YH1234, relax. Others, chill too.

First let's understand different people have different expectations about returns. They can set different benchmarks, some make sense and have high correlations, some don't.

GDP generally has high correlations with indices performance but it is a lagging indicator. Stocks go up before GDP data indicates so (they are trailing data) and vice versa.

Also, indices these days, especially in US markets are populated by monopolistic large cap tech stocks that are beneficiary of the sudden surge in WFH trend. So while main street is suffering, shares tell us otherwise. Without FAANG, S&P 500 wouldn't be that stellar. Looking back at Bursa, 2020 is only gives 3.5% YTD for capital gain. (See:

https://www.theedgemarkets.com/article/thes...ers-bursa-2020)This accounts for half of the earnings for EPF. You pointed out that EPF has extra cash to buy during the dip. That's correct (I did that too

), but one should bear in mind that EPF already has substantial stake over many of the companies. So the average-down effect will not be dramatic as you expect.

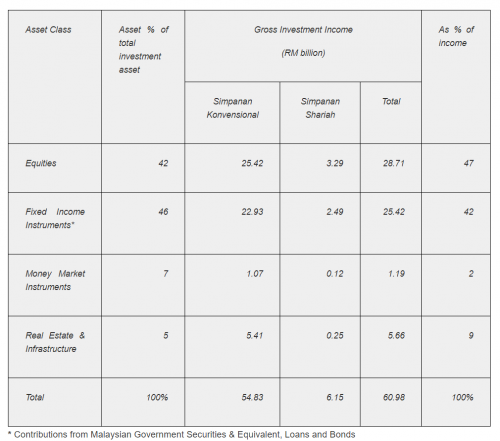

The other main important thing that you guys are missing is that EPF actually bought more bonds and not stocks during the March crash last year. Notice the following data:

Allocation of capital:

| Asset Classes | Q4 2019 | Q1 2020 | Q2 2020 |

| Equity | 39% | 36% | 38.2% |

| Fixed Income | 49% | 54% | 49.2% |

| Cash | 7% | 4% | 7.2% |

| Real Estate | 5% | 6% | 5.4% |

Source:

Q4 2019:

https://www.kwsp.gov.my/-/appendix-epf-2019-performanceQ1 2020:

https://www.kwsp.gov.my/-/epf-q1-2020-recor...vestment-incomeQ2 2020:

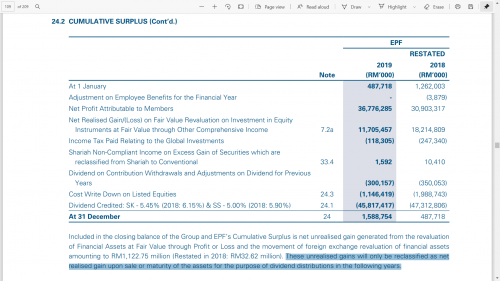

https://www.kwsp.gov.my/-/epf-records-rm15....ome-for-q2-2020Based on 10-year MGS yield, the capital gain from bonds from trough to peak in 2020 is about 25%-26%. But, firstly, 26% is

unrealized capital gain. EPF can't declare them as dividends unless the securities are sold. Secondly, EPF may not realized all their bond holdings. But one thing is certain, realized cash coupons from bond yields actually drop from 3.3% p.a. to around 2.7% p.a.

So it is not a surprise that the rates are slightly lower than 2019, realized capital gains from bonds unable to fully offset declining bond yields, low yields on stocks or even worse, companies don't declare dividends. These contributes to low realized portion as well. It's not wholly comparable with stock index. After all, EPF does not buy exactly on the worst sell-down date and sell all holdings immediately after biggest gain. Some are retained for future dividends, for instance, if they are good blue chips.

Just my 2 cents.

This post has been edited by TOS: Feb 27 2021, 11:30 PM

Dec 29 2020, 08:40 AM

Dec 29 2020, 08:40 AM

Quote

Quote

0.0485sec

0.0485sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled