QUOTE(Haloperidol @ Dec 20 2021, 04:56 PM)

You are right. What am I on about?EPF DIVIDEND, EPF

EPF DIVIDEND, EPF

|

|

Dec 20 2021, 04:57 PM Dec 20 2021, 04:57 PM

Return to original view | Post

#441

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

|

|

|

Dec 23 2021, 02:39 PM Dec 23 2021, 02:39 PM

Return to original view | Post

#442

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(contestchris @ Dec 23 2021, 02:18 PM) KWSP should cap interest to only the first RMxxx. Say the capping is at RM1mil. Meaning, amounts above RM1mil kept in EPF should be subject to no returns (i.e. must be returned back to unitholders). Or alternatively, provide board rate interest rates for those sums. Take hike to CCP nation if you think like that. hedfi, TheEquatorian, and 5 others liked this post

|

|

|

Dec 23 2021, 02:47 PM Dec 23 2021, 02:47 PM

Return to original view | Post

#443

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(contestchris @ Dec 23 2021, 02:41 PM) I think I didn't make myself clear. Current system is good enough. So you think it's acceptable that as shareholder who helped build up the existing asset portfolio with his funds through the years, to be Awarded lower returns compared the other shareholders who may have just started to contribute to the portfolio?BUT, if they want to penalize the whales, I personally feel it is better if they do a single cut-off, vs a progressive returns regime. The latter to me is just super unfair. join the CCP. This post has been edited by prophetjul: Dec 23 2021, 02:48 PM |

|

|

Dec 23 2021, 05:52 PM Dec 23 2021, 05:52 PM

Return to original view | Post

#444

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

Dec 24 2021, 08:29 AM Dec 24 2021, 08:29 AM

Return to original view | Post

#445

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(daniellehu @ Dec 24 2021, 05:27 AM) The fact remains that more than 80% of EPF members who retires at the age of 55 spent all of their savings within the first 3 to 5 years. Some used it to clear their home mortgage, some used it to fund their children's education, some mismanaged their fund due to majority who has little to no experience at all in managing a large amount of fund. All I am saying is EPF should conduct further study and come up with a tailored made schemes as options for individuals with different amount of savings and commitments. Finance management, consultation and even courses should be made available and mandatory to each individuals who has attained retirement age. Good luck teaching this to the B40! And some of the M40.A mutual agreement must be formed on a scheduled retirement expenditure based on their life style and savings, ensuring retirees will see their EPF coffer last for the next 20 years after their retirement as to avoid any untoward event. These agreement can be revisited for an update on various occasions related to emergencies, health related issue, fluctuating inflation rate and etc from time to time or a fixed intervals of between 2 and 3 years. i have held so many financial management courses and awareness for my B40 employees. They will joyfully go for the food. All this will be derailed by the easy access to the personal loans offered by the non financial institutions. The human attraction to material goods knows no bounds, no matter whether you are B40, M40 and T20. They, including M40 will live for the moment and worry about their later years after. TheEquatorian, Human Nature, and 2 others liked this post

|

|

|

Dec 24 2021, 03:24 PM Dec 24 2021, 03:24 PM

Return to original view | Post

#446

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(shamino_00 @ Dec 24 2021, 08:55 AM) This is unfair comment. In a study Maslow pyramid, physiological need which at the very bottom category of need, people need to able to survive and feed themselves with food first. Survival is of primary instinct. Except it is the B40 who needs to hear this. However, all the financial indicators and lingo will not matter to them if they are allowed to access easy loans perpetuated by these unscrupulous companies. AND our government willingly allows such companies to operate and then shouts that the B40 does not have enough to retire on! With low wages, rising food prices due inflation whatever amount they earn goes to food thus lack of extra savings that put money to work. Your financial courses certainly may not suitable to the B40 category and doubt whether they have the money to paid or attend for such courses » Click to show Spoiler - click again to hide... « Everyone needs to know the they have to live within their means. AND LEARN how to. Including the B40. This post has been edited by prophetjul: Dec 24 2021, 03:29 PM |

|

|

|

|

|

Dec 24 2021, 03:36 PM Dec 24 2021, 03:36 PM

Return to original view | Post

#447

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(shamino_00 @ Dec 24 2021, 11:30 AM) Should. Especially when the income is higher than 2020.QUOTE The EPF recorded a total investment income of RM34.05 billion for the first half of the year ended June 30, 2021 (1H21), which was an increase of RM6.79 billion, or 25%, compared to RM27.26 billion in 1H20. Now remember that many have withdrawn their principal through the various i-Citra, etc. Therefore, reasonably the earnings per share should be higher with higher income. However, in bolihland politics have the stranglehold on all aspects of life, including the politics of EPF dividends. |

|

|

Dec 26 2021, 07:31 PM Dec 26 2021, 07:31 PM

Return to original view | Post

#448

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

Dec 27 2021, 01:23 PM Dec 27 2021, 01:23 PM

Return to original view | IPv6 | Post

#449

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

Dec 27 2021, 01:39 PM Dec 27 2021, 01:39 PM

Return to original view | IPv6 | Post

#450

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(sgh @ Dec 27 2021, 01:33 PM)  This post has been edited by prophetjul: Dec 27 2021, 01:45 PM wongmunkeong and TOS liked this post

|

|

|

Dec 27 2021, 10:03 PM Dec 27 2021, 10:03 PM

Return to original view | IPv6 | Post

#451

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(shamino_00 @ Dec 27 2021, 08:37 PM) If it can surpassed last year 5.2 and match 2019 and more? Aiming for 5.5%, it's 1st half income at 34 billion. If the 2nd half performance is the same, that means 68 billion of gross income. 52 or 53 billion could be use for dividend payment. Next year is election year. Expect the dividend to be higher.https://www.kwsp.gov.my/-/epf-records-rm34....ome-for-1h-2021 Wedchar2912, KIP21, and 2 others liked this post

|

|

|

Dec 29 2021, 08:52 AM Dec 29 2021, 08:52 AM

Return to original view | IPv6 | Post

#452

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Chrono-Trigger @ Dec 28 2021, 09:23 PM) I think it's equally important for the government to safeguard the value of Ringgit as any savings from EPF will be useless if Ringgit depreciates in value 30 years from now. That is living in a dream world. The government is not here to safeguard the currency. They are here to safeguard their reign.Why do you think the ringgit has been sliding for the past 30 years, especially against the SGD? wongmunkeong liked this post

|

|

|

Dec 29 2021, 10:18 AM Dec 29 2021, 10:18 AM

Return to original view | IPv6 | Post

#453

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(TheEquatorian @ Dec 29 2021, 09:56 AM) Moreover, it is impossible to safeguard the currency when underlying issues are never dealt with. Tbh EPF needs to have a strategy on rationalising staff (as does civil service, restructure their pensions as well) with digitalistion I see that they have disposed many prime office locations, what will the people behind the counter be doing. Upskilling is such a big issues here. Instead there is this idea that we can reallocate dividends to continue to sustain an unsustainable structure in our interdependent globalised economy. You can’t prop up a currency forever if no one believes in the economy. 100% agreed. Fundamentally with all the NEP policies, there is only 1 direction that the country is heading. And it is not advancement.Rant done. ✔️ |

|

|

|

|

|

Dec 29 2021, 01:24 PM Dec 29 2021, 01:24 PM

Return to original view | IPv6 | Post

#454

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(shamino_00 @ Dec 29 2021, 01:20 PM) Very sad, guys, where can we hedge with dollars/sgd. Other then we go to forex exchange, get the currency and stick under our pillows or keep stacks of dollars cash in condo like Najib but it isn't growing. A waste if money didn't put to work. I know one is buying US stocks or indexes, or SG reits or others like that but we get taxed for it. Unless we migrate else stuck in Ringgit world. Any good way or ideas guys. i started migrating out some of my MYR into SGD SREITs in 2008/09. It has helped a great deal. 2.3 to 3.1 and enjoying the dividends while being hedged. The tax is small price compared to the risk of devaluation of the MYR. TOS and wongmunkeong liked this post

|

|

|

Dec 29 2021, 03:42 PM Dec 29 2021, 03:42 PM

Return to original view | IPv6 | Post

#455

|

All Stars

12,279 posts Joined: Oct 2010 |

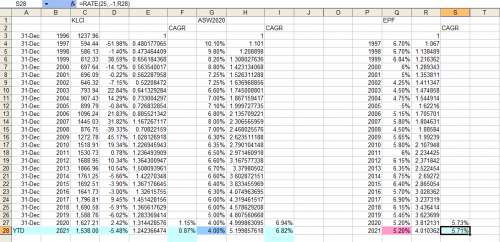

QUOTE(plc255 @ Dec 29 2021, 03:30 PM) Since I wanted to satisfy my curiosity, and recalled that I had this ASM2 Wawasan (previously known as ASW2020) fund when it first launch all the years back, so I did a little calculation, and added EPF number for comparison. Interesting and nice comparisons. For the past 25 years, ASW2020 would return 6.8% CAGR, while EPF return 5.7% CAGR, assuming 2021 dividend remain as 5.2% (a decent conservative assumption). Hence ASW2020 would beat EPF by 1% CAGR for 25 years, which is quite a big deal. However I would imagine most people had more money in EPF as most salaryman would have not much choice but to save & compound money there, while ASW or any PNB fund can be withdrawn anytime, hence can always empty out quite easily... ASB dividend had always done better than ASW2020 traditionally... hence the "ASB return higher than EPF" mindset is there after all the years of conditioning.. guess I just never thought of it that way and was surprise that the headline chose to state the obvious. Anyone directly Q: Where would you put some surplus cash into going forward? a. PNB Fixed Price fund - good luck for some getting some units.. b. EPF - RM60k a year limit self contribution. c. Others "Past performance is no guarantee of future results" An obvious thing is ASW2020 started like a horse bolting from the gate and losing steam after the long years. A bit like ASB. Probably running out of investment ideas. Unlike EPF which is able invest in properties and other types of assets. |

|

|

Dec 30 2021, 07:49 AM Dec 30 2021, 07:49 AM

Return to original view | IPv6 | Post

#456

|

All Stars

12,279 posts Joined: Oct 2010 |

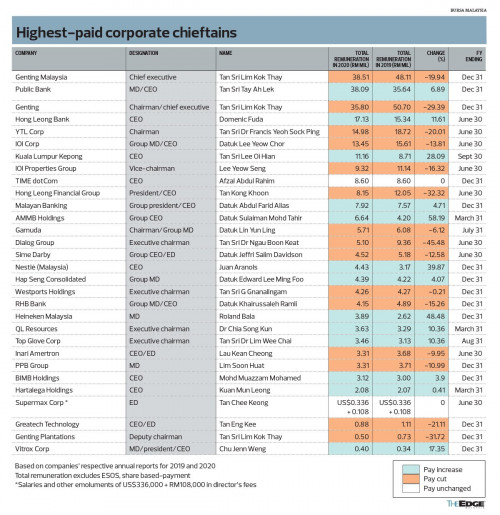

QUOTE(tekkaus @ Dec 29 2021, 08:53 PM) Obviously, EPF could have given us even more dividends. It is one of the biggest retirement fund in the world. Pay peanuts, you know what they say.I bet their CEO's annual salary has lots of zero. In fact, do they declare the salary of the CEO and directors? WE should write to them. |

|

|

Jan 5 2022, 02:31 PM Jan 5 2022, 02:31 PM

Return to original view | IPv6 | Post

#457

|

All Stars

12,279 posts Joined: Oct 2010 |

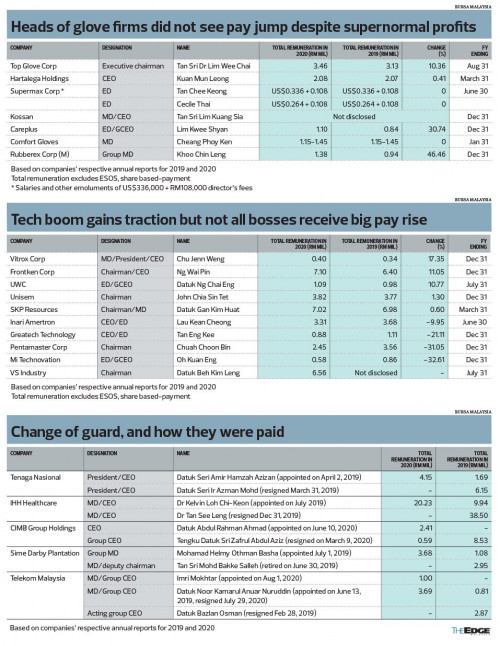

QUOTE(dasecret @ Jan 5 2022, 12:13 PM) Well, the information is disclosed in the annual report albeit not as detailed and specific as you might want it to be. The 2020 annual report was just released, see if for yourself That's great research! https://www.kwsp.gov.my/annualreport2020/pdf/[ENG]KWSP_AR2020.pdf On page 40, it says CEO and Deputy CEOs earned RM9,027,542.51. Since there's no DCEO listed in the report, perhaps can assume that's the amount that the CEO earned. How does it compare to the other PLC CEO remuneration you may ask? The Edge has just the answer for you https://www.theedgemarkets.com/article/cove...-take-home-2020  Interesting Amir Hamzah, the new CEO was earning significantly less as the CEO of TNB previously  Yeah. WE should expect Amir Hamzah to have a significant raise to jump rom TNB to EPF. |

|

|

Jan 6 2022, 02:23 PM Jan 6 2022, 02:23 PM

Return to original view | IPv6 | Post

#458

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

Jan 8 2022, 09:40 AM Jan 8 2022, 09:40 AM

Return to original view | Post

#459

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(daniellehu @ Jan 8 2022, 09:15 AM) Not really. It's based on the whims and fancies of the powers to be. gobiomani, mavistan89, and 1 other liked this post

|

|

|

Jan 8 2022, 10:10 AM Jan 8 2022, 10:10 AM

Return to original view | Post

#460

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(daniellehu @ Jan 8 2022, 09:51 AM) And its true.If you estimate by the performance of EPF for 2021 thus far, it has out performed 2020 by a long stretch. It can easily dish out 6% taking into account Rm100 billion principal has been withdrawn in the year. But politically, they won't. Because they will want to keep some for rainy day and it cannot be too much more than ASB. However, it its election year, they may give you a few points more. yhtan, wongmunkeong, and 4 others liked this post

|

| Change to: |  0.0462sec 0.0462sec

1.01 1.01

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 12:41 PM |