QUOTE(Madgeniusfigo @ Apr 27 2016, 12:16 PM)

Dude,

You have some issues.

and You are very EPIC...to say the least, legendary....

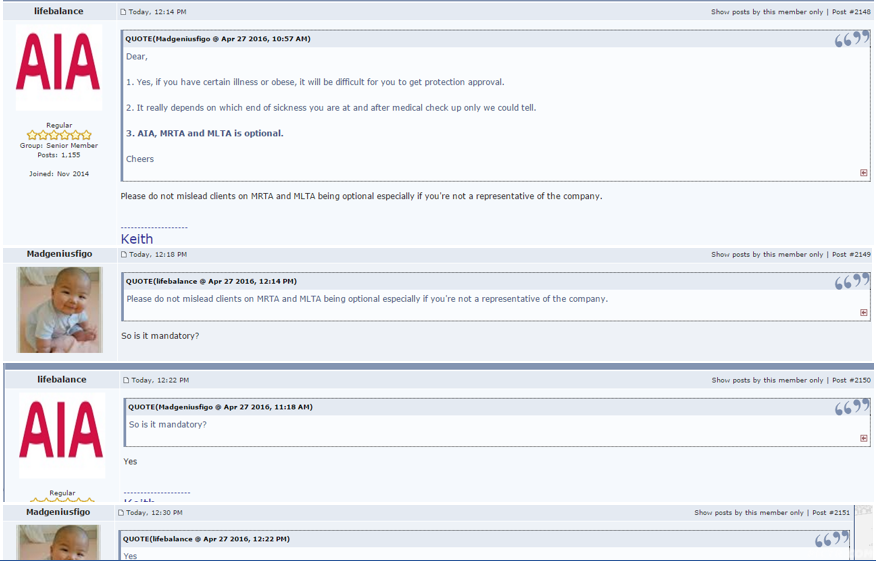

1. I give my advise to a netizen to his question that MRTA and MLTA is optionable. Whereby doesn't involve you in it.

2. You step in and argue that AIA MRTA is mandatory (Which is wrong)

3. I told you it's not and you insisted that MRTA is mandatory if apply AIA loan.

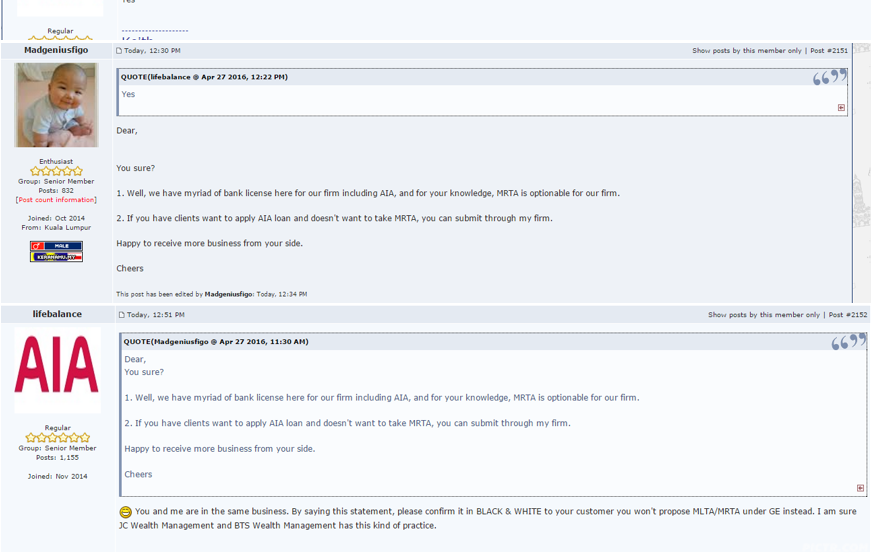

4. I offer you a solution to apply AIA loan without MRTA mandatory through my firm if you needed to, because from my side, AIA loan doesn't need to packaged with MRTA.

5. Did I tell you not to sell MRTA or MLTA to your client? Or you couldn't read simple english?

6. Dude... you really need to stop your tantrum... I'm laughing hard....

Gosh..

x

Kindly call back ur principle who gave you the AIA license whether it's mandatory or not. That's between you and them. As far as I know it's mandatory and clearly stated in all AIA LO unless you have proof to show me it doesn't exist at all.

Showing tantrum ? Who is ? Your assumption ?

As per your point 2, 3 and 4 is really baseless unless proven.

Don't need to beat behind the bush and wayang la.

Apr 14 2016, 06:11 PM

Apr 14 2016, 06:11 PM

Quote

Quote

0.1238sec

0.1238sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled