QUOTE(zhariffPTS @ Oct 10 2017, 01:49 PM)

Hi Everyone,

Enquiry for me.

Age : 27

Net income : RM3230

No commitments

Credit card : 500 Average

Loan amount : RM340,000 - 90%

DearEnquiry for me.

Age : 27

Net income : RM3230

No commitments

Credit card : 500 Average

Loan amount : RM340,000 - 90%

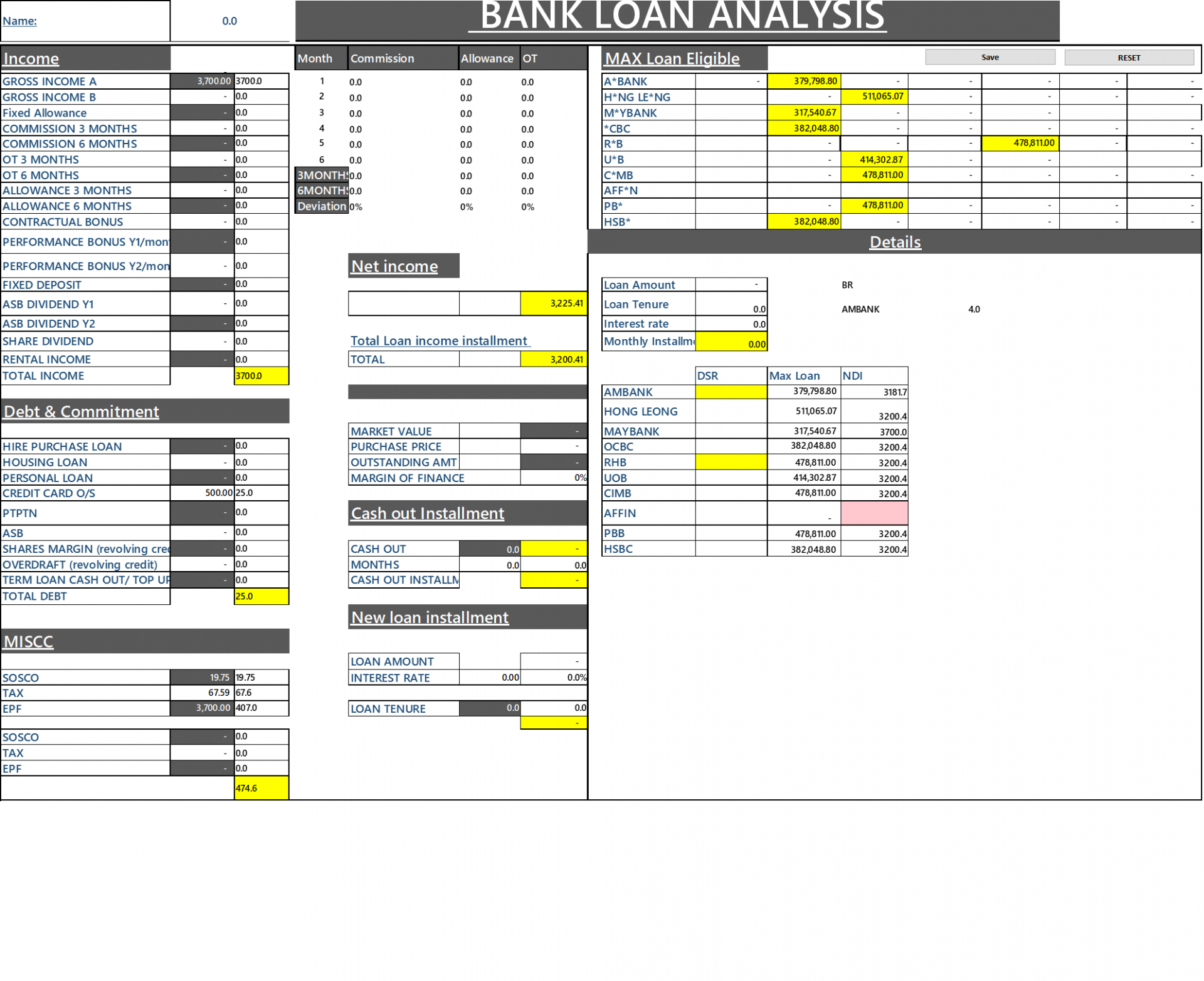

1. Based on the details given by you, Your max loan eligibility for each bank is as follow:

[CODE] Bank Loan amount

A*BANK 379,798.80

H*NG LE*NG 511,065.07

M*YBANK 317,540.67

*CBC 382,048.80

R*B 478,811.00

U*B 414,302.87

C*MB 478,811.00

AFF*N -

PB* 478,811.00

HSB* 382,048.80

Things to take note of based onmy max loan calculation

" -The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game

Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence,

I would need to do a due diligence on your profile before suggesting the best bank to proceed with."

" - I would need to check you CCRIS, CTOS and income documentation before giving you any assurance.

If everything goes fine, 90% shouldn't be a problem for you."

2. Rm340k Shouldn't be a problem

CHeers

Oct 10 2017, 03:24 PM

Oct 10 2017, 03:24 PM

Quote

Quote

0.0291sec

0.0291sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled