QUOTE(Kaka23 @ Jun 13 2014, 01:32 PM)

Sibuk dengan apa? Entertaining auditor kat pub? Fundsupermart.com v6, Manage your own unit trust portfolio

Fundsupermart.com v6, Manage your own unit trust portfolio

|

|

Jun 13 2014, 01:37 PM Jun 13 2014, 01:37 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

|

|

|

Jun 13 2014, 01:40 PM Jun 13 2014, 01:40 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

|

|

|

Jun 13 2014, 01:43 PM Jun 13 2014, 01:43 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Jun 13 2014, 02:30 PM Jun 13 2014, 02:30 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

|

|

|

Jun 13 2014, 05:18 PM Jun 13 2014, 05:18 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

just a note....if the NAV of your Hwang fund dropped a lot today...dun be afraid...it may just be distribution.

......between 1983 and 2013. Amazingly, the investor who dollar-cost-averaged at annual market peaks only performed slightly poorer than another investor who simply invested at the end of each year; the first investor would have gotten annualised returns of 9.5% while the second investor had earned 9.9%. http://www.fool.sg/2014/06/10/why-its-okay...-a-market-high/ (click Refresh if prompted to log in) |

|

|

Jun 13 2014, 05:37 PM Jun 13 2014, 05:37 PM

|

Senior Member

743 posts Joined: May 2014 |

QUOTE(yklooi @ Jun 13 2014, 05:18 PM) just a note....if the NAV of your Hwang fund dropped a lot today...dun be afraid...it may just be distribution. So it mean we better go in after distribution or just add-on every month?......between 1983 and 2013. Amazingly, the investor who dollar-cost-averaged at annual market peaks only performed slightly poorer than another investor who simply invested at the end of each year; the first investor would have gotten annualised returns of 9.5% while the second investor had earned 9.9%. http://www.fool.sg/2014/06/10/why-its-okay...-a-market-high/ (click Refresh if prompted to log in) This post has been edited by cappuccino vs latte: Jun 13 2014, 05:39 PM |

|

|

|

|

|

Jun 13 2014, 05:50 PM Jun 13 2014, 05:50 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jun 13 2014, 06:22 PM Jun 13 2014, 06:22 PM

|

Senior Member

743 posts Joined: May 2014 |

|

|

|

Jun 13 2014, 06:50 PM Jun 13 2014, 06:50 PM

|

||||||||||||||||||||||||||||||||||||||||||

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(yklooi @ Jun 13 2014, 05:18 PM) just a note....if the NAV of your Hwang fund dropped a lot today...dun be afraid...it may just be distribution. ......between 1983 and 2013. Amazingly, the investor who dollar-cost-averaged at annual market peaks only performed slightly poorer than another investor who simply invested at the end of each year; the first investor would have gotten annualised returns of 9.5% while the second investor had earned 9.9%. http://www.fool.sg/2014/06/10/why-its-okay...-a-market-high/ (click Refresh if prompted to log in)

|

||||||||||||||||||||||||||||||||||||||||||

|

|

Jun 13 2014, 07:01 PM Jun 13 2014, 07:01 PM

|

|||||||||||||||||||||||||||||||||||||||

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(David83 @ Jun 13 2014, 06:50 PM) | Date | Fund Name | Gross Distribution | missed 2 more?

Hwang AIIMAN Prs Syariah Growth and Hwang Prs Conservative |

|||||||||||||||||||||||||||||||||||||||

|

|

Jun 13 2014, 07:04 PM Jun 13 2014, 07:04 PM

|

||||||||||||||||||||||||||||||||||||||||||||||||

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(yklooi @ Jun 13 2014, 07:01 PM) missed 2 more? This post has been edited by David83: Jun 13 2014, 07:06 PMHwang AIIMAN Prs Syariah Growth and Hwang Prs Conservative Added:

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Jun 13 2014, 09:21 PM Jun 13 2014, 09:21 PM

|

Junior Member

50 posts Joined: Sep 2010 From: Malaysia |

Thanks sifus for all the info... although I am lost about all the interest compound, rollover, etc etc lol...

I will leave my holdings in KGF and CMF as is for the moment... I will keep monitoring this thread on the sideline.. watching all the gurus discussing money... |

|

|

Jun 13 2014, 10:44 PM Jun 13 2014, 10:44 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

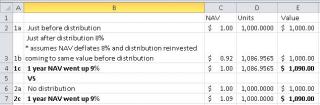

QUOTE(RO Player @ Jun 13 2014, 07:11 PM) IMO, higher distribution is better..i.e. more units is given to the holder. No doubt, total amt profit/loss is the same, but once NAV is gaining, your profit is getting fatter & fatter.. er.. U serious ar?There is a difference if Distribution, more units BUT lowered NAV, then NAV grow say 9% VS No distribution, same units, no lowered NAV then NAV grow same 9% ?

This post has been edited by wongmunkeong: Jun 13 2014, 10:46 PM |

|

|

|

|

|

Jun 13 2014, 10:52 PM Jun 13 2014, 10:52 PM

|

Senior Member

2,932 posts Joined: Sep 2007 |

QUOTE(RO Player @ Jun 13 2014, 07:11 PM) IMO, higher distribution is better..i.e. more units is given to the holder. No doubt, total amt profit/loss is the same, but once NAV is gaining, your profit is getting fatter & fatter.. Completely and totally incorrect.If you have more units, your NAV decreases accordingly. No doubt NAV will grow in future, but your DECREASED NAV will grow less accordingly, in future. So that overall, you are no better and no worse off. To say "NAV is gaining" while ignoring that fact the NAV has shrunked has nothing to do with "IMO" opinions. It's just plain wrong. If giving distributions will make investors better off, they will do it everyday. Why not? Because it makes investors better off, doesn't it? So why not did it everyday? Why not? Because it makes no difference. Or put it another way, there's no free lunch. Or do I need to @summon Pink to explain to you further? PS: ah, someone else beat me in replying. But on an added note, this "more units the better" has been proposed by people who write financial blogs, and disturbingly, by agents I dealt with. This post has been edited by howszat: Jun 13 2014, 10:58 PM |

|

|

Jun 13 2014, 11:07 PM Jun 13 2014, 11:07 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jun 13 2014, 11:20 PM Jun 13 2014, 11:20 PM

|

Senior Member

2,932 posts Joined: Sep 2007 |

QUOTE(yklooi @ Jun 13 2014, 11:07 PM) I like this...real enlightenment.....Thanks If people bothered with actual figures, they would not jump to the wrong "IMO" that more units are better.can this be "tagged" in post #1 for future continuously referenced when needed? For some reason, they work on "IMO", not spreadsheet figures. |

|

|

Jun 13 2014, 11:37 PM Jun 13 2014, 11:37 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

Never underestimate the lure of distribution to lay-person aka uncle and aunties.

To them, distribution = dividend. Manyak syiok wan. Something for those UTC to talk about. "Hey auntie, auntie... see, your unit increase ady. Good rite?" UT without Dividend ahem... I mean distribution is boring lar... like those stupid Insurance Investment Link type, never give distribution wan... NAV hit RM 3.XX... crazy wan. Psycho psycho... investor where got wanna buy leh? Xuzen |

|

|

Jun 14 2014, 12:07 AM Jun 14 2014, 12:07 AM

|

Senior Member

2,932 posts Joined: Sep 2007 |

QUOTE(RO Player @ Jun 13 2014, 11:31 PM) thanks for your enlightment, but why we invest in UT in the 1st place?, since u guys mention no difference at all! It's already been explained to you.Nobody said UT made no difference. People said distributions made no difference. Obviously, you can't tell the difference. |

|

|

Jun 14 2014, 12:09 AM Jun 14 2014, 12:09 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(RO Player @ Jun 13 2014, 11:31 PM) thanks for your enlightment, but why we invest in UT in the 1st place?, since u guys mention no difference at all! er.. U do know that UTs <> stocks right?before or after distribution, remains the same. Correct but PLease dont tell me, you know better than me or any street person. to me, there will be increase of profit gain..after distribution, for example, [visible to us, investors] NAV 1.05 10000 units = RM 10,500 after distribution of 0.05 per unit = 500 units NAV back to 1.00 with 10500 units = RM10,500 [*] NAV goes up (if market drops), NAV goes even higher (if market goes higher), that why some UT yield better than others. [not visible to investors] other investor may buy at cheaper NAV (after distribution), so more $$ for FMgr to leverage for more profit. More $$, more mgt fee for them. Incentive to perform. NAV = still increase, although KLCI or other market drops [*] Thinking back, wasting time to inform those 'expert' who knows everything, thru the books 'spreadsheet', but other mechanism doesnt work. Thus, more $ from uncles & aunties into the fund does NOT mean more cash chasing up the NAV or billions more for fund manager to fling. UTs' fund size is governed by SC - have U not seen some UTs being "closed" to new buys? http://www.sc.com.my/legislation-guideline...stment-schemes/ search for "Application to increase fund size for a unit trust fund" We're all here to learn. I was just pointing out in numbers your stated logic earlier. Please do share actual data and not anecdotes of invisible stuff - benda halus ke? Just because i farted & thunderstorm started doesn't mean kaka - have to look into the actual underlying causation, right? Anyhow, have U read the statistics that the bigger the fund becomes, the harder for it to maintain its profitability / CAGR? This post has been edited by wongmunkeong: Jun 14 2014, 12:11 AM |

|

|

Jun 14 2014, 12:14 AM Jun 14 2014, 12:14 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(xuzen @ Jun 13 2014, 11:37 PM) Never underestimate the lure of distribution to lay-person aka uncle and aunties. Dude - U gotta hand it to them marketing BS lor.To them, distribution = dividend. Manyak syiok wan. Something for those UTC to talk about. "Hey auntie, auntie... see, your unit increase ady. Good rite?" UT without Dividend ahem... I mean distribution is boring lar... like those stupid Insurance Investment Link type, never give distribution wan... NAV hit RM 3.XX... crazy wan. Psycho psycho... investor where got wanna buy leh? Xuzen <insert curses and hexes for evil marketing BS people here> Can con ppl about laying more eggs during distribution BUT didnt tell whole-truth - them eggs all smaller eggs and if one weighs them, dagnabit - total weight same! This post has been edited by wongmunkeong: Jun 14 2014, 12:18 AM |

|

Topic ClosedOptions

|

| Change to: |  0.0344sec 0.0344sec

0.26 0.26

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 06:13 AM |