Wilmar International Limited, founded in 1991 and headquartered in Singapore, is today Asia's leading agribusiness group. Wilmar is ranked amongst the largest listed companies by market capitalisation on the SGX.

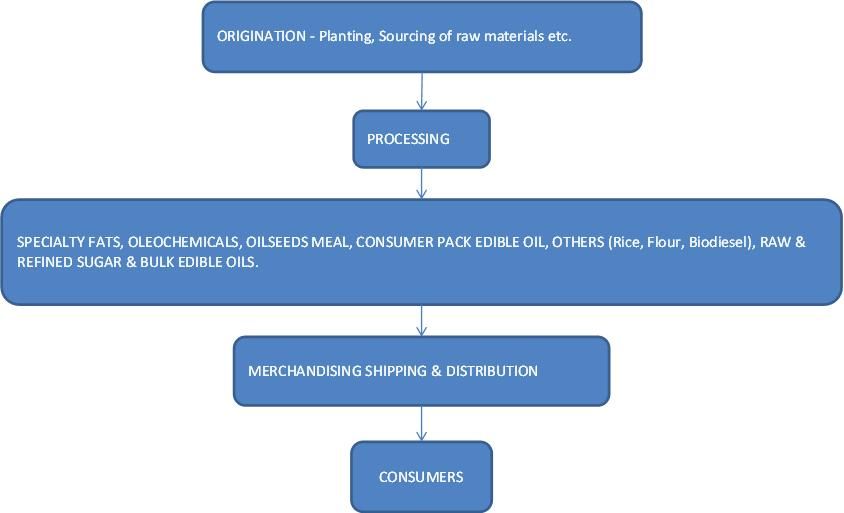

Wilmar's business activities include palm oil cultivation, oilseeds crushing, edible oils refining, sugar milling and refining, specialty fats, oleochemicals, biodiesel and fertilizers manufacturing and grains processing. At the core of Wilmar's strategy is a resilient integrated agribusiness

modeal that encompasses the enture value chain of the agricultural commodity processing business, from origination and processing to branding,

merchandising and distribution of a wide range of agricultural products. It has over 450 manufacturing plants and an extensive distribution

network covering China, India, Indonesia and some 50 other countries. The group is backed by a multinational workforce of over 93,000 people.

For those who are interested in Oil Palm and consumer product, perhaps you can consider this counter.

Some of the Key Brands under Wilmar associates FFM in Malaysia are e.g. Neptune Cooking Oil, Seri Murni, Krystal Cooking Oil, Marina, Massimo, V-soy Milk, Massimo Bread etc...

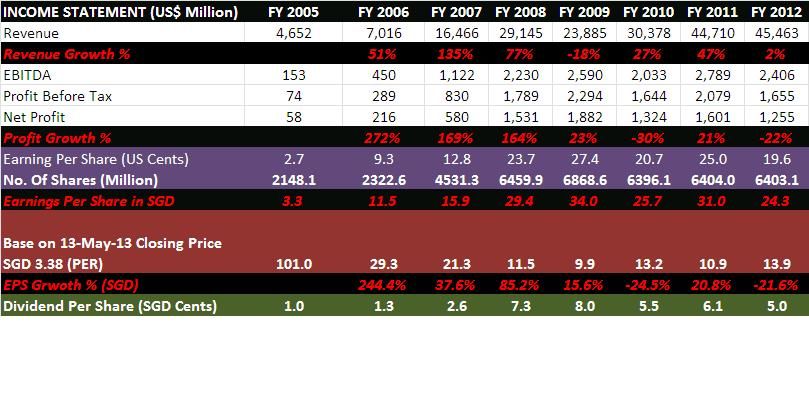

WILMAR EARNINGS TRACK RECORD

Base on above table, revenue almost 10 folds within 7 years period and same goes for Earning per share. The decline in 2012 earnings was mainly contributed by decline in crushing margin (High Soybean Price) and Overcapacity in China crushing capacity in Oil Seeds segment. However, part of the decline in contribution from Oil Seed segment was being offset by Sugar Segment as shown in table below and i foresee the oil seeds segment will recover soon once soft commodities price soften.

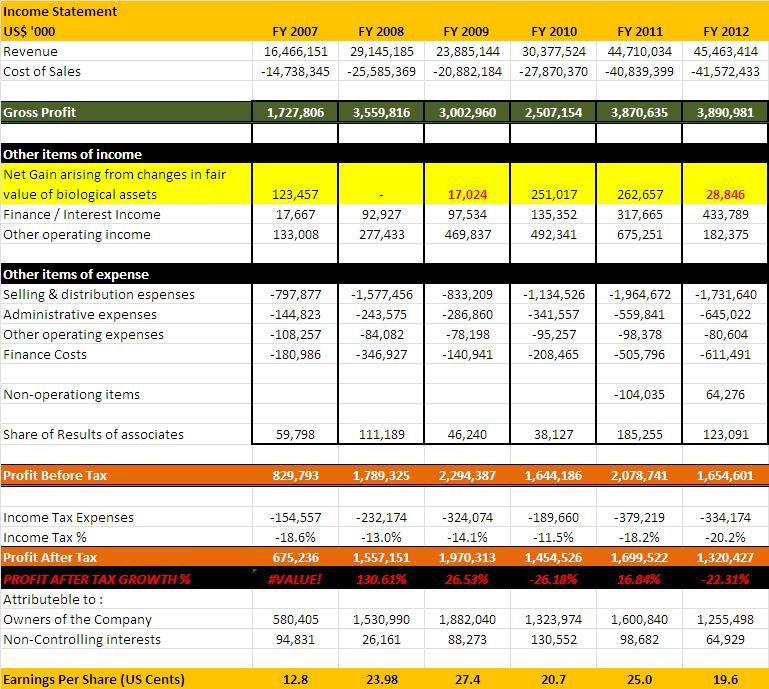

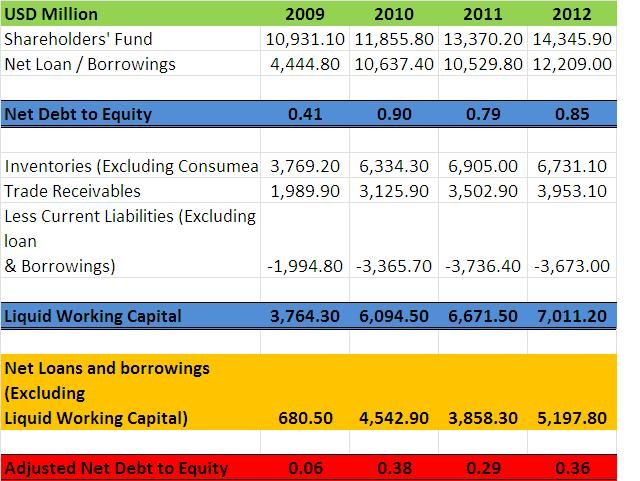

INCOME STATEMENT

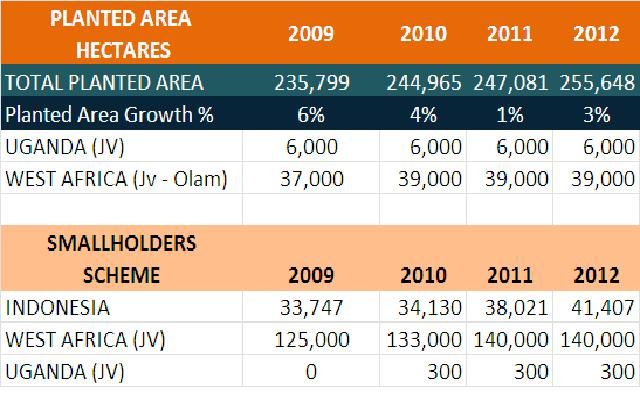

PLANTED AREA GROWTH

This post has been edited by darkknight81: May 29 2013, 08:50 PM

May 12 2013, 05:36 PM, updated 12y ago

May 12 2013, 05:36 PM, updated 12y ago

Quote

Quote

0.0172sec

0.0172sec

1.19

1.19

6 queries

6 queries

GZIP Disabled

GZIP Disabled