QUOTE(MUM @ Feb 17 2022, 09:20 PM)

My bad… read wrongly EPF DIVIDEND, EPF

EPF DIVIDEND, EPF

|

|

Feb 17 2022, 09:33 PM Feb 17 2022, 09:33 PM

Return to original view | IPv6 | Post

#21

|

Senior Member

2,541 posts Joined: Jan 2003 |

QUOTE(MUM @ Feb 17 2022, 09:20 PM) My bad… read wrongly netcrawler liked this post

|

|

|

|

|

|

Feb 19 2022, 11:47 AM Feb 19 2022, 11:47 AM

Return to original view | IPv6 | Post

#22

|

Senior Member

2,541 posts Joined: Jan 2003 |

QUOTE(romuluz777 @ Feb 19 2022, 11:19 AM) Maybe the announcement is tomorrow ? U better check with EPF. My January 2022 caruman sendiri can be seen under withdrawal eligibility after 2 days.Anyway, the February 2022 caruman be seen now under withdrawal eligibility. Strangely, the January 2022 caruman is not. |

|

|

Feb 20 2022, 11:59 AM Feb 20 2022, 11:59 AM

Return to original view | IPv6 | Post

#23

|

Senior Member

2,541 posts Joined: Jan 2003 |

QUOTE(contestchris @ Feb 20 2022, 11:49 AM) For the past 7 years the dividend announcement was on Saturday. I wonder why many people believe it will be Sunday today? MUM liked this post

|

|

|

Feb 28 2022, 08:54 PM Feb 28 2022, 08:54 PM

Return to original view | IPv6 | Post

#24

|

Senior Member

2,541 posts Joined: Jan 2003 |

QUOTE(TOS @ Feb 28 2022, 08:05 PM) First they tikam Monday, never kena.Now they tikam Wed. If no kena then they tikam Friday, Saturday and Monday again. Sure one day will kena. romuluz777, TheEquatorian, and 3 others liked this post

|

|

|

Mar 7 2022, 02:05 PM Mar 7 2022, 02:05 PM

Return to original view | IPv6 | Post

#25

|

Senior Member

2,541 posts Joined: Jan 2003 |

QUOTE(familyfirst3 @ Mar 7 2022, 02:01 PM) I check the FAQ and kwsp says u only need to fill up borang 17A (AHL) to contribute more, but never specify the max. Perhaps interested parties can email kwsp or through Facebook to check with them?

This post has been edited by ikanbilis: Mar 7 2022, 02:06 PM |

|

|

Mar 7 2022, 02:10 PM Mar 7 2022, 02:10 PM

Return to original view | IPv6 | Post

#26

|

Senior Member

2,541 posts Joined: Jan 2003 |

|

|

|

|

|

|

Mar 16 2022, 08:47 PM Mar 16 2022, 08:47 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

2,541 posts Joined: Jan 2003 |

Epf withdrawal payment start from 20 April. Max 10k, min RM50

https://www.bharian.com.my/berita/nasional/...-bermula-1-apri |

|

|

Apr 6 2022, 01:38 PM Apr 6 2022, 01:38 PM

Return to original view | IPv6 | Post

#28

|

Senior Member

2,541 posts Joined: Jan 2003 |

QUOTE(prophetjul @ Apr 6 2022, 12:07 PM) https://themalaysianreserve.com/2017/03/31/...-pembinaan-pfi/ They already loan RM21billion to PFI in 2018 as explained by EPF.Is this TRUE???????????? ------------------------------------------------------------------------------------------------------------------------------------------ The Employees Provident Fund (EPF) has loaned RM25.29 billion to government-onwed construction firm Pembinaan PFI Sdn Bhd, with the loan is guaranteed by revenue from leasebacks from the Malaysian government. Prime Minister cum Finance Minister Datuk Seri Mohd Najib Razak added the EPF has also invested RM200 million in debt-ridden 1Malaysia Development Bhd (1MDB), in a written parliamentary reply yesterday. These two transactions are among EPF’s total portfolio exposure in government-linked companies (GLCs) totalling RM79.99 billion as of March 31 this year. He said EPF’s financing exposure in GLCs was in the form of fixed-rate loans and bonds or sukuk subscriptions were part of it, based on government guarantee, asset mortgage and bank guarantee. Pembinaan PFI Sdn Bhd has racked up debts of up to RM26.6 billion in just seven years since its inception. The Finance Ministry Incorporated-owned “special purpose vehicle” set up on Sept 28, 2006, the company was aimed at acquiring capital to fund development projects and programmes identified by the government. According to the auditor-general’s report in 2013 (Series 3), Pembinaan PFI had the third highest liabilities among all government-owned entities at the end of 2012. On overall EPF’s investment in GLCs, Mohd Najib said the investments were aimed to provide stable and consistent returns in the long term. More than 50% of the investments were in fixed-income instruments, which encompassed Malaysian government securities, level coupon bonds as well as loans and bonds for domestic and global mandates. As such, he said EPF’s investment returns naturally would be influenced by interest rates movement and inflation. “Since inflation rates have increased since 2009, EPF will continue to invest and diversify its investments in equity asset class and inflation comprising real estate and infrastructure in line with its strategic asset allocation in order to generate an optimal investment returns at an appropriate risk,” he added. https://www.kwsp.gov.my/ms/web/guest/w/epf-...an-pfi-in-order |

|

|

Sep 20 2022, 02:32 AM Sep 20 2022, 02:32 AM

Return to original view | IPv6 | Post

#29

|

Senior Member

2,541 posts Joined: Jan 2003 |

I-saraan RM250 for the first half of the year has been credited to Kwsp account. CommodoreAmiga, TOS, and 1 other liked this post

|

|

|

Sep 20 2022, 10:48 AM Sep 20 2022, 10:48 AM

Return to original view | IPv6 | Post

#30

|

Senior Member

2,541 posts Joined: Jan 2003 |

QUOTE(elea88 @ Sep 20 2022, 08:28 AM) It ends this year 2022. Wait for budget 2023 whether the gov will extend another 5 years. wongmunkeong liked this post

|

|

|

Jan 9 2023, 08:16 PM Jan 9 2023, 08:16 PM

Return to original view | IPv6 | Post

#31

|

Senior Member

2,541 posts Joined: Jan 2003 |

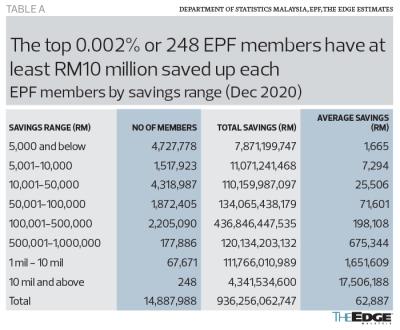

QUOTE(Ankle @ Jan 9 2023, 08:07 PM) There are only less than 70,000 out of 33million people who has more than 1million in epf

Wedchar2912 liked this post

|

|

|

Jan 14 2023, 12:38 PM Jan 14 2023, 12:38 PM

Return to original view | IPv6 | Post

#32

|

Senior Member

2,541 posts Joined: Jan 2003 |

|

|

|

Jan 14 2023, 05:41 PM Jan 14 2023, 05:41 PM

Return to original view | IPv6 | Post

#33

|

Senior Member

2,541 posts Joined: Jan 2003 |

QUOTE(gooroojee @ Jan 14 2023, 12:51 PM) Your self contribution is for 2023 onwards though, the dividends paid out in March is for last year 2022. 2023 could be a bumper year, who knows...? It’s just a yardstick for my decision. RM60k whether put in EPF, ASNB or FD is not going to change my financial position significantly. |

|

|

|

|

|

Jan 15 2023, 10:43 AM Jan 15 2023, 10:43 AM

Return to original view | IPv6 | Post

#34

|

Senior Member

2,541 posts Joined: Jan 2003 |

QUOTE(prophetjul @ Jan 15 2023, 08:05 AM) I am only ikan bilis compared to some whales hereQUOTE(Cubalagi @ Jan 15 2023, 09:22 AM) For my RM denominated assets, yes. Not much money left in Malaysia anyway.This post has been edited by ikanbilis: Jan 15 2023, 10:58 AM |

|

|

Jan 15 2023, 12:46 PM Jan 15 2023, 12:46 PM

Return to original view | IPv6 | Post

#35

|

Senior Member

2,541 posts Joined: Jan 2003 |

QUOTE(Wedchar2912 @ Jan 15 2023, 12:07 PM) what will happen to those assets after you move on? Out of topic so i PM you the answer alreadydid you put them in a trust or gotten a will that can be enforced in those jurisdiction? hope you don't mind sharing, as I think I may need to keep those in mind when I get much older. Wedchar2912 liked this post

|

|

|

Feb 15 2023, 08:11 PM Feb 15 2023, 08:11 PM

Return to original view | IPv6 | Post

#36

|

Senior Member

2,541 posts Joined: Jan 2003 |

|

|

|

Feb 17 2023, 03:20 PM Feb 17 2023, 03:20 PM

Return to original view | IPv6 | Post

#37

|

Senior Member

2,541 posts Joined: Jan 2003 |

QUOTE(Wedchar2912 @ Feb 17 2023, 03:04 PM) Don't do the monthly withdrawal option.... i remember (this is a while back) a old colleague who retired complained to us youngster that he choose the monthly withdrawal option to only find out that the entire amount earmarked for the monthly withdrawal for that year no longer earn interest. If they earmark the whole year amount, then it is better to just do manual withdrawal every month.best you go verify this first before selecting monthly withdrawal if this is still the case. (I didn't verify this of cos... how to when I am not even at 55 years old). |

|

|

Feb 20 2023, 03:33 PM Feb 20 2023, 03:33 PM

Return to original view | IPv6 | Post

#38

|

Senior Member

2,541 posts Joined: Jan 2003 |

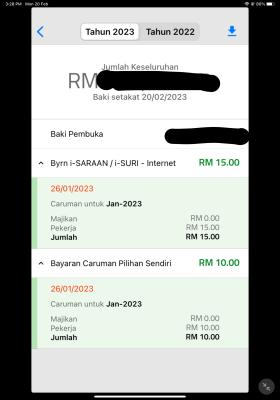

QUOTE(CommodoreAmiga @ Feb 20 2023, 03:17 PM) Can also use Bank to directly bank in. Can select EPF. Last time don't have app to contribute. But now, better use app, maybe reflected faster than Bank transfer. I tested using epf app rm10 and PBB online rm15. Both contribution appear same day. Do note that app appear as normal contribution and PBB appear as i-saraan.

DAPMPBAMCAuto liked this post

|

|

|

Feb 20 2023, 07:45 PM Feb 20 2023, 07:45 PM

Return to original view | IPv6 | Post

#39

|

Senior Member

2,541 posts Joined: Jan 2003 |

|

|

|

Feb 20 2023, 08:24 PM Feb 20 2023, 08:24 PM

Return to original view | IPv6 | Post

#40

|

Senior Member

2,541 posts Joined: Jan 2003 |

|

| Change to: |  0.5286sec 0.5286sec

0.61 0.61

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 03:13 PM |