Outline ·

[ Standard ] ·

Linear+

Traders Kopitiam! V6

|

gark

|

Jan 19 2015, 11:29 AM Jan 19 2015, 11:29 AM

|

|

QUOTE(TakoC @ Jan 19 2015, 11:28 AM) Is it? Which is in RM? From what I know they have petrochemical and crude oil tank storage. Petrochemical is slightly higher in comparison. Any idea of their operating (EBIT) margin earned? Their petrochemical tanks in kemaman is RM based.  |

|

|

|

|

|

gark

|

Jan 19 2015, 11:38 AM Jan 19 2015, 11:38 AM

|

|

QUOTE(TakoC @ Jan 19 2015, 11:30 AM) 30+- cent from your entry price only wor. So fast say pricey? Long way to go la. My first TP is at least RM3. When i first enter.. oil price is USD 58... Now oil price is USD 48... Although price has gone up.. the fundamentals continue to deteriorate.. that is why i say it is pricy.. |

|

|

|

|

|

gark

|

Jan 19 2015, 12:34 PM Jan 19 2015, 12:34 PM

|

|

QUOTE(wankongyew @ Jan 19 2015, 12:01 PM) Hmm, Shanghai Stock Exchange crashing. Is it just a correction or a sign of a credit crisis? (Property companies defaulting on bonds.) That has been going on with the first bond repayment problem since December.. surprised the market did not pick it up earlier.  |

|

|

|

|

|

gark

|

Jan 19 2015, 06:09 PM Jan 19 2015, 06:09 PM

|

|

QUOTE(Pink Spider @ Jan 19 2015, 05:38 PM) I'm using Jupiter with RM10 min Service no problem so far, so no need switch to RM8 one  I am using RM 12 one..    My Indon IB even more geng.. 0.1% x Rp 0 minimum.. lol.. i have made transaction with few sen worth of brokerage + GST.  I think the broker also  when see the statement. This post has been edited by gark: Jan 19 2015, 06:18 PM |

|

|

|

|

|

gark

|

Jan 19 2015, 06:11 PM Jan 19 2015, 06:11 PM

|

|

QUOTE(woonsc @ Jan 19 2015, 06:10 PM) Haha, but my broker is a girl..   cantik cantik belaka~ extra rm 4.. tak ape~ Someone here said.. lenglui girl broker already pupus.  Pic or GTFO!  This post has been edited by gark: Jan 19 2015, 06:11 PM This post has been edited by gark: Jan 19 2015, 06:11 PM |

|

|

|

|

|

gark

|

Jan 19 2015, 06:55 PM Jan 19 2015, 06:55 PM

|

|

QUOTE(MrLoo @ Jan 19 2015, 06:53 PM) melaka cimb securities?  if yes maybe we are on the same boat~  Mana pic?  |

|

|

|

|

|

gark

|

Jan 21 2015, 10:33 AM Jan 21 2015, 10:33 AM

|

|

QUOTE(Pink Spider @ Jan 21 2015, 09:41 AM) Hold!  Thinking of letting CMMT go...  Sungai Wang, rental growth is not too good..  Other than that they are doing a good job, average 10% rental growth from FY13 to FY14..  This post has been edited by gark: Jan 21 2015, 10:43 AM This post has been edited by gark: Jan 21 2015, 10:43 AM |

|

|

|

|

|

gark

|

Jan 21 2015, 07:48 PM Jan 21 2015, 07:48 PM

|

|

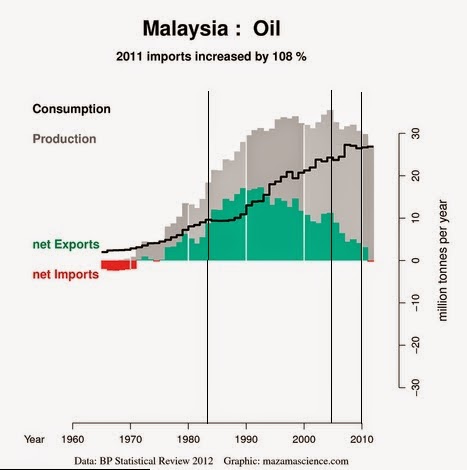

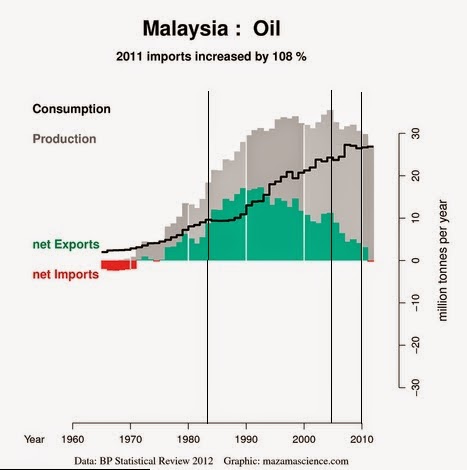

Food for thought...  QUOTE the Government has disclosed that Malaysia is a beneficiary of declining crude oil prices because the country is a net importer, and not exporter, of the commodity and petroleum products, if liquefied natural gas (LNG) was not in the equation.  http://www.thestar.com.my/Business/Busines...2014/?style=bizThis post has been edited by gark: Jan 21 2015, 07:49 PM http://www.thestar.com.my/Business/Busines...2014/?style=bizThis post has been edited by gark: Jan 21 2015, 07:49 PM |

|

|

|

|

|

gark

|

Jan 22 2015, 10:05 AM Jan 22 2015, 10:05 AM

|

|

QUOTE(holybo @ Jan 22 2015, 10:02 AM) sell OnG. not worth holding at current oil price  Pet pet.. uptrend wor..  Gonna ride the wave..  |

|

|

|

|

|

gark

|

Jan 22 2015, 10:28 AM Jan 22 2015, 10:28 AM

|

|

QUOTE(Pink Spider @ Jan 22 2015, 10:06 AM) Unker! Apasai big hippo PPB moved yesterday  CPO price up...  |

|

|

|

|

|

gark

|

Jan 22 2015, 10:33 AM Jan 22 2015, 10:33 AM

|

|

QUOTE(TakoC @ Jan 22 2015, 10:06 AM) Good work, gark! Grats on your SKP. Earn kopi money only.. if reach rm 3.. might sell.  This post has been edited by gark: Jan 22 2015, 10:34 AM This post has been edited by gark: Jan 22 2015, 10:34 AM |

|

|

|

|

|

gark

|

Jan 22 2015, 10:36 AM Jan 22 2015, 10:36 AM

|

|

QUOTE(river.sand @ Jan 22 2015, 10:33 AM) CPO price up because of recent flood affecting harvest? If so, no every plantation company will benefit from the higher CPO price. CPO is quoted in RM, soybean oil quoted in USD. CPO has always been traded at discount to soybean oil..about 10-20%.. RM devaluate against USD.. hence CPO in RM terms is going up to match the soybean traded in USD.  This post has been edited by gark: Jan 22 2015, 10:36 AM This post has been edited by gark: Jan 22 2015, 10:36 AM |

|

|

|

|

|

gark

|

Jan 22 2015, 10:37 AM Jan 22 2015, 10:37 AM

|

|

QUOTE(holybo @ Jan 22 2015, 10:35 AM) let's hope together. btw, i just unloaded some of my pet pet at 2.8 just now. 20% in ~ a month.  Oooh.. someone make money liao.  |

|

|

|

|

|

gark

|

Jan 22 2015, 10:38 AM Jan 22 2015, 10:38 AM

|

|

QUOTE(TakoC @ Jan 22 2015, 10:37 AM) I want collect le. Haha! gark are you looking at property segment? Not at the moment.. property sales seems weak... look at what happening to china, property company default loan.. Singapore property holding on massive unsold volume..  This post has been edited by gark: Jan 22 2015, 10:38 AM This post has been edited by gark: Jan 22 2015, 10:38 AM |

|

|

|

|

|

gark

|

Jan 22 2015, 10:46 AM Jan 22 2015, 10:46 AM

|

|

QUOTE(TakoC @ Jan 22 2015, 10:39 AM) thinking to collect matrix. DY 7% for too bad also. might consider collect if fall a bit lower. Just have to make sure that DY is sustainable.. where the get the continuous cashflow.  |

|

|

|

|

|

gark

|

Jan 22 2015, 10:51 AM Jan 22 2015, 10:51 AM

|

|

QUOTE(Pink Spider @ Jan 22 2015, 10:46 AM) no such thing as continuous cash flow in property  unless got recurring rental/management income  Yep property company which has recurring rental income is more stable.  Otherwise all the cash is used to secure more landbank = zero cashflow  |

|

|

|

|

|

gark

|

Jan 22 2015, 10:53 AM Jan 22 2015, 10:53 AM

|

|

IF you really have to own property/construction.. i would rekomend.. Tambun Mitra and to certain extend Matrix  Disclaimer : Not vested .. yet  |

|

|

|

|

|

gark

|

Jan 22 2015, 10:54 AM Jan 22 2015, 10:54 AM

|

|

QUOTE(Pink Spider @ Jan 22 2015, 10:52 AM) So, siapa ada?  UOA?  Ada..... Example is 1724.KL Others...go find.  Got a few more.  This post has been edited by gark: Jan 22 2015, 10:56 AM This post has been edited by gark: Jan 22 2015, 10:56 AM |

|

|

|

|

|

gark

|

Jan 22 2015, 05:37 PM Jan 22 2015, 05:37 PM

|

|

QUOTE(Pink Spider @ Jan 22 2015, 05:00 PM) Unker gark dah dumped CMMT? Today flying  Not yet..  Can't brain.. why it flying..  for the lousy 4 sen divvy?  |

|

|

|

|

|

gark

|

Jan 22 2015, 05:38 PM Jan 22 2015, 05:38 PM

|

|

QUOTE(Pink Spider @ Jan 22 2015, 05:36 PM) See its recent announcements... Almost every day directors are accumulating Mostly all plantation director eating..  Not necessary got something one.. see TSH, the boss buy almost everyday for the past 3-4 years already..  This post has been edited by gark: Jan 22 2015, 05:39 PM This post has been edited by gark: Jan 22 2015, 05:39 PM |

|

|

|

|

Jan 19 2015, 11:29 AM

Jan 19 2015, 11:29 AM

Quote

Quote

0.0536sec

0.0536sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled