QUOTE(Ramjade @ Jun 17 2015, 10:03 PM)

Nice.  But then gov where got so nice abolish the RM50/card.

But then gov where got so nice abolish the RM50/card.  If they abolish that, sure 6% GST some where. Or there is no 6%?

If they abolish that, sure 6% GST some where. Or there is no 6%?

Well, because you are paying Goods and Services Tax (6%) for most of the stuff and services you are purchasing. So, no more Government Service Tax. QUOTE(stormaker @ Jun 17 2015, 10:03 PM)

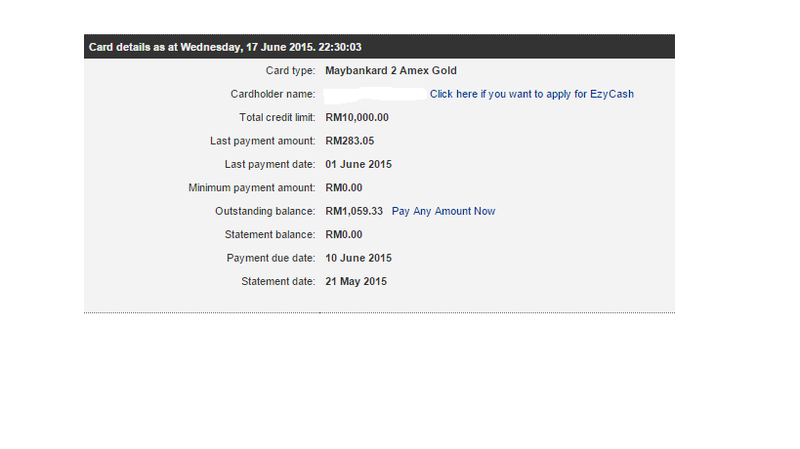

Below is my screenshot. On 9/6 I made full payment so my outstanding is RM0, 11/6 I used the card, but 12/6 i made the payment so it become RM0 again. 12/6 i used the card again but when i try to pay on the statement date, which is 14/6, i saw the amount is more than the amount i used previously on 12/6. So i checked the Statement details n found out im being charged with interest.

[attachmentid=4490495]

Well, if last month got interest charges, I think that's the one already.[attachmentid=4490495]

When is your statement due date?

This post has been edited by fruitie: Jun 17 2015, 10:15 PM

Jun 17 2015, 10:15 PM

Jun 17 2015, 10:15 PM

Quote

Quote

0.0265sec

0.0265sec

0.36

0.36

6 queries

6 queries

GZIP Disabled

GZIP Disabled