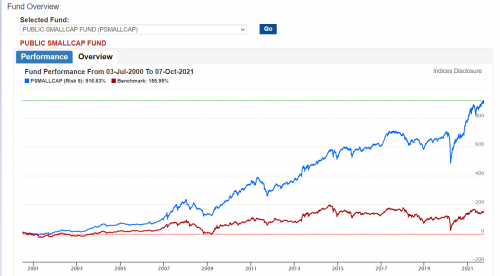

QUOTE(ITzai @ Oct 5 2021, 10:24 PM) is PIOF and Public small cap worth to invest? These two funds reopen recently. PSmallCap has always been one of the many Public Mutual "Blue Chips" in a way as it has excellent track record since inception. It outperformed the benchmark steadily over time. I have been promoting Psmallcap to majority of my clients since 2007. Do check out the fund performance first hand.  |

|

|

|

|

|

daniellehu

|

Oct 10 2021, 10:12 PM Oct 10 2021, 10:12 PM

|

|

QUOTE(ironman16 @ Oct 10 2021, 08:41 PM) but i prefer PIOF return , but too bad, the volatility is super high  PSmallCap volatility is low  , but return is so so nia all depends on your risk return appetite. if you have the time to ride out the market volatility and wishing to maximize your return, POGF is obviously your cup of tea. for majority of my clients, they are in their 40s and more inclined to optimize their savings while taking only necessary risk over time. |

|

|

|

|

|

daniellehu

|

Oct 11 2021, 07:06 AM Oct 11 2021, 07:06 AM

|

|

QUOTE(ironman16 @ Oct 10 2021, 11:09 PM) I almost in middle of 40s 😂 It is obviously you are living with the investment principle of "No risk, No gain"  |

|

|

|

|

Feb 9 2021, 07:47 AM

Feb 9 2021, 07:47 AM

Quote

Quote

0.1074sec

0.1074sec

1.02

1.02

7 queries

7 queries

GZIP Disabled

GZIP Disabled