QUOTE(tiongkeat @ Sep 19 2016, 04:35 PM)

Dear1. May I know who did you asked?

2. From my side, maybank reno loan still active, just that not easy to get this loan approved.

Cheers

Mortgage Loan Package Inquiries v2, Loan agents pls read the 1st post!

|

|

Sep 19 2016, 03:42 PM Sep 19 2016, 03:42 PM

Return to original view | Post

#281

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

|

|

|

|

|

|

Sep 22 2016, 03:04 PM Sep 22 2016, 03:04 PM

Return to original view | Post

#282

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(axisresidence17 @ Sep 22 2016, 03:36 PM) Hi, I want to sell my flat and Im wondering the highest valuation it can get. Im seeing other ads putting between 160k to 200k asking price. Pm me for the details of the flat. Dear1. To get an actual valuation from the bank, you need to check with bank panel valuers Do provide me with below details, so that I can check your current market housing value -Property full address - Property type - Square feet built up landsize -What kind of renovation done and how much it costs? 2. To see whether your loan can be approved, or what's the rate you will get or what's your max loan amount. Do fill in below templates. So that I can assess. 1.Borrower a.age b. No. of borrowers c. no. of housing loan 2. Income (borrower) a. Gross salary A: B: b.Variable income for business (6months latest) "1. 2. 3. 4. 5. 6." c. OT d. Fixed allowance e. Variable Allowance (6months latest) "1. 2. 3. 4. 5. 6." f. Bonus contractual (1 year bonus amount) g. Bonus performance (2 years bonus amount) h. Comission (6 months, each month amount from the earliest) "1. 2. 3. 4. 5. 6." 3. Supporting income (borrower) -Tenancy agreement rental (6months) "1. 2. 3. 4. 5. 6." i. ASB ( 2 years total DIV) j. Shares dividend k. Fixed deposit 4. Debt / commitment (borrower) "joint or indiv" a. Hire purchase loan b. Housing loan c. Personal loan d. PTPTN e. Credit card (Outstanding/usage) (Every card credit limit and outstanding) f. ASB loan g. Overdraft 4. Background (borrower) a. Occupation b. age c. currently staying at? 5. Property a. purchase price b. subsales or underconstruction c. freehold or leasehold d. 1 borrower or joint borrower e. Strata title or master title Cheers |

|

|

Sep 24 2016, 07:30 PM Sep 24 2016, 07:30 PM

Return to original view | Post

#283

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(Altis TM @ Sep 24 2016, 02:19 PM) Hi all sifu, Dear, I've just heard about AFFIN bank offer a package which under Islamic loan with MM basis. The package cover all losses when the project is abandon, even including the Dow payment. And also the ceiling rate is set on 10%. Is this useable ? Need all sifu advice. Tq You are right. Affin Islamic loan package right now is musyarakah mustanaqisah. -No lock in period -ceiling rate -syariah compliance -abandoned project, bank will return all the progressive interest payment while installment dont need to pay. The project must be affin bank paneled. 2. Make sure read the terms definition of how affin bank defines the project considered abandoned, in their letter offer. Other than that, if the interest rate is competitive, it's a good catch. Cheers |

|

|

Sep 25 2016, 05:44 AM Sep 25 2016, 05:44 AM

Return to original view | Post

#284

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

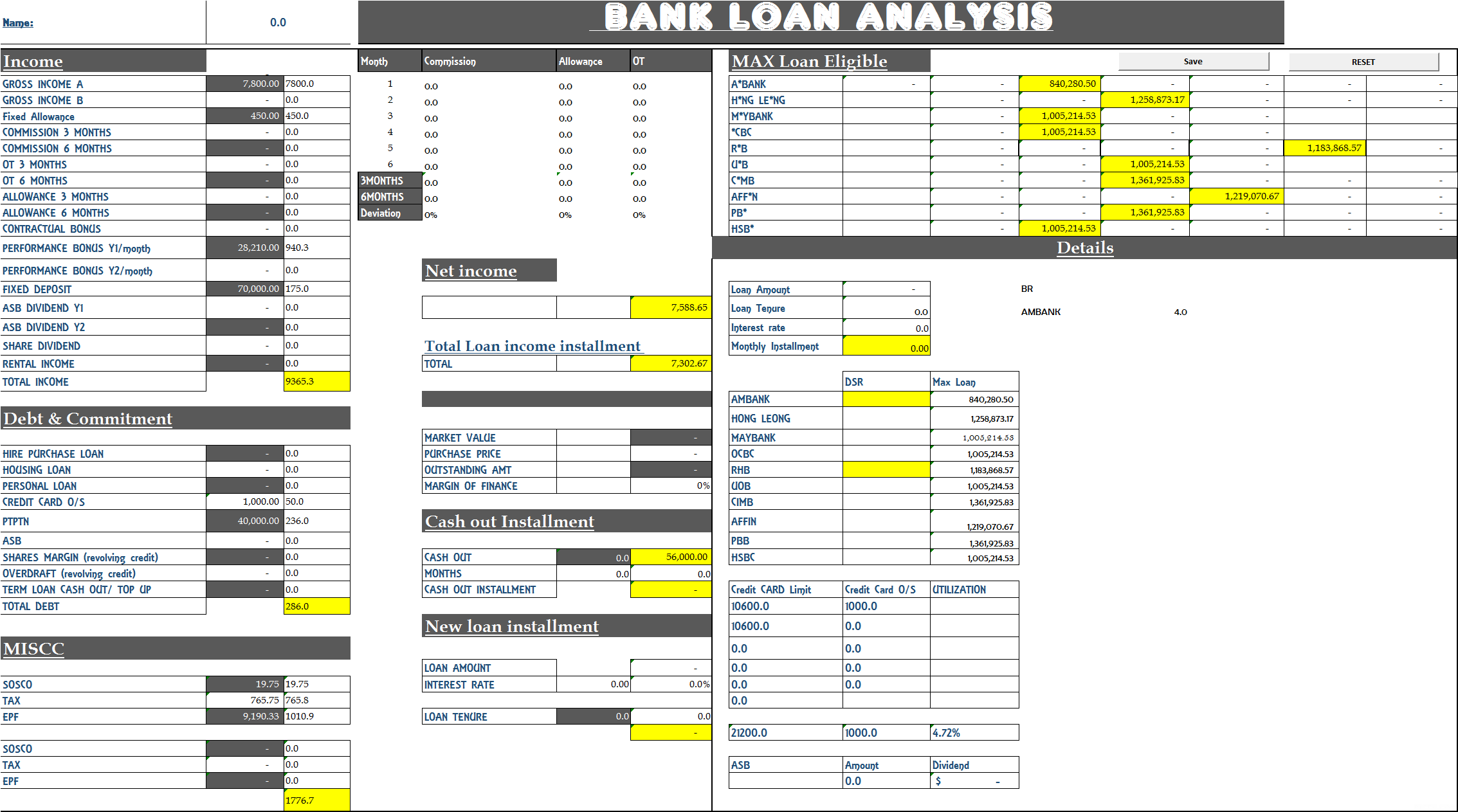

QUOTE(rdv8 @ Sep 24 2016, 09:27 PM) Hi sifu.. What is the loan sum im looking at based on the profile below:- 1 borrower, age 31, Current Gross pay RM7800, Current Nett pay RM6314 Bonus : 2015 - RM28210 (abt 4.55months based on previous salary of RM6200) Entertainment allowance (reimbursement basis) - 400 per month Mobile phone allowance -50 permonth FD - 70k Commitment - credit card minimum payment 1000. ptptn 265.35 QUOTE(rdv8 @ Sep 24 2016, 10:20 PM) Trying to get 1 15m. Any advice? Any bank takes into account fixed allowances on reimbursement basis? Which bank can give highest loan? Thanks. Dear-Does your payslips shows RM400 stating reimbursement? -Bonus is contractual or performance bonus? - What's your 2014 bonus amount? 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK 840,280.50 H*NG LE*NG 1,258,873.17 M*YBANK 1,005,214.53 *CBC 1,005,214.53 R*B 1,183,868.57 U*B 1,005,214.53 C*MB 1,361,925.83 AFF*N 1,219,070.67 2. The best bank to get the highest loan would be HLBB and cimb. However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." 3. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 4. If you need any assistance in this, just inform me Cheers  |

