QUOTE(lifebalance @ Apr 19 2016, 08:10 AM)

About 4.5% market standard. Certain banks giving special lower rates if you exceed certain loan size as part of a promo to boost their sales.

Opps, tot cn get 4.4% timm.. cos agent said around 4.4%-4.5%Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

|

Apr 19 2016, 08:32 AM Apr 19 2016, 08:32 AM

Return to original view | Post

#21

|

Senior Member

3,718 posts Joined: Nov 2015 |

|

|

|

|

|

|

Apr 21 2016, 11:06 PM Apr 21 2016, 11:06 PM

Return to original view | Post

#22

|

Senior Member

3,718 posts Joined: Nov 2015 |

Something cross my mind just now, as now I'm in the process of getting loan for my 2nd property, I was thinking how the calculations for my 3rd loan will be:

1. 1st property is residential title (double storey house) 2. 2nd property is commercial service apartment So, will my 3rd property (be it residential/commercial) be lowered to 70% of house price? Why? And, is there a way to make it 90% again? By paying off one of the loan? Or commercial property doesn't count? |

|

|

Apr 21 2016, 11:17 PM Apr 21 2016, 11:17 PM

Return to original view | Post

#23

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(lifebalance @ Apr 21 2016, 11:12 PM) As long as no more than 2 residential loan. Commercial loan is not considered as residential loan So, commercial service apartment is not counted when determining the loan margin? What if one changed all his utilities bill and assessment rate from commercial to residential, will this be considered as residential or commercial? Actually it's a commercial service apartment built under HDA.It's a regulation by the government Say if I'm having 2 residential properties, one loan being fully settled before I applied for the 3rd property, I'm actually eligible for 90% right? What if the 2nd loan is still there but one will be selling it off after getting the new property, still capped at 70%? |

|

|

Apr 21 2016, 11:32 PM Apr 21 2016, 11:32 PM

Return to original view | Post

#24

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(lifebalance @ Apr 21 2016, 11:20 PM) If its on HDA the it's residential loan Ohh no!!! Even commercial also become residential just because of the HDA?? So must prepare 30% downpayment for next property ady. No other way out? If joint name with first home buyer?If you settle the 1st, the 3rd is 90%. As long as it's not settle you're at 70% Thanks yaa This post has been edited by WahBiang: Apr 21 2016, 11:33 PM |

|

|

Apr 21 2016, 11:49 PM Apr 21 2016, 11:49 PM

Return to original view | Post

#25

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(lifebalance @ Apr 21 2016, 11:44 PM) If the loan you took is under commercial then it will be considered commercial p, if you took residential then it will be residential loan. I see.. maybe for simplicity just ask my future wife to buy one ... Haha thx yaaYou can't use your own name as you're considered to have more than 2 housing loan already. Even if the other borrower doesn't have a property, it will be 70% if they joint with you |

|

|

Apr 22 2016, 09:51 AM Apr 22 2016, 09:51 AM

Return to original view | Post

#26

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(Madgeniusfigo @ Apr 22 2016, 08:38 AM) Dear, 1. If your 2nd property commercial is purely a comemrcial property which isn't under HDA, then your 3rd property loan will be 90% 2. If 2nd property commercial is under HDA, which will become a residential property. Hence your 3rd property would be 70% 3. If both is under HDA(HOUSING DEVELOPMENT ACT), and you want to secure 90% for 3rd property a. sell of any 1 of the property b. use another family members name Cheers QUOTE(Madgeniusfigo @ Apr 22 2016, 08:39 AM) Dear Thanks!! Need save more bullets then, tot can just sell 2nd and buy the 3rd at the same time. With this, maybe need to think other way round. It's no necessary to sell, but paying off loan also can right?1. If comemrcial is under HDA, you are eligible for 90% margin of finance, hence you had the perks with you. Cheers QUOTE(Madgeniusfigo @ Apr 22 2016, 09:25 AM) QUOTE(lifebalance @ Apr 22 2016, 09:27 AM) DSR go till 90%?? Still waiting their reply my application, so slow... |

|

|

|

|

|

Apr 22 2016, 10:11 AM Apr 22 2016, 10:11 AM

Return to original view | Post

#27

|

Senior Member

3,718 posts Joined: Nov 2015 |

|

|

|

Apr 22 2016, 02:24 PM Apr 22 2016, 02:24 PM

Return to original view | Post

#28

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(Madgeniusfigo @ Apr 22 2016, 12:32 PM) Dear, I see...1. To sell, you need to sign the LO and wait for the next month for the record the be removed, hence you can do it not at the same time but in 1-2 months time together. 2. Yes, paying off loan works too, but you will used up lots of cash. You need to calculate which one cost the most, 30% downpayment or settle the housing loan. Cheers How about refinance (with the same bank)? Will this incurred additional legal fees / stamp duties? Or, we can talk to bank on getting top-up for 3rd property? Any restriction on amount/term? |

|

|

Apr 22 2016, 02:29 PM Apr 22 2016, 02:29 PM

Return to original view | Post

#29

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(lifebalance @ Apr 22 2016, 02:25 PM) Top up will not recur any loan agreement fees. Only based on the new loan installment and interest rate. Can explain further how this works? Say I take a loan of 400k at BLR-2.4% few years back, and if now left 300k loan, then what's next? And how to get the top-up?You can tip up a property loan that is non existant In this case it's a new housing loan. |

|

|

Apr 22 2016, 03:40 PM Apr 22 2016, 03:40 PM

Return to original view | Post

#30

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(Madgeniusfigo @ Apr 22 2016, 02:45 PM) Dear, 1. It's called top up. It will incur legal loan fees, stamp duty loan and legal fees. 2. If you have 2 residential loan with bank, and wish to top up or refinance cash out, it will be 90% still. Amount and term will be the same as normal housing loan. CODE 1. You need to understand refinance and top up: Refinance: When you have loan A with BANK MBB, and your refinance the loan, meaning to say you change from BANK MBB to Bank RHB. Lets say if your loan A owe RM300K outstanding balance. Loan A market value is RM800K You can refinance the RM300K to Bank RHB from BANK MBB. Cash out the market value price RM800K Hence, You can cash out (RM800K *90% =RM720,000. RM720,000 - RM300K(OUTSTANDING BALANCE) RM420,000 (CASHOUT) Pros: - New and better interest rate =- Change a better bank - To Change borrower or SPA ownership TOP UP: When you have exisitng loan A with BANK MBB, you wish to cash out money from the property and doesn't want to change bank. Hence you cash out the money from the same bank. You will need to pay new installment based on RM420,000 (TOP UP) Pros: - cheap entry cost - Fast disbursement of cash out. Cheers QUOTE(lifebalance @ Apr 22 2016, 03:03 PM) Basically your old loan interest will be based on the new interest rate e.g last time based on blr now it's based on BR rate. Meaning to say, the existing loan balance and top-up will be based on the new rate? How about the loan term, can extend as well or remained the same as existing loan?The new loan amount you top up is based on the new base rate. Since the amount all changed, don't we need new loan agreement which may attract more legal fees and stamp duties? |

|

|

Apr 24 2016, 12:58 AM Apr 24 2016, 12:58 AM

Return to original view | Post

#31

|

Senior Member

3,718 posts Joined: Nov 2015 |

A bit confused on the islamic loan. Will it stamp duties be higher (even though may got 20% off) as its agreement was based on higher "sales price" which already inclusive of the interest amount? Normally, what is the interest rate used when determining the sale price before rebate (to compete conventional loan)?

I heard in the case of project being abandoned, the bank need to bear the risk instead of buyer? how this works? |

|

|

Apr 27 2016, 01:46 PM Apr 27 2016, 01:46 PM

Return to original view | Post

#32

|

Senior Member

3,718 posts Joined: Nov 2015 |

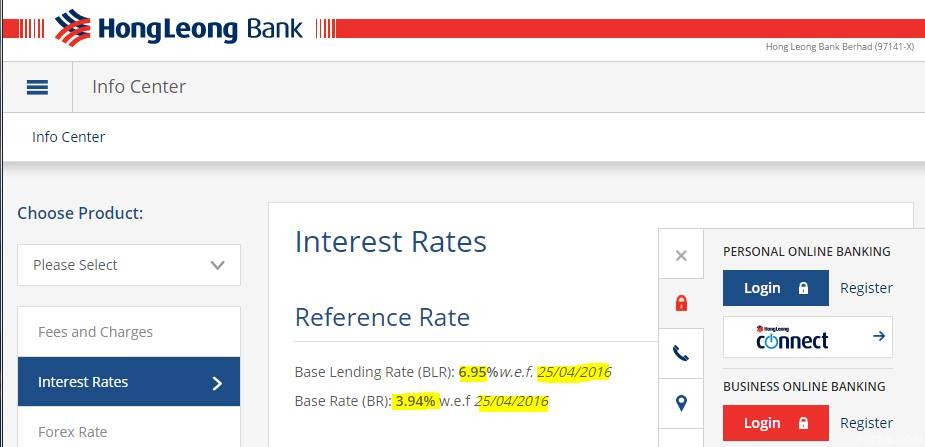

QUOTE(Madgeniusfigo @ Apr 27 2016, 11:24 AM) Dear, Ohh, my installment gonna be higher again...1. Nope, it will still follows the normal rate. All my clients receive the same rate range with PTPTN restructure/settled borrower. However, the rate will differ by profile... 2. Well, HLBB just raise their BASE RATE TO 3.94% 3. Well, may I know which banker from which bank provide you such information? Cheers  QUOTE(narutotan90 @ Apr 27 2016, 12:47 PM) Aiyaaa, but they still quote me pretty high loan rate, 4.45%.. So my spread of 0.61% is higher than previous customer?[URL=http://www.bnm.gov.my/documents/2016/base_rates/base_rates_160425a.pdf] |

|

|

Apr 27 2016, 02:19 PM Apr 27 2016, 02:19 PM

Return to original view | Post

#33

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(narutotan90 @ Apr 27 2016, 02:00 PM) 4.45% still standard rate lo. Spread 0.61% now. You hope BR drop again lo then you can enjoy lower interest. =D Tot they just lower BR only, who noes they will lower BR but incresse spread at the same time.. would be in bad position compared previous loan taker which nw cn enjoy lower than 4.45%.. |

|

|

|

|

|

Apr 27 2016, 04:33 PM Apr 27 2016, 04:33 PM

Return to original view | Post

#34

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(Madgeniusfigo @ Apr 27 2016, 04:28 PM) Dear, They are playing in the grey area. When BR goes lower, they increase the spread to make it eff. rate similar.. but the bad thg is when BR increased, new loan taker (when BR is low) is negaticely affected even he has same profile as others..1. YES, installment will increase. The bank will give notification to you soon 2. If your spread is higher than the other borrower, within the same bank, definitely your effective rate will be higher! Cheers |

|

|

Apr 27 2016, 05:45 PM Apr 27 2016, 05:45 PM

Return to original view | Post

#35

|

Senior Member

3,718 posts Joined: Nov 2015 |

|

|

|

Apr 28 2016, 09:44 PM Apr 28 2016, 09:44 PM

Return to original view | Post

#36

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(narutotan90 @ Apr 28 2016, 10:17 AM) Your existing spread rate is fixed. If BR drop, it will be good to you. People who newly applied for loan, will have to take BR + higher spread rate. However, still equal to standard effective rate such as 4.45%. Yeah, a bit unfair to new customer when BR is lower than previously. They shud apply similar spread for customer with similar profile...Let say now you applied loan ...Rate Offer to you... BR=3.84% your spread = 0.61% BR+Spread = 4.45% (effective rate) -------------------------------------------------------------------------------------------------------------- ...Your existing rate after BR drop... If Br drop to let say 3.60% your existing spread = 0.61% BR+Spread = 4.21% (effective rate for previously spread 0.61%) -------------------------------------------------------------------------------------------------------------- .....Compare to new customer..... For new customer who just about to apply loan at the point of time. BR = 3.60% Spread = will increase to 0.85% BR+Spread= 4.45% (Effective rate) - (standard rate) |

|

|

Apr 29 2016, 01:38 PM Apr 29 2016, 01:38 PM

Return to original view | Post

#37

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(lifebalance @ Apr 29 2016, 11:41 AM) Yes it's still applicable for your first house purchase But this move only applicable to "first home" buyer right? even I never claim it under my first house, my 2nd house also no entitle for it ady..http://www.themalaymailonline.com/malaysia...ghlights-so-far Property – Budget extends 50 per cent stamp duty exemption for first-time home buyers and increases the purcase limit from RM400,000 to RM500,000. The exemption will be given until the end of 2016. This is somewhat different from EPF withdrawal, where the house that being used to make withdrawal from EPF is treated as first house by EPF, regardless whether it's actually 1st, 2nd or x-th house.. |

|

|

May 16 2016, 09:47 PM May 16 2016, 09:47 PM

Return to original view | Post

#38

|

Senior Member

3,718 posts Joined: Nov 2015 |

Help! help...

I ady booked one unit of "Project A" few weeks ago and loan just recently being approved (still pending with my acceptance). This seems appeared in my CCRIS already. But now heart itchy and wanted to change to "Project B", and haven't make cancellation "Project A". Can I just proceed to book "Project B" and apply for new loan without the cancellation letter? What will happen? To get special discount, I need to sign the SPA and Loan within a month! Else all gone. |

|

|

May 16 2016, 10:01 PM May 16 2016, 10:01 PM

Return to original view | Post

#39

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(lifebalance @ May 16 2016, 09:49 PM) I applied thru middle person, dunnoe the bankers... Scared that middle person dun wan do...to cancel LO, need cancellation letter from the Project A? I dun plan to cancel Project A now, cos plan if really confirm wan B then book it, thereafter only go cancel A, just scared cant complete all process in 1 month. Heard, sum bank need us the cancellation letter, sum bank dunned it? |

|

|

May 16 2016, 10:06 PM May 16 2016, 10:06 PM

Return to original view | Post

#40

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(lifebalance @ May 16 2016, 10:03 PM) Lol then let another middle person do it. No need cancellation letter. Just say you are not accepting the bank offer and you decided to cancel purchase for project A that's all. Really?? Means I can just proceed with new loan and new project, even without actual cancellation?I know there are ppl out there that utilising his/her 2nd property quota for 3rd property 90% loan, scared bank tot me also doing this. Bro, this involve more than 10k cash discount, confirm can proceed with just my verbal confirmation to cancel? |

| Change to: |  0.0487sec 0.0487sec

0.74 0.74

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 12:37 PM |