QUOTE(darkknight81 @ May 28 2013, 06:44 PM)

Thanks for your valuable info. No doubt Wilmar has higher gearing.

But in term of P/E ratio Wilmar is lower which is around 14 and PPB is near to 17 times.

RM 13.64 - (2012 EPS - 71 CENTS) - P/E (19.2 TIMES)

Wilmar

SGD 3.37 (2012 EPS - 0.24 CENTS) - P/E (14 TIMES ONLY)

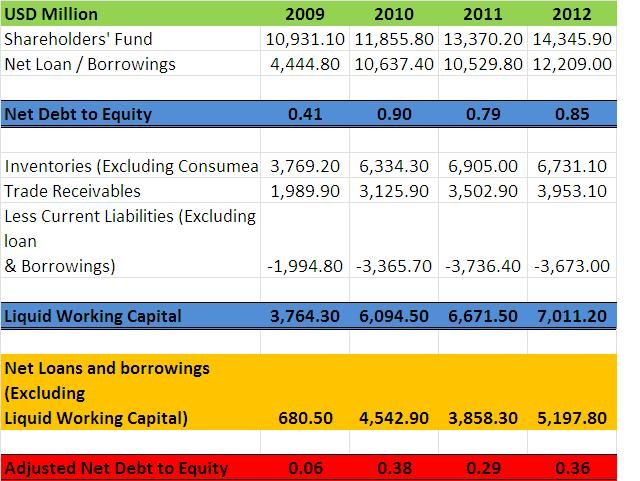

Yes, definitely, as Wilmar's EPS is much better than PPB. However, PE ratio alone cannot tell the full-story. One gotta look from the company's cash flow perspective coupled with its financial position (aka Balance sheet) too.But in term of P/E ratio Wilmar is lower which is around 14 and PPB is near to 17 times.

RM 13.64 - (2012 EPS - 71 CENTS) - P/E (19.2 TIMES)

Wilmar

SGD 3.37 (2012 EPS - 0.24 CENTS) - P/E (14 TIMES ONLY)

As an investor, we would want to know how much money can be taken out from the business and the business still runs and sustains. Thus, free cash flow is another important yardstick.

Anyway, I understand that it is just different perspective that we are looking at.

Most are earning-geared (# such as revenue, income, etc.) but I look more from the financial capability of the company if it can withstand shocks from the economy. Well, then again, I am a conservative investor myself

Just my personal opinion =)

May 28 2013, 07:08 PM

May 28 2013, 07:08 PM

Quote

Quote

0.0176sec

0.0176sec

0.46

0.46

6 queries

6 queries

GZIP Disabled

GZIP Disabled