QUOTE(backspace66 @ Dec 10 2021, 01:42 PM)

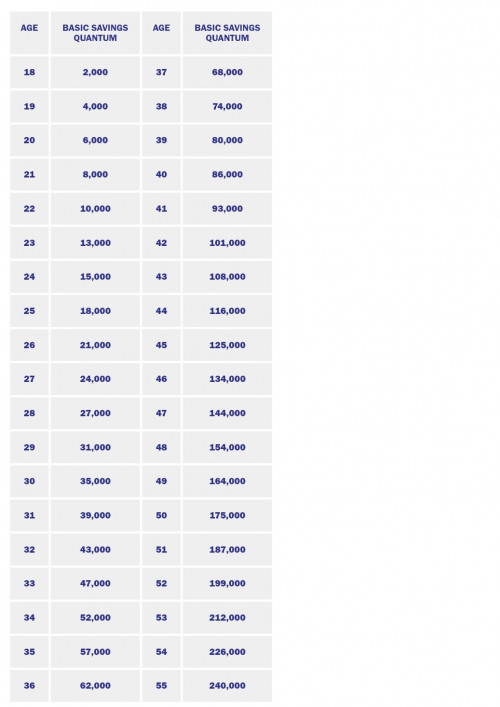

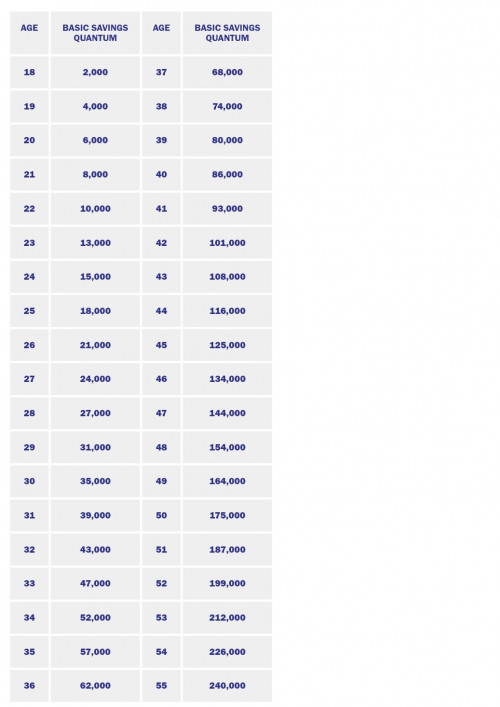

Lol, it is not what i am suggesting. I agree if the limit is determined by minimum saving by age as set out by epf. This i agree, not some random number like you mentioned. The minimum saving by age was created for a reason, best if one find out the purpose of that.

Playing devil's advocate.

firstly, tiering is basically robbing Peter to pay Paul. EPF is a defined contribution retirement scheme and the assets inside belongs to the members. To assign tiering is basically just that.

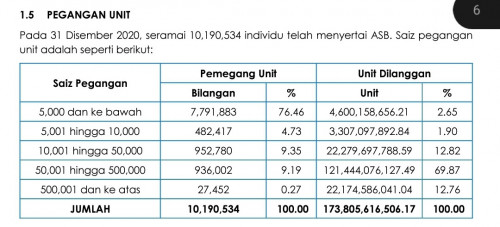

If you think my number is random, it is not. At least it is designed to help the majority. The average amount mentioned repeatedly by media is about 60K rm per pax, so just help the bottom 50%.

But it sure hurts those who are above the average right?

Your suggestion basically means you already bought the government's propaganda.

We all should think critically about information provided by government. The said minimum saving by age was created out of half baked thin air and most probably propagated to suit some agenda. What is stopping some smart alec to just change the number to some arbitrary new tier? This is the part that got many hardworking contributors annoyed. I believe that many of us would support proper "socialist" moves to help the less fortunate, but not using EPF. Already we have taxes and other social programs that do or aim to do that.

(ps: if you believe RM 240K is some golden number, don't. Each person's financials are different, and a single doesn't mean anything with proper context)

May 24 2020, 01:38 PM

May 24 2020, 01:38 PM

Quote

Quote

0.0437sec

0.0437sec

0.49

0.49

7 queries

7 queries

GZIP Disabled

GZIP Disabled