Outline ·

[ Standard ] ·

Linear+

Personal Financial Management V3, It's all about managing your $$$

|

MalaysianFire

|

May 7 2020, 12:23 PM May 7 2020, 12:23 PM

|

Getting Started

|

Hi all,

Looking for some advice building wealth as a young person.

Age: 23

Nett Pay: 4000 ( been working for about half a year)

Monthly Expenses:

Rent: 1200 (Rent is very high because I work in KL and prefer to live nearby, rather than being in the car for 4 hours per day)

Food: 600 (Every month since living alone have to buy groceries)

Phone bill: 60

Other bills: 130 (Electricity, Water)

LRT: 60

Entertainment: 200

-----------

2,250

Monthly savings: 1,750

Cash in hand: 21,000 (In a high-interest rate savings account)

ASM: 1000

EPF: 7000

Total Assets: 29,000 (although I don't like to count EPF as an asset at my age, what do you all think ?)

No outstanding loans.

I know the rent is high, but I don't pay for any petrol or car loan in this scenario. I do take grab sometimes but rarely.

Really appreciate any advice on how to improve my financial standing or grow my wealth.

Thanks in advance for all the help.

|

|

|

|

|

|

MalaysianFire

|

May 9 2020, 06:18 PM May 9 2020, 06:18 PM

|

Getting Started

|

QUOTE(yklooi @ May 7 2020, 12:32 PM) if this earning to saving ratio can be sustained for 20 yrs....then very good.... allocate some % for networking expenses (not only with the usual guys but more to the NEW network... I think it's quite hard no once you reach at an elder age ? Need to buy house, car etc. That will rack up more commitments and thus the savings will be depleted ? I do go out to drink to network but that is only maybe every Friday after work. |

|

|

|

|

|

MalaysianFire

|

May 9 2020, 06:21 PM May 9 2020, 06:21 PM

|

Getting Started

|

QUOTE(honsiong @ May 7 2020, 12:35 PM) You save quite a lot for that income. I consider superannuities like EPF & PRS as assets, its just something you cant touch in short term. Good on you not having a car I guess, cars arent just loan, petrol, also got maintenance, insurance, and repairs after accidents. It would be a huge money sink even if you own an Axia. I would diversify the investments out from MYR denominated assets. I am just about to embark on buying some Malaysian stocks as now might be a good time to enter the market. Although diversifying some out of MYR assets would be good as well, would you happen to know any platforms that I can get foreign stocks or ETFs through here in Malaysia ? Thanks for the tip on the car, I am a person that prefers liquidity instead of something that is fixed and I have a commitment towards it. |

|

|

|

|

|

MalaysianFire

|

May 9 2020, 06:26 PM May 9 2020, 06:26 PM

|

Getting Started

|

QUOTE(xcxa23 @ May 7 2020, 01:14 PM) Assuming you don't have emergency cash Set aside 6 month worth of monthly expenses in the high yield savings, as long as it's easy reachable. The rest, invest it. If you yet to familiarise with investment, read and learn. Meanwhile I suggest the extra cash/saving/salary leftover either 1. Push around 50% to 80% of your cash (depending on how much cash on hand you need). Or 2. FD, 1 or 3 month terms. Longer if you require more time to learn about investment. The 21k I listed that of my cash on hand is listed there, the 6 months emergency cash is already part of it and it's easily accessible when I need it. The high yield savings account is paying decent, a bit higher than FD. Hahaha, OPR just cut. The FD rate now is so low. Ready to take on some risk to see some growth, guess now is a good time since younger can tolerate more risk .. |

|

|

|

|

|

MalaysianFire

|

May 10 2020, 12:56 PM May 10 2020, 12:56 PM

|

Getting Started

|

QUOTE(xcxa23 @ May 10 2020, 08:45 AM) Good!! Many underestimated the importance of emergency cash. What's your planning with the extra cash? And I'm interested with higher than FD. May I know which bank and how much is the rate? Currently I'm parking my emergency cash in rhb bonus saver, as of now still giving 2.65% Calculate daily, credit monthly. Best of all, no requirement. thinking of venturing into the stock market. But still reading about it, have a full-time job so not much time to actually go and research the companies. So taking it slowly, its money anyways would not want to regret losing it. I'm putting my money now into Standard Chartered PSA. Gives 3.6% provided you put in 3000 fresh funds every month and spend RM1000 in credit card spend every month and you get the 3.6%. I have this as my salary account, so automatically, 2.1%, if spend RM1000 which is possible, then another 1.5%. Some requirements but hey no free lunch in this world. |

|

|

|

|

|

MalaysianFire

|

May 10 2020, 12:58 PM May 10 2020, 12:58 PM

|

Getting Started

|

QUOTE(brokenbomb @ May 10 2020, 11:04 AM) But MCO did force some of the kedai runcit to “card x accept boss, boost boleh” 🤣 nowadays should use e-wallet more. a lot of banks giving rewards if use credit card to top up to e-wallet. |

|

|

|

|

|

MalaysianFire

|

May 10 2020, 01:01 PM May 10 2020, 01:01 PM

|

Getting Started

|

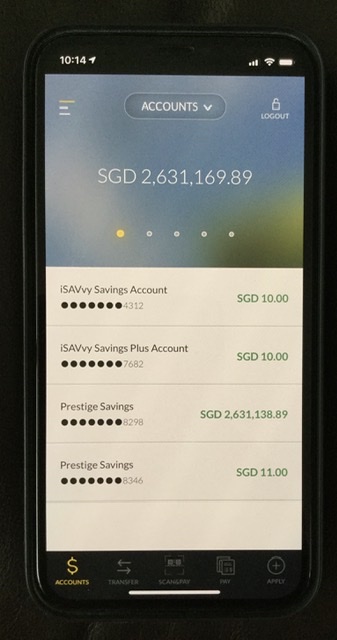

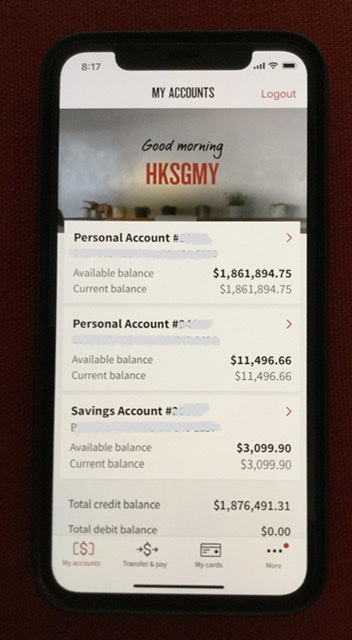

QUOTE(hksgmy @ May 10 2020, 10:24 AM) I’m a self avowed ultra-conservative investor. When I say emergency funds, I mean the most liquid of all liquid assets - short of stashing physical notes like Najib in his house - I have them in high yield accounts that I ping-pong every 2 to 3 months to take advantage of the promotion rates. Not even in FD (which I do have money locked up as well). Here are 2 examples - one is with Maybank Singapore, the other is with NAB: » Click to show Spoiler - click again to hide... « And yes, my NAB account bears my lowyat forum nickname. I thought it to be a nice touch. My UOB accounts have also been renamed to my lowyat nickname too haha. wow. nice. even dividens alone from the savings accounts can keep you going in terms of expenses. If you don't mind, may I know how long you have been investing already ? |

|

|

|

|

|

MalaysianFire

|

May 11 2020, 02:34 AM May 11 2020, 02:34 AM

|

Getting Started

|

QUOTE(hksgmy @ May 10 2020, 03:40 PM) Indeed, my wife and I consider ourselves very fortunate. A rule of thumb for us is that we keep at least 10% of our net worth in a highly liquid environment (not even FDs) - and that means either as cash or in a high yield/savings account. You’ll never know when you need to use money urgently, or if a good bargain emerges in the market. During the recent COVID19 induced market upheaval, we bought more than $1,000,000 worth of good quality Singapore bank bonds (DBS, OCBC and UOB) at between 98 to 99¢ - which was even lower than their IPO prices! I already have bonds of these banks bought years ago, and I’ve had to pay way more than 98¢ for them, that’s for sure! And that is the primary reason why we steadfastly follow a conservative bias when it comes to investing - because every cent is hard earned money, from much blood, sweat and tears. Moreover, we are not young anymore and correspondingly, our risk appetites are also lower, given the difficulty of recouping losses from risky stocks or margin calls gone bad. Hence, we don’t leverage and we don’t believe in risky assets. Really cool for you to lend your advise and experience here to the younger people ! Thanks a lot  |

|

|

|

|

May 7 2020, 12:23 PM

May 7 2020, 12:23 PM

Quote

Quote

0.1205sec

0.1205sec

0.83

0.83

7 queries

7 queries

GZIP Disabled

GZIP Disabled