|

|

Sep 29 2016, 05:17 PM Sep 29 2016, 05:17 PM

Return to original view | Post

#285

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

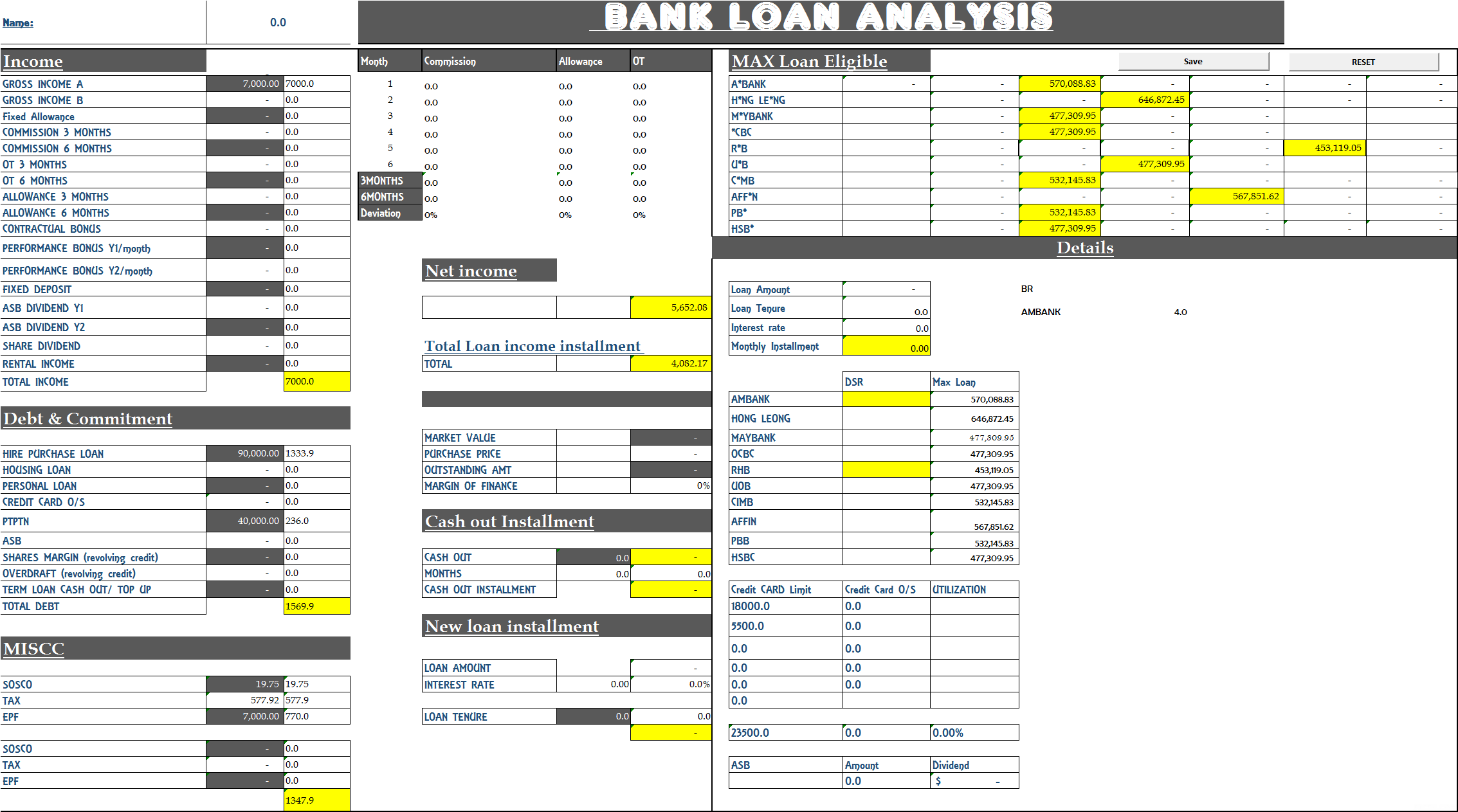

QUOTE(jasontung @ Sep 26 2016, 10:44 PM) DearJust based on this brief details: 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK 570,088.83 H*NG LE*NG 646,872.45 M*YBANK 477,309.95 *CBC 477,309.95 R*B 453,119.05 U*B 477,309.95 C*MB 532,145.83 AFF*N 567,851.62  2. The best bank to get the highest loan would be HLBB. However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." 3. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." QUOTE(blu.sockz @ Sep 29 2016, 03:47 PM) hi sifu, need some advice on max loan possible with below detail; Deargross - 7800 car loan - 1000 housing loan - 1800 credit card - few cards with inconsistent amount hundreds to thousands), but fully paid monthly. Will this contribute to credit score in a positive or negative way? Can you breakdown on Debt 1. Car loan initial borrowing amount 2. housing loan initial borrowing amount 3. Credit card Credit card outstanding / Credit card limit a b c d Cheers |

