Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

T231H

|

Mar 14 2021, 11:04 AM Mar 14 2021, 11:04 AM

|

|

QUOTE(effectz @ Mar 14 2021, 10:53 AM) That's PRS. Cash is cash, UT is UT. They are on different running track, different pace. EPF invests cash in shares then gives return back in cash form. Cash is straightforward. UT is unit price x number if units, it got unit split, distribution and of course charges like trustee fee etc. EPF gives dividend in cash form. For long term (30+ years), investor take some risk to negate inflation. Why leave EPF in cash form for 30+ years (working years)? Diverse into UT, hence PRS is introduced.

Above all, make informed decision and understand the risk involved. maybe that is why yklooi posted this question earlier.... QUOTE(yklooi @ Mar 10 2021, 04:16 PM) my earlier thinking was,... if i had 600k, i took out 60k for investment 600k x 5% EPF rate i get RM30k total after 12 months is RM630k if i took out 60k, my EPF is left with 540k 540k x 5% = 27k 60k x 10% = 6k, total dividend/roi is RM33k, total still invested is RM60k thus total in port is RM633k 633k vs 630k i get 3k extra over if i did not take out. 3k out of 630k is about 0.48%  was thinking to myself, if this extra 0.48% or 3k is justify for me to chase in relation to the risk of investing and a need to beat this 5% epf rate.... |

|

|

|

|

|

T231H

|

Sep 30 2021, 12:10 PM Sep 30 2021, 12:10 PM

|

|

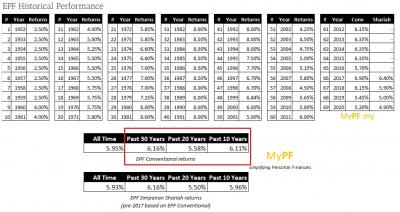

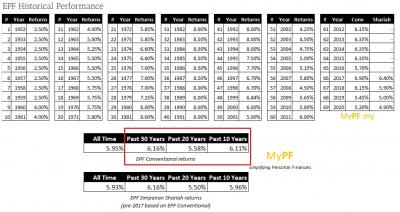

QUOTE(MUM @ Sep 30 2021, 11:58 AM) yes, you are right on this latest year (last year was 5.2%)...also in year 2019 was 5.45% to be precise any idea of the average pa for the last 12 years? Historical rates.... Attached thumbnail(s)

|

|

|

|

|

|

T231H

|

Nov 11 2021, 02:48 PM Nov 11 2021, 02:48 PM

|

|

QUOTE(MUM @ Nov 11 2021, 02:32 PM) The truth about Warren Buffett’s investment track record https://finance.yahoo.com/news/the-truth-ab...-113829049.htmlWarren Buffett, the billionaire head of Berkshire Hathaway (BRK-A, BRK-B), will probably go down as the greatest investor in history. For more than half a century, he's been responsible for the performance of Berkshire and its legendary stock portfolio, which have long track records of market-beating returns. But here's what every serious investor needs to know about Buffett: despite above-average performance, t here have been many years Berkshire underperformed the market and there have been many individual stock trades that have lost mountains of money.  did EPF have that or ever publish that? Will MPs/NGOs makes noises if it does? even if it does publish or exposed,.... they can response with as posted.... QUOTE(yklooi @ Sep 26 2021, 11:04 AM) Why is that no sound from the authorities, MPs or any lawmakers or etc etc,? .. When they replied. "EPF says 'not able to comment' on glove maker Riverstone Holdings share trade". https://www.klsescreener.com/v2/news/view/8...ngs-share-tradeAre their actions above board and there is no oversight committee for check n balance? Now I begin to wonder how many unknown numbers of buy higher than market prices incidences...(those not exposed, made known publicly). If epf can do that, are ASNB doing that too?? 🤔🤔 |

|

|

|

|

|

T231H

|

Feb 19 2022, 03:42 PM Feb 19 2022, 03:42 PM

|

|

One mentioned, "Confirm" & now another one said, "rightfully should",.....

🤔🤔👏👏

|

|

|

|

|

|

T231H

|

Feb 19 2022, 06:27 PM Feb 19 2022, 06:27 PM

|

|

QUOTE(Ankle @ Feb 19 2022, 05:01 PM) Today is not over yet.  Office hours already over... Lah Especially earlier cut off time on Sat |

|

|

|

|

|

T231H

|

Mar 19 2022, 01:16 PM Mar 19 2022, 01:16 PM

|

|

QUOTE(Human Nature @ Mar 19 2022, 01:09 PM) Instead of keep harping about this, they should instead use their time and media-power to educate people on savings and being prudent. A member on RM1200 min wage constant, statutory contribution rate, working for 30 years (25 to 55 years old), avg dividend rate 5% - would be around 240k, if left untouched. This current 240k minimum basic saving amount will be raised too by that time.... As per below post.. QUOTE(prophetjul @ Mar 17 2022, 11:03 AM) Present 240k should project to 940k in 35 years at 4% inflation rate.  i did a fast check on my model with Rm1200 starting pay at 4% increment . End result is 690k at year 35. |

|

|

|

|

|

T231H

|

Mar 19 2022, 01:23 PM Mar 19 2022, 01:23 PM

|

|

QUOTE(Human Nature @ Mar 19 2022, 01:20 PM) My calculation is based on constant min wage for 30 years. Salary and correspondingly statutory contribution would increase over time as well. My point is, for those accounts with less than RM10000, what happened there? Based on current starting pay n based on that 30 yrs time frame.. 10k is nothing when compared to the total sum in epf. The point is that.. The 240k target will continue to rise in the next 30 yrs for those accounts with less than RM10000, what happened there?... They will have still hv a life as like others of their financial standing... This post has been edited by T231H: Mar 19 2022, 01:27 PM |

|

|

|

|

was thinking to myself, if this extra 0.48% or 3k is justify for me to chase in relation to the risk of investing and a need to beat this 5% epf rate....

was thinking to myself, if this extra 0.48% or 3k is justify for me to chase in relation to the risk of investing and a need to beat this 5% epf rate....

Mar 14 2021, 11:04 AM

Mar 14 2021, 11:04 AM

Quote

Quote

0.1385sec

0.1385sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled