QUOTE(Michael_Lee @ Jun 9 2023, 11:02 PM)

Wah! Bro, ?..unker curious. You 12 years lowyat member, suddenly wanna buy gold. Whats your motivation?A. Heard wet market seller say gold gonna bull run.

B. More wealth, oledi sufficient in kwsp, asnb, sspn, etc now wanna diversify portfolio.

C. Worried about inflation, ringgit depreciate, wanna preserve wealth.

D. Others...pls elaborate.

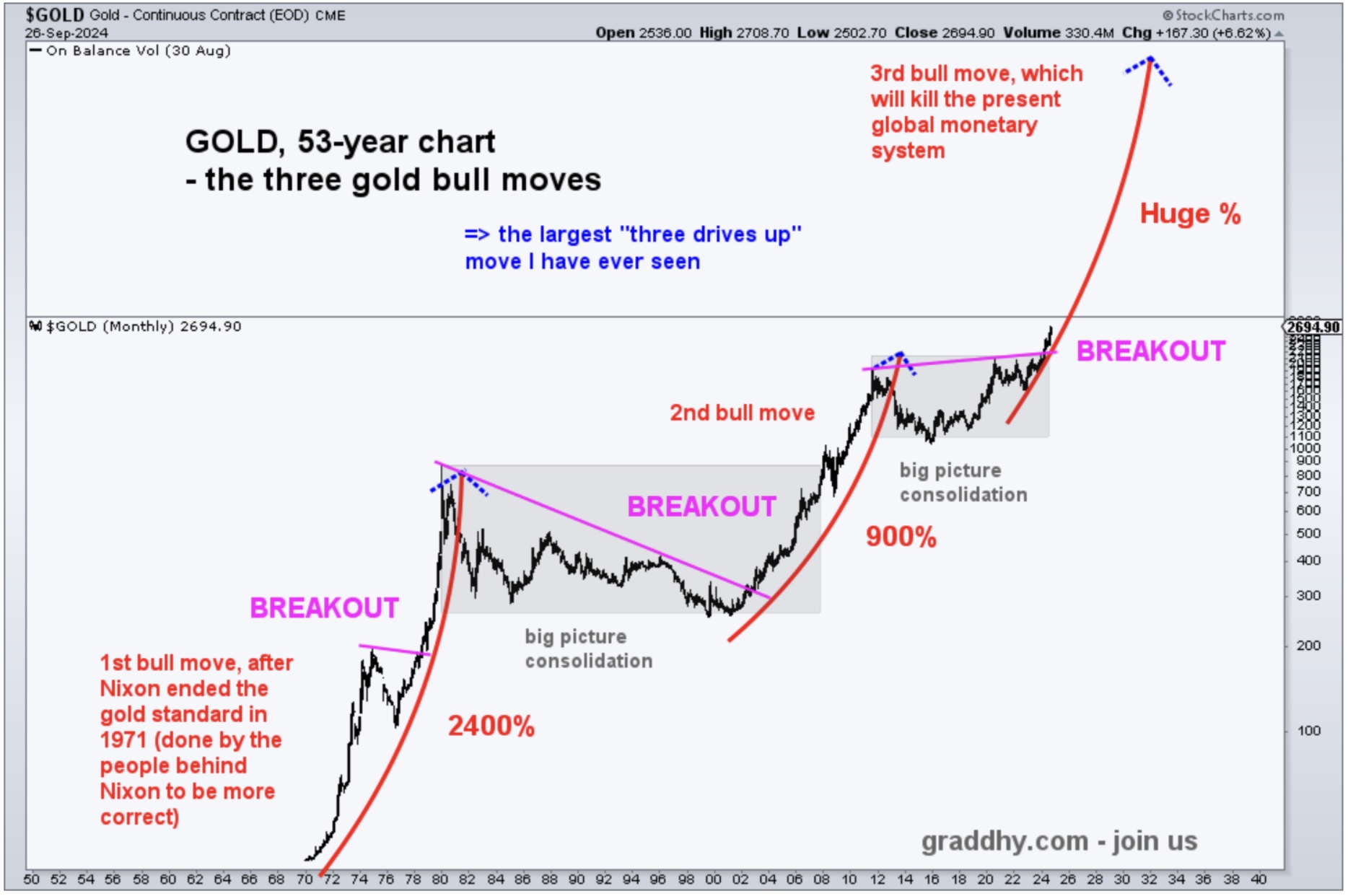

Gold making higher lows, touched upper band 3 times, right now ranging...unker feel still sleeping for medium short/term

IF/WHEN/UNLESS stock market roll over, just DCA. But dont lose on premiums %.

Jun 14 2023, 07:41 PM

Jun 14 2023, 07:41 PM

Quote

Quote

0.0286sec

0.0286sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled