QUOTE(cherroy @ Jul 31 2013, 05:14 PM)

Gold bugs will tell us physical gold in the safe is the most realistic one STOCK MARKET DISCUSSION V134, CI step into 1800, are you happy?

STOCK MARKET DISCUSSION V134, CI step into 1800, are you happy?

|

|

Jul 31 2013, 08:52 PM Jul 31 2013, 08:52 PM

|

Senior Member

3,816 posts Joined: Feb 2012 |

|

|

|

|

|

|

Jul 31 2013, 08:53 PM Jul 31 2013, 08:53 PM

|

Senior Member

5,369 posts Joined: Jan 2003 |

|

|

|

Jul 31 2013, 08:53 PM Jul 31 2013, 08:53 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

And just for the record...

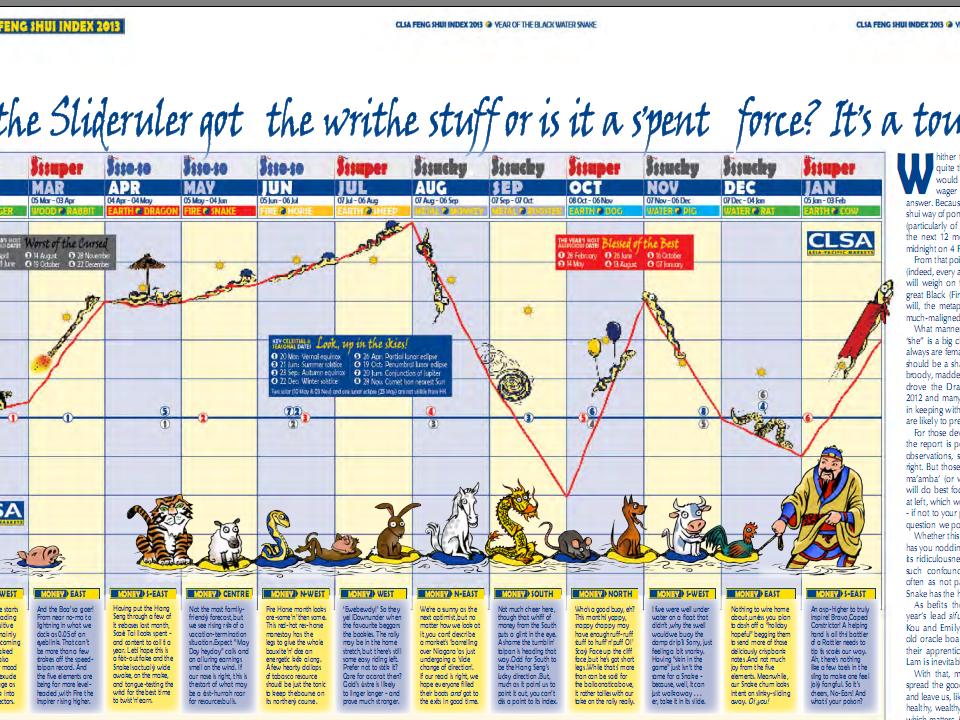

Jan: 1627.55 Feb: 1,637.63 - up 10.08 March: 1,671.63 - up 34.00 Apr: 1,717.65 - up 46.02 May: 1,769.22 - up 52 June: 1773.54 - up 4.3 July: 1772.62 - DOWN 0.92 Looks like payback time. June looked like a super bad month. Last couple days brought the index up. July looked like a super good month. Last couple days brought the index back down. Let me tell you again straight up. You won't get rich or even smarter referring to them Ponnnnnnng Sway charts.  |

|

|

Jul 31 2013, 09:07 PM Jul 31 2013, 09:07 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(simplesmile @ Jul 31 2013, 08:42 PM) Still need to do own research and not fully rely on such info.For example, on page 5, CIMB clearly stated QUOTE "In summary, companies that will lose out from a weaker ringgit are those with: 1) high foreign debt , such as Tenaga, MISC and AirAsia Why then on page 8, on Appendix 1, it only states AirAsia issue is 'fuel costs in US$'? IINM the bulk of AirAsia debts are in USD. |

|

|

Jul 31 2013, 10:17 PM Jul 31 2013, 10:17 PM

|

Junior Member

266 posts Joined: Oct 2010 From: Pahang/Melaka |

hello all sifus

need recommendation on technical analysis book, care to share some |

|

|

Jul 31 2013, 10:26 PM Jul 31 2013, 10:26 PM

|

Senior Member

1,006 posts Joined: Mar 2006 From: Proud of Kelantan |

QUOTE(cherroy @ Jul 31 2013, 05:14 PM) That's why I said again and again. we need to united and be investor activist Cash in the pocket (dividend) is the most realistic one. One can buy an undervalued stock that give zero dividend, it can forever undervalued, due to whatever reason. Price no up, no dividend, what investors can do? Just like can buy a house at Rm100K which is undervalued, but nobody want to rent, nobody want to buy higher than 100k, so everyday just can watch "undervalued". |

|

|

|

|

|

Jul 31 2013, 10:32 PM Jul 31 2013, 10:32 PM

|

Senior Member

1,177 posts Joined: Nov 2007 |

|

|

|

Jul 31 2013, 11:04 PM Jul 31 2013, 11:04 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(panasonic88 @ Jul 31 2013, 05:14 PM) actually not so bad if hold them, if yield continue raising in coming years, worst case is after few years later, capital gain flat, but still already received dividend every year 4-6% pa. key point is, if, yield continue increasing for next 5-10 years. |

|

|

Jul 31 2013, 11:05 PM Jul 31 2013, 11:05 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jul 31 2013, 11:05 PM Jul 31 2013, 11:05 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jul 31 2013, 11:06 PM Jul 31 2013, 11:06 PM

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(yok70 @ Jul 31 2013, 11:04 PM) actually not so bad if hold them, if yield continue raising in coming years, worst case is after few years later, capital gain flat, but still already received dividend every year 4-6% pa. have to see how fast the manger expanding with acquisition asset.key point is, if, yield continue increasing for next 5-10 years. |

|

|

Jul 31 2013, 11:40 PM Jul 31 2013, 11:40 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jul 31 2013, 11:44 PM Jul 31 2013, 11:44 PM

|

Senior Member

2,991 posts Joined: Jun 2007 |

QUOTE(cherroy @ Jul 31 2013, 05:14 PM) That's why I said again and again. This means the person who bought the house never did enough homework. House location good, price cheap. Looks undervalued, but nobody wants to rent and nobody willing to pay higher to buy from you. Meaning it's a haunted house la. Then he can change strategy, turn the haunted house into a tourist spot. Charge $$ for people to take walk in the house.Cash in the pocket (dividend) is the most realistic one. One can buy an undervalued stock that give zero dividend, it can forever undervalued, due to whatever reason. Price no up, no dividend, what investors can do? Just like can buy a house at Rm100K which is undervalued, but nobody want to rent, nobody want to buy higher than 100k, so everyday just can watch "undervalued". QUOTE(Boon3 @ Jul 31 2013, 09:07 PM) Still need to do own research and not fully rely on such info. I know. Have learnt my lesson with MEGB.For example, on page 5, CIMB clearly stated Why then on page 8, on Appendix 1, it only states AirAsia issue is 'fuel costs in US$'? IINM the bulk of AirAsia debts are in USD. I have 4 stocks. Glad 2 of my stocks could benefit from the MYR depreciation and none of my stocks are on the negative impact in the list on page 8. This post has been edited by simplesmile: Jul 31 2013, 11:49 PM |

|

|

|

|

|

Aug 1 2013, 12:00 AM Aug 1 2013, 12:00 AM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

cimb downgrades presbhd. nice.

Attached File(s)  presbhd_cimb_310713.pdf ( 480.12k )

Number of downloads: 57

presbhd_cimb_310713.pdf ( 480.12k )

Number of downloads: 57 |

|

|

Aug 1 2013, 08:33 AM Aug 1 2013, 08:33 AM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Aug 1 2013, 09:06 AM Aug 1 2013, 09:06 AM

|

Junior Member

374 posts Joined: Mar 2005 From: Sarawak |

Wow, the market so green... but CI seems like not recovering thou

|

|

|

Aug 1 2013, 09:12 AM Aug 1 2013, 09:12 AM

|

Senior Member

6,779 posts Joined: Dec 2005 From: Kuala Lumpur |

what's today outlook? another -22?

|

|

|

Aug 1 2013, 09:13 AM Aug 1 2013, 09:13 AM

|

Senior Member

6,779 posts Joined: Dec 2005 From: Kuala Lumpur |

|

|

|

Aug 1 2013, 09:15 AM Aug 1 2013, 09:15 AM

|

Senior Member

6,779 posts Joined: Dec 2005 From: Kuala Lumpur |

|

|

|

Aug 1 2013, 09:20 AM Aug 1 2013, 09:20 AM

|

Senior Member

8,441 posts Joined: Nov 2005 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0289sec 0.0289sec

0.70 0.70

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 08:47 PM |