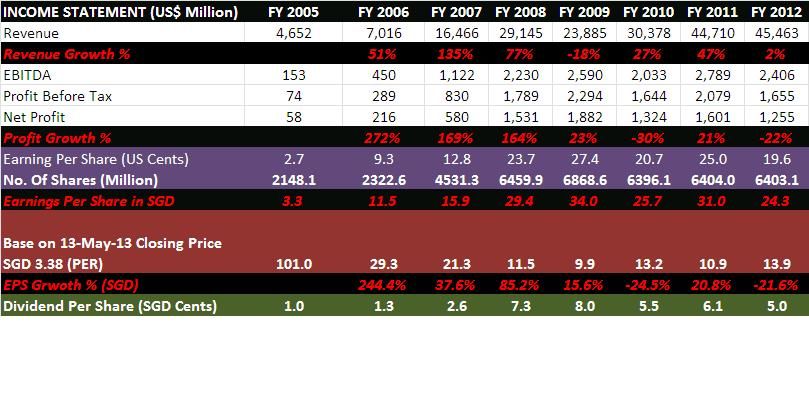

Base on today closing price of SGD 3.38. Per is around 13 which is far more cheaper than any listed Plantation stocks in Bursa.

WILMAR INTERNATIONAL, Sugar, Oil Palm, Consumer Prod, Oil Seed

|

|

May 13 2013, 10:53 PM May 13 2013, 10:53 PM

|

Senior Member

3,944 posts Joined: Jul 2008 |

|

|

|

|

|

|

May 13 2013, 10:54 PM May 13 2013, 10:54 PM

|

Senior Member

3,482 posts Joined: Sep 2007 |

QUOTE(darkknight81 @ May 13 2013, 10:38 PM) Yup agree with you on the focus thing. Besides, i think Golden Agri has more room to growth. I also have Golden Agri bro Golden Agri indeed not bad for growth stocks investing. I read the financial report yesterday ( Thanks to many recommendation from many forumer here However, don't forget the power of Wilmar especially after their oil seed segment start to recover. But compared Golden agri & Wilmar, Wilmar have more business in downstream level, and I do think they are in progress to unlock the value chain. |

|

|

May 13 2013, 11:13 PM May 13 2013, 11:13 PM

|

Senior Member

3,944 posts Joined: Jul 2008 |

QUOTE(foofoosasa @ May 13 2013, 11:54 PM) Golden Agri indeed not bad for growth stocks investing. I read the financial report yesterday ( Thanks to many recommendation from many forumer here Buy both lor. Like me. But compared Golden agri & Wilmar, Wilmar have more business in downstream level, and I do think they are in progress to unlock the value chain. |

|

|

May 13 2013, 11:16 PM May 13 2013, 11:16 PM

|

Senior Member

3,482 posts Joined: Sep 2007 |

|

|

|

May 14 2013, 01:17 PM May 14 2013, 01:17 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

2nd Opinion :-

Kenanga Investment Bank Bhd ------------------------------------------------------------------------------- Plantation Companies: High stockpiles in China and India • Malaysia’s Apr13 palm oil output rose 4% m-o-m to 1.366m MT – or c.4% below our forecast • End Apr13 palm oil inventory dipped by 11% m-o-m to 1.926m MT on lower imports, better exports • CPO price may not recover as fast we had expected; as China and India continue to accumulate stocks • We urge investors to exit low-growth upstream planters. Renewed price pressure seen in 2H13 Output trails expectations. Malaysian palm oil output seasonally recovered by 3% m-o-m to 1.366m MT in Apr13 – 4% below our initial forecast of 1.419m MT. We attribute the slightly lower-than-expected output to the delayed ripening of the fruits. Mar13 rainfall over Peninsular and Sarawak was reportedly below average based on monthly review by Malaysian Meteorological Department (MMD). Apr13 oil yields in Sarawak failed to pick up in line with seasonal trend during the month. Imputing Apr13 number; we now expect May13 output to catch up by 13% m-o-m to 1.542m MT. However, please note that southern Sarawak is still expected to receive 20-40% less rainfall in Apr-May13, according to MMD. Inventory dropped on better exports, lower imports. Palm oil inventory at the end of Apr13 continued to drop by 11% m-o-m to 1.927m MT – or 7% lower than the 2.072m MT we were looking for. Palm oil exports of 1.449m MT (-5% m-o-m) were 13k MT higher than expected, while imports of 45k MT were 76k MT lower than forecast. For the month, higher exports to India and EU-27 were offset by lower exports to China, Iran and Egypt. We expect Malaysia’s May13 palm oil exports to rise 4% m-o-m to 1.508m MT; while ending inventory should further decline to 1.890m MT (vs. previous expectation of 2.017m MT). How high can edible oil consumption go? Despite the encouraging data, the palm oil price may still lack near-term catalyst for significant recovery (as we had previously anticipated in our previous report). On page 3 of this report, we highlight the fact that recent spikes in China and India inventories have not reversed; and we continue to see prospects of higher y-o-y output this year (primarily in 2H13). Hence, the transfer of inventory from producing to consuming countries (thanks to low prices) highlights flattish intake. Consumers’ price elasticity of demand has a limit, in our view. Take opportunity of any share price strength. Pending further data analysis, our CY13F CPO price forecast of RM2,640 now looks aggressive, considering YTD average of RM2,313. In a declining price environment, we recommend investors take cover in diversified or high volume growth/low-cost upstream planters. Our picks for the sector are currently AALI IJ and FR SP. |

|

|

May 14 2013, 01:34 PM May 14 2013, 01:34 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(darkknight81 @ May 13 2013, 11:13 PM) Don't like either.. for me it's First Resources... super prime land in dumai area & east kalimantan. Consistently good FFB yield, OER, with very good tree profile with lots of reserve land to plant. Concentrated plantation is better than widespread ones. This post has been edited by gark: May 14 2013, 01:36 PM |

|

|

|

|

|

May 14 2013, 01:36 PM May 14 2013, 01:36 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(gark @ May 14 2013, 01:34 PM) Don't like either.. for me it's First Resources... super prime land in dumai area. FR SP Consistently good FFB yield, OER, with very good tree profile with lots of reserve land to plant. Concentrated plantation is better than widespread ones. Take opportunity of any share price strength. Pending further data analysis, our CY13F CPO price forecast of RM2,640 now looks aggressive, considering YTD average of RM2,313. In a declining price environment, we recommend investors take cover in diversified or high volume growth/low-cost upstream planters. Our picks for the sector are currently AALI IJ and FR SP. This post has been edited by SKY 1809: May 14 2013, 01:37 PM |

|

|

May 14 2013, 01:42 PM May 14 2013, 01:42 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(SKY 1809 @ May 14 2013, 01:36 PM) FR SP FR FFB yield is 22.2 t/ha & CPO OER is averaging at 23.6% which is one of the industry's highest considering that it's tree profile of average 8 years old is still very young.Take opportunity of any share price strength. Pending further data analysis, our CY13F CPO price forecast of RM2,640 now looks aggressive, considering YTD average of RM2,313. In a declining price environment, we recommend investors take cover in diversified or high volume growth/low-cost upstream planters. Our picks for the sector are currently AALI IJ and FR SP. Current planted is 140k ha, with reserve of 100k ha to be planted for the next 5 years. This post has been edited by gark: May 14 2013, 01:44 PM |

|

|

May 14 2013, 01:44 PM May 14 2013, 01:44 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

May 14 2013, 01:48 PM May 14 2013, 01:48 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(SKY 1809 @ May 14 2013, 01:44 PM) Dividend...2008 - 1.4 cents 2009 - 2.18 cents 2010 - 2.9 cents 2011 - 3.5 cents 2012 - 4 cents Dividend policy minimum 30% earnings... PE is currently high about 13 550 mil borrowing, but holding cash of 329 mil... not too bad. Total asset 2 bil.. conservatively geared. But this one old man stock ha.. hardly got movement. This post has been edited by gark: May 14 2013, 01:52 PM |

|

|

May 14 2013, 01:50 PM May 14 2013, 01:50 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(gark @ May 14 2013, 01:48 PM) Dividend... Wow Nice 2008 - 1.4 cents 2009 - 2.18 cents 2010 - 2.9 cents 2011 - 3.5 cents 2012 - 4 cents PE is currently high about 13 Currently there is a big campaign in China to cut huge wastage in food consumption , ada impact tak Thanks This post has been edited by SKY 1809: May 14 2013, 01:53 PM |

|

|

May 14 2013, 03:03 PM May 14 2013, 03:03 PM

|

Senior Member

3,944 posts Joined: Jul 2008 |

QUOTE(gark @ May 14 2013, 02:34 PM) Don't like either.. for me it's First Resources... super prime land in dumai area & east kalimantan. Not everyone like to eat kfc. Same for investment la bro.Consistently good FFB yield, OER, with very good tree profile with lots of reserve land to plant. Concentrated plantation is better than widespread ones. They have their own strength and weaknesses. I don like pure planter. I prefer those who can plant, process and sell out in consumer pack. To me more sustainable. |

|

|

May 14 2013, 03:08 PM May 14 2013, 03:08 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(darkknight81 @ May 14 2013, 03:03 PM) Not everyone like to eat kfc. Same for investment la bro. Yes, not saying your preference is wrong.. just putting some of my view for benefit of all...They have their own strength and weaknesses. I don like pure planter. I prefer those who can plant, process and sell out in consumer pack. To me more sustainable. Look at this way.. plantation gross margin 40% to 50%, refinery margin 5% to10%, oil seed crushing margin -5% to 5%, consumer packaging margin 10%-15% Anyone can enter refinery, oil seed, packaging within 1-2 years, and the investment cost is low. For plantation, you need 3-5 years growing period. Which business do you prefer? This post has been edited by gark: May 14 2013, 03:10 PM |

|

|

|

|

|

May 14 2013, 03:10 PM May 14 2013, 03:10 PM

|

Senior Member

3,944 posts Joined: Jul 2008 |

te=darkknight81,May 14 2013, 04:03 PM]Not everyone like to eat kfc. Same for investment la bro.

They have their own strength and weaknesses. I don like pure planter. I prefer those who can plant, process and sell out in consumer pack. To me more sustainable. Why wilmar planted area are widely spread in indonesia, Papua, malaysia,africa ETC? I am not expert. But my view is they have different business model. Wilmar have at least few hundred Refinery world wide and their business network are wolrd wide. How can you expect them to plant in one area only. The logistic cost how. Bro, you are comparing chicken with duck le [/quote] This post has been edited by darkknight81: May 14 2013, 03:13 PM |

|

|

May 14 2013, 03:16 PM May 14 2013, 03:16 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(darkknight81 @ May 14 2013, 03:10 PM) Why wilmar planted area are widely spread in indonesia, Yes you can plant widely and still do business... just like all those plantation companies. But estates planted in groups can have big cost savings & higher efficiency. CPO FFA% and PV, AV deteriorates over time if the fruit is far from a mill and long transport time to refineries. Higher quality CPO commands a premium price above the MPOP price. Best quality CPO is currently from Sabah, West Semenanjung and riau/sumatra area. In these areas, less than 1 day fruit from the tress are milled and delivered to refineries.Papua, malaysia,africa ETC? I am not expert. But my view is they have different business model. Wilmar have at least few hundred Refinery world wide and their business network are world wide. How can you expect them to plant in one area only. The logistic cost how. Bro, you are comparing chicken with duck le Do you know wilmar's plantation is only enough to sustain less than 30% of their refineries? They are buying the other 70% from major planters which includes FR under long term contract. Also wilmar consumes 50% of Indonesia CPO but produces only less than 20% of the amount. So who needs who? When I look at wilmar's oil seed crushing margins, it is very similar to fertilizer margins... high revenue/turnover but very very little earnings. Why do you think KLK does not want to go upstream... you can compare KLK to IOI which is heavy in upstream business. This post has been edited by gark: May 14 2013, 03:25 PM |

|

|

May 14 2013, 03:20 PM May 14 2013, 03:20 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

Not everyone like to eat kfc. Same for investment la bro. They have their own strength and weaknesses. I don like pure planter. I prefer those who can plant, process and sell out in consumer pack. To me more sustainable. Why wilmar planted area are widely spread in indonesia, Papua, malaysia,africa ETC? I am not expert. But my view is they have different business model. Wilmar have at least few hundred Refinery world wide and their business network are wolrd wide. How can you expect them to plant in one area only. The logistic cost how. Bro, you are comparing chicken with duck le » Click to show Spoiler - click again to hide... «

|

|

|

May 14 2013, 06:54 PM May 14 2013, 06:54 PM

|

Senior Member

3,944 posts Joined: Jul 2008 |

QUOTE(gark @ May 14 2013, 04:16 PM) Yes you can plant widely and still do business... just like all those plantation companies. But estates planted in groups can have big cost savings & higher efficiency. CPO FFA% and PV, AV deteriorates over time if the fruit is far from a mill and long transport time to refineries. Higher quality CPO commands a premium price above the MPOP price. Best quality CPO is currently from Sabah, West Semenanjung and riau/sumatra area. In these areas, less than 1 day fruit from the tress are milled and delivered to refineries. Doing business we need to look at their business model, market presence, distribution network. Not every also margin.Do you know wilmar's plantation is only enough to sustain less than 30% of their refineries? They are buying the other 70% from major planters which includes FR under long term contract. Also wilmar consumes 50% of Indonesia CPO but produces only less than 20% of the amount. So who needs who? When I look at wilmar's oil seed crushing margins, it is very similar to fertilizer margins... high revenue/turnover but very very little earnings. Why do you think KLK does not want to go upstream... you can compare KLK to IOI which is heavy in upstream business. Do you think tycoon like robert kuok, kuok khoon hong, Wijaja family don't know how to calculate? If wilmar does not have strong distribution network in china do you think kelogg an international brand willing to 50 : 50 joint venture with them? Noble group willing to sell of more than 50% of their plantation arm to wilmar? Do you know how the presence of wilmar in china? Besides, why do you think both golden agri Wijaja family and wilmar kuoks group are Involve in the whole value chain? 1. Easier for them to diversify to other sector. 2, A chinese proverb network = wealth 3. What if one day wilmar palm oil are able to self sustain? Will they renew contract with FR? 4. Wilmar have no concern of cpo oversupply. They can pack into consumer pack. FR have the same advantages? This post has been edited by darkknight81: May 14 2013, 07:03 PM |

|

|

May 14 2013, 09:38 PM May 14 2013, 09:38 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(darkknight81 @ May 14 2013, 06:54 PM) Doing business we need to look at their business model, market presence, distribution network. Not every also margin. Well a diversified bussiness is not necessary a good business. I am familiar with both wilmar indo , kerry group and smart group as i have business relation with them in the past. Sure they are great companies, but over diversification has diluted thier potentials hence becoming a conglomerateDo you think tycoon like robert kuok, kuok khoon hong, Wijaja family don't know how to calculate? If wilmar does not have strong distribution network in china do you think kelogg an international brand willing to 50 : 50 joint venture with them? Noble group willing to sell of more than 50% of their plantation arm to wilmar? Do you know how the presence of wilmar in china? Besides, why do you think both golden agri Wijaja family and wilmar kuoks group are Involve in the whole value chain? 1. Easier for them to diversify to other sector. 2, A chinese proverb network = wealth 3. What if one day wilmar palm oil are able to self sustain? Will they renew contract with FR? 4. Wilmar have no concern of cpo oversupply. They can pack into consumer pack. FR have the same advantages? Wilmar and smart group plantation arm is not able to self sustain as indonesia is fast running out of suitable planting lands. Wilmar bought a stake in kencana agri recently to secure their cpo supply. Smart group pt lonsum has already exausted all thier reserve lands. For the packaged oils, wilmar is selling the sania and arowana brand and smart group filma brand. They only represent like less than 20 pct of thier total refining volume. Most of thier refinery is used for making bulk oil for export, remaining into biodiesel and oleo chem. More often than not the refineries are not able to run at full capacity due to lack of cpo or poor cpo. Recently mewah oil decided to abandon thier half built refinery in indonesia due to not able to secure enough cpo. Did you see fr results annouced evening today? They manage to increase profit 20 % y on y, with low cpo price. This post has been edited by gark: May 14 2013, 09:56 PM |

|

|

May 14 2013, 10:37 PM May 14 2013, 10:37 PM

|

Junior Member

16 posts Joined: May 2013 |

a good counter for long term holding. they going to open a palm-oil refinery in ghana with a investment of around $16 million

|

|

|

May 15 2013, 11:37 AM May 15 2013, 11:37 AM

|

Senior Member

4,305 posts Joined: Sep 2008 |

Yesterday Noble post some bad result, might worth a look...

|

| Change to: |  0.0252sec 0.0252sec

0.56 0.56

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 09:07 PM |