Outline ·

[ Standard ] ·

Linear+

Personal Financial Management V3, It's all about managing your $$$

|

brokenbomb

|

May 9 2020, 10:21 PM May 9 2020, 10:21 PM

|

|

QUOTE(MalaysianFire @ May 9 2020, 06:26 PM) The 21k I listed that of my cash on hand is listed there, the 6 months emergency cash is already part of it and it's easily accessible when I need it. The high yield savings account is paying decent, a bit higher than FD. Hahaha, OPR just cut. The FD rate now is so low. Ready to take on some risk to see some growth, guess now is a good time since younger can tolerate more risk .. I know I memang kena flame for this but ya, my emergency cash are almost 90% in unit trust. Yes drawdowns due occur but I just have to ride this through until next year. But selagi still ok, continue doing RSP ja |

|

|

|

|

|

brokenbomb

|

May 10 2020, 10:34 AM May 10 2020, 10:34 AM

|

|

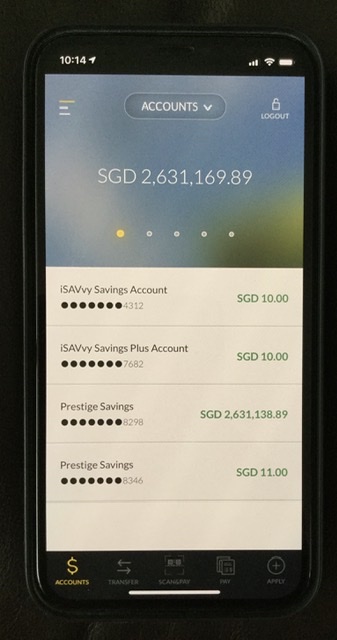

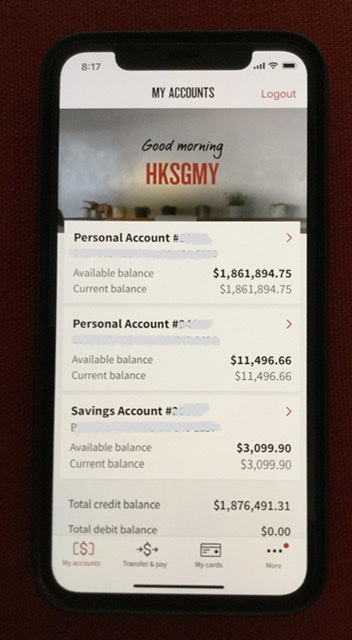

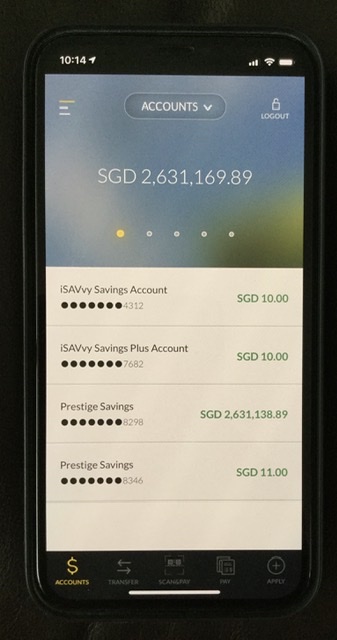

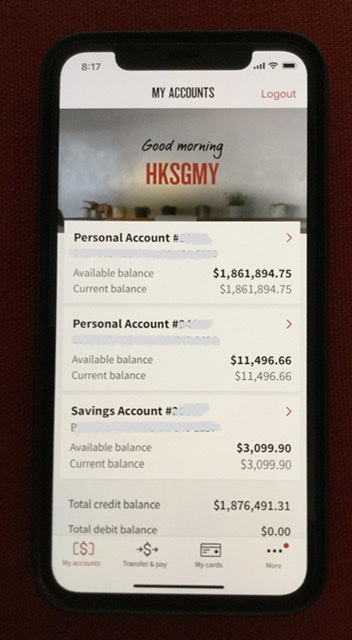

QUOTE(hksgmy @ May 10 2020, 10:24 AM) I’m a self avowed ultra-conservative investor. When I say emergency funds, I mean the most liquid of all liquid assets - short of stashing physical notes like Najib in his house - I have them in high yield accounts that I ping-pong every 2 to 3 months to take advantage of the promotion rates. Not even in FD (which I do have money locked up as well). Here are 2 examples - one is with Maybank Singapore, the other is with NAB:   And yes, my NAB account bears my lowyat forum nickname. I thought it to be a nice touch. My UOB accounts have also been renamed to my lowyat nickname too haha. 3% of a million is already 30k. Haha. But mine is only in the 4 figures, So maybe my risk profile is different 😅 But then again after i reach that 1 million mark, I might be looking at FD or filling up my asb 1 and 2. |

|

|

|

|

|

brokenbomb

|

May 10 2020, 11:04 AM May 10 2020, 11:04 AM

|

|

QUOTE(xcxa23 @ May 10 2020, 11:02 AM) i guess i will stick with rhb 2.65%  i got think of ''CC to tide at least 30 days'' but then i realise, not every place accept CC and during MCO, while buying groceries, i prefer go to those smaller kedai runcit. bit more pricey but less Q and crowd But MCO did force some of the kedai runcit to “card x accept boss, boost boleh” 🤣 |

|

|

|

|

|

brokenbomb

|

May 10 2020, 02:08 PM May 10 2020, 02:08 PM

|

|

QUOTE(hksgmy @ May 10 2020, 01:27 PM) Yes, my wife and I’ve been lucky to both share decent salaries coupled with frugal habits. And we have also been lucky with some of our property purchases, before all these additional stamp buyers duties and taxes came into force. Overall, we’ve started investing in IG bonds and blue chip stocks for the past decade or so, after we paid off all our property purchases in Singapore and Australia. All our properties are mortgage-free and are tenanted, which also makes for a good passive income stream. Both my wife and I are a couple of years away from turning 50, so I believe we are much older than most of you here. Good luck! Thanks for the sharing! Its good to see people who reached their goals helping some of the young adults here  |

|

|

|

|

May 9 2020, 10:21 PM

May 9 2020, 10:21 PM

Quote

Quote

0.0908sec

0.0908sec

0.49

0.49

7 queries

7 queries

GZIP Disabled

GZIP Disabled