QUOTE(Unkerpanjang @ Mar 5 2021, 07:50 PM)

Bro,

Apmex fees is in USD.

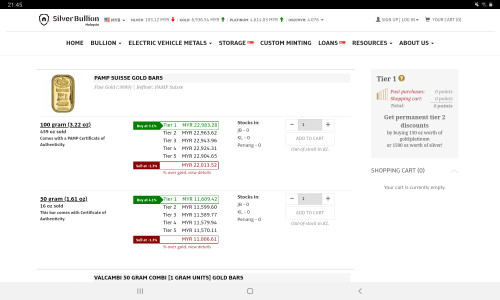

MY n SG have just as reputable dealers.

If u wish to buy gold coins, try our Tiger Bank, etc.

If u have serious trust issues with MY banks n dealers, then buy from Bullionstar, Goldsilver in SG. Shipping fee is like SGD40, for 100 grams gold.

Surely, you can trust SG governance/regulations.

You gonna redeem yr bitcoin for lots of gold?

Since I just read about gold and silver lately (mostly from US sites), I never knew our Tiger Bank sell the gold and silver coins like (American Eagle, Canadian maple leaf, Krug etc..)Apmex fees is in USD.

MY n SG have just as reputable dealers.

If u wish to buy gold coins, try our Tiger Bank, etc.

If u have serious trust issues with MY banks n dealers, then buy from Bullionstar, Goldsilver in SG. Shipping fee is like SGD40, for 100 grams gold.

Surely, you can trust SG governance/regulations.

You gonna redeem yr bitcoin for lots of gold?

Yes another reason I asked about Apmex is that they accept Bitcoin so I do not have to sell them to fiat first and buy gold.

Mar 6 2021, 07:39 AM

Mar 6 2021, 07:39 AM

Quote

Quote

0.0257sec

0.0257sec

0.46

0.46

6 queries

6 queries

GZIP Disabled

GZIP Disabled