QUOTE(gchowyh @ Sep 25 2014, 07:12 PM)

True, the next branch is further.

Actually, the RM did not ask me but she put option 3.

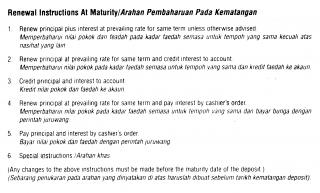

I think Renewal Instruction 3 is the best option.

In case if we cannot make it on time to withdraw the FD on the maturity date, at least we can

get some interest in the saving account, perhaps not too much of interest in saving account, but

it is better than nothing.

Since yours is option 3, then I think I should not have any problems to change from option 1 to option 3.

Your Leng Lui did a good job to get you option 3, this saves your time and energy to go back to SCB to change to 3,

and also you can skip to see the Prudential insurance agent again..

Ha ha..

QUOTE(gchowyh @ Sep 25 2014, 07:12 PM)

Yes, SCB did make a photostat copy but chopped only for SCB use. Guess if we can't say we do not want to allow them to photostat.

SCB did the same to me. I saw they stamped on the center part of my IC photostat copy.

Am Bank is worst, they stamped on the very edge side of my IC photostat copy.

I feel that if they want to play a trick on me, they can simply use liquid paper to cover the chopped mark on the edge

of my IC photostat copy, and then make another photostat copy that without showing chopped mark.

I requested Am Bank to stamp on the center part of my IC photostat copy, but they refused.

They said it had to be chopped on the edge side of the IC photostat copy..

I feel that it is very unsecured to me...

QUOTE(bbgoat @ Sep 25 2014, 07:28 PM)

Yes, notice the same today. Still photostat ic copy and a chop. But the chop is away from the ic image so can re-photostat some more copies. If chop is on the ic image/wording then will be better security.

Oh, you should have asked the Leng Lui to chop on the center part of your IC copy...

I have been wondering all my days how do con-men steal people IC copy to borrow money from banks?

Last time I asked UOB about this question, they said most of the times con-men use other people IC copy

to borrow money from Ah Long; bank procedures are more straight, not easy for con-men to do like this.

I feel sacred when every time my IC needs to be photostat even with a chop on it.

I think the best way is to renew IC every year.. Will our IC department allow us to do like this or not..?

QUOTE(Human Nature @ Sep 25 2014, 09:57 PM)

oh, so still need to open CASA

The photocopy was done inside their office (cannot see)

This is true, we cannot see what they are doing with our IC inside their photostat room..

I have one idea, we can spend some money to photostat our IC in a stationery shop, and bring IC copies to the

banks and ask them to chop in front of us...

I saw one customer did that in RHB bank, I guess she was applying for something like credit card, but not FD...

This post has been edited by BoomChaCha: Sep 27 2014, 12:42 PM

This post has been edited by BoomChaCha: Sep 27 2014, 12:42 PM

Sep 24 2014, 08:10 PM

Sep 24 2014, 08:10 PM

Quote

Quote

0.0272sec

0.0272sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled