QUOTE(maximushiglander @ Nov 4 2016, 12:15 PM)

want to buy another house underconstruction for RM235,000

want to enquiry financing 90%

Saving at current account : RM42,000

Saving at ASB now : RM60,000

Amount paid income tax : RM5,000

Net income declared to LHDN : RM70,000

Housing Loan : RM273,867/RM280808 (RM1381 installment)

Shop lot : RM322,968/RM352,000 (RM2246 installment

Credit card 1 since 2015 : 38569/58400

Credit card 2 since 2014: 0/15000

Credit Card 3 since 2012 : 0/10000

Personal Loan 1 : 15,497/30000 (installment RM763)

Personal Loan 2 : 15,124/22000 (installment RM550)

Car Loan : RM26,972/RM65,000 (RM888 permonth)

Rental income House : (rental) RM1400/RM1381 (installment)

Rental income shoplot : RM1800/RM2246

so can i get 90% for all of commitment vs income that i have right now?QUOTE(maximushiglander @ Nov 4 2016, 01:53 PM)

oh really? Erm...

although i've rental income for that both property?

QUOTE(maximushiglander @ Nov 4 2016, 02:00 PM)

based on Credit card 1 since 2015 : 38569/58400

how much i need to paid to lower down that CC outstanding

Dear

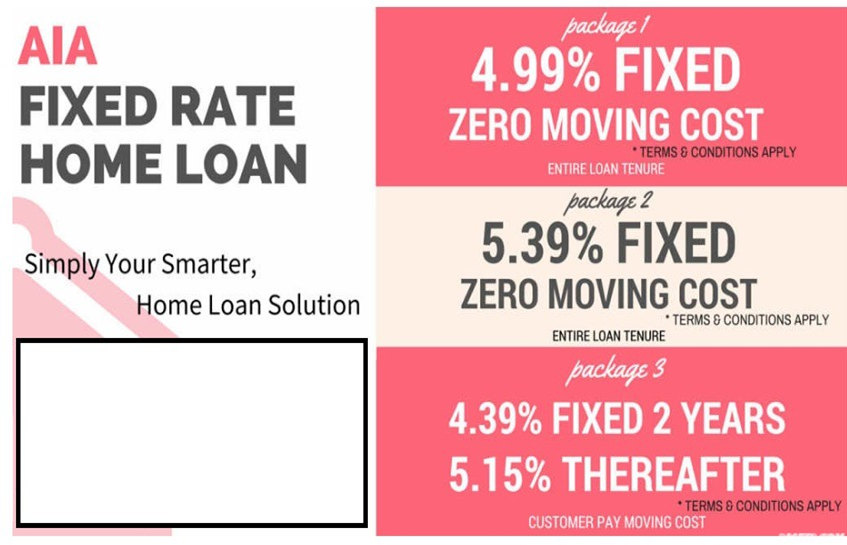

1. Only OCBC can try but chances are low, other bank DSR burst! Moreover, do provide actual offer letter of the loan, to reduce the debt calculation by the bank. It will increase chances for your max loan. However, OCBC has been very strict lately i doubt the chance.

2. If you able to reduce the credit card O/S, settle atleast RM20K of the debt amount would be best. Or best scenario, settle the whole amount, then every bank would be able to finance you the loan.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

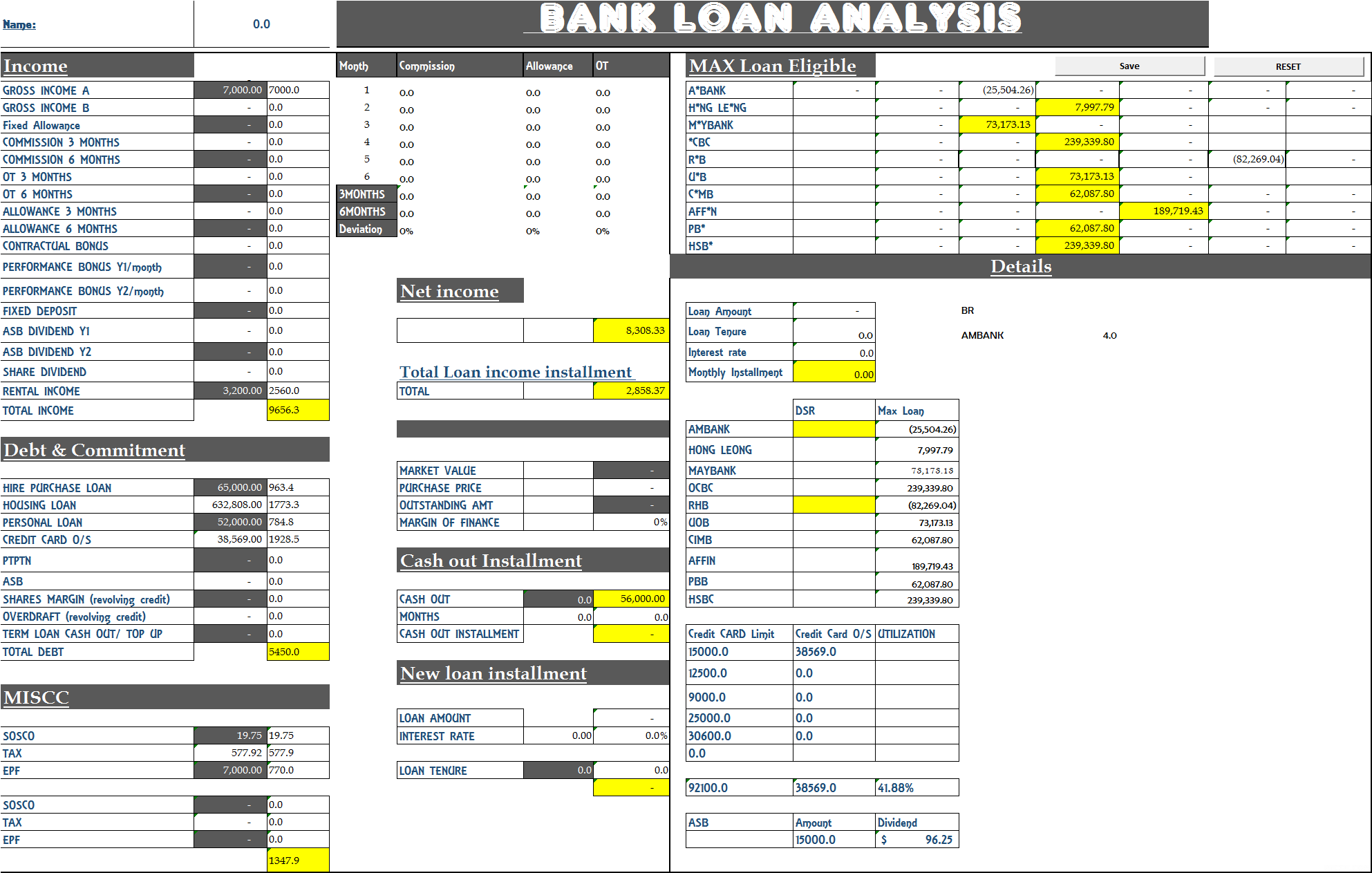

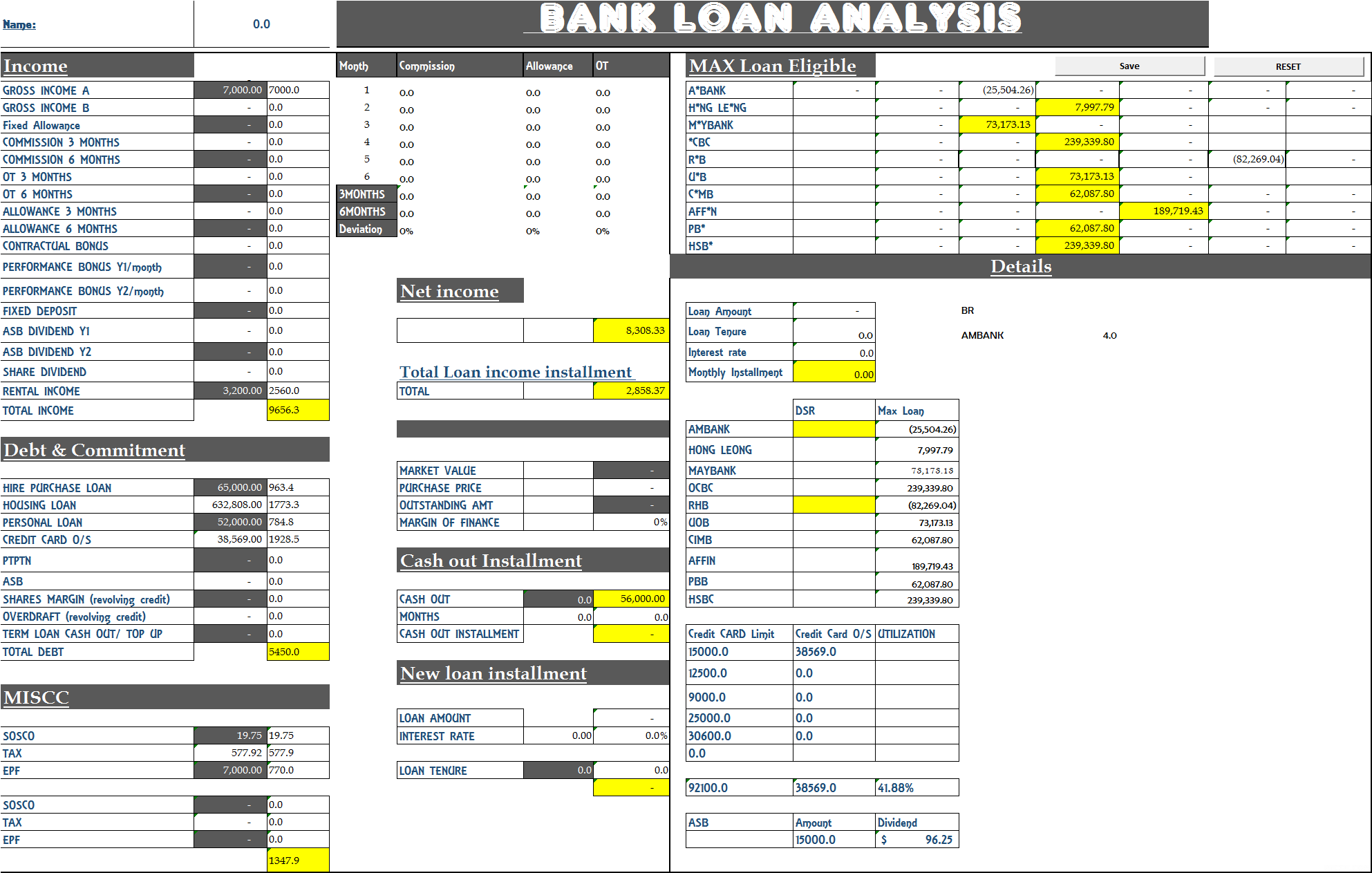

1. Based on the details given by you, Your max loan eligibility for each bank is as follow:

Rm

A*BANK -

H*NG LE*NG 7,997.79

M*YBANK 73,173.13

*CBC 239,339.80

R*B (82,269.04)

U*B 73,173.13

C*MB 62,087.80

AFF*N 189,719.43

2. Each bank has it's own ball game

Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence,

I would need to do a due diligence on your profile before suggesting the best bank to proceed with."

3. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance.

If everything goes fine, 90% shouldn't be a problem for you."

4. If you need my help, do feel free to contact me. I will be all ears in guiding you towards this rough path.

5. I have wrote some articles that help guide first time home buyer to get housing loan, feel free to read it at below link:

5 Tips for employee to prepare for loan application Few easy tweaks for self employed and freelancer to ensure loan approved

Cheers

Oct 27 2016, 03:05 PM

Oct 27 2016, 03:05 PM

Quote

Quote

0.1244sec

0.1244sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled