QUOTE(boyboycute @ Apr 18 2025, 07:41 PM)

Those who are buying at current high prices must be prepared to ride through the difficult times.

Usually,most would likely sell at losses after few years

Best advice is to avoid chasing high prices

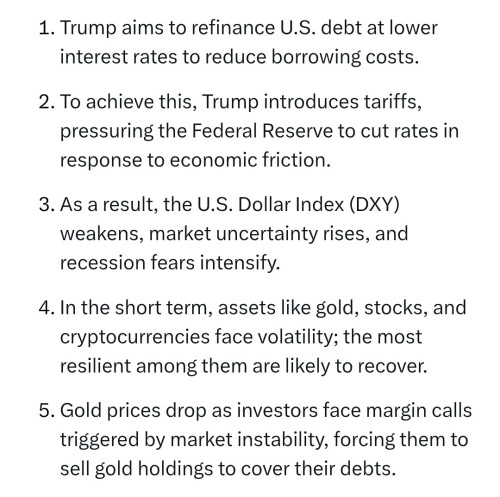

Unker, I believe we might be overemphasizing the risk of buying gold at current prices. The real issue, if any, stems from improper asset allocation.

For instance, if gold constitutes only 10% of your portfolio (alongside kwsp, asnb, stocks, ETFs, crypto, rental properties, and other investment tools) and you are still gainfully employed, a 30% drop in gold price would only result in a 3% decline in your overall portfolio. That's hardly catastrophic. Stat the course-its not the end of the world.

However, if someone struggling to cover monthly expenses is pouring money into gold, that's a different issue altogether. It's poor money management, investing in gold is never a make or break gamble.

Apr 3 2025, 06:22 PM

Apr 3 2025, 06:22 PM

Quote

Quote

0.1169sec

0.1169sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled