QUOTE(kueyteowlou @ May 10 2013, 04:26 PM)

So easy to sell/buy single digit penny stocks with one bid gain/loss? STOCK MARKET DISCUSSION V130, Bull rally after GE

STOCK MARKET DISCUSSION V130, Bull rally after GE

|

|

May 10 2013, 05:39 PM May 10 2013, 05:39 PM

Return to original view | Post

#61

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

May 10 2013, 06:40 PM May 10 2013, 06:40 PM

Return to original view | Post

#62

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(yhtan @ May 10 2013, 06:11 PM) They did show the overall return, 500%++ since year 2001 if I'm not mistaken Got meh?I think you have to be careful. They do a lot of adjustments, like deducting dividends from their cost, making that individual stock percentage gain look good. Last time, I follow reading their portfolio 'management'. After a short while, I gave up. I did not like their way of buying/selling stocks. I was also puzzled with how some individual stock cost suddenly went down. It took me a while to figure out they did the deducting dividend from their stock cost trick. *side track* I know a lot of 'investors' like to follow such portfolios. When Insider Asia showed BIG individual stock gains (with the dividend deducted from the stock cost), it attracted a lot of people. I know of many who followed Insider Asia buying of stocks because Insider Asia stock portfolio showed big percentage gains. |

|

|

May 10 2013, 06:42 PM May 10 2013, 06:42 PM

Return to original view | Post

#63

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(gloryyan @ May 10 2013, 06:06 PM) This is one of the methods used by many investors worldwide. It clearly defines the real profits/loss of a counter without much fuss. Anyway, dividend is also a profit shared by the company with the investor Yes, I have to agree it's easy to see the real profit/loss of a counter without much fuss.The downside is most investors likes to focus on percentage gain/loss. With this method, the percentage is skewed to look much better than actual. |

|

|

May 11 2013, 09:16 AM May 11 2013, 09:16 AM

Return to original view | Post

#64

|

All Stars

15,942 posts Joined: Jun 2008 |

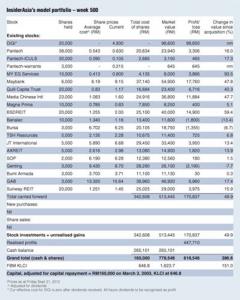

QUOTE(yhtan @ May 10 2013, 08:45 PM) The dividend received will knock off against the cost, hence the cost will be lower. Cash level will increase. Ah Tan ah... By this way it will show the overall performance Ignore the individual stock return, some of it hold for quite long time and it doesn't reflect the true return My one issue was highlighting the precentage gain of a stock using deducting dividends from stock cost method. I say it is wrong and it is not accurate. It is misleading and it is boosting one own's ego. Example... (

This portfolio is Insider Asia portfolio - week 500. I use MyEG as an example because it is simple and clean. Insider Asia purchase of MyEG is stated on week 345. Link: 345 Purchase price is 44.5 sen. Total dividends received from MyEG is 3.15 sen. Using DEDUCTING DIVIDENDS FROM SHARE COST, new cost per share should be 0.445 - 0.032 = 0.4135 Total adjusted cost of investment becomes 4135.00. Price of MyEG at week 500 = 80 sen. For easy reference, say we sell MyEG at 80 sen. Price of shares sold is 8000.00, total dividends received is 315.00. Cost of shares is 4450.00. What is your profit and your margin? Using my lousy method of NOT deducting dividends. Profit = (8000 - 4450) + 315 = 3865.00 Percentage gain = 3865 / 4450 = 86.85% Do you agree? Look at InsiderAsia portfolio again. What is the percentage stated? 93.5% They get that by.. Gain = 8000 - 4135 = 3865. (which is the same) Percentage gain = 3865 / 4135 = 93.47% or 93.5% rounded. What's the difference? The denominator used in counting is changed from 4450 to 4135. This increased the percentage. Which makes the individual stock return looks much better!!!! Is this correct? I say it is wrong. We can say we use different ways to count BUT the end result should be same. The end result or the PERCENTAGE GAIN should be the same. Is percentage gain important? Answer is yes. Look at InsiderAsia. It is so important for them that they purposely have one last column to show the CHANGE IN VALUE SINCE ACQUISITION (%). Anyone reads a portfolio, what do they look for? Percentage gain. You ask someone, what do you ask? What's your percentage gain for your portfolio? (I understand this is not the TRUE value because we need to take time factor and other factors into consideration but for simplicity sake, everyone just use percentage gain.) Refer back at InsiderAsia. By having that CHANGE IN VALUE SINCE ACQUISITION (%) in their table, I find their portfolio table VERY MISLEADING because of how they deduct these dividend gains from their stock cost. It increases the individual stock gain percentage and ends up misleading readers. |

|

|

May 11 2013, 02:38 PM May 11 2013, 02:38 PM

Return to original view | Post

#65

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Larrylow @ May 11 2013, 11:36 AM) For your information, every asset management/ mutual fund company is using the dividend deduction method, cause dividend = money. Yes dividend is money. I never said it wasn't. If you go through what I had written, I have clearly added back the dividends received as my gain.My issue is on the percentage gain. Question is why the difference in percentage gain then? Look at InsiderAsia portfolio and look at MyEg. InsiderAsia states it's carrying a 93.5% gain. Without deduction the dividends from the cost, the percentage gain is much lesser at 86.85%. |

|

|

May 12 2013, 10:35 AM May 12 2013, 10:35 AM

Return to original view | Post

#66

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Larrylow @ May 11 2013, 11:36 AM) For your information, every asset management/ mutual fund company is using the dividend deduction method, cause dividend = money. Many seem to misunderstand the simple message I am saying.For those, saying dividend deduction is correct, do look at the end result shown by a reputable group like InsiderAsia. We need to understand what's happening before we give judgement. REMEMBER: MY ISSUE FROM DAY ONE IS THE PERCENTAGE GAIN.  Look at line 5, MyEG. It states the CHANGE IN VALUE SINCE ACQUISITION (%) is 93.5%. InsiderAsia uses deduction dividends from cost method. Purchase price is 44.5 sen. Total dividends received from MyEG is 3.15 sen. Price then for MyEg was 80 sen. Question is the percentage gain since acquisition (93.5%) correct? ( Another question, if it is wrong why is InsiderAsia highlighting this % ? ) Working.. New cost after deducting dividends = 4450 - 315 = 4135 Share then was 80 sen. Gain = 8000 - 4135 = 3865. ( Gain total is same. Doesn't make a difference if you add back dividends or minus dividends from cost) BUT look at percentage gain now. Percentage gain according to InsiderAsia = 3865 / 4135 = 93.5%. Is that correct? My answer is no. See carefully. If you divide the gain with the deducted cost, the percentage gain will be increase. Simple maths. You are dividing with a smaller number. The correct answer should be 86.85%. WHY? You started with 4450. You collected dividends of 315. You sell at 80 sen. Your gain is 3865. You started with 4450. You gain 3865. What is the percentage gain? Percentage gain is 3865 / 4450 = 86.85%. THIS IS MY ISSUE with deducting cost from dividends. After deducting the cost, the percentage gain as shown by InsiderAsia increases! Is this correct? One cannot say there is different ways to count things and because it's different it is acceptable. Different methods is acceptable ONLY if the end result is the same. If deducting cost from dividends cannot produce a simple % gain correctly, what good is the method? Lastly... When you deduct cost from dividends, your cost will be zero. Sounds acceptable and nice of course but we are talking about simple portfolio accounting here. When the cost becomes zero, how will you account the next dividend? Are you going to have a negative number for the adjusted cost of shares? |

|

|

|

|

|

May 12 2013, 11:18 AM May 12 2013, 11:18 AM

Return to original view | Post

#67

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(foofoosasa @ May 12 2013, 11:10 AM) Take it easy dude, I m sure everyone understand what are you trying to deliver the message here. Thanks, for sure I am easy. Are you? The other message that many might not see is, 'just because so-so does it, we should follow'.... Sometimes it is good to find more ourselves. Another question. If InsiderAsia knows this % gain is flawed, why is it using it? Why is it using something that makes the percentage gain looks more? Portfolio management/accounting should be important for the many 'investors' here. Knowing simple % gain, should be important gua. I am just a trader. What's important for me is, I start out with how much, end of the day how much I have and if I have any dividends, I will add back as my gains. Simple. |

|

|

May 12 2013, 03:59 PM May 12 2013, 03:59 PM

Return to original view | Post

#68

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(kueyteowlou @ May 12 2013, 03:13 PM) ur stock all ahpek one wor .. trader must trade those penny penny counter ! fast in fast out mah... what to trade next week?? any tips can do intraday? I am not smart enough to do intraday trading ma. You know this long ago... AhPek Trader.... Macha, ahpek trader sounds macam terror geng jor!! Where is the LIKE button? |

|

|

May 12 2013, 04:11 PM May 12 2013, 04:11 PM

Return to original view | Post

#69

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(kueyteowlou @ May 12 2013, 04:06 PM) joking joking .. The trend should be like this Bluechip.... Second liner... and penny... so.. next week might be Penny days coming... after that... the market will be cooldown abit... hopefully u did get something that I mentioned that day... I hope you know I am also joking wif you (most of the time.. Hands full for now... Just riding no adding new positions. Best of luck next week. |

|

|

May 13 2013, 03:20 PM May 13 2013, 03:20 PM

Return to original view | Post

#70

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(simplesmile @ May 12 2013, 11:27 PM) I had never liked the way InsiderAsia deduct the dividend from the cost. Yay!It messes up alot of types of calculation and analysis. Example assume Cost RM1.00, and annual dividend of RM0.10. First year the Dividend Yield is 10%. If this is deducted from cost, then the DY in second year becomes 11%, DY in third year becomes 12.5% and so on. Yield increase even though the dividend amount stay the same? This doesn't make sense. The only time to deduct the receipt from the cost is when the receipt is a capital repayment. » Click to show Spoiler - click again to hide... « At least someone understand what I am trying to say, unlike some who purposely made this into personal issue. If we think about it, why are these so-called pros using a calculation method that clearly boosts up their gains? My answer is these so-called pros want to look more good. And there are benefits for them to look good. |

|

|

May 13 2013, 03:37 PM May 13 2013, 03:37 PM

Return to original view | Post

#71

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(gark @ May 13 2013, 03:24 PM) I am busy selling... others busy buying.... Too much, too fast, too euphoric... Busy selling? Me still riding... something wrong with me? |

|

|

May 13 2013, 05:37 PM May 13 2013, 05:37 PM

Return to original view | Post

#72

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(gark @ May 13 2013, 05:01 PM) I don't know about you, but when prices of stock rise up like crazy with no catalyst, it scares me .. so sell sell sell. I think slightly different. But sell slowly, not all 1 shot. Go up sell some, go up again sell some..until finish If it goes down like a rock then only i will buy. Another one approaching my sell list after divvy is 2054... go up like rocket... since CIMB gave a glowing review I listened and this is what's the market telling me.... ( you can actually see this being reflected in this forum too... sure kena flying daggers one. A lot.. a lot of money... funds.... stayed out of the market because the GE factor. Some sold all... some reduced holdings.... Now that GE is over (could there be another twist.. Sit on the sidelines... eat what? Hence, they have to BUY. Listen to the market after GE. You, yourself, spotted one trend. Well done. Low PE.. just whack! LOL! What we have now is... quite a well rounded rally. It's not just one or two sectors. It's not just GLC linked stocks. Construction stocks... they were laggard ... deservedly so... but after GE... they are building a good base run up. Stocks like TDM.. it should still have much room to move. Look at Iskandar stocks. The stocks not only recover but looks like going to move on a much higher plane. Overall, my listening tells me... it's a well rounded rally...and you need big money play for this to happen and my guess we are seeing the UT money getting into action. This is why... I feel sitting still is the best action (oh - unless you think you have discover a new stock with much potential) Sitting still is one big skill. We wait to buy. We wait to sell. Be patient. There's much gains to be made ..... |

|

|

May 13 2013, 05:54 PM May 13 2013, 05:54 PM

Return to original view | Post

#73

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(gark @ May 13 2013, 05:46 PM) Yes there is much money to be made now, i sat still for 1 week, and the 1 week gains is almost equal my total last year's gain... LOL. There is a lot of hot money out there..ie money with no place to go. Hence the total rally of the stock market. But however hot the money, they will eventually run out of places to put it. One day someone will scratch their head, and say wait a minute, what the heck i am buying with such high valuations? First it is the Index stocks, next the GLC and crony stocks, when those went up too high they are switching to mid PE middle cap stocks. Middle cap stocks rally is not over but it is slowing down. Now the trend has shifted to low PE high Divvy stocks.. mostly in small caps. Wonder how long it will last. Next they will have no more places to go... Then..... whatever goes up must .... You sounding like an AhPek Trader jor (phrase thanks to Chef kueyteowlou ) LOL! Sure not a trader also? Hehe. Yes the gains is incredible. My saliva flooding out everytime I look into my..... All the best in gaining more. |

|

|

|

|

|

May 14 2013, 08:29 AM May 14 2013, 08:29 AM

Return to original view | Post

#74

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(gark @ May 13 2013, 05:46 PM) » Click to show Spoiler - click again to hide... « Steel stock could be in favour. Southern Steel kicked if off end of last month when it recorded a good turnaround. CSC Steel is following up with a solid turnaround too. » Click to show Spoiler - click again to hide... « |

|

|

May 14 2013, 03:19 PM May 14 2013, 03:19 PM

Return to original view | Post

#75

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(gark @ May 14 2013, 10:42 AM) Question is ... will it be temporary or long term correction? That's the thing isn't it?If we keep selling on every spike up, how is one going to win big? The older books written about that Jess Livermore had one important teaching. The big money is always in the sitting. Guess what investors did years later? They introduced the buy and hold method. Exactly a year ago, IBhd was trading at 75 sen. IBhd is not plunging as I write. LOL! But before it started falling, IBHD closed yesterday at 3.04. Sit patiently... if you sure you made a good choice with your stock pick. Hahaha! Kinda funny now. We now have a trader here telling not to simply buy/sell/buy..... |

|

|

May 14 2013, 03:34 PM May 14 2013, 03:34 PM

Return to original view | Post

#76

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(gark @ May 14 2013, 03:29 PM) So..... you keep how many years already? It's not the number of years that matters, it really depends on the stock for me. But to answer your question more precisely, the longest recent one was close to 1 1/2 years I think. |

|

|

May 14 2013, 03:40 PM May 14 2013, 03:40 PM

Return to original view | Post

#77

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(gark @ May 14 2013, 03:35 PM) Not bad.. i thought you pure trader... the longest one i still keep is 3 years ago.. but that one is in cold storage. Sometimes how the stock moves and how the news flow/earnings flow do help/encourage me to sit still. I think it is so important to understand ourselves first before we play the stock market. In the long run, market will not be kind to those that are arrogant. Is like fighting a war. An inpatient and arrogant general can win many small battles but when it comes to the battle that matters the most, they will end up be beaten by the patient and wise general. |

|

|

May 15 2013, 08:38 AM May 15 2013, 08:38 AM

Return to original view | Post

#78

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(kueyteowlou @ May 14 2013, 05:02 PM) our market need hero like him ! and there I was thinking... our market only need heroes like Chef Kuey! Looks like someone is going to have another good week. |

|

|

May 15 2013, 09:45 AM May 15 2013, 09:45 AM

Return to original view | Post

#79

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

May 15 2013, 09:50 AM May 15 2013, 09:50 AM

Return to original view | Post

#80

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0438sec 0.0438sec

0.74 0.74

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 10:23 AM |