I would like to say something about my stance on safety of EPF and tier dividen.

For EPF safety, i had been hearing rumour that it would be bankrupted or inside EPF already empty, since i was 12yo, 22yo, and 20+ years later, until now. I am a guy growing up in a restaurant, uncle and untie here day day would tell you all kind of secret, they told all these secrets (included EPF was broke) with a mysterious look / sound, and the kind of serious face that "i got this secret from some way, i only tell you this, don't tell other". My parent took out all their saving in EPF when they were 55, and now my father is 80, and EPF is still there.

So, personally, i would continue having faith in EPF and will continue to pump in money as far as i can. (i have other reasons to, but not going to discuss)

As for tier dividen, if they really implement it,

1. Doesn't matter what is the difference % compare to FD, i will remove all the money > 1mil

2. And also will clean the second account by transfer all the money into house loan

3. No more extra self-contribution into EPF

The main reason is, i will feel better this way, and to show them i am really unhappy with tier divide.

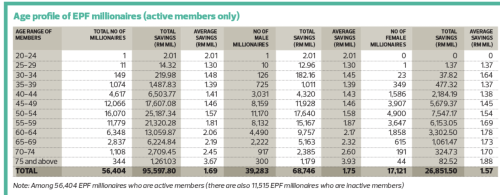

It will not at least in the next few years. As mentioned by the deputy finance minister that the epf is now mainly contributed by T20, and he is using the extra dividend rm 500 generated from the total pool of profits to the targeted individuals. Imagine if T20 pull out most of the funds, where is the extra profit to give B40? FYI, rm500 / rm 10000 is already 5% extra dividend. On top of the original dividend, it wil be around 10 to 11% for the targeted individuals.

Dec 23 2022, 07:47 PM

Dec 23 2022, 07:47 PM

Quote

Quote

2.5896sec

2.5896sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled