QUOTE(DragonReine @ Jun 16 2021, 04:39 PM)

Thanks mate. EPF DIVIDEND, EPF

EPF DIVIDEND, EPF

|

|

Jun 16 2021, 04:52 PM Jun 16 2021, 04:52 PM

Return to original view | IPv6 | Post

#381

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

|

|

|

Jun 16 2021, 05:32 PM Jun 16 2021, 05:32 PM

Return to original view | IPv6 | Post

#382

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

Jun 25 2021, 08:06 AM Jun 25 2021, 08:06 AM

Return to original view | IPv6 | Post

#383

|

All Stars

12,279 posts Joined: Oct 2010 |

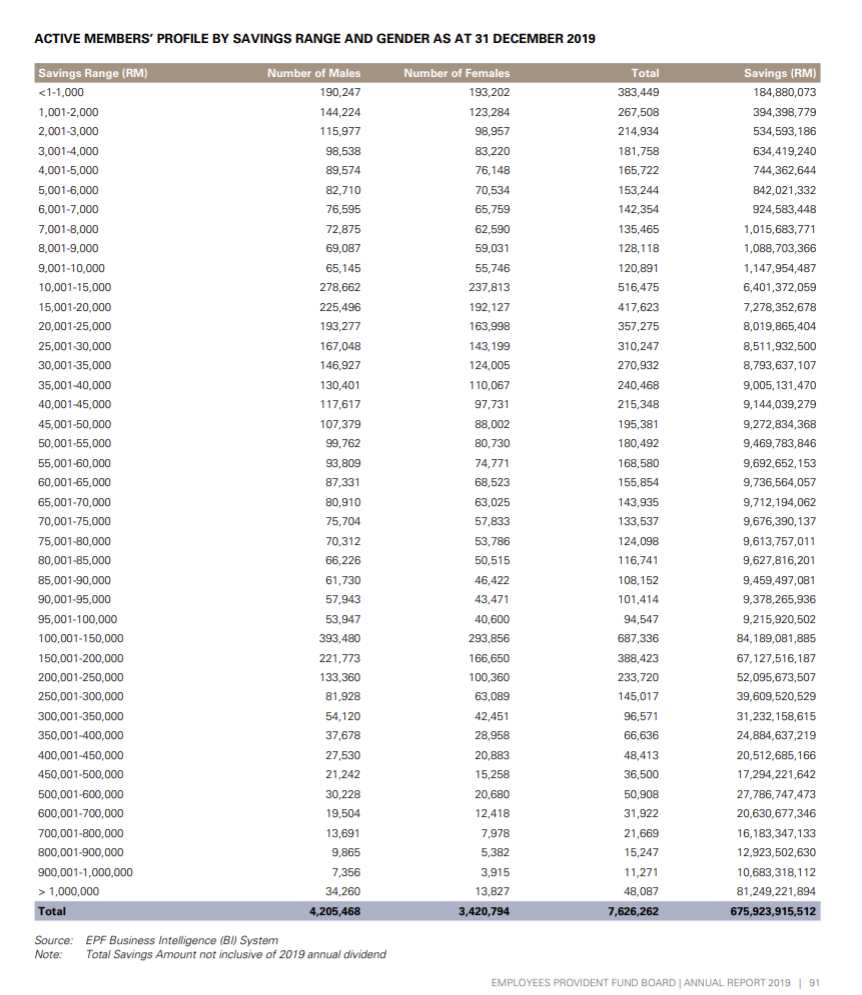

QUOTE(MUM @ Jun 25 2021, 02:50 AM) from that article,..... This 42% statement does not seem to jive with this 2019 chart?» Click to show Spoiler - click again to hide... « It’s worrying that 42% of the total membership has less than RM10,000 and if you look at Account 2, which is the amount set aside where members can access in certain instances, 9.3 million people have less than RM10,000." » Click to show Spoiler - click again to hide... «  |

|

|

Jun 25 2021, 08:59 AM Jun 25 2021, 08:59 AM

Return to original view | IPv6 | Post

#384

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Cubalagi @ Jun 25 2021, 08:54 AM) Active vs Total 42% of 9 million account holders is 3.8 million2019 vs Now after all the withdrawals Sure got difference which can only see in 2021 annual report. The chart shows about 2.4 million 10k and below. So after withdrawals, approx 1.4 million dropped to below 10k? WOW! This post has been edited by prophetjul: Jun 25 2021, 08:59 AM |

|

|

Aug 26 2021, 07:10 AM Aug 26 2021, 07:10 AM

Return to original view | IPv6 | Post

#385

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(TOS @ Aug 25 2021, 08:06 PM) Interesting:QUOTE EPF’s gross investment income for 1Q2021 of RM19.29 billion (RM19.24 billion net) is the highest quarterly showing in at least 17 quarters while the lowest over the same period was RM9.7 billion in 1Q2019. Seems EPF has done quite well with lower principal after the numerous withdrawals last year. |

|

|

Aug 26 2021, 09:55 AM Aug 26 2021, 09:55 AM

Return to original view | IPv6 | Post

#386

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(xcxa23 @ Aug 26 2021, 09:52 AM) Ever since EPF venture overseas, their return are good. On steady uptrend Yes. The decision to invest overseas was a good one. i think forex helped in the earnings too. With MYR as weak as it is.Remember ex CEO was against withdrawal during covid, which personally wholeheartedly supported this statement, but receive backslash from netizen. Instead of receiving help from government due to pandamic, Malaysian are "force" to use retirement fund. Well, a poor 3rd world nation cannot help theiir citizens directly. These retirees will have problems in their retirement years. No thanks to the government. Human Nature and honsiong liked this post

|

|

|

|

|

|

Aug 26 2021, 10:51 AM Aug 26 2021, 10:51 AM

Return to original view | IPv6 | Post

#387

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(honsiong @ Aug 26 2021, 10:40 AM) Crises like this happen and we see the gov just let wealth gap widens, instead of trying QE + stimulus, or increase nominal tax rate. i don't think they knew what to do with the economy amidst the pandemic.Retirement is just a dream man, it's a recent invention, there was no such thing as retirement in the past. People didn't live long enough, or they just depend on their kids to jaga them. So it was que sera sera and concentrate on the vaccine supply where there was easy money to be made. Welcome to the future! That includes retirement! |

|

|

Sep 5 2021, 11:40 AM Sep 5 2021, 11:40 AM

Return to original view | IPv6 | Post

#388

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

Sep 7 2021, 09:23 AM Sep 7 2021, 09:23 AM

Return to original view | IPv6 | Post

#389

|

All Stars

12,279 posts Joined: Oct 2010 |

Hi Y'all

Many years ago, i made a rough assessment on UTs which beat EPF over 10 to 15 years tenure. There is only a HANDFUL. Maybe less than 3%. The problem is this: How do you pick these UTs? That is the question. Conclusion: I never invested in UTs in my 60 year old life. |

|

|

Sep 7 2021, 12:18 PM Sep 7 2021, 12:18 PM

Return to original view | IPv6 | Post

#390

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

Sep 21 2021, 01:48 PM Sep 21 2021, 01:48 PM

Return to original view | IPv6 | Post

#391

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(CoronaV @ Sep 21 2021, 01:34 PM) Received circulation of this in social media, just to confirm with all is that true? They cannot do that.If ONE (1) of your Nominees in the EPF Nominees list dies, automatically the whole arrangement (EPF Nominees list) is VOID .. Meaning if, you only put in One (1) name & unfortunately he/she dies before you - automatically EPF will channel your EPF money to trustee of AMANAH RAYA upon your death. A nominee is only effective if you die, not when the nominee dies. |

|

|

Sep 21 2021, 02:05 PM Sep 21 2021, 02:05 PM

Return to original view | IPv6 | Post

#392

|

All Stars

12,279 posts Joined: Oct 2010 |

Chain Email On Nomination Subject: EPF Rules: A must read If ONE (1) of your Nominees in the EPF Nominees list dies, automatically the whole arrangement (EPF Nominees list) is VOID. Meaning if, you only put in One (1) name & unfortunately he/she dies before you? Automatically EPF will channel your EPF money to trustee of AMANAH RAYA upon your death. Even though if you have few names in the EPF Nominees list, - the whole arrangement is VOID & none of the individual names left in the EPF Nominees list will get their portion & automatically EPF will channel your EPF money to trustee of AMANAH RAYA upon your death. Piece of advice - if any of the your Nominees in the EPF Nominees list dies, please do immediately approach the nearest EPF counter & present the Death Certificate of the individual & register your NEW / LATEST Nominee in the EPF Nominees list + NEW /LATEST percentage If, you & the other party (maybe spouse) involved in the same misfortune (accident/ illness) that caused death to both yourself / spouse please, please, please alert your siblings / relatives / parents to immediately approach the nearest EPF counter & share the information within 3 days to AVOID all EPF money to be surrendered to trustee of AMANAH RAYA. Upon surrender to trustee of AMANAH RAYA, your children will have to battle the money thru 3 channels; Majlis Agama Pejabat Tanah Mahkamah EPF’s Response The EPF emphasises that the information in the chain email is NOT TRUE. If a member has nominated more than one beneficiary and one of them dies, only the portion that was bequeathed to the deceased beneficiary will be invalid. If the member later dies without updating his/her nomination, the surviving beneficiaries will receive their portion accordingly. Only the portion that was bequeathed to the deceased beneficiary will subject to procedures under the “EPF savings without nomination” in which case priority for the right to claim the deceased member’s savings shall go to next of kin or appointed administrator of the deceased member’s estate. Hence, it is not true that when a member has named more than one beneficiary, the entire nomination will be deemed void when one of the beneficiaries dies before the member. However, if a member has named only one beneficiary and the beneficiary dies before the member, the nomination will then be deemed void unless a new beneficiary is nominated. Please note that members do not have to produce the death certificate of a deceased beneficiary to change their nomination. Members can change or update their nomination anytime by completing a new KWSP 4 Form. This will automatically revoke any earlier nomination made. Another allegation in the chain email which mentioned that members need to go to the EPF counter within three (3) days to avoid the EPF savings being “surrendered to Amanah Raya” if no nomination is made or if a beneficiary and the member die at the same time is also not true. If a member dies without nominating a beneficiary and depending on the amount the member has in his/her EPF account, the following conditions will apply: If the member has less than RM25,000 in his/her EPF Account, the initial sum of RM2,500 will be paid to his/her next of kin. The balance will be paid two months after the member’s death. If the member has more than RM25,000 in his/her EPF Account, the initial sum of RM2,500 will be paid to his/her next of kin. The second payment (not more than RM17,500) will be paid to the next of kin two months after date of death. The balance of the savings will be paid upon submitting the Letter of Administration/Grant of Probate/Distribution Order/Faraid Certificate from estate administrators such as Amanah Raya Berhad or the Court or the Land Office. The EPF wishes to remind that obtaining these documents can be time-consuming and fees may be imposed by the issuing authorities. By nominating beneficiary(s), members will be able to ensure that all the documents will not be necessary and that the withdrawal process by his/her beneficiary(s) will be hassle-free and free of any charges. For Muslim members, the Faraid Law will apply, in which case the beneficiary will act as an administrator or “wasi” who will be responsible for distributing the savings in accordance to the Faraid Law. This is why nomination is very important. Members are also advised to check their nomination and update if and when necessary, particularly if the member has gone through life-changing events such as marriage, divorce or birth of a child. TOS and wongmunkeong liked this post

|

|

|

Sep 23 2021, 06:08 PM Sep 23 2021, 06:08 PM

Return to original view | IPv6 | Post

#393

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

|

|

|

Sep 24 2021, 09:58 PM Sep 24 2021, 09:58 PM

Return to original view | IPv6 | Post

#394

|

All Stars

12,279 posts Joined: Oct 2010 |

EPF’s 1H investment income rises 25% to RM34.05b

KUALA LUMPUR (Sept 24): The Employees Provident Fund (EPF) recorded RM34.05 billion in total investment income for the first half of the year ended June 30, 2021 (1H21), an increase of RM6.79 billion or 25% compared with RM27.26 billion for the corresponding period in 2020. Total gross investment income for the second quarter of 2021 (2Q21) was RM14.77 billion, RM350 million or 2.31% lower than the RM15.12 billion recorded for the same quarter last year, said the EPF in a statement today. The EPF said that equities continued to be the main contributor of income for 2Q21 at RM7.89 billion, accounting for 53% of total gross investment income. As part of its internal policy to ensure a healthy portfolio, the retirement fund has adopted cost write-downs on listed equities. According to the EPF, in 2Q21, RM210 million was written down for listed equities, compared with RM1.66 billion for the same quarter in 2020, following the continued recovery across global markets. After netting off these write-downs, a total of RM14.56 billion of investment income was recorded for 2Q21, 8% higher than the RM13.46 billion recorded for 2Q20. Its chief executive officer (CEO) Datuk Seri Amir Hamzah Azizan said the EPF delivered a resilient performance in 1H21, driven by the progressive recovery of equity markets and most asset classes amid the global rebound. “The accelerating roll-out of Covid-19 vaccines and the reopening of economies supported a stronger performance of equities in developed markets. “However, equities in emerging markets were more muted due to the resurgence of Covid-19 in Southeast Asian countries and tighter regulations imposed by China authorities on several sectors that triggered a sharp decline in stock prices,” he said. Meanwhile, fixed Income instruments continued to contribute a stable income of RM5.28 billion or 36% of gross investment income in 2Q21. This was lower compared with the RM6.17 billion recorded for 2Q20 due to lower trading gains. This was also in line with higher interest rates in 2Q21, compared to the corresponding period last year. Real estate and infrastructure, and money market instruments, meanwhile, were recorded at RM1.4 billion and RM200 million respectively. The EPF said that diversification into different asset classes, markets and currencies continued to provide income stability and added value to its overall return. As at end-June 2021, the EPF’s investment assets stood at RM989.14 billion, of which 37% were invested overseas. For 2Q21, overseas investments generated an income of RM8.71 billion or 59% of total gross investment income recorded. To assist members affected by the pandemic, the EPF launched the i-Sinar and i-Citra facilities to provide some financial relief. To date, this involves the disbursement of a total of RM67.6 billion. About 89% of applicants under i-Sinar and 86% under i-Citra stated that the withdrawals were for daily expenses or urgent financial needs, according to the EPF. For the remaining half of the year, Amir Hamzah highlighted that the country’s recovery prospects are dependent on how the Covid-19 situation plays out in the near term. |

|

|

Sep 25 2021, 10:07 AM Sep 25 2021, 10:07 AM

Return to original view | IPv6 | Post

#395

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

Sep 26 2021, 10:02 AM Sep 26 2021, 10:02 AM

Return to original view | IPv6 | Post

#396

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(MGM @ Sep 25 2021, 04:12 PM) Shouldnt that be the case where the returns r distributed pro-rata to the the capital who r invested in 2021? QUOTE(c64 @ Sep 25 2021, 04:19 PM) I think it will evens out...people who withdraw will not get the returns. US market has been trending up the last 6 months or so. Impossible not to make money. But major correction or crash might be looming. WE understand that in normal shareholders of equity, we should be rewarded with return on equity.However, we also know that EPF does NOT distribute out ALL their earnings for the year. Indeed, they will retain some profits and distribute them in later years to smoothen out the returns. So, in spite of lower equity due to the withdrawals and higher returns, i am not holding my breath that those who held on will be rewarded accordingly. |

|

|

Sep 26 2021, 10:34 AM Sep 26 2021, 10:34 AM

Return to original view | IPv6 | Post

#397

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(c64 @ Sep 26 2021, 10:20 AM) I notice a couple of post that you are pretty anti EPF. i have not advised anyone to withdraw anything if that is what you mean.I won't be suprised if it goes down a bit. But EPF has been here..what..50 to 60 years? I see a lot of naysayers always keep asking people to withdraw money from EPF. And i know a lot of people retiring comfortably with EPF dividends alone. I intend to be the latter group, since i am almost near the retiring age. Cheers. i take it as akin to a bond, a Ringgit denominated one. i am only anti EPF as far as it's transparency is concerned. And i have been with EPF for 40 years. Recently EPF invested in Riverstone Holdings Ltd and if the edge is to be believed looks rather dodgy. https://www.theedgemarkets.com/article/epf-...L_gFL8.facebook And of course past history of MAS et al. |

|

|

Sep 26 2021, 01:32 PM Sep 26 2021, 01:32 PM

Return to original view | IPv6 | Post

#398

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Unkerpanjang @ Sep 26 2021, 10:56 AM) Clearly, there r Unkers n Aunties with over RM4M invested in Kwsp, Asnb, Sspn. Govt of the day will beg, steal n borrow to ensure minimum recent You must be an unker with RM4mil in EPF! annual dividend is 4-5% So, oledi sipping iced tea everyday n hobby collecting gold coins. These r tax free dividends. Govt will only allow short term controlled corrections in equity market. Thats where the Kwsp, Asnb, others will just use digitally printed currency (not even need to print paper currency) to buy up all the shares. Then repeat the cycle of creatively managed dividends for next 8-10 years to appeas all the poor rakyat. (Wah! Gomen great lah..Asb 8%, Kwsp 6%, Sspn 4+1%)... hmm, not to forget creative accounting, where liabilities become assets n pristine collaterals. As long as the financial assistance/opportunity can trikle down to our reach...grab it! Surely with corrections, these Unkers will also scoop Tiger Bank, Sotong Bank, at 30-40% discount. They oledi learned the trade of financial literacy n makinng money. In summary, Capitalism favors the rich! To the younglings, you see... Unkers' generation have been stealing from all of you. In the past, we enjoy Asnb 10-12%, Kwsp >6% etc, dividends, Tiger Bank at rm4.50. Country accumulating more debts, Ringgit weakening further, Property getting unattainable. Imo, the only way to beat the generational wealth stealing (Unkers' generation stealing from your generation) is investing in Crypto. The big institutions are just coming in with ETFs. Have to front run them now, its risky n volatile but a 1% investment in networth can deliver 100x returns. Ahem, Sunday sharing sipping iced tea while waiting for Unker Prophetxxx to share his numesmatic gold coins. Full disclosure, am 58 now..still working like a canine. Chest pain, self made worries, bluddy high professional pride - dunno how to let go even when my cardiologist say 'slow down lah', aspire for more n thinking hard to take 2 months sabbatical leave to relect on my next phase. I am a year older than you. No chest pain. No high BP. No nothing. Only waiting to retire soon. QUOTE(yklooi @ Sep 26 2021, 11:04 AM) Why is that no sound from the authorities, MPs or any lawmakers or etc etc,? .. When they replied. That is the thing. They do not answer to their stakeholders. Ketuanan at work here. "EPF says 'not able to comment' on glove maker Riverstone Holdings share trade". https://www.klsescreener.com/v2/news/view/8...ngs-share-trade Are their actions above board and there is no oversight committee for check n balance? Now I begin to wonder how many unknown numbers of buy higher than market prices incidences...(those not exposed, made known publicly). If epf can do that, are ASNB doing that too?? 🤔🤔 This post has been edited by prophetjul: Sep 26 2021, 01:33 PM |

|

|

Sep 30 2021, 12:45 PM Sep 30 2021, 12:45 PM

Return to original view | IPv6 | Post

#399

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

Sep 30 2021, 03:42 PM Sep 30 2021, 03:42 PM

Return to original view | IPv6 | Post

#400

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(MUM @ Sep 30 2021, 02:30 PM) ThanksAny data on 20 year return? |

| Change to: |  0.0568sec 0.0568sec

1.09 1.09

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 05:40 PM |