|

|

Oct 1 2016, 06:02 PM Oct 1 2016, 06:02 PM

Return to original view | IPv6 | Post

#286

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

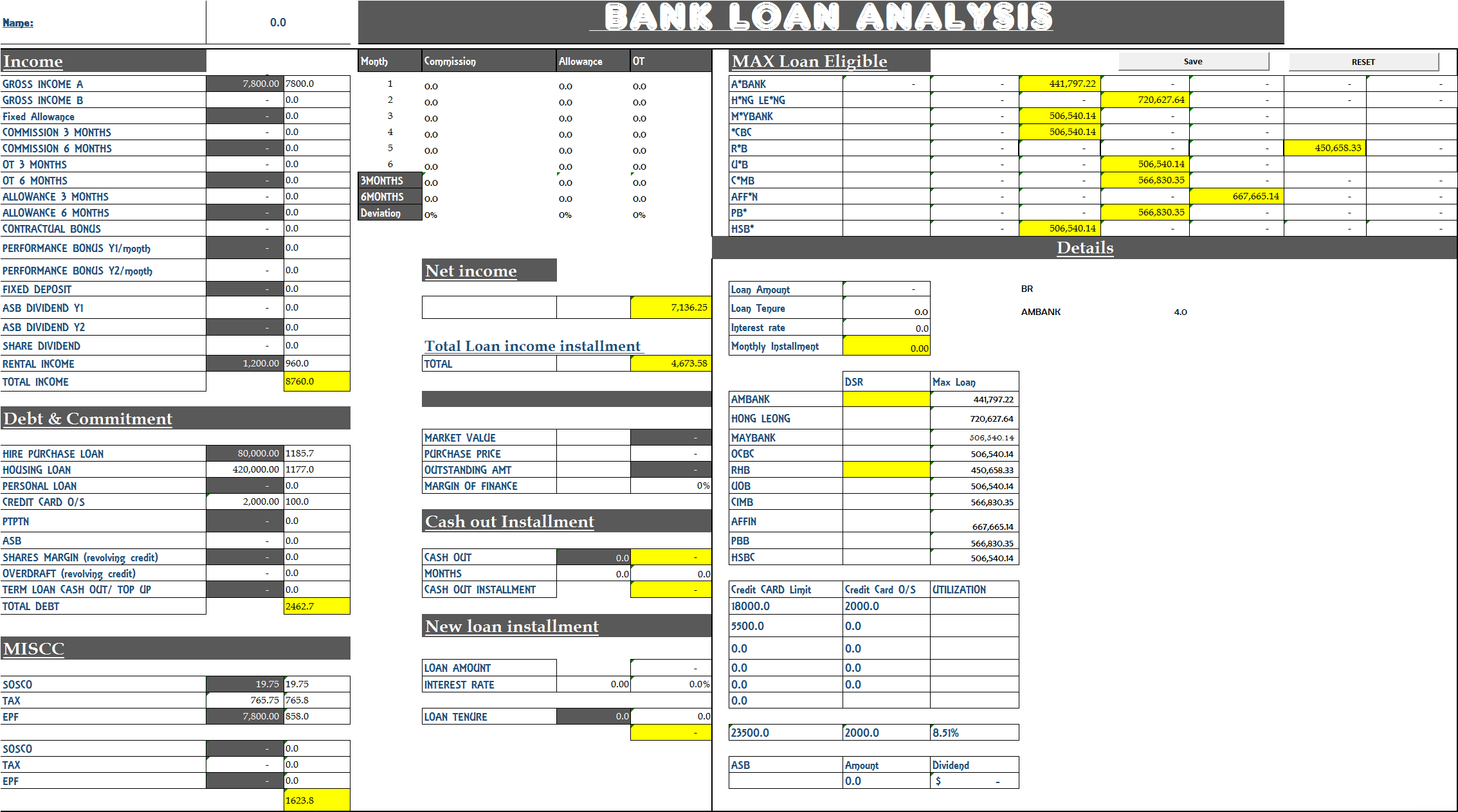

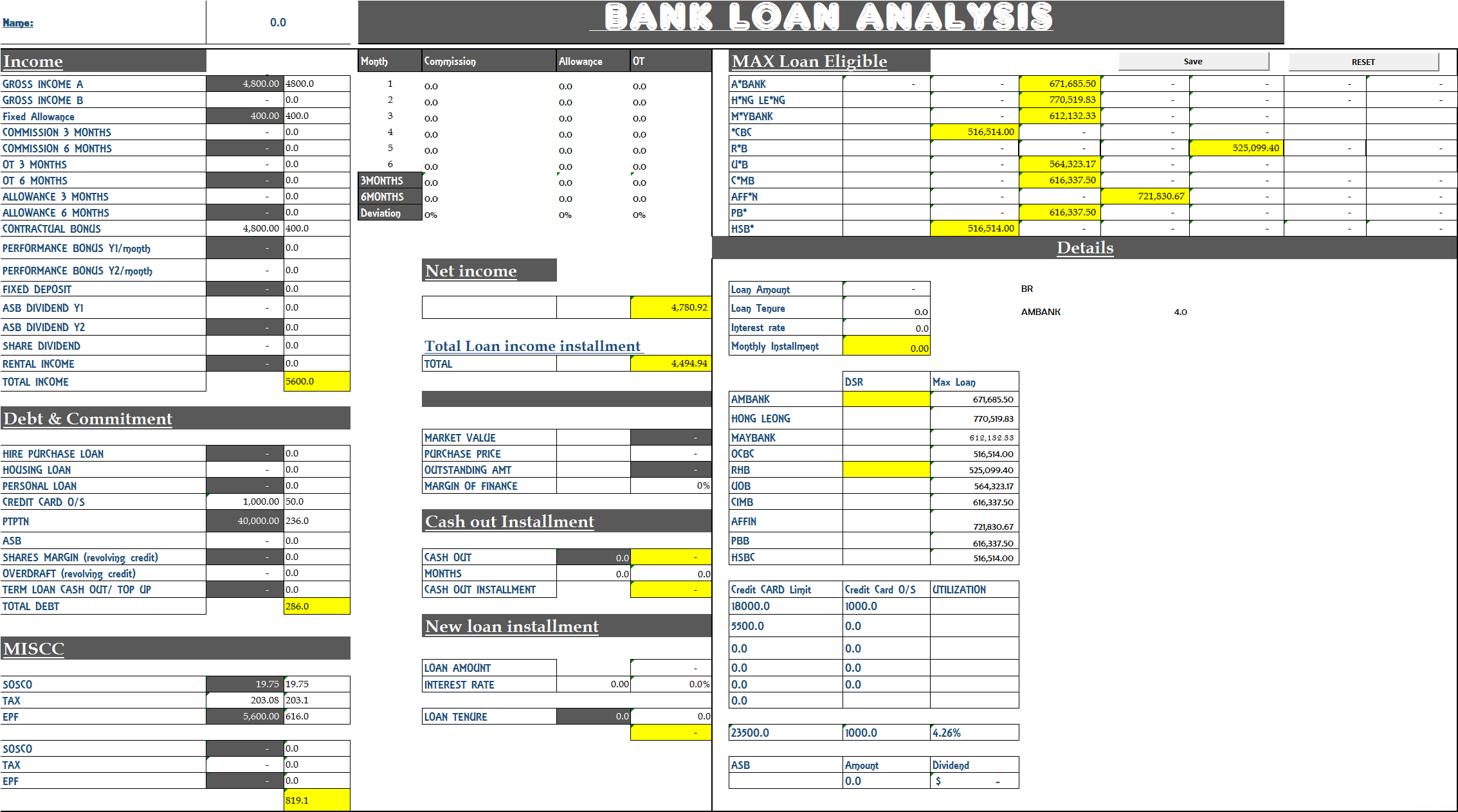

QUOTE(blu.sockz @ Sep 30 2016, 03:42 PM) Age - 33 DearGross pay - 7800 Nett pay - 6200 Rental income - 1200 Asb - 0 Bonus - 1 month contractual bonus Commitment House - 1800 Car - 1000 Personal loan - 0 Credit card outstanding - <2k, but cleared before due date Ptptn - 0 thanks 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK 441,797.22 H*NG LE*NG 720,627.64 M*YBANK 506,540.14 *CBC 506,540.14 R*B 450,658.33 U*B 506,540.14 C*MB 566,830.35 AFF*N 667,665.14 2. The best bank to get the highest loan would be HLBB and. However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." 3. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 4. If you need my help, do feel free to contact me. I will be all ears in guiding you towards this rough path.  Cheers QUOTE(usermode @ Oct 1 2016, 02:40 PM) Hello, DearI want to make Home Loan to buy a sub-sale in Cyberjaya with price of 160K. - Looking for 30 years commitment. - Employed | Avg: 3,000/mth | 33yrs old I'm a first time home-buyer. Plan to buy for my own stay (come on, a 33yrs old guy dun have house? loser oh!) and for that, I might need help with certain areas as well as: - bank-valuation report (i need to know before I can sign for anything) - My CCRIS is empty. I've finished my car loan and PL early of the year. Thought now since no hutang, can make new one la for house. Bad move. I dont use CC anymore because it have gave me a scary experience before (many years ago) but now regret not having one. More bad move. so yeah. definitely might need help on this!! So any kind bank-sales ppl who can walk me through getting the loan i need, is highly appreciated. Please do PM me. Thank you in advance p/s: I prefer OCBC > PBB > Other Bank as long can get it approve. LOL! (but I avoid MBB, Ambank and CIMB. personal preferences.) Pmed. QUOTE(tuanlam417 @ Oct 1 2016, 05:49 PM) hi sifu, Deari am currently working in sg, planning to get my first property real soon within 1 year or so. does this hurt my chances of getting Housing loan? 1) Borrower info Age - 26 Occupation - contact executive No of borrower - 1 No of housing loan on hand - 0 2) income A) Salary earner Gross salary - 2300 sgd Allowances - 200 - Contractual - 1 month Ptptn loan - 250 myr Credit card - 1000 myr 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK 671,685.50 H*NG LE*NG 770,519.83 M*YBANK 612,132.33 *CBC 516,514.00 R*B 525,099.40 U*B 564,323.17 C*MB 616,337.50 AFF*N 721,830.67 2. It doesn't hurt your chances, you just need to apply with banks that are welcomes SGD earner. This I can guide you. Below is the table of analysis 3. Feel free to ask me anything Cheers  |

|

|

|

|

|

Oct 5 2016, 04:16 AM Oct 5 2016, 04:16 AM

Return to original view | Post

#287

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

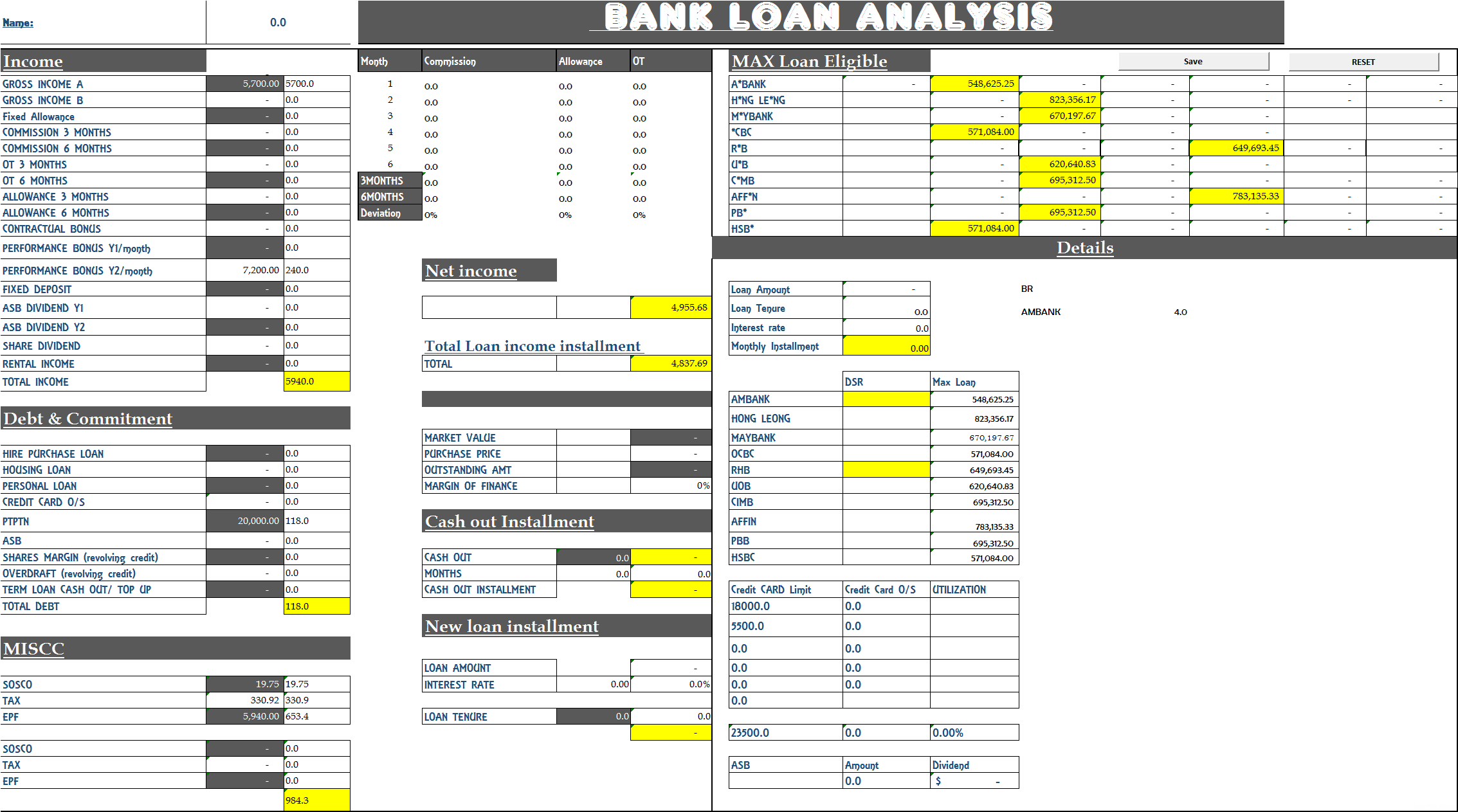

QUOTE(engtat @ Oct 4 2016, 07:17 PM) Question, Dear engtat,1. Nowadays, home loan still imposed early settlement fee outside lock-in period? Let say my tenure is 30 years, lock-in period 5 years, one still need to pay penalty if finish the loan in 10 years? 2. If penalty based on outstanding amount, does it mean outstanding amount on the scheduled balance from 11th to 30th year? 3. What if I left 1 ringgit remain unsettled until end of contract? 1. Nope, it's written in your letter offer penalty to pay is "lock in period", late payment etc YOu will be imposed of penalty charges if you settle the loan in 5 years lock in period, not after that... 2. It depends how your letter offer definite the penalty. Cheers QUOTE(engtat @ Oct 4 2016, 08:03 PM) Thanks for quick reply. DearWe are considering a home loan, all the while we thought it was done under conventional, but when the LO came out, it was Commodity Murabahah Home Financing-i (Maybank). The agent keeps saying this is good, no early settlement penalty, no lock-in period. We told her, we don't mind lock-in and nowadays there won't be early settle penalty after lock-in period, but the agent insists all banks do have, 30 years is 30 years, early settlement, penalty, I laughed. We have a feeling Murabahah concept is old product, and if Islamic home loan, MM is better. Going to read through all LO terms tonight. 1. It means that the agent submitted as islamic loan, which is unethical where they need to inform and get confirmation from clients before proceeding it, you can ask him her to alter or just switch bank banker. 2. MM is new product.. better than old product BB. MM is similar to conventional loan. 1. -For islamic loan there's 2 package for it, that is Bai Bithaman Ajil (BBA) and Musyarakah mustanaqisah(MM). For BBA there's a max cap amount that you pay. example RM200K LOAN/ 5.5%/ 30YEARS =Installment RM1135.58 Total price to be paid is = RM1135.58 X 30 =RM408,808 This price stated in the contract will be the absolute price, the fixed profit has added into the total payable amount. For loan settlement, For usual loan, you will just need to pay off the outstanding balance stated in the bank, but For BBA product, the total paymentis very vague, no actual formula For it. Musyarakah mustanaqisah -tries to be the complete and newer version of islamic loan - it is similar to conventional loan in terms of interest calculation, interest rate, early repayment and capital repayment. The difference is this loan is a Profit loss joint venture for you and the bank. Starting 10% (DP) will own by you and 90%(bank puchase from the seller) so that doesn't breach syariah law. - no lock in period (depends on the bank) - ceiling rate fixed. it's all about preference. Cheers QUOTE(painkillerz @ Oct 4 2016, 08:33 PM) Hi all sifus 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: I would like to know my eligible max loan Age - 28 Gross pay - Rm 5700 Nett pay - Rm 4800 Performance Bonus in 2yrs - Rm 7200 Commitment House - 0 Car - 0 Personal loan - 0 Credit card outstanding - 0 Ptptn - 100 per month Thanks! Rm A*BANK 548,625.25 H*NG LE*NG 823,356.17 M*YBANK 670,197.67 *CBC 571,084.00 R*B 649,693.45 U*B 620,640.83 C*MB 695,312.50 AFF*N 783,135.33 2. The best bank to get the highest loan would be HLBB. However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." 3. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you."  Cheers QUOTE(propusers @ Oct 5 2016, 12:15 AM) if 2 banks offer same effective interest rate 4.3% and both bank branches are easy access, should I choose the higher Base Rate or lower Base Rate? Any reason? DearOne of the bank agent said Base Rate lower is better but I am not sure is it true? Spread rate lower is better.. but is a subjective topic.. Base rate + spread rate = Effective lending rate Base rate will alter according to banks need from time to time, hence it will affect your EFL Spread rate will be fixed throughout the loan tenure. Hence, banker like to say lower spread rate will be better: Example: A) 4% + 0.5% = 4.5% effective lending rate B) 4.1% + 0.4%=4.5% effective lending rate Both ELR is the same, but the spread rate is different. Hence in common perspective sense, people will chose the lower spread rate as it is fixed throughout loan tenure. Thus will say B is better. But actual sense, there's no best solutions or answer for this. Because, lower spread rate doesn't secure the bank from increasing the base rate in the future and ELR is higher than A in the future. It's very subjective, For me, if the ELR is the same, spread rate different isn't differ by alot, I will chose according to few criteria as below: A. Banks that are easily accessible to your vicinity, why take loan offer form bank when you need them, you need to drive 20-40km. B. Customer services, go with bank that offer tremendous value added service, try calling their hotline whether easily reached and are they responsive and helpful. In long term, this will lessen any unwanted hassle. C. Semi or Full flexi that suits your criteria. SOmetimes, different banks semi and full flexi mechanism is different D. Does the loan package has the right features that you need? Finance legal fees, semi/full/fixed/islamic loan ? lock in period or without? defaultment period ? loan account is it link to saving or current account? E. Does the consultant serves you well? etc all this that must put into consideration into long term perspectives instead of just interest rate. Effective interest rate right now is quite short term view. CHeers |

|

|

Oct 10 2016, 05:56 PM Oct 10 2016, 05:56 PM

Return to original view | Post

#288

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

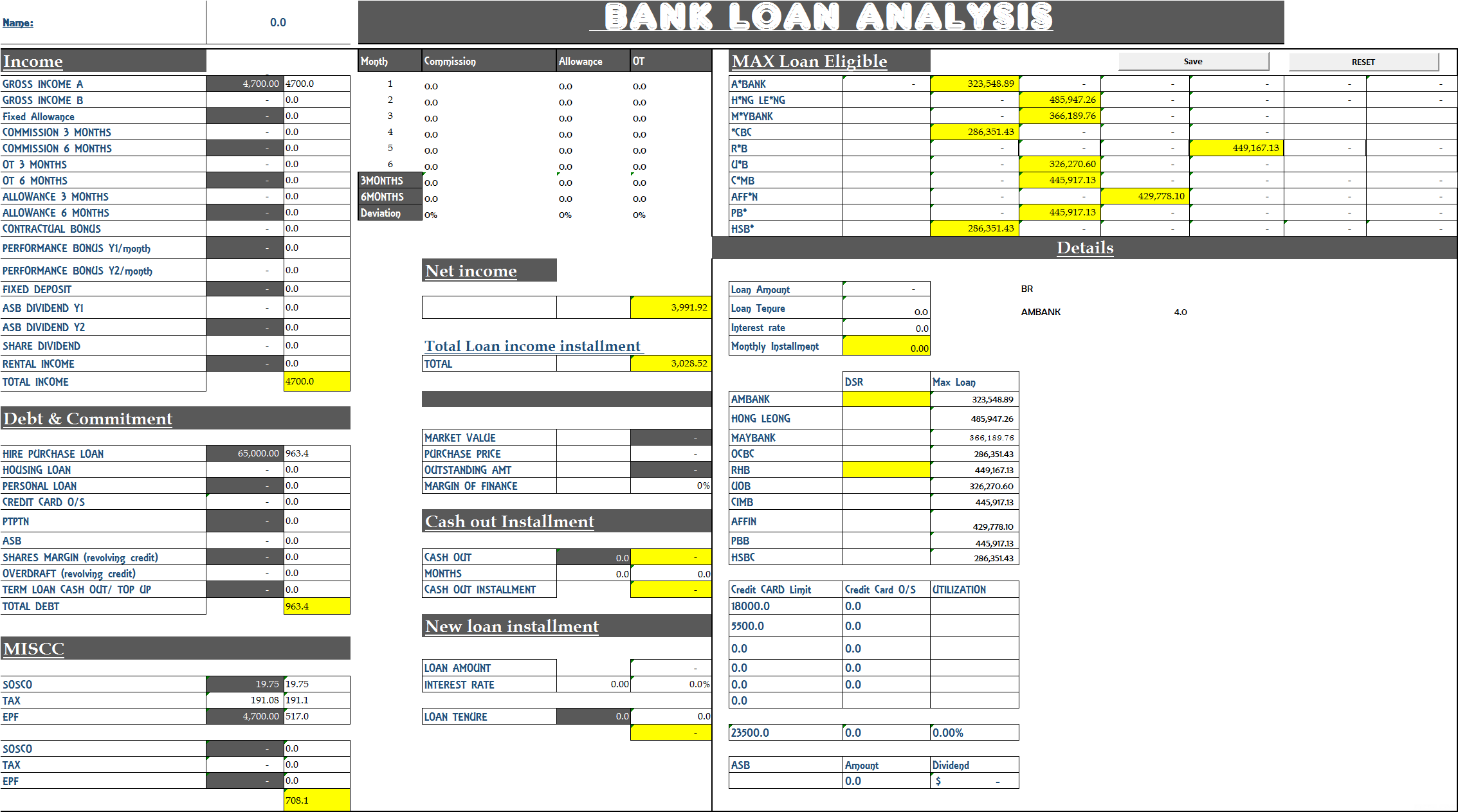

QUOTE(AccO2324 @ Oct 9 2016, 08:03 PM) Hi sifu.. DearToday I went to a completed condo project and there are still developer units available. Loan amount after developer discount will be approximately RM550k (85% of selling price). The sales agent mentioned that the gross salary needed is approximately RM8k to have the loan approved. My current details are as follow, please guide me on the max. loan amount I will be able to undertake: Age : 29 Job : Sales Exec with commission Gross pay : RM4700 (Basic Salary RM3700 & Transport Allowance RM1k) Nett pay : RM4100 without commission (Avg commission/mth = RM2000 - Based on 9 months data) Rental income : None Asb : None Bonus 2 years total : None Commitment : Insurance : RM500 House : None Car : RM750 Personal loan : None Credit card outstanding : None Ptptn : RM300 Thank you!! 1. Based on your income without commission would be slighly enough,, however with Commission income, your loan wouldn't be a problem 2. May i know the project details? -developer name -project name - Phase? So that I can double check which bank can proceed with. -------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK 323,548.89 H*NG LE*NG 485,947.26 M*YBANK 366,189.76 *CBC 286,351.43 R*B 449,167.13 U*B 326,270.60 C*MB 445,917.13 AFF*N 429,778.10 2. The best bank to get the highest loan would be HLBB. However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." 3. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 4. If you need my help, do feel free to contact me. I will be all ears in guiding you towards this rough path. 5. I have wrote some articles that help guide first time home buyer to get housing loan, feel free to read it at below link: 5 Tips for employee to prepare for loan application Few easy tweaks for self employed and freelancer to ensure loan approved  Cheers |

|

|

Oct 12 2016, 11:28 AM Oct 12 2016, 11:28 AM

Return to original view | Post

#289

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

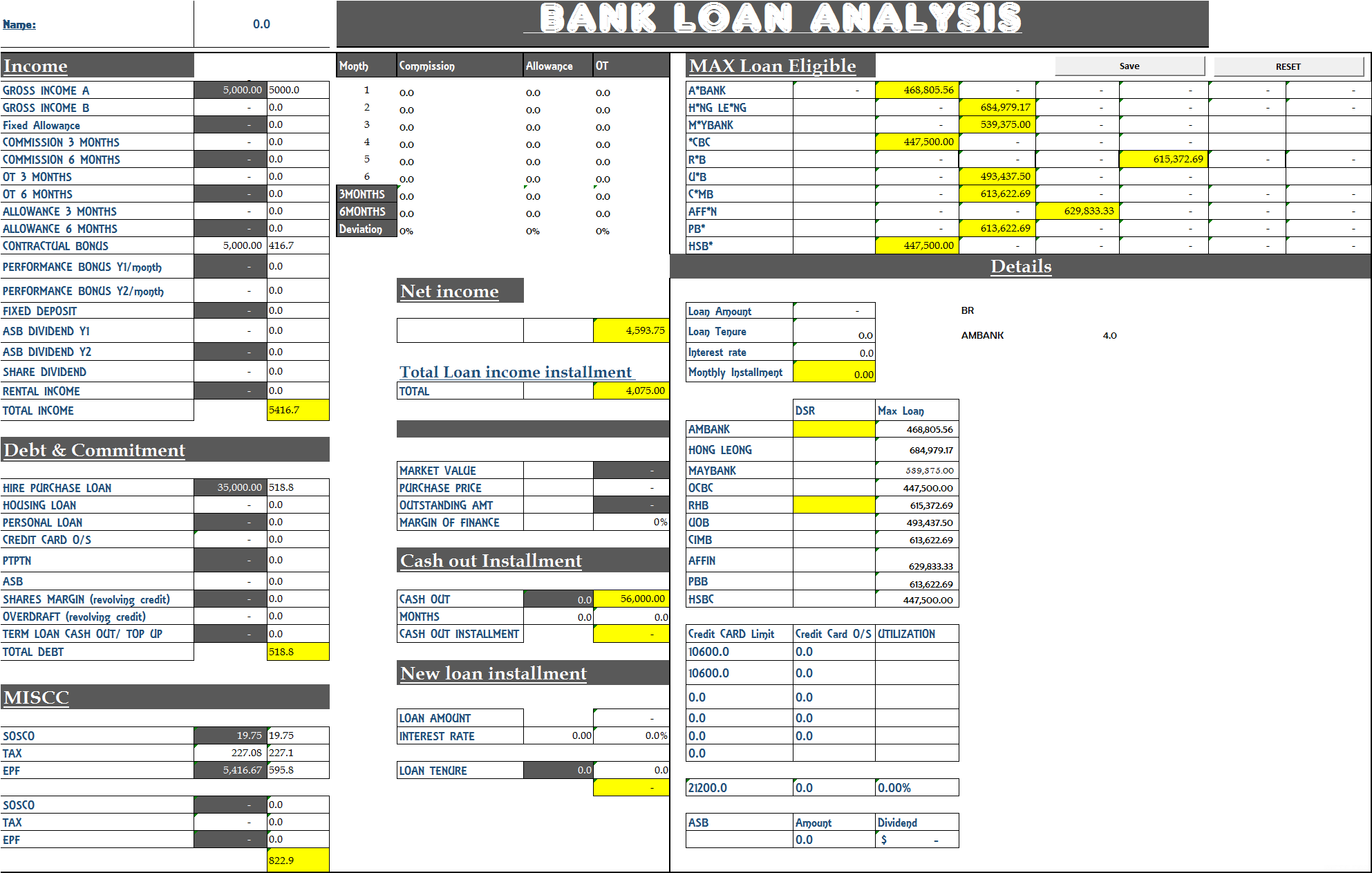

QUOTE(turion64 @ Oct 11 2016, 09:15 PM) hello, what is current best home loan rate? from which bank? loan amount >500k. please suggest...thanks! DearFrom all the rates received, best rate will be PBB,HLBB,RHB,MAYBANK. It is based on your sscoring, hence other bank might give similar rate too. Cheers QUOTE(sapphist @ Oct 12 2016, 12:12 PM) Hi I would like to know whats the max I would be able to borrow from the bank DearAge: 30 Occupation : Assistant Account Net pay after deduction : RM 4,344.65 Bonus: 1 month Yearly bonus Commitments: Car : 450 (finish in 2018) Credit card : RM 8000 credit limit (Fully Paid) Thank you 1. Btw, what's your usage of last month september credit card? swipe how much the amount -------------------------------------------------------------------------------------------------------------------------------------- 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK 468,805.56 H*NG LE*NG 684,979.17 M*YBANK 539,375.00 *CBC 447,500.00 R*B 615,372.69 U*B 493,437.50 C*MB 613,622.69 AFF*N 629,833.33 2. The best bank to get the highest loan would be HLBB. However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." 3. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 4. If you need my help, do feel free to contact me. I will be all ears in guiding you towards this rough path. 5. I have wrote some articles that help guide first time home buyer to get housing loan, feel free to read it at below link: 5 Tips for employee to prepare for loan application Few easy tweaks for self employed and freelancer to ensure loan approved  CHeers |

|

|

Oct 12 2016, 05:36 PM Oct 12 2016, 05:36 PM

Return to original view | Post

#290

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(sapphist @ Oct 12 2016, 04:15 PM) Hi , I did not use my credit card in Sept at all. Dear sapphistAnother question for everyone is, is it ok if I submit my loan application to a few banks at once or must I do it one by one ? Thank you 1. That's excellent! Your scoring would be alittle higher! 2. The golden rule of thumb is to 3-4 banks. Reasons - If too many banks application shown in the ccris, bank will question your motives - Every bank has differernt guideline, hence certain bank approve your case certain bank kenot. What if you submitted 2 banks that can't approved your loan and 3rd bank last bank approved your loan, due to rejection from previous bank, your credit scoring will be low and interest rate will be higher.. else loan rejection if your scoring already at bottom line Best approach. Get consultant or bankers that you trust let them study your case, if they say the bank has high chances.. etc, then only you apply with the banks that can approve your loan. Most bankers that I have seen, usually they won't do forefront due diligence, and will just submit try luck on your case... NOt all, but has witnessed it. Cheers |

|

|

Oct 17 2016, 07:23 PM Oct 17 2016, 07:23 PM

Return to original view | Post

#291

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

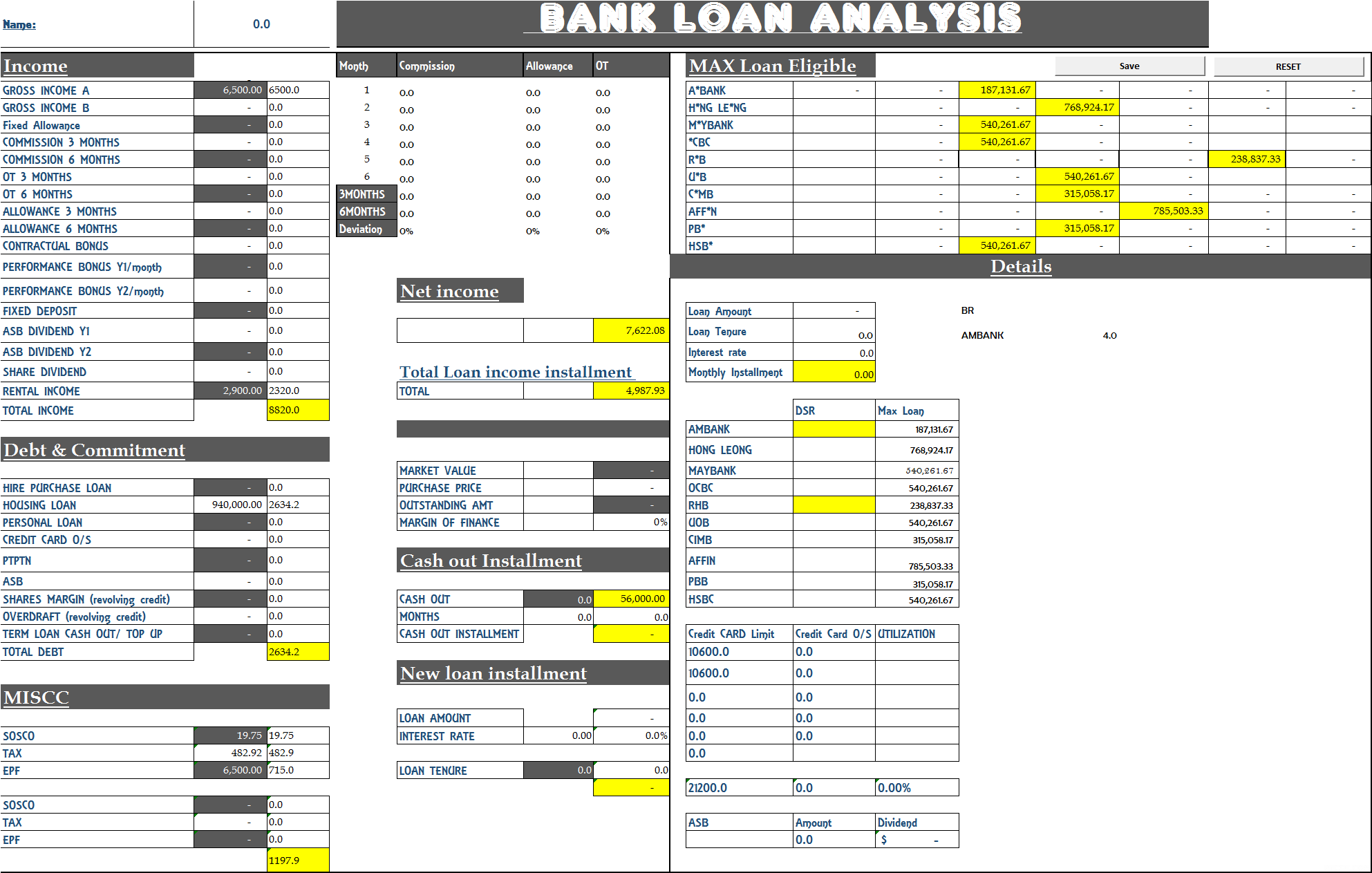

QUOTE(bluegreen8 @ Oct 16 2016, 11:10 PM) Hi Madgeniusfigo, Dear bluegreen8I would like to know what is the max I still be able to borrow from bank Age: 32 Gross salary: 6500 Rental income: 1600 + 1300 Commitments: Housing loan: RM 2364 Commercial loan: RM 1605 Credit card : 3 cc (clear every month) Thank you 1. What's is the total usage of your credit card last month? 2. Rental agreement, is it stamped? else do you have up to 3 months of rental credited into the bank account? ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK 187,131.67 H*NG LE*NG 768,924.17 M*YBANK 540,261.67 *CBC 540,261.67 R*B 238,837.33 U*B 540,261.67 C*MB 315,058.17 AFF*N 785,503.33 2. The best bank to get the highest loan would be HLBB. However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." 3. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 4. If you need my help, do feel free to contact me. I will be all ears in guiding you towards this rough path. 5. I have wrote some articles that help guide first time home buyer to get housing loan, feel free to read it at below link: 5 Tips for employee to prepare for loan application Few easy tweaks for self employed and freelancer to ensure loan approved  Cheers |

|

|

Oct 19 2016, 09:05 PM Oct 19 2016, 09:05 PM

Return to original view | Post

#292

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(Nymphetamine666 @ Oct 19 2016, 01:03 AM) Hi experts. Dear Nymphetamine666,I booked a landed house and my 90% loan amount is rm470k.and the loan is me alone. Not joint loan. Ok, skimmed thru a lot of pages doesn't seem like HSB* Ama**h is not 1 of preferred bank. The reason i go for this bank because their DSR is up to 90% which is my priority concern. Ok, here's some bit and pieces and would like to ask and its a lot. Hope can get satisfied answer from u guys. Thanks in advance. - Br+spread rate: 3.5%+0.85%=4.35% offered to me. Is it good? - Normally heard about mrta/mlta,but this bank called it TRTC (Takaful Reducing Term Cover). This what banker say to me. Anyone explain whats the difference from others? - Islamic (Syariah comply). Clear card. - Full flex. What's the difference between full or semi? - lock in period only during construction phase. For my house: took 3 years. This one,i think fair enough. 'After VP can straight away sell' alike yes? - Then, due to my limited knowledge on this, he say, better pick this kind of setup: kinda like monthly payment housing insurance. For my house, he calculated i need to pay around rm88/month. No clue on this. Is it good? Or expensive? Or cheaper? Shed some light please. Thanks. QUOTE(Nymphetamine666 @ Oct 19 2016, 01:36 AM) Thanks bro life balance. U missed out 1 question. Can table out difference between full and semi flexi. Tq. On point no.3, now i getting confuse edi. Ok, the banker told me, this TRTC is self finance, not lumped into the loan(not subjected to 4.35% interest. That is why he calc my monthly insurance payment for Rm88/month (self finance). Different from what u explained earlier, TRTC is kinda like, no, its not 'kinda like' but it is MRTA which is lumped into the loan (per ur table). 1. it's consider good, but hear me out. CODE Dear Base rate + spread rate = Effective lending rate Base rate will alter according to banks need from time to time, hence it will affect your EFL Spread rate will be fixed throughout the loan tenure. Hence, banker like to say lower spread rate will be better: Example: A) 4% + 0.5% = 4.5% effective lending rate B) 4.1% + 0.4%=4.5% effective lending rate Both ELR is the same, but the spread rate is different. Hence in common perspective sense, people will chose the lower spread rate as it is fixed throughout loan tenure. Thus will say B is better. But actual sense, there's no best solutions or answer for this. Because, lower spread rate doesn't secure the bank from increasing the base rate in the future and ELR is higher than A in the future. It's very subjective, For me, if the ELR is the same, spread rate different isn't differ by alot, I will chose according to few criteria as below: A. Banks that are easily accessible to your vicinity, why take loan offer form bank when you need them, you need to drive 20-40km. B. Customer services, go with bank that offer tremendous value added service, try calling their hotline whether easily reached and are they responsive and helpful. In long term, this will lessen any unwanted hassle. C. Semi or Full flexi that suits your criteria. SOmetimes, different banks semi and full flexi mechanism is different D. Does the loan package has the right features that you need? Finance legal fees, semi/full/fixed/islamic loan ? lock in period or without? defaultment period ? loan account is it link to saving or current account? E. Does the consultant serves you well? etc all this that must put into consideration into long term perspectives instead of just interest rate. Effective interest rate right now is quite short term view. 2. It's the same with MRTA... same thing different package but with syariah compliances. 3. CODE Full flexi: 1) current account tied to loan account 2) auto debit from current account at month end and interest is calculated based on outstanding balance minus amount in current account 3) maintenance charge of RM10 per month 4) setup/ processing fee of Rm200 (certain bank) 5)The liquidity comes in the form of an ATM card or a linked CASA account to the housing loan. Example: You have a shop that is opened Monday to Satuday, rest on Sunday. On Saturday, you deposit all your proceeds of the week into the flexi account, on Sunday, you would save [(your-HL-interest-rate)/365]*AmountDeposited worth of interest. On Monday, you withdraw the money to run your business 6) Withdrawal of money or crediting of money through ATM,CHEQUE,OVER THE COUNTER, or online Semi Flexi semi flexi package typically has these features: 1) requires you to phone in to indicate the extra payment as early settlement of advance payments 2) if you fail to indicate, you will be charged 1% (some banks do this afaik) 3) if you indicate advance payment, no additional interest is saved as "advance" payment will only be credited to your loan account when it reaches your cycle date, so it is plain advance payments. and must be in multiple of your monthly payment. 4) For redrawable prepayments, you need to indicate separately and Redraw charge of RM50 is imposed (M*B charge Rm25) 5) Withdrawal of money or crediting of money through Cheque or Over the counter 4. If it's over 3 years... yes. 5. Well they can structure the deal anyway the bank wants, they are doing it monthly payment, payment scheme structured differently. QUOTE(jeffy9292 @ Oct 19 2016, 02:33 PM) Dear1. it's no and it's yes It depends on if you feel that protection is important to you and your family in the future.. 2. For your question, certain bank or branches will required a compulsory must take MRTA if you want to sign the letter offer... coercive... However, in actual, it's non mandatory... Cheers QUOTE(jeffy9292 @ Oct 19 2016, 03:04 PM) How about C**B DearFor homeflexismart and homeflexismart-i Is insurance compulsory on it? and usually there is option to choose insurance in Application form, should we tick apply through the bank or can we just tick buying own ? Not compulsory! BUying own will do the work.. or just leave that part blank.. Why are you filling the form? thought agent doing that for you! haha CHeers |

|

|

Oct 24 2016, 07:05 AM Oct 24 2016, 07:05 AM

Return to original view | Post

#293

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

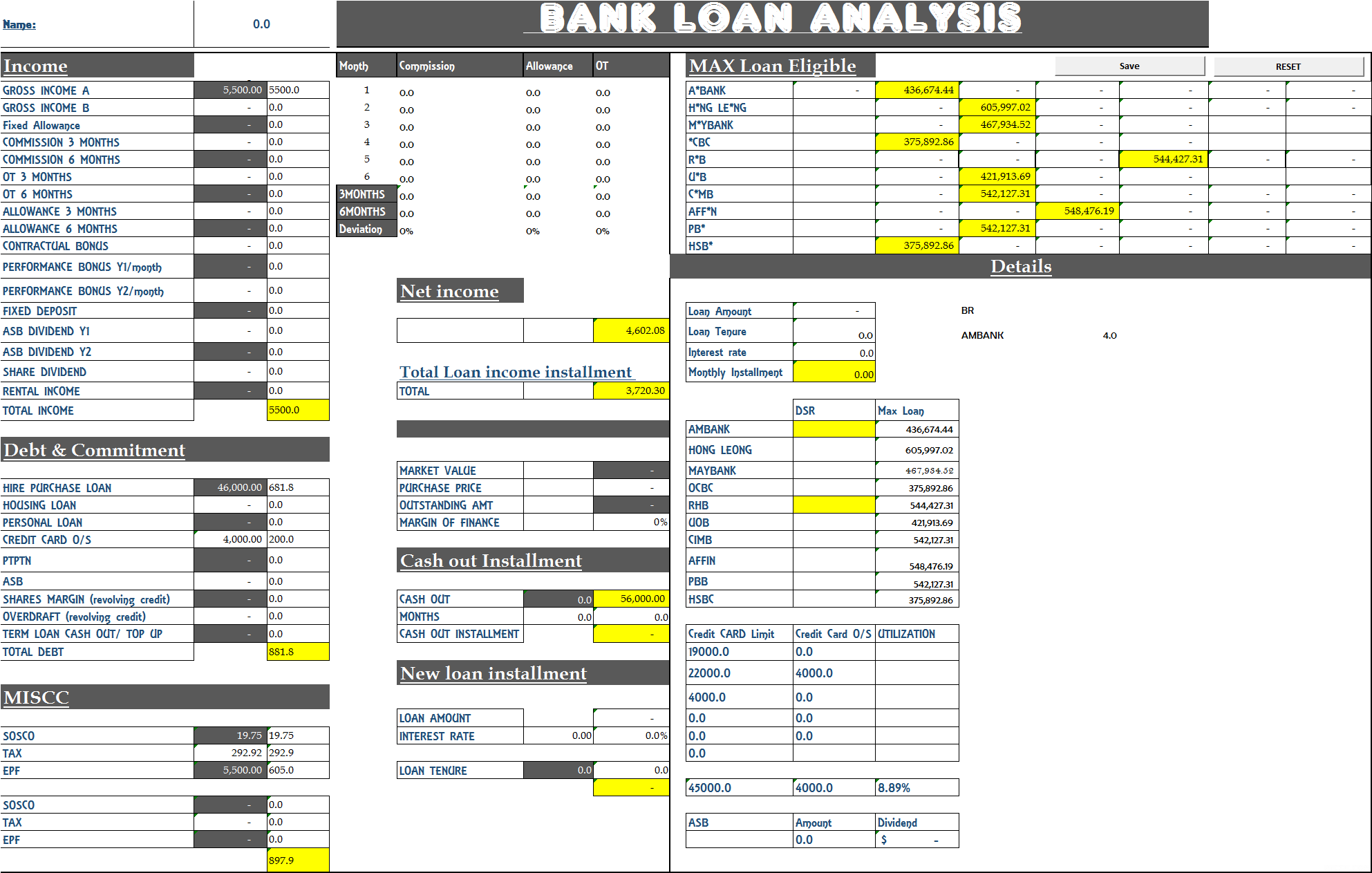

[quote=emperor_o4118,Oct 20 2016, 10:01 PM]

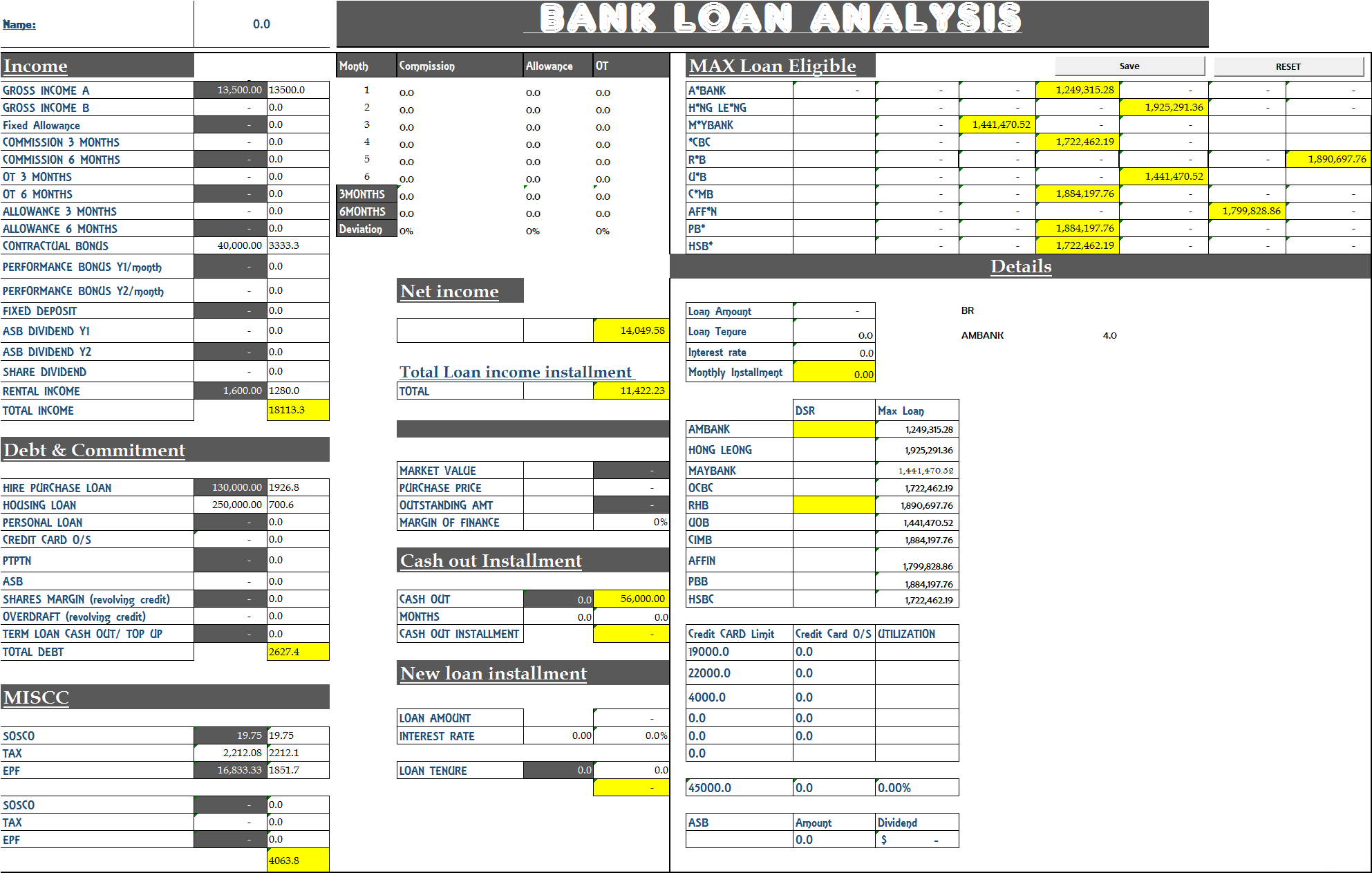

Hi all, i recently book house at Sr Sendayan Seremban. House price - Rm538888 net income me and wife - Around RM4500 joint applicatiom Finance - 90% Commitment - car Rm550 credit card - monthly rm175 i have calculated roughly my dsr around 70%, my question how are my chances for my application to be approve? I apply with CIMB, RHB, Maybank n Ambank. What are other factors that bank consider to approvr my application?Is DSR calculated bank will be higher compare to standard DSR calculation? [/quote] Dear emperor_o4118 1. HLBB, CIMB, RHB has highest chances 2. DSR is based on the profile you just shown Bank will also look at your ccris arrears, any CTOS problems, any restructured debts, how many debt facilities you have, your company, your jobs nature of business.. etc. all myriad of factors will be calculated into the credit scoring ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK 436,674.44 H*NG LE*NG 605,997.02 M*YBANK 467,934.52 *CBC 375,892.86 R*B 544,427.31 U*B 421,913.69 C*MB 542,127.31 AFF*N 548,476.19 2. The best bank to get the highest loan would be HLBB. However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." 3. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 4. If you need my help, do feel free to contact me. I will be all ears in guiding you towards this rough path. 5. I have wrote some articles that help guide first time home buyer to get housing loan, feel free to read it at below link: 5 Tips for employee to prepare for loan application Few easy tweaks for self employed and freelancer to ensure loan approved  Cheers [quote=Nymphetamine666,Oct 21 2016, 01:20 AM] Dear Nymphetamine666, 1. it's consider good, but hear me out. CODE Dear Base rate + spread rate = Effective lending rate Base rate will alter according to banks need from time to time, hence it will affect your EFL Spread rate will be fixed throughout the loan tenure. Hence, banker like to say lower spread rate will be better: Example: A) 4% + 0.5% = 4.5% effective lending rate B) 4.1% + 0.4%=4.5% effective lending rate Both ELR is the same, but the spread rate is different. Hence in common perspective sense, people will chose the lower spread rate as it is fixed throughout loan tenure. Thus will say B is better. But actual sense, there's no best solutions or answer for this. Because, lower spread rate doesn't secure the bank from increasing the base rate in the future and ELR is higher than A in the future. It's very subjective, For me, if the ELR is the same, spread rate different isn't differ by alot, I will chose according to few criteria as below: A. Banks that are easily accessible to your vicinity, why take loan offer form bank when you need them, you need to drive 20-40km. B. Customer services, go with bank that offer tremendous value added service, try calling their hotline whether easily reached and are they responsive and helpful. In long term, this will lessen any unwanted hassle. C. Semi or Full flexi that suits your criteria. SOmetimes, different banks semi and full flexi mechanism is different D. Does the loan package has the right features that you need? Finance legal fees, semi/full/fixed/islamic loan ? lock in period or without? defaultment period ? loan account is it link to saving or current account? E. Does the consultant serves you well? etc all this that must put into consideration into long term perspectives instead of just interest rate. Effective interest rate right now is quite short term view. 2. It's the same with MRTA... same thing different package but with syariah compliances. 3. CODE Full flexi: 1) current account tied to loan account 2) auto debit from current account at month end and interest is calculated based on outstanding balance minus amount in current account 3) maintenance charge of RM10 per month 4) setup/ processing fee of Rm200 (certain bank) 5)The liquidity comes in the form of an ATM card or a linked CASA account to the housing loan. Example: You have a shop that is opened Monday to Satuday, rest on Sunday. On Saturday, you deposit all your proceeds of the week into the flexi account, on Sunday, you would save [(your-HL-interest-rate)/365]*AmountDeposited worth of interest. On Monday, you withdraw the money to run your business 6) Withdrawal of money or crediting of money through ATM,CHEQUE,OVER THE COUNTER, or online Semi Flexi semi flexi package typically has these features: 1) requires you to phone in to indicate the extra payment as early settlement of advance payments 2) if you fail to indicate, you will be charged 1% (some banks do this afaik) 3) if you indicate advance payment, no additional interest is saved as "advance" payment will only be credited to your loan account when it reaches your cycle date, so it is plain advance payments. and must be in multiple of your monthly payment. 4) For redrawable prepayments, you need to indicate separately and Redraw charge of RM50 is imposed (M*B charge Rm25) 5) Withdrawal of money or crediting of money through Cheque or Over the counter 4. If it's over 3 years... yes. 5. Well they can structure the deal anyway the bank wants, they are doing it monthly payment, payment scheme structured differently. Dear 1. it's no and it's yes It depends on if you feel that protection is important to you and your family in the future.. 2. For your question, certain bank or branches will required a compulsory must take MRTA if you want to sign the letter offer... coercive... However, in actual, it's non mandatory... Cheers Dear Not compulsory! BUying own will do the work.. or just leave that part blank.. Why are you filling the form? thought agent doing that for you! haha CHeers [/quote] Thank you sir. [/quote] Dear Nymphetamine666, No problem! Hope it helps! [quote=cwtien,Oct 21 2016, 10:34 AM] Hi, I currently have a semi-flexi loan with RHB Bank. I'm looking to convert this loan to a full-flexi loan (RM 1mil over 20 years). I have asked RHB Bank to give me a quote, but they don't seem that interested (maybe because they get to earn less I'm asking regarding: 1) Fees for moving loans across banks. 2) Estimated monthly amount I have to pay. 3) Any other fees. I can give more details via PM. I don't want to provide full details in an open forum. Basically, I'm asking agents from other banks to contact me with offers if they're interested [/quote] Dear 1) Refinance Legal loan fees RM16245 CODE Loan amount: 1000000 Sub Total Professional Charges Facilities Agreement 7,450.00 Charge Annexure 900 Discharge of charge Entry and Withdrawal of Private Caveat 350 Statutory Declaration 100 Professional Charge 8800 Disbursement Stamp duty on the Facility Agreement (Original) 5000 Stamp duty on the Facility Agreement (Copies) 20 Stamp duty on the Charge Annexure 40 Stamp duty on the Discharge of charge Stamp duty on Letter of Offer 20 Registration Fee on Charge 120 Registration Fee on Entry and Withdrawal of Private Caveat 450 Registration fees on Discharge of charge Affirming Fee/Bankruptcy Search 100 Stamping on Statutory Declaration (Owner Occupation/not a bankrupt) 40 Land Search 120 Documentation Fee 318 Transportation 300 Telephone Calls, Facsmile, Printing charges and couriers and etc 300 Miscellaneous 50 GST 6% 567 16245 Valuatioan fees around RM2K 16245 + rm2000 = RM18245 2. RM5000 3. as stated at NO.1 Cheers [quote=Skylinestar,Oct 21 2016, 02:32 PM] I'm sure CIMB will approve easily (based on my experience) [/quote] oh wow.. confidence. [quote=snowswc,Oct 22 2016, 01:54 AM] Hi sifu.. need your advice. i plan to buy a second house located at Damansara Utama. the price is about RM 1m. My current details are as follow, please guide me on the max. loan amount I will be able to undertake: Age : 29 Job :Finance Manager Gross pay : RM 13500 Nett pay : RM10,500 Bonus : estimate 3 months a year Commitment : Insurance : RM300 House : total RM 2100 (joint loan - remaining 450 months *40 years loan*) Car : RM 1,500 (remaining 26 months) Existing Mortgage Loan (JB property) Loan outstanding : RM 480k current account (flexi loan) : RM300k cash monthly payment : mentioned above RM 2100. Rental income : 1,600 Thank you!! [quote=snowswc,Oct 22 2016, 02:03 AM] thanks. may i know what is the best rate currently exist in the market? my existing loan with Alliance, i get 4.27%. would it be good to continue with Alliance combine to get better rate or it makes no difference if i go for another bank? [/quote] [quote=snowswc,Oct 22 2016, 02:08 AM] thanks. i heard some of the banks require the borrower to buy the what MRTA or MLTA insurance, is that truth? because i insist not to purchase any insurance for my JB property and Alliance still approved my loan. [/quote] [/quote] Dear snowswc 1. If GIVEN YOUR ccris has no prolem, 1million loan should be fine and great 2. Do provide me the property market value, so taht i can check whetehr the property value can match the selling price -Property full address -square feet landsize built up -Property type -aNY RENOVATION 3. For your loan amount, best rate can go towards 4.3%, last month 1million loan client of mine receive best rate 4.3% Unfortunately, alliance.. rate nowadays are bad.. not that competitive as usual anymore.. 4. Well, There's no such thing as compulsory! It's optionable for the borrower! Nothing is compulsory in this world. -------------------------------------------------------------------------------------------------------------------------------------------------------------- 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK 1,249,315.28 H*NG LE*NG 1,925,291.36 M*YBANK 1,441,470.52 *CBC 1,722,462.19 R*B 1,890,697.76 U*B 1,441,470.52 C*MB 1,884,197.76 AFF*N 1,799,828.86 "2. The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." "3. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 4. If you need my help, do feel free to contact me. I will be all ears in guiding you towards this rough path. 5. I have wrote some articles that help guide first time home buyer to get housing loan, feel free to read it at below link: 5 Tips for employee to prepare for loan application Few easy tweaks for self employed and freelancer to ensure loan approved  Cheers This post has been edited by Madgeniusfigo: Oct 24 2016, 07:09 AM |

|

|

|

|

|

Oct 24 2016, 11:40 AM Oct 24 2016, 11:40 AM

Return to original view | Post

#294

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(snowswc @ Oct 24 2016, 10:44 AM) Anyone here can share based on your experieced what is the best interest rate for mortgage currently? Is it 4.2%? Dear1. 4.2%, is hlbb package. 1st year 4.2%, consecutive year board rate.. 4.3-5% 2. The best rate I get for clients is 4.25%, best profile..!! haha Cheers |

|

|

Oct 24 2016, 05:18 PM Oct 24 2016, 05:18 PM

Return to original view | Post

#295

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(snowswc @ Oct 24 2016, 05:41 PM) thanks bro. anybody so far is there any good free gift from outsource. e.g. ringgit plus and etc. because i plan to apply a housing loan. purchase value 990k. Dearit depends on the customer service applicable by that outsource company, they might give cash back or rebate.. or etc 2. Is it a subsales purchase or project property? Cheers |

|

|

Oct 24 2016, 08:08 PM Oct 24 2016, 08:08 PM

Return to original view | Post

#296

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(snowswc @ Oct 24 2016, 08:07 PM) erm...just my opinion, i don think they are unprofessional. i would think is the same thing that when we go to the mall to apply credit card and the sales executive give you some free gift, vouchers and etc, some agent give you discount for your first year insurance which is coming from their "commission" as well. frankly speaking, now is a realistic society and we have a very competitive market, everybody will just opt for something benefit more to them. Dearanyway, thanks for your advice bro. 1. In competitive societies, every profession has to phase out competitive edge to out win each other. Nothing is wrong from being more competitive. It's not robbing other people though, just outsmarting others. LOL QUOTE(snowswc @ Oct 24 2016, 08:44 PM) i think you react too much because everything is on the basis of " you wish i love" and nobody force anybody to do it. DearAnd why bank officer might not be a professional job, i think you are too much and also mind your word here. if you ever receive a free gift from the sales executive by applying a credit card, it makes no different because they bought the gift from their commission. 1. Yes, I do agree he is overreacting. Well, I don't blame him on purely being professional outright and thinking on their part of benefits.. 2. World is changing, competition is disrupting. People have to outsmart or outwitted. 3. Give him a break, he just couldn't fathom that people are innovating... I don't blame him though. He just wish that everyone can compete on same phase and not over evolve.... Cheers QUOTE(snowswc @ Oct 24 2016, 08:50 PM) add on. even a lot of insurance agent will give provide an iphone if you purchase above certain value and this is what is happening in the market everyday. of course, the consumer will not simply buy the product because of the "gift" but is really based on the need. frankly speaking, i won't ask the agent to give me an iphone but i will accept it if they offer me an phone. for sure i wont say no to accept the gift. Yes, alot are giving out such gifts! haha This post has been edited by Madgeniusfigo: Oct 24 2016, 08:49 PM |

|

|

Oct 24 2016, 08:13 PM Oct 24 2016, 08:13 PM

Return to original view | Post

#297

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(lifebalance @ Oct 24 2016, 09:03 PM) If it's what is being offered by the bank as stated in their brochure then it's fine but if such offer had to whispered through your ears with "Hey if you sign up with me I'll give you RM200 back from my own" then it's clearly a wrong conduct and obviously you do not know what a bank officer is bound by the Banking Act for such actions. There are somethings that can't be done then it can't be done no matter how you try to turn it to the left or right. Chill man. It's just other person point of will. MOreover, the fact is he she ain't hinting that people sign deals based on gifts and stuff only.If you're talking about outsource then by all means as long as they have not sign up with any Banking Act. They can give you everything they want, if they would like to remain this way as part of their business model operation then we can't stop them. We can't stop someone who wants to give away his money and build his reputation such as that. However if you're attached to a bank, then you represent the bank and if this conduct is permitted, what example is it telling to the other employees and the reputation of the bank ?? And no, you don't have to ask me to mind my words if you're not up to discuss about it. Another example of wrong doing being conducted in the industry. You are thinking very narrowly, why not think of it as they provide a professional services, clients love them, sign the deal with them. In the end, the firm value such loyal clients, give gifts and voucher for their loyalty. And not luring them with rebate instead of rebate based on appreciation. Chill yourself down.. You don't need to drill down to intense debate or argument with everyone that doesn't stand on the same point of the fence yo.. |

|

|

Oct 24 2016, 08:27 PM Oct 24 2016, 08:27 PM

Return to original view | Post

#298

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(lifebalance @ Oct 24 2016, 09:23 PM) Sorry I won't bend my back to ppl who think a wrong is right. Clearly you're trying to make things worse by approving such act. Dear..Clearly you didn't read the discussion that we're having, as I mentioned my example is with a direct bank. If your outsource firm would like to provide such gifts and vouchers then it's fine. I won't be stopping your business to do that if you need to be on a "competitive edge". Calling me to think narrow, can't fathom how other ppl can do a better business than me is being so judgemental and clearly you don't even know me and just dish out negative words just because we haven't been in good terms. You're not in a very good position as well to say that. Anyways I've enough of this discussion and will definitely be the last of it. Thanks You really have some issue 1. My firm isn't doing such a thing.. and you accused (1) accusation is a sin 2. I am asking you to chill down, and not burning every netizen that you don't feel right with. Even if they don't understand, you as a professional guy shouldn't lay down hard words on them. Come on. 3. You clearly thinking this the wrong way... How is it we are not in good term? I have zero hardfeeling with you and What's wrong though? Anyway, this is a discussion section not for raging...You really need to keep your cool. You are raging with a netizen for not standing on your ground .. 4. Well. have a nice day to yourself man, keep your chill and not screw every netizen here in LOWYAT would be amazing first step Cheer This post has been edited by Madgeniusfigo: Oct 24 2016, 08:47 PM |

|

|

Oct 24 2016, 08:55 PM Oct 24 2016, 08:55 PM

Return to original view | Post

#299

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(snowswc @ Oct 24 2016, 06:19 PM) Dear1. If it is subsales, better get market value before signing the booking form. As different bank have different valuers. Do provide below details if you need such assistance -Property full address -squarefeet landsizr built up -Property type -Renovation? Cheers |

|

|

Oct 27 2016, 02:05 PM Oct 27 2016, 02:05 PM

Return to original view | Post

#300

|

Senior Member

1,451 posts Joined: Oct 2014 From: Kuala Lumpur |

QUOTE(jeffy9292 @ Oct 27 2016, 02:28 PM) QUOTE(jeffy9292 @ Oct 27 2016, 02:53 PM) DearDocuments 1. IC 2. 6 months bank statements 3. FUll SSM copy 4. Tax B/Be form - Tax receipt - bank statement showing the amount -make sure business >2 years However If you don't pay tax, there's way to play with it =) Cheers |

| Change to: |  0.1370sec 0.1370sec

0.44 0.44

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 06:51 PM |