QUOTE(MalaysianFire @ May 7 2020, 12:23 PM)

» Click to show Spoiler - click again to hide... «

Personal Financial Management V3, It's all about managing your $$$

|

|

May 8 2020, 10:47 AM May 8 2020, 10:47 AM

Show posts by this member only | IPv6 | Post

#2141

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(MalaysianFire @ May 7 2020, 12:23 PM) » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

May 9 2020, 06:18 PM May 9 2020, 06:18 PM

Show posts by this member only | IPv6 | Post

#2142

|

Junior Member

63 posts Joined: Jan 2020 |

QUOTE(yklooi @ May 7 2020, 12:32 PM) if this earning to saving ratio can be sustained for 20 yrs....then very good.... I think it's quite hard no once you reach at an elder age ? Need to buy house, car etc. That will rack up more commitments and thus the savings will be depleted ?allocate some % for networking expenses (not only with the usual guys but more to the NEW network... I do go out to drink to network but that is only maybe every Friday after work. |

|

|

May 9 2020, 06:21 PM May 9 2020, 06:21 PM

Show posts by this member only | IPv6 | Post

#2143

|

Junior Member

63 posts Joined: Jan 2020 |

QUOTE(honsiong @ May 7 2020, 12:35 PM) You save quite a lot for that income. I consider superannuities like EPF & PRS as assets, its just something you cant touch in short term. I am just about to embark on buying some Malaysian stocks as now might be a good time to enter the market. Although diversifying some out of MYR assets would be good as well, would you happen to know any platforms that I can get foreign stocks or ETFs through here in Malaysia ?Good on you not having a car I guess, cars arent just loan, petrol, also got maintenance, insurance, and repairs after accidents. It would be a huge money sink even if you own an Axia. I would diversify the investments out from MYR denominated assets. Thanks for the tip on the car, I am a person that prefers liquidity instead of something that is fixed and I have a commitment towards it. |

|

|

May 9 2020, 06:26 PM May 9 2020, 06:26 PM

Show posts by this member only | IPv6 | Post

#2144

|

Junior Member

63 posts Joined: Jan 2020 |

QUOTE(xcxa23 @ May 7 2020, 01:14 PM) Assuming you don't have emergency cash The 21k I listed that of my cash on hand is listed there, the 6 months emergency cash is already part of it and it's easily accessible when I need it. The high yield savings account is paying decent, a bit higher than FD.Set aside 6 month worth of monthly expenses in the high yield savings, as long as it's easy reachable. The rest, invest it. If you yet to familiarise with investment, read and learn. Meanwhile I suggest the extra cash/saving/salary leftover either 1. Push around 50% to 80% of your cash (depending on how much cash on hand you need). Or 2. FD, 1 or 3 month terms. Longer if you require more time to learn about investment. Hahaha, OPR just cut. The FD rate now is so low. Ready to take on some risk to see some growth, guess now is a good time since younger can tolerate more risk .. |

|

|

May 9 2020, 10:12 PM May 9 2020, 10:12 PM

Show posts by this member only | IPv6 | Post

#2145

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(MalaysianFire @ May 9 2020, 06:26 PM) The 21k I listed that of my cash on hand is listed there, the 6 months emergency cash is already part of it and it's easily accessible when I need it. The high yield savings account is paying decent, a bit higher than FD. Well done on your plans!Hahaha, OPR just cut. The FD rate now is so low. Ready to take on some risk to see some growth, guess now is a good time since younger can tolerate more risk .. |

|

|

May 9 2020, 10:21 PM May 9 2020, 10:21 PM

Show posts by this member only | IPv6 | Post

#2146

|

Senior Member

1,269 posts Joined: May 2005 |

QUOTE(MalaysianFire @ May 9 2020, 06:26 PM) The 21k I listed that of my cash on hand is listed there, the 6 months emergency cash is already part of it and it's easily accessible when I need it. The high yield savings account is paying decent, a bit higher than FD. I know I memang kena flame for this but ya, my emergency cash are almost 90% in unit trust. Hahaha, OPR just cut. The FD rate now is so low. Ready to take on some risk to see some growth, guess now is a good time since younger can tolerate more risk .. Yes drawdowns due occur but I just have to ride this through until next year. But selagi still ok, continue doing RSP ja |

|

|

|

|

|

May 10 2020, 06:40 AM May 10 2020, 06:40 AM

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

QUOTE(brokenbomb @ May 9 2020, 10:21 PM) I know I memang kena flame for this but ya, my emergency cash are almost 90% in unit trust. haha, i think i saw someone in this forum asking about maybe putting his/her emergency fund into bond funds. some responded that it may not be a very good idea coz bonds still not liquid and safe enuf to park their emergency funds.Yes drawdowns due occur but I just have to ride this through until next year. But selagi still ok, continue doing RSP ja i currently have my emergency funds in a liquid money market. maybe not such a bad idea to put them into a bond fund. |

|

|

May 10 2020, 08:45 AM May 10 2020, 08:45 AM

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(MalaysianFire @ May 9 2020, 06:26 PM) The 21k I listed that of my cash on hand is listed there, the 6 months emergency cash is already part of it and it's easily accessible when I need it. The high yield savings account is paying decent, a bit higher than FD. Good!! Many underestimated the importance of emergency cash.Hahaha, OPR just cut. The FD rate now is so low. Ready to take on some risk to see some growth, guess now is a good time since younger can tolerate more risk .. What's your planning with the extra cash? And I'm interested with higher than FD. May I know which bank and how much is the rate? Currently I'm parking my emergency cash in rhb bonus saver, as of now still giving 2.65% Calculate daily, credit monthly. Best of all, no requirement. |

|

|

May 10 2020, 09:53 AM May 10 2020, 09:53 AM

Show posts by this member only | IPv6 | Post

#2149

|

Senior Member

2,032 posts Joined: Jan 2014 From: Sabah, Malaysia |

QUOTE(xcxa23 @ May 10 2020, 08:45 AM) Good!! Many underestimated the importance of emergency cash. Mine is in Stashaway 6.5% Risk portfolio. What's your planning with the extra cash? And I'm interested with higher than FD. May I know which bank and how much is the rate? Currently I'm parking my emergency cash in rhb bonus saver, as of now still giving 2.65% Calculate daily, credit monthly. Best of all, no requirement. |

|

|

May 10 2020, 10:24 AM May 10 2020, 10:24 AM

Show posts by this member only | IPv6 | Post

#2150

|

Senior Member

7,847 posts Joined: Sep 2019 |

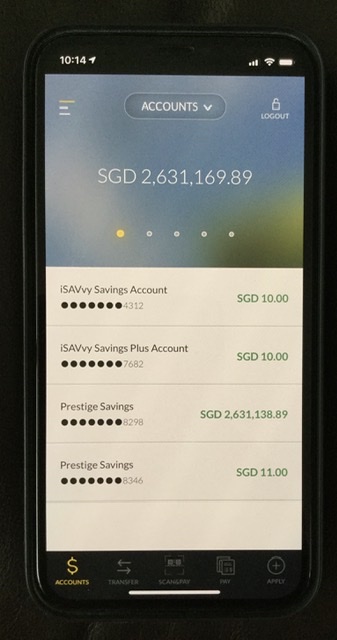

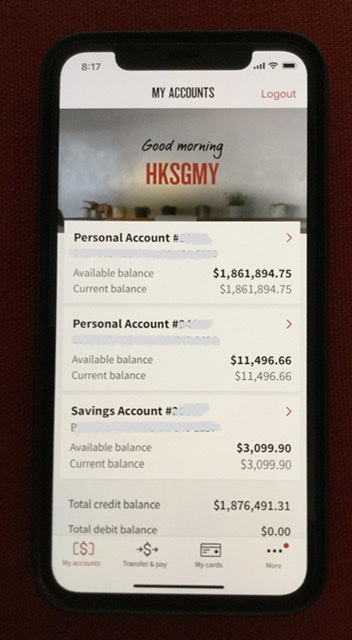

QUOTE(brokenbomb @ May 9 2020, 10:21 PM) I know I memang kena flame for this but ya, my emergency cash are almost 90% in unit trust. I’m a self avowed ultra-conservative investor. When I say emergency funds, I mean the most liquid of all liquid assets - short of stashing physical notes like Najib in his house - I have them in high yield accounts that I ping-pong every 2 to 3 months to take advantage of the promotion rates. Yes drawdowns due occur but I just have to ride this through until next year. But selagi still ok, continue doing RSP ja Not even in FD (which I do have money locked up as well). Here are 2 examples - one is with Maybank Singapore, the other is with NAB: » Click to show Spoiler - click again to hide... « And yes, my NAB account bears my lowyat forum nickname. I thought it to be a nice touch. My UOB accounts have also been renamed to my lowyat nickname too haha. This post has been edited by hksgmy: May 10 2020, 10:32 AM |

|

|

May 10 2020, 10:30 AM May 10 2020, 10:30 AM

|

Senior Member

2,649 posts Joined: Nov 2010 |

|

|

|

May 10 2020, 10:33 AM May 10 2020, 10:33 AM

Show posts by this member only | IPv6 | Post

#2152

|

Senior Member

2,032 posts Joined: Jan 2014 From: Sabah, Malaysia |

|

|

|

May 10 2020, 10:34 AM May 10 2020, 10:34 AM

|

Senior Member

1,269 posts Joined: May 2005 |

QUOTE(hksgmy @ May 10 2020, 10:24 AM) I’m a self avowed ultra-conservative investor. When I say emergency funds, I mean the most liquid of all liquid assets - short of stashing physical notes like Najib in his house - I have them in high yield accounts that I ping-pong every 2 to 3 months to take advantage of the promotion rates. 3% of a million is already 30k. Haha.Not even in FD (which I do have money locked up as well). Here are 2 examples - one is with Maybank Singapore, the other is with NAB:   And yes, my NAB account bears my lowyat forum nickname. I thought it to be a nice touch. My UOB accounts have also been renamed to my lowyat nickname too haha. But mine is only in the 4 figures, So maybe my risk profile is different 😅 But then again after i reach that 1 million mark, I might be looking at FD or filling up my asb 1 and 2. |

|

|

|

|

|

May 10 2020, 10:38 AM May 10 2020, 10:38 AM

Show posts by this member only | IPv6 | Post

#2154

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(brokenbomb @ May 10 2020, 10:34 AM) 3% of a million is already 30k. Haha. SGD deposit rates are way lower. I’m getting less than 2% on my SGD savings - but it’s a trade off for being highly liquid. I’ve already drawn down quite a bit during the recent stock market turmoil due to COVID 19, and picked up a few good IG bonds below IPO price as well as a few banking stocks that I’ve been eyeing.But mine is only in the 4 figures, So maybe my risk profile is different 😅 But then again after i reach that 1 million mark, I might be looking at FD or filling up my asb 1 and 2. |

|

|

May 10 2020, 11:02 AM May 10 2020, 11:02 AM

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(woonsc @ May 10 2020, 10:33 AM) As of now 0.13% MWR i guess i will stick with rhb 2.65% 0.8% TWR Don't need to be that liquid, I have CC to tide at least 30 days. While withdrawing. i got think of ''CC to tide at least 30 days'' but then i realise, not every place accept CC and during MCO, while buying groceries, i prefer go to those smaller kedai runcit. bit more pricey but less Q and crowd |

|

|

May 10 2020, 11:04 AM May 10 2020, 11:04 AM

Show posts by this member only | IPv6 | Post

#2156

|

Senior Member

1,269 posts Joined: May 2005 |

QUOTE(xcxa23 @ May 10 2020, 11:02 AM) i guess i will stick with rhb 2.65% But MCO did force some of the kedai runcit to “card x accept boss, boost boleh” 🤣i got think of ''CC to tide at least 30 days'' but then i realise, not every place accept CC and during MCO, while buying groceries, i prefer go to those smaller kedai runcit. bit more pricey but less Q and crowd |

|

|

May 10 2020, 12:55 PM May 10 2020, 12:55 PM

Show posts by this member only | IPv6 | Post

#2157

|

Senior Member

2,032 posts Joined: Jan 2014 From: Sabah, Malaysia |

QUOTE(xcxa23 @ May 10 2020, 11:02 AM) i guess i will stick with rhb 2.65% i got think of ''CC to tide at least 30 days'' but then i realise, not every place accept CC and during MCO, while buying groceries, i prefer go to those smaller kedai runcit. bit more pricey but less Q and crowd But yeah, if that keeps you save! |

|

|

May 10 2020, 12:56 PM May 10 2020, 12:56 PM

Show posts by this member only | IPv6 | Post

#2158

|

Junior Member

63 posts Joined: Jan 2020 |

QUOTE(xcxa23 @ May 10 2020, 08:45 AM) Good!! Many underestimated the importance of emergency cash. thinking of venturing into the stock market. But still reading about it, have a full-time job so not much time to actually go and research the companies. So taking it slowly, its money anyways would not want to regret losing it.What's your planning with the extra cash? And I'm interested with higher than FD. May I know which bank and how much is the rate? Currently I'm parking my emergency cash in rhb bonus saver, as of now still giving 2.65% Calculate daily, credit monthly. Best of all, no requirement. I'm putting my money now into Standard Chartered PSA. Gives 3.6% provided you put in 3000 fresh funds every month and spend RM1000 in credit card spend every month and you get the 3.6%. I have this as my salary account, so automatically, 2.1%, if spend RM1000 which is possible, then another 1.5%. Some requirements but hey no free lunch in this world. |

|

|

May 10 2020, 12:58 PM May 10 2020, 12:58 PM

Show posts by this member only | IPv6 | Post

#2159

|

Junior Member

63 posts Joined: Jan 2020 |

|

|

|

May 10 2020, 01:01 PM May 10 2020, 01:01 PM

Show posts by this member only | IPv6 | Post

#2160

|

Junior Member

63 posts Joined: Jan 2020 |

QUOTE(hksgmy @ May 10 2020, 10:24 AM) I’m a self avowed ultra-conservative investor. When I say emergency funds, I mean the most liquid of all liquid assets - short of stashing physical notes like Najib in his house - I have them in high yield accounts that I ping-pong every 2 to 3 months to take advantage of the promotion rates. wow. nice. even dividens alone from the savings accounts can keep you going in terms of expenses. If you don't mind, may I know how long you have been investing already ?Not even in FD (which I do have money locked up as well). Here are 2 examples - one is with Maybank Singapore, the other is with NAB: » Click to show Spoiler - click again to hide... « And yes, my NAB account bears my lowyat forum nickname. I thought it to be a nice touch. My UOB accounts have also been renamed to my lowyat nickname too haha. |

| Change to: |  0.0305sec 0.0305sec

0.37 0.37

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 04:29 AM |